Key Insights

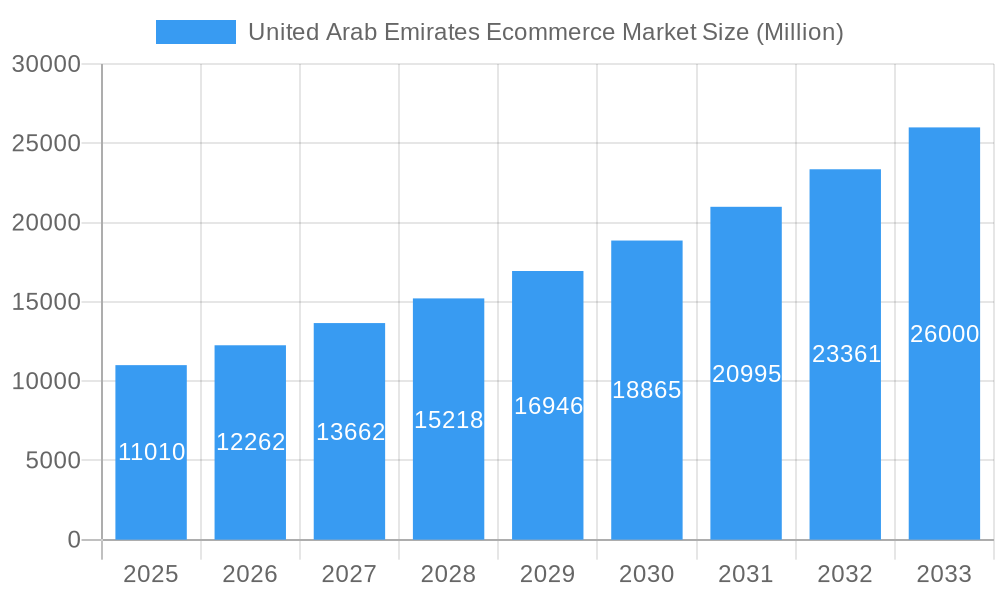

The United Arab Emirates (UAE) e-commerce market is experiencing robust growth, projected to reach \$11.01 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.52% from 2025 to 2033. This expansion is fueled by several key drivers. Rising smartphone penetration and internet usage among the UAE's young and tech-savvy population are creating a large and engaged online consumer base. Government initiatives promoting digital transformation and e-commerce infrastructure development, coupled with a burgeoning logistics sector facilitating efficient and reliable delivery options (express, standard, and same-day), are further accelerating market growth. Consumer preference for convenient online shopping experiences, amplified by the COVID-19 pandemic's acceleration of digital adoption, significantly contributes to this expansion. The market is segmented across diverse application categories, including food, beverages, consumer electronics, fashion, beauty, furniture, and others. E-commerce platforms range from dedicated websites and apps to prominent social media channels, catering to varied consumer preferences. Payment options like cash on delivery, credit/debit cards, and mobile wallets offer flexibility, boosting overall market accessibility. Key players like Amazon, Noon, and others are driving competition and innovation, contributing to the overall market dynamism.

United Arab Emirates Ecommerce Market Market Size (In Billion)

The UAE's e-commerce landscape shows a strong preference for convenient delivery methods, with express and same-day delivery options gaining traction among consumers. The dominance of established players highlights the importance of brand recognition and customer trust in a competitive market. However, challenges remain, such as the need for enhanced cybersecurity measures to protect consumer data and address potential concerns about online fraud. Furthermore, the market faces the ongoing need to address logistics challenges, particularly in remote areas, and ensure consistent customer experience across all delivery methods and platforms. Future growth will depend on adapting to evolving consumer preferences, leveraging technological advancements such as artificial intelligence and personalized shopping experiences, and continually enhancing the overall online shopping experience. The expansion into niche market segments and the continued focus on customer satisfaction will be pivotal for sustained growth in the years to come.

United Arab Emirates Ecommerce Market Company Market Share

United Arab Emirates Ecommerce Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic United Arab Emirates (UAE) ecommerce market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's current state, future trajectory, and key players shaping its evolution. Expect detailed analysis across key segments, including consumer electronics, fashion, and food, examining various platforms, delivery methods, and payment options. Unlock actionable strategies to navigate the competitive landscape and capitalize on emerging opportunities in this rapidly expanding market.

United Arab Emirates Ecommerce Market Dynamics & Concentration

The UAE ecommerce market exhibits a high degree of dynamism, driven by factors such as robust infrastructure, a tech-savvy population, and government initiatives promoting digitalization. Market concentration is relatively high, with a few major players commanding significant market share. For example, Noon AD Holdings Ltd and Amazon Inc hold a combined xx% market share in 2025 (estimated). However, the market also features numerous smaller players, particularly in niche segments. Innovation is a key driver, with companies constantly introducing new technologies and services to enhance the customer experience. The regulatory framework is generally supportive, with ongoing efforts to streamline regulations and ensure consumer protection. Product substitution is a significant factor, with consumers readily switching between platforms based on price, convenience, and product offerings. End-user trends reveal a growing preference for mobile commerce, same-day delivery, and cashless payment methods. M&A activity has been robust, with xx deals recorded between 2019 and 2024, indicating a consolidating market. The average deal size was approximately $xx Million.

United Arab Emirates Ecommerce Market Industry Trends & Analysis

The UAE ecommerce market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fuelled by several factors, including rising internet and smartphone penetration, increasing disposable incomes, and a shift in consumer preferences towards online shopping. Technological disruptions, such as the rise of social commerce and the adoption of AI-powered personalization tools, are further accelerating market expansion. Consumer preferences are evolving towards seamless omnichannel experiences, personalized recommendations, and convenient delivery options. Competitive dynamics are characterized by intense rivalry between established players and emerging startups, leading to innovation and price competition. Market penetration is steadily increasing, with xx% of the population expected to engage in online shopping by 2033. These trends suggest a bright future for the UAE ecommerce sector, with opportunities for both established and new entrants.

Leading Markets & Segments in United Arab Emirates Ecommerce Market

The UAE ecommerce market is dominated by the urban centers of Dubai and Abu Dhabi, driven by high population density, advanced infrastructure, and strong consumer spending. Within application segments, Consumer Electronics, Fashion and Apparel, and Food demonstrate the strongest growth, fueled by high demand and favorable demographics.

Key Drivers:

- Strong Infrastructure: Advanced logistics and reliable internet connectivity are critical factors.

- High Disposable Incomes: A significant portion of the population has high purchasing power.

- Favorable Government Policies: Initiatives promoting digitalization create a supportive ecosystem.

- Tech-Savvy Population: High smartphone and internet penetration facilitates online shopping adoption.

Dominant Segments Analysis:

The Consumer Electronics segment benefits from the high demand for electronics coupled with competitive pricing and promotional offers. Fashion and Apparel thrive because of the diverse population with a preference for online shopping. The Food segment is witnessing significant growth due to the increased convenience of online grocery shopping services. Website and mobile app platforms dominate, with increasing integration of social media for marketing and sales. Cash on Delivery, Credit/Debit Cards, and Mobile Wallets are the widely accepted payment methods. Express Delivery is the preferred choice for many consumers.

United Arab Emirates Ecommerce Market Product Developments

Product innovation in the UAE ecommerce market is characterized by a focus on enhancing customer experience through personalized recommendations, seamless payment gateways, and faster delivery options. The integration of augmented reality (AR) and virtual reality (VR) technologies is gaining traction, offering immersive shopping experiences. Companies are also focusing on developing specialized mobile apps to cater to the mobile-first consumer base. These innovations aim to differentiate products and gain a competitive edge in this rapidly evolving marketplace.

Key Drivers of United Arab Emirates Ecommerce Market Growth

The growth of the UAE ecommerce market is primarily driven by factors such as increasing internet and smartphone penetration, rising disposable incomes, and a supportive government regulatory environment promoting digital transformation. The government's initiatives to develop robust digital infrastructure and improve logistics play a significant role. Technological advancements, like AI-powered personalization and improved payment gateways, also contribute significantly to market expansion.

Challenges in the United Arab Emirates Ecommerce Market Market

Challenges in the UAE ecommerce market include maintaining robust cybersecurity and data privacy, addressing concerns related to counterfeit products, and managing logistics efficiently to meet the increasing demand for fast delivery. Competition among major players also creates pressure on profit margins. Supply chain disruptions due to global events can impact the availability of goods and affect consumer satisfaction.

Emerging Opportunities in United Arab Emirates Ecommerce Market

Long-term growth in the UAE ecommerce market is fueled by the expanding adoption of mobile commerce, the potential for cross-border ecommerce, and the growing popularity of subscription-based services. Strategic partnerships between retailers and fintech companies are expected to enhance payment options and overall customer experience. The market will also benefit from new technological innovations, particularly in areas such as AI-powered customer service and delivery optimization.

Leading Players in the United Arab Emirates Ecommerce Market Sector

- Newegg Commerce Inc

- Microless

- LetsTango Com

- Amazon Inc

- Tryano

- Dubai Shopper

- LuLu Group International

- Sharaf DG LLC

- Noon AD Holdings Ltd

- Apple Inc

Key Milestones in United Arab Emirates Ecommerce Market Industry

- May 2023: UAE Mastercard launched Click to Pay with payment service provider (PSP) Foloosi, significantly improving online payment options for over 6,000 shops. This streamlined guest checkout process boosted ease of online transactions.

- February 2023: Etisalat UAE's acquisition of ServiceMarket strengthened its online marketplace presence and diversified its business portfolio, enhancing consumer empowerment.

Strategic Outlook for United Arab Emirates Ecommerce Market Market

The future of the UAE ecommerce market looks promising, with continued growth driven by technological advancements, supportive government policies, and evolving consumer preferences. Strategic partnerships and investments in logistics and technology will be key to success. The market's potential lies in its ability to leverage its strong infrastructure, tech-savvy population, and strategic location to become a leading ecommerce hub in the Middle East and beyond.

United Arab Emirates Ecommerce Market Segmentation

-

1. Application

-

1.1. Food

- 1.1.1. Fruits and Vegetables

- 1.1.2. Fish, Poultry, and Meat

- 1.1.3. Condiments (includes Oil, Sauces, and Spices)

- 1.1.4. Confectionery Items

- 1.1.5. Other Applications

-

1.2. Beverage

- 1.2.1. Hot Drinks

- 1.2.2. Soft Drinks and Other Beverages

- 1.3. Consumer Electronics

- 1.4. Fashion and Apparel

- 1.5. Beauty and Personal Care

- 1.6. Furniture and Home

- 1.7. Other Applications (Toys, DIY, Media, Etc.)

-

1.1. Food

United Arab Emirates Ecommerce Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Ecommerce Market Regional Market Share

Geographic Coverage of United Arab Emirates Ecommerce Market

United Arab Emirates Ecommerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector

- 3.2.2 including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About Intellectual Property Outsourcing

- 3.4. Market Trends

- 3.4.1. Food Industry to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Ecommerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food

- 5.1.1.1. Fruits and Vegetables

- 5.1.1.2. Fish, Poultry, and Meat

- 5.1.1.3. Condiments (includes Oil, Sauces, and Spices)

- 5.1.1.4. Confectionery Items

- 5.1.1.5. Other Applications

- 5.1.2. Beverage

- 5.1.2.1. Hot Drinks

- 5.1.2.2. Soft Drinks and Other Beverages

- 5.1.3. Consumer Electronics

- 5.1.4. Fashion and Apparel

- 5.1.5. Beauty and Personal Care

- 5.1.6. Furniture and Home

- 5.1.7. Other Applications (Toys, DIY, Media, Etc.)

- 5.1.1. Food

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Newegg Commerce Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microless

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LetsTango Com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tryano

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dubai Shopper

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LuLu Group International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharaf DG LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Noon AD Holdings Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Newegg Commerce Inc

List of Figures

- Figure 1: United Arab Emirates Ecommerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Ecommerce Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Ecommerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: United Arab Emirates Ecommerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: United Arab Emirates Ecommerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United Arab Emirates Ecommerce Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Ecommerce Market?

The projected CAGR is approximately 11.52%.

2. Which companies are prominent players in the United Arab Emirates Ecommerce Market?

Key companies in the market include Newegg Commerce Inc, Microless, LetsTango Com, Amazon Inc, Tryano, Dubai Shopper, LuLu Group International, Sharaf DG LLC, Noon AD Holdings Ltd, Apple Inc.

3. What are the main segments of the United Arab Emirates Ecommerce Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector. including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers.

6. What are the notable trends driving market growth?

Food Industry to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness About Intellectual Property Outsourcing.

8. Can you provide examples of recent developments in the market?

May 2023: UAE Mastercard launched Click to Pay with payment service provider (PSP) Foloosi, who has rolled out the revolutionary payment mechanism across its entire merchant base. The cooperation makes the embedded Click to Pay solution the recommended payment method for guest checkout for Foloosi'sretailers and consumers. As part of the rollout, over 6,000 shops will provide Click to Pay to their customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Ecommerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Ecommerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Ecommerce Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Ecommerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence