Key Insights

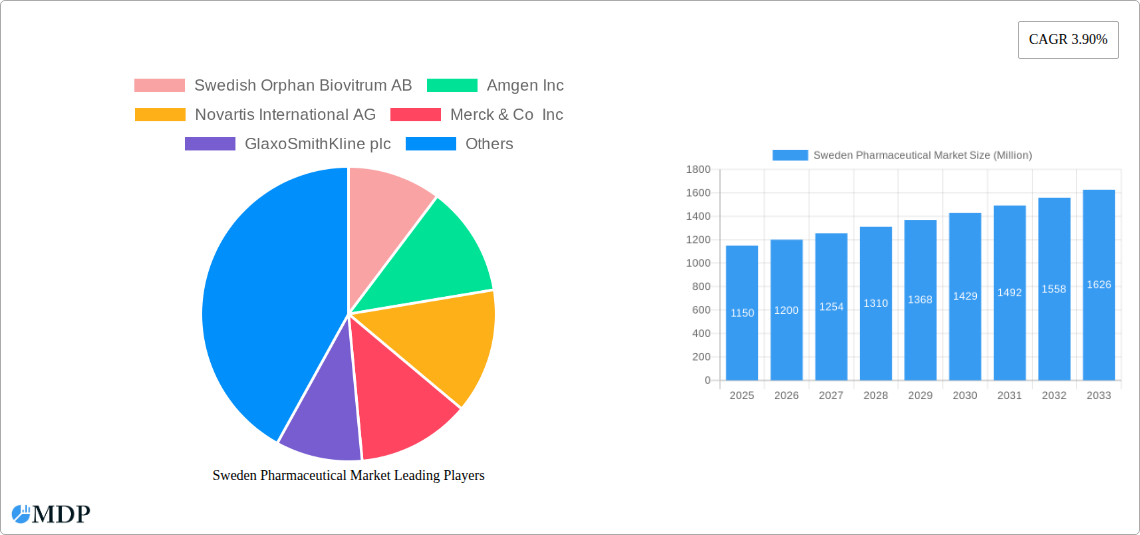

The Swedish pharmaceutical market, valued at approximately [Estimate based on market size XX and extrapolation using 3.9% CAGR; for example, if XX is 1000, 2025 value might be around 1150 million] in 2025, is projected to experience steady growth, driven by a rising elderly population requiring more medications and increasing prevalence of chronic diseases like cardiovascular conditions and diabetes. The market's structure is diverse, encompassing branded and generic drugs across various therapeutic areas. Prescription drugs dominate, reflecting a healthcare system prioritizing physician-led treatment. Key players like Swedish Orphan Biovitrum AB, Amgen Inc., and AstraZeneca plc compete intensely, often focusing on specialized therapies and innovative drug development to maintain a strong market presence. Government regulations, pricing pressures, and the increasing adoption of biosimilars present challenges to market growth.

Growth in the Swedish pharmaceutical sector is anticipated to be fueled by several key trends, including the ongoing investment in R&D by pharmaceutical companies focusing on emerging therapeutic areas, and the government's focus on improving patient access to essential medications. However, the market faces constraints such as stringent regulatory approvals for new drugs, generic competition affecting branded drug pricing, and potential cost-containment measures by the Swedish healthcare system. The market segmentation reveals a significant share held by segments like Digestive Organs and Metabolism, Cardiovascular drugs and Anti-infectives, aligning with the nation's disease burden. The future trajectory indicates continued expansion, albeit at a moderate pace, with the market's dynamics shaped by a complex interplay of innovation, regulation, and economic factors.

Sweden Pharmaceutical Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Sweden pharmaceutical market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, leading players, and future outlook. High-growth segments are identified, along with key challenges and opportunities, ensuring a well-rounded understanding of this vital sector.

Keywords: Sweden pharmaceutical market, pharmaceutical industry Sweden, Swedish drug market, pharmaceutical market analysis Sweden, ATC therapeutic classes, branded drugs Sweden, generic drugs Sweden, prescription drugs Sweden, OTC drugs Sweden, Swedish Orphan Biovitrum AB, Amgen, Novartis, Merck, GlaxoSmithKline, Eli Lilly, AstraZeneca, AbbVie, Pfizer, market size Sweden pharmaceuticals, pharmaceutical market growth Sweden, CAGR Sweden pharmaceutical market

Sweden Pharmaceutical Market Dynamics & Concentration

The Sweden pharmaceutical market exhibits a moderately concentrated landscape, with several multinational giants holding significant market share. Market concentration is influenced by factors including stringent regulatory frameworks, high research and development (R&D) costs, and the increasing prevalence of chronic diseases. Innovation within the Swedish pharmaceutical sector is driven by substantial government funding dedicated to medical research and a strong talent pool. The regulatory environment, while stringent, aims to ensure drug safety and efficacy, balancing innovation with public health. Product substitutes, particularly generics, exert significant competitive pressure, impacting pricing and profitability. End-user trends, such as an aging population and rising healthcare awareness, significantly influence demand. M&A activity has been steady, with xx mergers and acquisitions recorded between 2019 and 2024, reflecting consolidation and strategic expansion within the industry. Market share analysis reveals that top 5 players hold approximately xx% of the market in 2024.

Sweden Pharmaceutical Market Industry Trends & Analysis

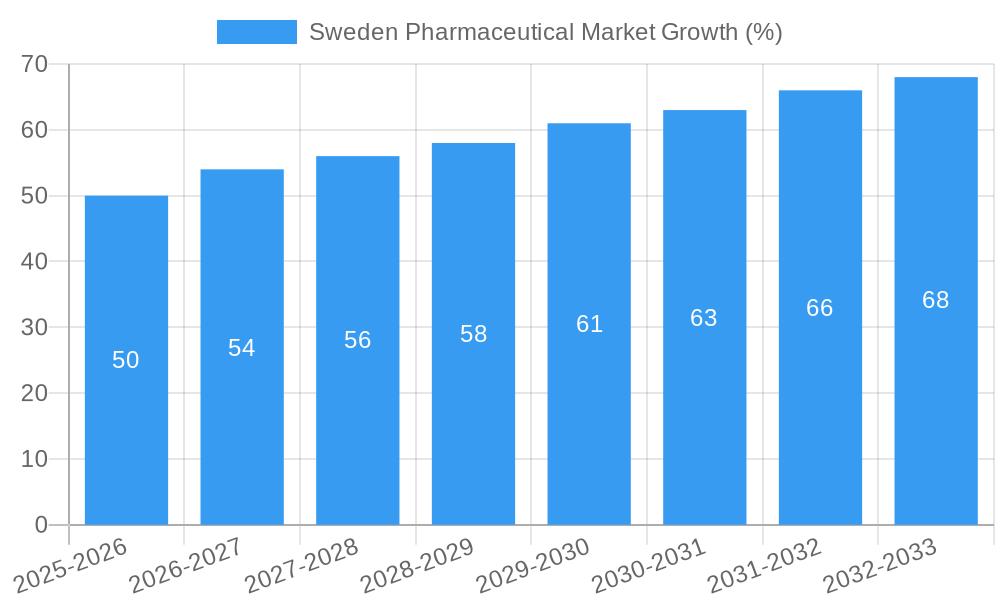

The Swedish pharmaceutical market is experiencing robust growth, driven by factors including an aging population, increasing prevalence of chronic diseases, rising healthcare expenditure, and continuous advancements in pharmaceutical technologies. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Technological disruptions, such as the increasing adoption of personalized medicine, biosimilars, and digital health solutions, are reshaping the industry landscape. Consumer preferences are shifting towards more convenient and accessible healthcare options, driving demand for telehealth and home healthcare services. Competitive dynamics are intense, with both established players and emerging biotech companies vying for market share. Market penetration of novel therapies continues to increase, driven by unmet medical needs and successful clinical trials.

Leading Markets & Segments in Sweden Pharmaceutical Market

The Swedish pharmaceutical market is segmented by ATC/therapeutic class, drug type, and prescription type. While data on specific regional dominance isn't available for this report, we can outline the significant segments:

By ATC/Therapeutic Class:

- Several therapeutic areas show strong growth, including cardiovascular diseases, oncology, and central nervous system disorders. Digestive organs and metabolism, as well as Blood and Blood Forming Organs, are also significant segments. Market size for these varies widely, but oncology and cardiovascular drugs consistently hold a large proportion of revenue.

- The largest segment by value is likely “Blood and Blood Forming Organs,” due to the high costs of cancer treatment and increasing prevalence of related diseases.

By Drug Type:

- Branded drugs currently dominate the market share, although generic drugs are gaining traction due to cost-effectiveness and increased market access. This is influenced by both pricing strategies of pharmaceutical companies and government regulations.

By Prescription Type:

- Prescription drugs (Rx) represent the dominant segment, reflecting the high prevalence of chronic diseases and specialized healthcare needs in Sweden. OTC drugs also constitute a significant portion of the market.

Key Drivers:

- Sweden’s robust healthcare infrastructure and high healthcare expenditure contribute substantially to market growth.

- Government initiatives promoting innovation and investment in healthcare research further fuel market expansion.

- Positive economic conditions, and rising disposable incomes amongst the populace supports pharmaceutical consumption.

Sweden Pharmaceutical Market Product Developments

The Swedish pharmaceutical market witnesses ongoing innovation, marked by the launch of novel therapies, biosimilars, and advanced drug delivery systems. Technological advancements in drug discovery, development, and manufacturing processes contribute to the introduction of more effective and targeted treatments. The market shows a strong emphasis on personalized medicine, aiming to tailor therapies to individual patients' genetic profiles and specific disease characteristics. These developments frequently lead to a competitive advantage for the companies implementing them.

Key Drivers of Sweden Pharmaceutical Market Growth

Several factors drive the growth of the Sweden pharmaceutical market. These include:

- Technological advancements: The development of novel therapies, such as targeted cancer drugs and biologics, significantly contributes to market growth.

- Economic factors: A strong Swedish economy and high healthcare expenditure support industry expansion.

- Regulatory environment: While stringent, Sweden's regulatory framework ensures high drug safety standards, attracting investment and fostering innovation.

Challenges in the Sweden Pharmaceutical Market

The Swedish pharmaceutical market faces certain challenges, including:

- Stringent regulatory approvals: The rigorous approval process can delay product launches and increase development costs.

- Price controls: Government price controls on medications can impact profitability.

- Generic competition: The increasing availability of generic drugs puts pressure on branded drug prices.

Emerging Opportunities in Sweden Pharmaceutical Market

Emerging opportunities exist in personalized medicine, biosimilars, and digital health technologies. Strategic partnerships between pharmaceutical companies and technology providers offer significant growth potential. Expansion into underserved therapeutic areas and the integration of innovative healthcare delivery models present further opportunities for market expansion.

Leading Players in the Sweden Pharmaceutical Market Sector

- Swedish Orphan Biovitrum AB

- Amgen Inc

- Novartis International AG

- Merck & Co Inc

- GlaxoSmithKline plc

- Eli Lilly and Company

- Life Medical Sweden A

- F Hoffmann-La Roche AG

- AstraZeneca plc

- AbbVie Inc

- Medartuum AB

- InDex Pharmaceuticals Holding AB

- Sanofi S A

- Pfizer Inc

Key Milestones in Sweden Pharmaceutical Market Industry

- July 2022: The European Union approved AstraZeneca and Daiichi Sankyo's drug for treating HER2-positive breast cancer, significantly impacting the oncology segment.

- January 2022: Annexin Pharmaceuticals AB initiated a clinical trial for ANXV in hospitalized COVID-19 patients, indicating ongoing research and development efforts.

Strategic Outlook for Sweden Pharmaceutical Market

The Swedish pharmaceutical market presents substantial long-term growth potential. Strategic opportunities lie in capitalizing on technological advancements, forging strategic collaborations, and expanding into new therapeutic areas. Focusing on personalized medicine, digital health solutions, and effective market access strategies will be crucial for success in this dynamic market.

Sweden Pharmaceutical Market Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Digestive orgnas and metabolism

- 1.2. Blood and Blood Forming Organs

- 1.3. Heart and Circulation

- 1.4. Skin Preparation

- 1.5. Urinary and Genital Organs and Sex Hormones

- 1.6. Systemic

- 1.7. Antiinfectives For Systemic Use

- 1.8. Tumors and Disorder of Immune System

- 1.9. Musculo-Skeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Others

-

2. Drug Type

- 2.1. Branded

- 2.2. Generic

-

3. Prescription Type

- 3.1. Prescription Drugs (Rx)

- 3.2. OTC Drugs

Sweden Pharmaceutical Market Segmentation By Geography

- 1. Sweden

Sweden Pharmaceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Scenario

- 3.4. Market Trends

- 3.4.1. Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Pharmaceutical Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Digestive orgnas and metabolism

- 5.1.2. Blood and Blood Forming Organs

- 5.1.3. Heart and Circulation

- 5.1.4. Skin Preparation

- 5.1.5. Urinary and Genital Organs and Sex Hormones

- 5.1.6. Systemic

- 5.1.7. Antiinfectives For Systemic Use

- 5.1.8. Tumors and Disorder of Immune System

- 5.1.9. Musculo-Skeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Others

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Branded

- 5.2.2. Generic

- 5.3. Market Analysis, Insights and Forecast - by Prescription Type

- 5.3.1. Prescription Drugs (Rx)

- 5.3.2. OTC Drugs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Swedish Orphan Biovitrum AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amgen Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novartis International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck & Co Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GlaxoSmithKline plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly and Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Life Medical Sweden A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 F Hoffmann-La Roche AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AstraZeneca plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AbbVie Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Medartuum AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 InDex Pharmaceuticals Holding AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sanofi S A

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pfizer Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Swedish Orphan Biovitrum AB

List of Figures

- Figure 1: Sweden Pharmaceutical Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Pharmaceutical Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 3: Sweden Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Sweden Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 5: Sweden Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Sweden Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Sweden Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 8: Sweden Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 9: Sweden Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 10: Sweden Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Pharmaceutical Market?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the Sweden Pharmaceutical Market?

Key companies in the market include Swedish Orphan Biovitrum AB, Amgen Inc, Novartis International AG, Merck & Co Inc, GlaxoSmithKline plc, Eli Lilly and Company, Life Medical Sweden A, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Medartuum AB, InDex Pharmaceuticals Holding AB, Sanofi S A, Pfizer Inc.

3. What are the main segments of the Sweden Pharmaceutical Market?

The market segments include ATC/Therapeutic Class, Drug Type, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Scenario.

8. Can you provide examples of recent developments in the market?

In July 2022, The European Union approved a drug developed by British-Swedish pharmaceutical company AstraZeneca and Japanese Daiichi Sankyo to treat an aggressive form of breast cancer. The drug was approved for the treatment of patients with unresectable or metastatic HER2-positive breast cancer who have received one or more prior anti-HER2-based regimens

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Pharmaceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Pharmaceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Pharmaceutical Market?

To stay informed about further developments, trends, and reports in the Sweden Pharmaceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence