Key Insights

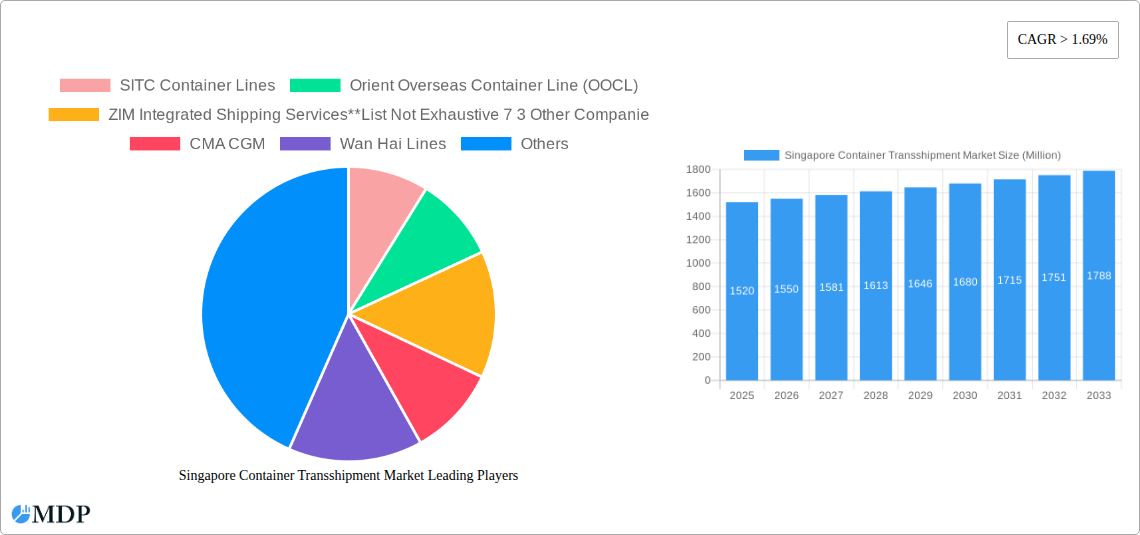

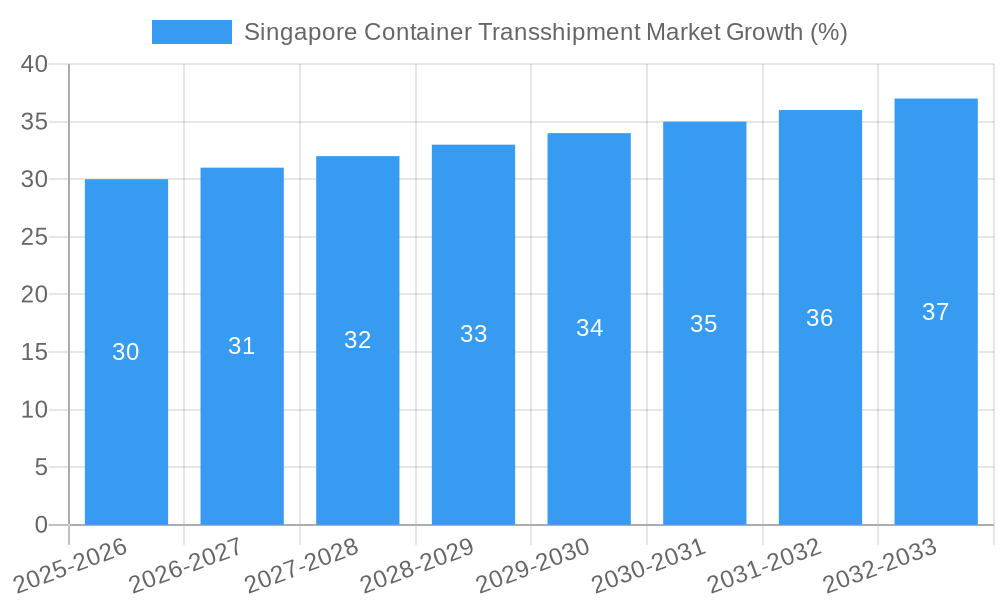

The Singapore container transshipment market, valued at $1.52 billion in 2025, is projected to experience robust growth, driven by the nation's strategic location as a major maritime hub in Southeast Asia and its well-developed port infrastructure. The compound annual growth rate (CAGR) exceeding 1.69% indicates a steady increase in container throughput over the forecast period (2025-2033). This growth is fueled by increasing global trade, particularly within the Asia-Pacific region, coupled with Singapore's commitment to enhancing port efficiency and technological advancements in container handling. Key segments driving this growth include refrigerated containers, crucial for perishable goods, and strong demand from end-users in the automotive, chemicals & petrochemicals, and food & beverage sectors. While challenges such as global economic fluctuations and geopolitical uncertainties might pose some restraints, Singapore's proactive measures to maintain its competitive edge, including investments in infrastructure and digitalization, are expected to mitigate these risks. The market's competitive landscape is dominated by global players like Maersk Line, MSC, CMA CGM, and COSCO, alongside regional players. These companies are continuously vying for market share through operational efficiencies, strategic alliances, and technological innovations.

The continued expansion of the global supply chain and the burgeoning e-commerce sector are expected to significantly boost demand for container transshipment services in Singapore. The increasing focus on sustainable practices within the shipping industry, such as the adoption of cleaner fuels and environmentally friendly port operations, is likely to further shape the market's future trajectory. Furthermore, government initiatives aimed at promoting digitalization and automation in port operations will contribute to improved efficiency and reduced operational costs. However, potential risks include fluctuating fuel prices, labor costs, and the potential impact of future pandemics or geopolitical events on global trade flows. Despite these challenges, Singapore's strategic location, robust infrastructure, and supportive government policies position it favorably for continued growth in the container transshipment market.

Singapore Container Transshipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Singapore container transshipment market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unravels the market's dynamics, growth drivers, challenges, and future prospects. The report meticulously analyzes key segments (By Container Type: General, Refrigerator; By End-User: Automotive, Mining & Minerals, Agriculture, Chemicals & Petrochemicals, Pharmaceuticals, Food & Beverages, Retail, Other End-Users), prominent players (including SITC Container Lines, OOCL, ZIM Integrated Shipping Services, CMA CGM, Wan Hai Lines, NYK Line, Hapag-Lloyd, PIL, MSC, Maersk Line, and Evergreen Marine Corporation), and significant market developments. Expect precise data and actionable intelligence to navigate the complexities of this thriving market.

Singapore Container Transshipment Market Dynamics & Concentration

The Singapore container transshipment market is characterized by a high degree of concentration, with a few major players commanding significant market share. While precise market share figures for each company are unavailable for this report (xx%), the market is dominated by global giants like Maersk and MSC, alongside significant regional players such as PIL and Evergreen. The market’s consolidation is further driven by strategic mergers and acquisitions (M&A) activities, with an estimated xx number of M&A deals recorded between 2019 and 2024.

Innovation in areas such as automation, digitization, and sustainable practices is shaping the competitive landscape. Stringent regulatory frameworks, including environmental regulations and safety standards, significantly impact market operations. The existence of limited viable substitutes for container transshipment services ensures its continued relevance. End-user trends, particularly in e-commerce and the increasing demand for faster delivery times, are driving market growth. The evolving demands of various end-user industries, such as automotive, retail, and chemicals, further influence market dynamics.

Singapore Container Transshipment Market Industry Trends & Analysis

The Singapore container transshipment market exhibits robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the strategic location of Singapore as a crucial transshipment hub, facilitating efficient connectivity between major global trade routes. The increasing global trade volume, especially in Asia-Pacific, directly contributes to the market's expansion. Technological disruptions, including the adoption of automation technologies in port operations, contribute to improved efficiency and reduced costs. These advancements in port infrastructure and technology lead to increased market penetration and improved overall productivity. The competitive dynamics are intense, with major players investing heavily in capacity expansion, infrastructure upgrades, and technological advancements to maintain their market positions. Consumer preferences for faster and more reliable shipping services exert significant influence on market trends.

Leading Markets & Segments in Singapore Container Transshipment Market

Dominant Segment: The general cargo segment holds the largest market share within the container type category, driven by the high volume of general merchandise traded globally. The refrigerated container segment exhibits significant growth, driven by the increasing demand for temperature-sensitive goods in the food and pharmaceutical industries.

Dominant End-User: The retail sector constitutes a major end-user segment, fueled by the booming e-commerce industry and the rising consumer demand. The automotive industry presents another substantial segment, reflecting the extensive global automotive trade.

The dominance of these segments is fueled by several factors:

- Strong Economic Policies: Singapore's pro-business environment and stable political landscape encourage foreign investment and stimulate economic growth.

- Robust Infrastructure: Singapore's world-class port infrastructure, including advanced technologies and efficient logistics networks, ensures seamless container handling and transportation.

- Strategic Location: Its geographical position at the crossroads of major shipping lanes provides unparalleled access to global markets.

Singapore Container Transshipment Market Product Developments

Recent product innovations focus on enhancing efficiency and sustainability in container handling. Technological advancements, such as automation in container stacking and automated guided vehicles (AGVs), are improving speed and reducing operational costs. The integration of digital technologies like blockchain and IoT (Internet of Things) enhances transparency and traceability across the supply chain. These innovative solutions are designed to address the increasing demands for faster turnaround times, cost optimization, and enhanced supply chain visibility. The market fit for these developments is high, aligning with the industry's evolving needs for efficiency and sustainability.

Key Drivers of Singapore Container Transshipment Market Growth

Technological advancements, such as automation and digitization, are streamlining port operations, reducing congestion, and increasing efficiency. The robust economic growth in Asia-Pacific and the rising global trade volume significantly boost demand for container transshipment services. Supportive government policies, including infrastructure investments and trade liberalization measures, foster a conducive environment for market expansion.

Challenges in the Singapore Container Transshipment Market

The market faces challenges such as increasing operational costs, driven by rising fuel prices and labor costs. Port congestion can lead to delays and disruptions, impacting overall efficiency. Intense competition among major players creates price pressures, impacting profitability margins. Environmental concerns and regulations related to emissions pose a significant hurdle, requiring ongoing investments in sustainable technologies.

Emerging Opportunities in Singapore Container Transshipment Market

The integration of Artificial Intelligence (AI) and machine learning holds the potential to revolutionize port operations, further enhancing efficiency and predictability. Strategic partnerships between port operators and technology providers can lead to innovative solutions that address industry challenges. Expansion into new markets and diversification of services can create new revenue streams and further solidify market positions.

Leading Players in the Singapore Container Transshipment Market Sector

- SITC Container Lines

- Orient Overseas Container Line (OOCL)

- ZIM Integrated Shipping Services

- CMA CGM

- Wan Hai Lines

- NYK Line

- Hapag-Lloyd

- Pacific International Lines (PIL)

- Mediterranean Shipping Company (MSC)

- Maersk Line

- Evergreen Marine Corporation

Key Milestones in Singapore Container Transshipment Market Industry

February 2024: Maersk announced a USD 500 Million investment to expand its Southeast Asian supply chain infrastructure, adding nearly 480,000 sqm of capacity by 2026. This signifies a commitment to strengthening its position in the region's rapidly growing market.

February 2024: HERE Technologies partnered with PSA Singapore to revolutionize the container truck ecosystem, enhancing goods movement efficiency at the world's second busiest container port. This collaboration underscores the ongoing efforts to optimize logistics and leverage technology for improved efficiency.

Strategic Outlook for Singapore Container Transshipment Market Market

The Singapore container transshipment market presents significant growth potential driven by increasing globalization, technological innovation, and supportive government policies. Strategic partnerships, investments in advanced technologies, and expansion into new service offerings will be crucial for players to secure a competitive advantage and capitalize on the market's long-term growth trajectory. The focus on sustainability and efficient logistics will play an important role in shaping the future of the industry.

Singapore Container Transshipment Market Segmentation

-

1. Container Type

- 1.1. General

- 1.2. Refrigerator

-

2. End-User

- 2.1. Automotive

- 2.2. Mining & Minerals

- 2.3. Agriculture

- 2.4. Chemicals & Petrochemicals

- 2.5. Pharmaceuticals

- 2.6. Food & Beverages

- 2.7. Retail

- 2.8. Other End Users

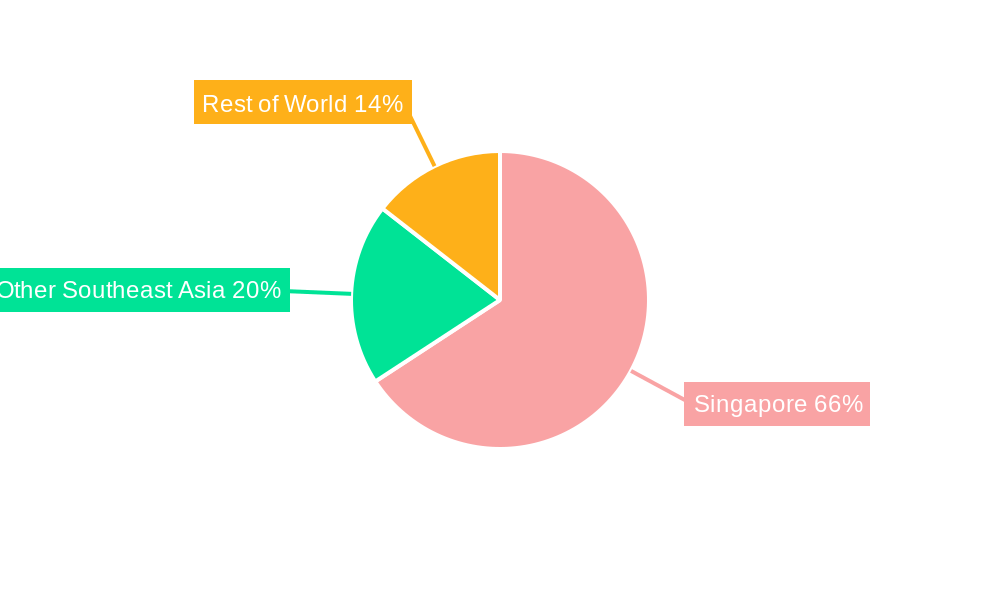

Singapore Container Transshipment Market Segmentation By Geography

- 1. Singapore

Singapore Container Transshipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.69% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce is Booming the Market; Increasing Intra-Regional Trade

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor; Competition From the Global Players

- 3.4. Market Trends

- 3.4.1. Increasing Trade Activities are Boosting the Market Growth in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Container Transshipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 5.1.1. General

- 5.1.2. Refrigerator

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Mining & Minerals

- 5.2.3. Agriculture

- 5.2.4. Chemicals & Petrochemicals

- 5.2.5. Pharmaceuticals

- 5.2.6. Food & Beverages

- 5.2.7. Retail

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SITC Container Lines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orient Overseas Container Line (OOCL)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wan Hai Lines

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NYK Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hapag-Lloyd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific International Lines (PIL)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediterranean Shipping Company (MSC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Maersk Line

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Evergreen Marine Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SITC Container Lines

List of Figures

- Figure 1: Singapore Container Transshipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Container Transshipment Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore Container Transshipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2019 & 2032

- Table 3: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Singapore Container Transshipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Singapore Container Transshipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2019 & 2032

- Table 7: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Singapore Container Transshipment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Container Transshipment Market?

The projected CAGR is approximately > 1.69%.

2. Which companies are prominent players in the Singapore Container Transshipment Market?

Key companies in the market include SITC Container Lines, Orient Overseas Container Line (OOCL), ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie, CMA CGM, Wan Hai Lines, NYK Line, Hapag-Lloyd, Pacific International Lines (PIL), Mediterranean Shipping Company (MSC), Maersk Line, Evergreen Marine Corporation.

3. What are the main segments of the Singapore Container Transshipment Market?

The market segments include Container Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce is Booming the Market; Increasing Intra-Regional Trade.

6. What are the notable trends driving market growth?

Increasing Trade Activities are Boosting the Market Growth in the Country.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor; Competition From the Global Players.

8. Can you provide examples of recent developments in the market?

February 2024: A.P. Moller-Maersk (Maersk) announced more than USD 500 million in investment to expand its supply chain infrastructure to support Southeast Asia's emergence as a global production hub and a consumption powerhouse. Maersk’s planned three-year investment will target its Logistics & Services arm. Still, at the same time, a substantial amount of investment will also be channeled into its Ocean and Terminals infrastructure. By 2026, Maersk expects to add nearly 480,000 sqm capacity spread across Malaysia, Indonesia, Singapore, and the Philippines. With these investments, Maersk will be able to better serve customers with mega distribution centers that are strategically located, sustainable, and equipped with advanced automation to drive increased efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Container Transshipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Container Transshipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Container Transshipment Market?

To stay informed about further developments, trends, and reports in the Singapore Container Transshipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence