Key Insights

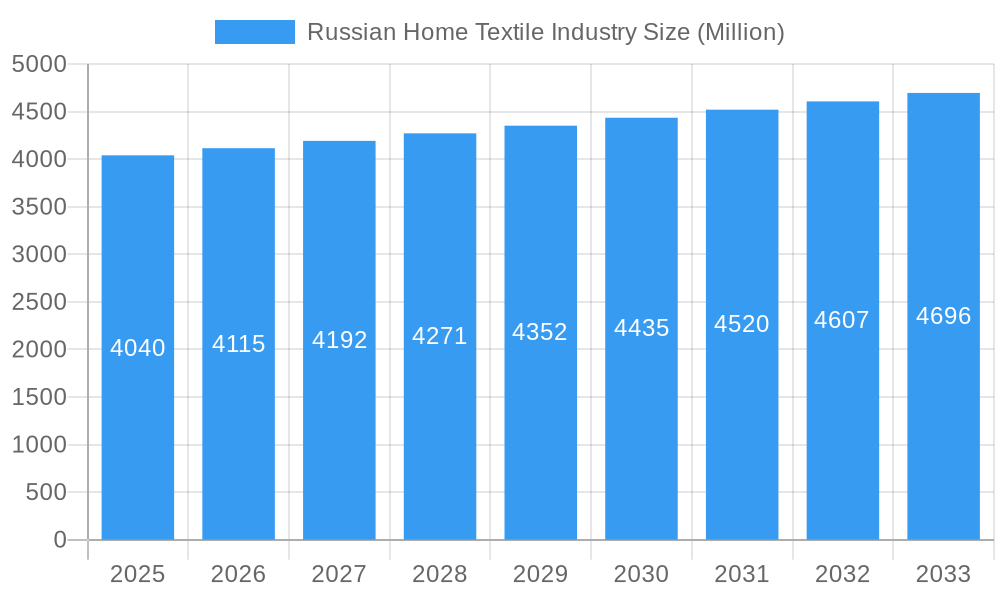

The Russian home textile market, valued at $4.04 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 1.76% from 2025 to 2033. This growth is fueled by several key factors. Increasing disposable incomes among the burgeoning middle class are driving demand for higher-quality home textiles, including premium bed linen, bath linen, and other home furnishings. A rising preference for aesthetically pleasing and comfortable home environments is also contributing to market expansion. Furthermore, the increasing popularity of online retail channels is providing convenient access to a wider range of products, boosting sales. While the market shows resilience, certain challenges remain. Economic fluctuations and potential import restrictions could impact market growth. Competition from both domestic and international players is also intensifying. Market segmentation reveals strong demand across various product categories, with bed linen and bath linen dominating, followed by kitchen linen and upholstery. Supermarkets and hypermarkets remain the primary distribution channel, although online stores are experiencing rapid growth, presenting opportunities for both established and emerging players. The geographical distribution of the market indicates that Western Russia currently holds the largest market share, reflecting higher purchasing power and consumer density in these regions.

Russian Home Textile Industry Market Size (In Billion)

The competitive landscape is marked by a mix of large established players like Goldtex Home Textile, Krasnodar Textile Factory, and Askona, alongside smaller, regionally focused manufacturers. These companies are actively focusing on product diversification, innovative designs, and strategic partnerships to strengthen their market positions. The forecast period will likely witness further consolidation as larger players acquire smaller companies to gain market share and expand their product portfolios. Companies are also investing in sustainable and eco-friendly production methods in response to growing consumer awareness regarding environmental issues. This focus on sustainability, combined with a continued focus on quality and design, will shape the future of the Russian home textile industry.

Russian Home Textile Industry Company Market Share

Russian Home Textile Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russian home textile industry, covering market dynamics, leading players, key trends, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis and expert insights to provide actionable intelligence on this dynamic market. We examine the market's evolution through its historical period (2019-2024) and its projected growth trajectory.

Keywords: Russian Home Textile Industry, Market Size, Market Share, Bed Linen, Bath Linen, Kitchen Linen, Upholstery, Floor Covering, Goldtex Home Textile, Krasnodar Textile Factory, NordTex, Vologda Textile Factory, DARGEZ, TDL Textile, Askona, Vyshnevolotsk Cotton Mill, Togas, Sortex Company, Ecotex, Market Analysis, Market Trends, Industry Growth, CAGR, M&A Activity, Competitive Landscape, Investment Opportunities, Russian Textile Market.

Russian Home Textile Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Russian home textile market, exploring factors influencing market concentration, innovation, regulation, and consumer behavior. The market is characterized by a mix of established players and emerging companies, with varying levels of market share. While precise market share figures for individual companies are unavailable publicly (xx%), this report analyzes concentration based on available financial and production data.

Market Concentration: The Russian home textile market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion (xx%) of the overall market share. Smaller players compete primarily through niche offerings and regional focus.

Innovation Drivers: Technological advancements in fiber production, manufacturing processes, and design are driving innovation within the industry. The increasing demand for eco-friendly and sustainable products also fuels innovation.

Regulatory Frameworks: Government regulations regarding product safety, labeling, and environmental standards significantly impact industry operations. This report analyzes the impact of relevant legislation on market dynamics.

Product Substitutes: The market faces competition from substitutes like synthetic alternatives and imported products. This analysis assesses the market share and competitive threat posed by these substitutes.

End-User Trends: Shifting consumer preferences toward sustainable, high-quality products, and the growth of e-commerce are reshaping the market.

M&A Activities: The number of mergers and acquisitions (M&A) deals in the Russian home textile industry from 2019 to 2024 was xx. This report analyzes the reasons behind these activities and their impact on market dynamics.

Russian Home Textile Industry Industry Trends & Analysis

The Russian home textile industry is experiencing dynamic growth, driven by several key factors. The compounded annual growth rate (CAGR) for the period 2019-2024 was estimated at xx%, and projections for the forecast period (2025-2033) indicate a CAGR of xx%. This growth reflects a number of factors including:

Rising Disposable Incomes: Increased purchasing power among consumers fuels demand for higher-quality and more diverse home textile products.

Urbanization: The ongoing shift toward urban living in Russia contributes to an increased demand for home furnishings.

E-commerce Growth: The expansion of online retail channels opens new avenues for market penetration and facilitates increased consumer access.

Consumer Preferences: Consumers are showing increasing preferences for sustainable and eco-friendly products, driving innovations in materials and manufacturing.

Technological Disruptions: The adoption of automation and advanced manufacturing technologies enhances production efficiency and opens opportunities for new product development.

Leading Markets & Segments in Russian Home Textile Industry

The Russian home textile market is geographically diverse, with varying demand and consumption patterns across different regions. While precise regional market dominance data is not readily available (xx%), this analysis identifies key segments and growth drivers:

Dominant Product Segments:

Bed Linen: This segment commands a substantial share of the market, fueled by consistent demand from residential and hospitality sectors. Key drivers include changing consumer lifestyles, preference for high-quality materials, and the increasing popularity of online retail channels.

Bath Linen: Similar to bed linen, the bath linen segment experiences steady demand and growth.

Kitchen Linen: This segment demonstrates moderate growth, primarily influenced by evolving trends in home decor and consumer preference for practical, aesthetic kitchen textiles.

Dominant Distribution Channels:

Supermarkets & Hypermarkets: This channel is a significant player, providing broad reach and accessibility for consumers.

Specialty Stores: These stores cater to consumers seeking higher-quality products and specialized designs. Their market share is growing due to the rise in consumer demand for unique home decor.

Online Stores: The rapid growth of e-commerce is transforming the distribution landscape, offering unparalleled convenience for consumers. This segment is expected to experience significant growth in the forecast period.

Russian Home Textile Industry Product Developments

Recent product developments in the Russian home textile industry reflect a focus on innovation and consumer demand. There's a noticeable shift towards the production of high-quality products using sustainable materials. Manufacturers are increasingly incorporating advanced technologies in their production processes, resulting in improved efficiency and product quality. The integration of smart textiles and other tech-infused features is also gaining traction, enhancing product value and offering unique features for consumers. The increasing focus on organic and recycled materials aligns with evolving consumer preferences and sustainable initiatives.

Key Drivers of Russian Home Textile Industry Growth

Several key factors contribute to the growth of the Russian home textile industry:

Technological Advancements: Automation and improved manufacturing processes are leading to higher efficiency and product quality.

Economic Growth: Rising disposable incomes and a growing middle class lead to higher demand for home textiles.

Government Support: Supportive government policies and initiatives aimed at promoting the domestic textile industry are contributing to growth. The shift toward technical textiles encouraged by the government is an important factor.

Challenges in the Russian Home Textile Industry Market

Despite favorable growth prospects, the Russian home textile industry faces various challenges:

Raw Material Costs: Fluctuations in global cotton prices significantly impact the cost of production. Russia's heavy reliance on cotton imports from neighboring countries like Uzbekistan exposes it to price volatility.

Competition from Imports: Foreign imports pose a competitive threat due to price advantages and brand recognition.

Infrastructure Limitations: Inefficient infrastructure in certain regions hinders market access and distribution.

Emerging Opportunities in Russian Home Textile Industry

The Russian home textile industry has significant long-term growth potential. The increasing adoption of sustainable materials and manufacturing practices presents significant opportunities for growth. Further market expansion, particularly in online channels, also presents a significant potential for growth. Strategic partnerships with global players can introduce advanced technologies and expertise to the industry.

Leading Players in the Russian Home Textile Industry Sector

- Goldtex Home Textile

- Krasnodar Textile Factory

- NordTex

- Vologda Textile Factory

- DARGEZ

- TDL Textile

- Askona

- Vyshnevolotsk Cotton Mill

- Togas

- Sortex Company

- Ecotex

Key Milestones in Russian Home Textile Industry Industry

- December 2021: Leading domestic textile manufacturers begin expanding into technical and nonwoven textiles.

- 2022: Balashov Textile Mill (Baltex) announces a USD 200 Million investment in polyamide fiber and fabric production expansion. This reflects the growing focus on technical textiles within the industry.

Strategic Outlook for Russian Home Textile Industry Market

The Russian home textile industry is poised for continued growth, driven by factors including increasing consumer spending, technological advancements, and government support. Strategic partnerships, innovation in sustainable materials, and expansion into new distribution channels will be key factors for success in the coming years. The market is expected to witness a consolidation of players, with larger companies acquiring smaller ones to gain market share. The market also showcases considerable potential for the integration of smart technology into home textiles and the adoption of circular economy principles.

Russian Home Textile Industry Segmentation

-

1. Product

- 1.1. Bed Linen

- 1.2. Bath Linen

- 1.3. Kitchen Linen

- 1.4. Upholstery

- 1.5. Floor Covering

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Russian Home Textile Industry Segmentation By Geography

- 1. Russia

Russian Home Textile Industry Regional Market Share

Geographic Coverage of Russian Home Textile Industry

Russian Home Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in demand of cordless

- 3.2.2 light-weight and small-sized vacuum cleaner

- 3.3. Market Restrains

- 3.3.1. Rise in price of electronic products post covid

- 3.4. Market Trends

- 3.4.1. Increase in E-Commerce of Textile Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bed Linen

- 5.1.2. Bath Linen

- 5.1.3. Kitchen Linen

- 5.1.4. Upholstery

- 5.1.5. Floor Covering

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Goldtex Home Textile

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Krasnodar Textile Factory

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NordTex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vologda Textile Factory

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DARGEZ

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TDL Textile

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Askona

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vyshnevolotsk Cotton Mill

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Togas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sortex Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ecotex

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Goldtex Home Textile

List of Figures

- Figure 1: Russian Home Textile Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russian Home Textile Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Home Textile Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Russian Home Textile Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Russian Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Russian Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Russian Home Textile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Russian Home Textile Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Russian Home Textile Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Russian Home Textile Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Russian Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Russian Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Russian Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Russian Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Home Textile Industry?

The projected CAGR is approximately 1.76%.

2. Which companies are prominent players in the Russian Home Textile Industry?

Key companies in the market include Goldtex Home Textile, Krasnodar Textile Factory, NordTex, Vologda Textile Factory, DARGEZ, TDL Textile, Askona, Vyshnevolotsk Cotton Mill, Togas, Sortex Company, Ecotex.

3. What are the main segments of the Russian Home Textile Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand of cordless. light-weight and small-sized vacuum cleaner.

6. What are the notable trends driving market growth?

Increase in E-Commerce of Textile Market.

7. Are there any restraints impacting market growth?

Rise in price of electronic products post covid.

8. Can you provide examples of recent developments in the market?

In 2022, One of Russia's leading producers of technical textiles and nonwovens, Balashov Textile Mill (Baltex), will invest USD 200 million for expansion of the production of polyamide fibres and fabrics over the next few years. The current market of technical textiles in Russia relies on imports. The contribution of domestic manufacturers is estimated to be merely 17 per cent of the total market. Nevertheless, with Russia's growing automotive sector, healthcare and construction industry, the internal demand for technical textile will rise. Other leading groups like Kuibyshevazot, Kurskhimvolokno and BTK Group have also declared expansion plans in Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Home Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Home Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Home Textile Industry?

To stay informed about further developments, trends, and reports in the Russian Home Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence