Key Insights

The Indian steam room market is poised for significant expansion, projected to reach $1.6 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 14.4% from 2024 to 2033. This growth is propelled by increasing disposable incomes, a growing middle class, and heightened consumer awareness of steam therapy's health benefits, including stress reduction and improved respiratory function. The burgeoning hospitality sector, encompassing luxury hotels and spas, is also a key demand driver.

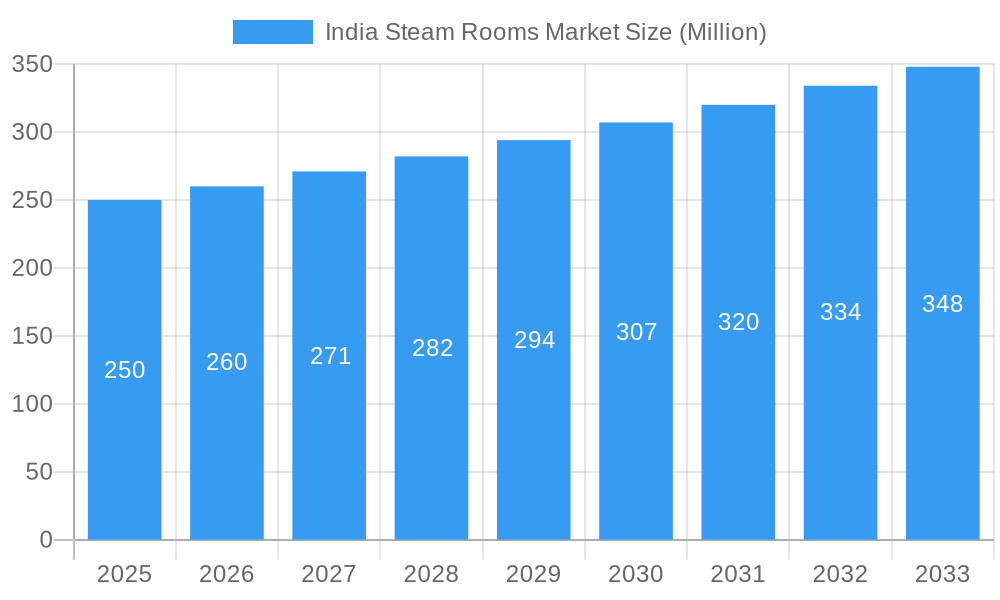

India Steam Rooms Market Market Size (In Billion)

The market is segmented by type into conventional and infrared steam rooms, and by end-user into residential and commercial applications. The residential segment is experiencing robust growth due to urbanization and a desire for enhanced home amenities. The commercial segment, driven by the popularity of wellness tourism and health-conscious lifestyles, benefits from the expansion of spas, gyms, and hotels. Challenges, such as high initial investment costs and regional awareness gaps, are being addressed through increased affordability and strategic marketing initiatives.

India Steam Rooms Market Company Market Share

Metropolitan areas, including Mumbai, Delhi, and Bangalore, currently exhibit higher market penetration. Key industry players include established brands like Kohler, alongside various domestic manufacturers catering to diverse market needs.

The forecast period (2024-2033) presents substantial opportunities for market participants. Strategic priorities should include innovative product development, such as compact and energy-efficient models for smaller residences, and expanded distribution networks. Collaborations with wellness centers and healthcare professionals will amplify brand visibility and build consumer trust. A trend towards premium, technologically advanced steam rooms featuring aromatherapy and chromotherapy is anticipated, aligning with the demand for personalized wellness experiences. The growing influence of online sales channels offers further potential for market reach and enhanced customer convenience.

India Steam Rooms Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Steam Rooms Market, offering valuable insights for industry stakeholders, investors, and businesses seeking to capitalize on its significant growth potential. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by type (Conventional, Infrared) and end-user (Residential, Commercial). Key players analyzed include Kohler, Hi-tech Bath Solutions, Quantum Solutions India, Steam Smith Systems, Bath Systems India, Orion Bathing Concepts, Potent Water Care, Steamers India, Omega Bath Solutions, and Woven Gold India (list not exhaustive). The report projects a market value of xx Million by 2033, driven by several key factors detailed below.

India Steam Rooms Market Market Dynamics & Concentration

The India Steam Rooms Market exhibits a moderately concentrated landscape, with a few key players holding significant market share. However, the market also features several smaller, regional players contributing to the overall dynamism. Market concentration is influenced by factors such as brand recognition, product innovation, distribution networks, and pricing strategies. Innovation, driven by technological advancements and evolving consumer preferences, is a key driver, particularly in areas like energy efficiency and smart features. Regulatory frameworks, though generally supportive of the wellness sector, impact product safety and compliance standards. Substitute products, such as traditional saunas and hot tubs, pose some competition but are generally distinct in their appeal.

- Market Share: Kohler and Hi-tech Bath Solutions hold the largest market shares (xx% and xx% respectively, estimated 2025), followed by other key players.

- M&A Activity: The number of mergers and acquisitions in the past five years has been relatively low (xx deals), indicating a stable but not highly consolidated market. However, increased competition is likely to drive further consolidation in the forecast period.

- End-User Trends: Growing disposable incomes, coupled with increasing health awareness and a preference for wellness experiences at home, are boosting demand, especially within the residential segment.

India Steam Rooms Market Industry Trends & Analysis

The India Steam Rooms Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by a combination of factors: rising health consciousness among consumers, increasing disposable incomes leading to higher spending on home improvement and wellness products, and a shift towards personalized wellness solutions. Technological advancements, such as the integration of smart features, energy-efficient designs, and advanced aromatherapy capabilities, are further enhancing the market appeal. Consumer preferences are evolving towards customized designs, aesthetically pleasing installations, and ease of use. The competitive dynamics are characterized by a mix of established players focusing on brand recognition and innovation and new entrants emphasizing cost-effective solutions. Market penetration remains relatively low, with significant untapped potential across various regions and segments.

Leading Markets & Segments in India Steam Rooms Market

The residential segment currently dominates the India Steam Rooms Market, accounting for approximately xx% of the total market share in 2025. This is driven by increased awareness of the health benefits of steam rooms, growing disposable incomes, and a preference for home-based wellness solutions. The metropolitan areas of major cities like Mumbai, Delhi, Bangalore, and Chennai exhibit the highest market penetration, owing to their higher disposable incomes and larger middle-class populations. The infrared segment shows a faster growth rate than the conventional segment due to its energy efficiency and ease of installation.

- Key Drivers for Residential Segment:

- Increasing disposable incomes and higher spending on home improvement.

- Growing awareness of steam therapy's health benefits.

- Preference for home-based wellness experiences.

- Key Drivers for Commercial Segment:

- Growing popularity of wellness centers and spas.

- Demand from hotels and resorts for enhanced guest experiences.

- Increasing corporate wellness initiatives.

India Steam Rooms Market Product Developments

Recent product developments focus on improved energy efficiency, smart features (e.g., app-controlled temperature and aromatherapy settings), and aesthetically pleasing designs that seamlessly integrate into modern homes. The introduction of pre-assembled models simplifies installation, reducing costs and time. Competition focuses on providing a superior user experience, enhanced features, and long-term durability. These developments address consumer demands for convenience, advanced functionalities, and design flexibility.

Key Drivers of India Steam Rooms Market Growth

Several factors fuel the market's growth trajectory:

- Rising Disposable Incomes: Increased spending power allows more consumers to invest in wellness products.

- Health & Wellness Awareness: Growing recognition of steam therapy's health benefits is driving adoption.

- Technological Advancements: Innovations in design, features, and energy efficiency are boosting market appeal.

- Favorable Government Policies: Supportive government policies regarding the wellness sector promote market growth.

Challenges in the India Steam Rooms Market Market

The market faces challenges such as:

- High Initial Investment Costs: The initial investment can be prohibitive for some consumers.

- Space Constraints: Limited space in urban apartments can hinder adoption.

- Competition from Substitutes: Other wellness options, like saunas, pose competition.

- Supply Chain Disruptions: Potential supply chain issues can impact product availability.

Emerging Opportunities in India Steam Rooms Market

Several opportunities exist for long-term market growth, including the expansion of the commercial segment, particularly in hotels and wellness centers, focusing on energy-efficient technologies, and strategic partnerships with interior designers to integrate steam rooms into new home constructions. Further penetration into Tier 2 and 3 cities is expected, as disposable incomes rise.

Leading Players in the India Steam Rooms Market Sector

- Kohler

- Hi-tech Bath Solutions

- Quantum Solutions India

- Steam Smith Systems

- Bath Systems India

- Orion Bathing Concepts

- Potent Water Care

- Steamers India

- Omega Bath Solutions

- Woven Gold India

Key Milestones in India Steam Rooms Market Industry

- 2021: Hi-tech Bath Solutions launched a new five-person indoor steam room with pre-assembled panels, designed for corner placement. This product launch expanded the market by offering a more convenient and attractive option.

Strategic Outlook for India Steam Rooms Market Market

The India Steam Rooms Market presents significant growth potential driven by increased consumer awareness and technological advancements. Focusing on energy-efficient models, smart features, and strategic collaborations with architects and interior designers are likely to be key strategic imperatives for achieving success. Expanding into underserved markets and tapping into the growing demand for luxury and customized solutions will further shape the market's future.

India Steam Rooms Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Steam Rooms Market Segmentation By Geography

- 1. India

India Steam Rooms Market Regional Market Share

Geographic Coverage of India Steam Rooms Market

India Steam Rooms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.144% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Urbanization; Advancements in Kitchen Technology

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth in Tourism is Driving the Indian Steam Room Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Steam Rooms Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kohler

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hi tech Bath Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Quantum Solutions India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Steam Smith Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bath Systems India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orion Bathing Concepts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Potent Water Care**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Steamers India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Omega Bath Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Woven Gold India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kohler

List of Figures

- Figure 1: India Steam Rooms Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Steam Rooms Market Share (%) by Company 2025

List of Tables

- Table 1: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Steam Rooms Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Steam Rooms Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Steam Rooms Market?

The projected CAGR is approximately 0.144%.

2. Which companies are prominent players in the India Steam Rooms Market?

Key companies in the market include Kohler, Hi tech Bath Solutions, Quantum Solutions India, Steam Smith Systems, Bath Systems India, Orion Bathing Concepts, Potent Water Care**List Not Exhaustive, Steamers India, Omega Bath Solutions, Woven Gold India.

3. What are the main segments of the India Steam Rooms Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Urbanization; Advancements in Kitchen Technology.

6. What are the notable trends driving market growth?

Growth in Tourism is Driving the Indian Steam Room Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Hitech bath solutions launched a new steam room. It is an indoor model that seats up to five individuals. The entire sauna showcases a beautiful blending of vertical and horizontal lines and is designed for corner placement. The panels, backrests, and benches come pre-assembled for an easy, seamless in-home assembly by two individuals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Steam Rooms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Steam Rooms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Steam Rooms Market?

To stay informed about further developments, trends, and reports in the India Steam Rooms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence