Key Insights

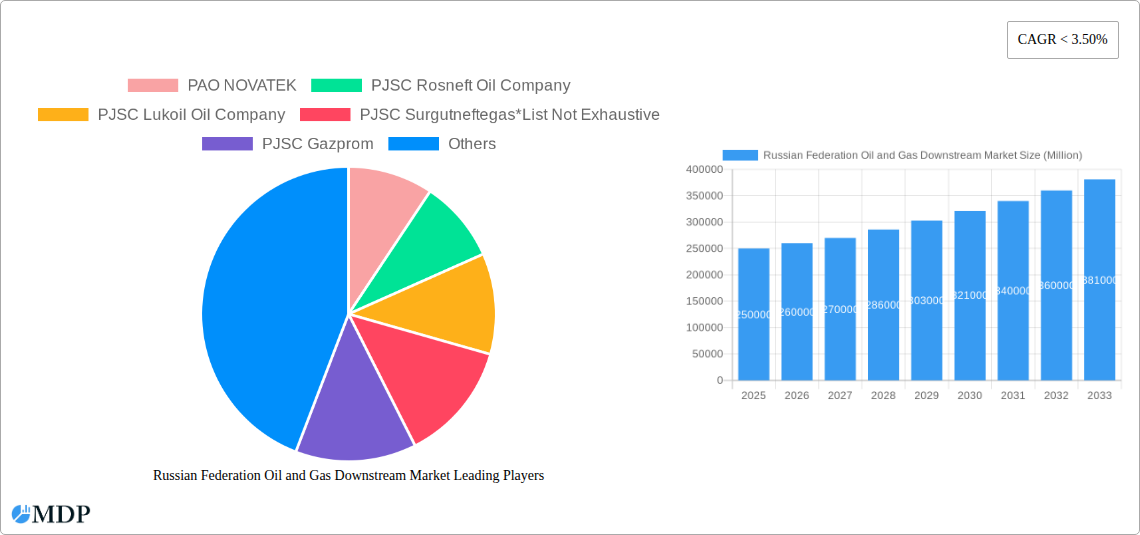

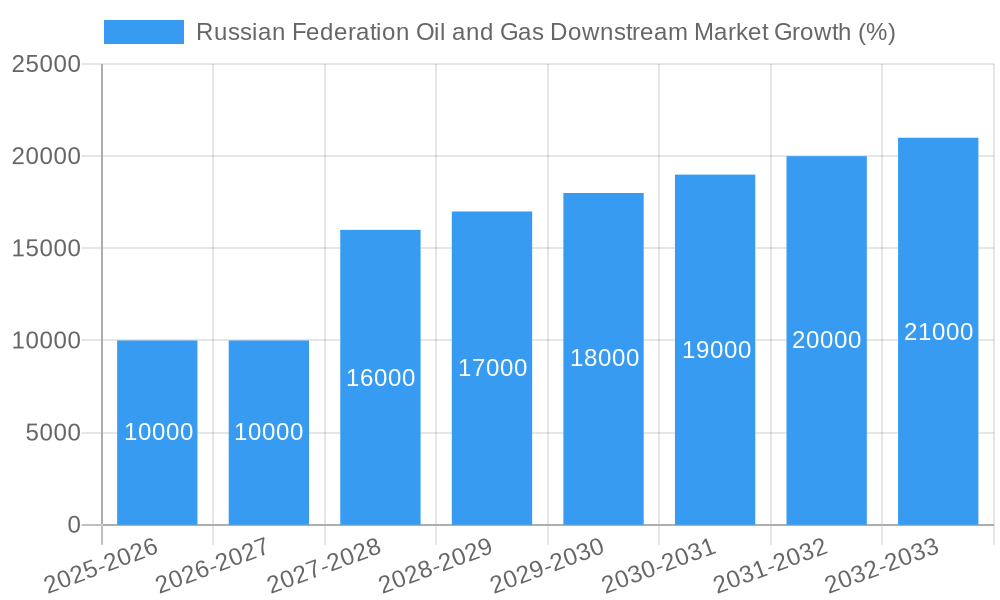

The Russian Federation's oil and gas downstream market, encompassing refining, petrochemicals, and distribution, presents a complex landscape shaped by geopolitical factors, domestic policies, and global energy dynamics. While precise market sizing for the historical period (2019-2024) isn't provided, it's reasonable to assume significant fluctuations based on fluctuating global oil prices and sanctions. The base year of 2025 likely reflects a market recovering from previous disruptions, though possibly still operating under some constraints. A CAGR extending to 2033 suggests a projected period of growth, indicating investment in modernization of refineries and expansion of petrochemical production. This growth will likely be influenced by factors such as domestic consumption, export opportunities (especially to Asia), and ongoing investment in infrastructure. The market's future trajectory is significantly dependent on the evolving geopolitical situation, international sanctions, and Russia's ability to adapt to changing global energy demand and competition from other producing nations. Government policies regarding investment, environmental regulations, and energy diversification will also play a pivotal role in shaping the market's future.

The forecast period (2025-2033) for the Russian Federation oil and gas downstream market anticipates moderate to strong growth, driven by both domestic demand and export opportunities. However, this growth is contingent upon several factors. The ongoing impact of sanctions could limit investment and access to advanced technologies, potentially slowing expansion. Conversely, increased investment in domestic infrastructure and diversification into higher-value petrochemical products could stimulate growth. The interplay between these factors will determine the ultimate trajectory of the market. A robust analysis requires a deeper understanding of specific government policies, investment flows, and the evolving geopolitical environment affecting Russia's energy sector. Furthermore, the level of integration with international markets will be crucial in determining the overall success and size of the downstream sector in the coming years.

Russian Federation Oil and Gas Downstream Market: A Comprehensive Forecast to 2033

This in-depth report provides a comprehensive analysis of the Russian Federation's oil and gas downstream market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth potential. Benefit from detailed forecasts, crucial market sizing data, and actionable recommendations for navigating this complex and evolving landscape.

Russian Federation Oil and Gas Downstream Market Market Dynamics & Concentration

The Russian Federation's oil and gas downstream market is characterized by a high degree of concentration, with a few major players dominating the landscape. Companies such as PAO NOVATEK, PJSC Rosneft Oil Company, PJSC Lukoil Oil Company, PJSC Surgutneftegas, and PJSC Gazprom collectively hold a significant market share (xx%). However, the market is not static; ongoing M&A activity (xx deals between 2019-2024) and increasing competition from smaller, more agile players are reshaping the competitive dynamics. Innovation, driven by the need for improved efficiency and environmental sustainability, is also a key factor. The regulatory framework, while generally supportive of the industry, is subject to change and presents both opportunities and challenges. Product substitutes, such as renewable energy sources, are gaining traction, albeit slowly, posing a long-term threat to traditional fossil fuel dominance. End-user trends, including shifts in energy consumption patterns and growing environmental awareness, are also shaping the market.

Russian Federation Oil and Gas Downstream Market Industry Trends & Analysis

The Russian Federation's oil and gas downstream market exhibits a complex interplay of growth drivers and challenges. From 2019 to 2024, the market experienced a CAGR of xx%, driven primarily by robust domestic demand and strategic export initiatives. Technological disruptions, such as advancements in refining technologies and the adoption of digitalization across the value chain, are reshaping operational efficiency and profitability. Consumer preferences are shifting towards higher-quality and environmentally friendly products, demanding innovation from industry players. The competitive landscape remains intense, with major players vying for market share through strategic investments, mergers, acquisitions, and capacity expansions. The forecast period (2025-2033) projects a CAGR of xx%, although geopolitical factors and global energy transition trends may influence this trajectory. Market penetration of new technologies, particularly in LNG and petrochemicals, is expected to increase significantly.

Leading Markets & Segments in Russian Federation Oil and Gas Downstream Market

- LNG Terminals: The Western Siberian region dominates the LNG terminal segment due to substantial natural gas reserves and existing infrastructure. Key projects include expansions of existing terminals and development of new facilities to cater to growing domestic and export demand. Key drivers include government support for LNG exports and increasing global demand for cleaner energy sources.

- Refineries: The Central Federal District and Southern Federal District houses the majority of Russia's refineries, benefiting from proximity to crude oil sources and established distribution networks. Major projects include modernization and capacity expansion to improve efficiency and produce higher-value products. Key drivers include the government's focus on increasing refining capacity and producing high-quality fuels meeting international standards.

- Petrochemicals Plants: The Volga Federal District and Northwest Federal District are key regions for petrochemical production due to existing infrastructure and proximity to feedstock sources. Key projects focus on expanding the production of petrochemical products like polymers and fertilizers to meet domestic and export demand. Key drivers include government support for the development of the petrochemical sector and the growth of downstream industries.

Russian Federation Oil and Gas Downstream Market Product Developments

The Russian oil and gas downstream market is witnessing significant product innovations, driven by the need for enhanced efficiency and environmental compliance. Advances in refining technologies are leading to the production of cleaner fuels with reduced sulfur content and improved performance. The focus is on value-added products, such as specialty chemicals and advanced polymers, which cater to diverse industries. These innovations provide competitive advantages and enable companies to cater to evolving consumer demands and market trends.

Key Drivers of Russian Federation Oil and Gas Downstream Market Growth

Several factors are fueling the growth of the Russian Federation's oil and gas downstream market. Government policies promoting investment in refining and petrochemical capacities are attracting significant capital expenditure. The continuous expansion of domestic demand for fuels and petrochemical products is further driving market growth. Technological advancements such as improved efficiency in refining, production and distribution processes contribute to higher profitability and sustainability initiatives.

Challenges in the Russian Federation Oil and Gas Downstream Market Market

The Russian oil and gas downstream market faces several challenges. Geopolitical uncertainty and sanctions significantly impact investment and trade. Stringent environmental regulations necessitate significant investments in upgrading facilities to meet emission standards, impacting profitability. Fluctuations in crude oil prices present risks to the industry's financial stability. Competition from international players and growing domestic competition further increase pressure on margins.

Emerging Opportunities in Russian Federation Oil and Gas Downstream Market

The Russian oil and gas downstream market presents several exciting opportunities. The development of new LNG terminals will unlock significant export potential. The growing domestic demand for high-value petrochemical products offers opportunities for expansion. Technological advancements such as carbon capture and storage technologies will also present lucrative investment prospects for companies investing in sustainability.

Leading Players in the Russian Federation Oil and Gas Downstream Market Sector

- PAO NOVATEK

- PJSC Rosneft Oil Company

- PJSC Lukoil Oil Company

- PJSC Surgutneftegas

- PJSC Gazprom

Key Milestones in Russian Federation Oil and Gas Downstream Market Industry

- 2020: Launch of a new petrochemical plant in the Volga Federal District.

- 2021: Completion of an LNG terminal expansion project, boosting export capacity.

- 2022: Announcement of a major refinery upgrade project focusing on emission reductions.

- 2023: Acquisition of a smaller downstream player by a major oil company, consolidating market share.

- 2024: Implementation of new environmental regulations impacting the sector's operations.

Strategic Outlook for Russian Federation Oil and Gas Downstream Market Market

The Russian Federation's oil and gas downstream market is poised for continued growth, driven by domestic demand, strategic investments, and technological advancements. While challenges remain, particularly in navigating geopolitical complexities and adapting to environmental regulations, the market's long-term outlook is positive. Companies focusing on innovation, efficiency, and sustainability will be best positioned to capitalize on the considerable opportunities available. The market's evolution will be further shaped by the balance between fossil fuels and the ongoing global energy transition.

Russian Federation Oil and Gas Downstream Market Segmentation

-

1. Refineries

- 1.1. Overview

-

1.2. Key Projects

- 1.2.1. Existing Infrastructure

- 1.2.2. Projects in pipeline

- 1.2.3. Upcoming projects

-

2. Petrochemicals Plants

- 2.1. Overview

-

2.2. Key Projects

- 2.2.1. Existing Infrastructure

- 2.2.2. Projects in pipeline

- 2.2.3. Upcoming projects

-

3. LNG Terminals

- 3.1. Overview

- 3.2. Key Projects

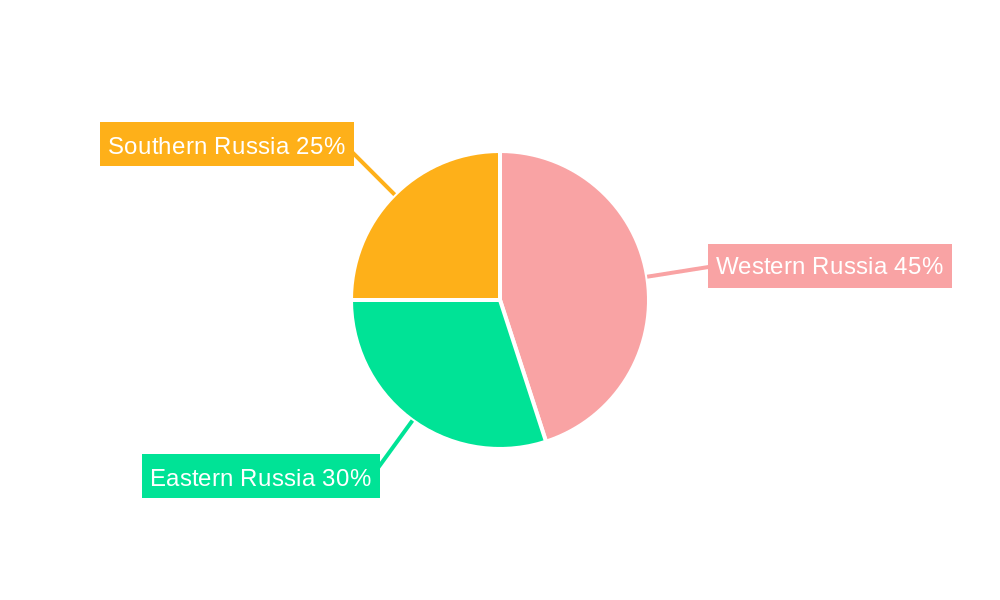

Russian Federation Oil and Gas Downstream Market Segmentation By Geography

- 1. Russia

Russian Federation Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Refining Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Federation Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.2. Key Projects

- 5.1.2.1. Existing Infrastructure

- 5.1.2.2. Projects in pipeline

- 5.1.2.3. Upcoming projects

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.2. Key Projects

- 5.2.2.1. Existing Infrastructure

- 5.2.2.2. Projects in pipeline

- 5.2.2.3. Upcoming projects

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.2. Key Projects

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Western Russia Russian Federation Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russian Federation Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russian Federation Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russian Federation Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 PAO NOVATEK

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PJSC Rosneft Oil Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 PJSC Lukoil Oil Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PJSC Surgutneftegas*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PJSC Gazprom

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 PAO NOVATEK

List of Figures

- Figure 1: Russian Federation Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russian Federation Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 5: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Western Russia Russian Federation Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Russia Russian Federation Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Russia Russian Federation Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern Russia Russian Federation Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 12: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 13: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 14: Russian Federation Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Federation Oil and Gas Downstream Market?

The projected CAGR is approximately < 3.50%.

2. Which companies are prominent players in the Russian Federation Oil and Gas Downstream Market?

Key companies in the market include PAO NOVATEK, PJSC Rosneft Oil Company, PJSC Lukoil Oil Company, PJSC Surgutneftegas*List Not Exhaustive, PJSC Gazprom.

3. What are the main segments of the Russian Federation Oil and Gas Downstream Market?

The market segments include Refineries, Petrochemicals Plants, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Refining Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Federation Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Federation Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Federation Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Russian Federation Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence