Key Insights

The Northern Virginia data center market is experiencing robust growth, driven by factors such as the concentration of major cloud providers (Amazon Web Services, Microsoft Azure, Google Cloud), significant government presence, and a robust fiber optic infrastructure. This region's strategic location, coupled with its access to skilled labor and relatively low energy costs compared to other major data center hubs, fuels continuous expansion. The market's segmentation reveals a significant concentration in large and hyperscale colocation facilities catering primarily to cloud & IT and government end-users. While retail colocation also plays a role, the wholesale and hyperscale segments dominate, reflecting the demand for massive infrastructure capacity. The utilized capacity consistently exceeds non-utilized space, indicating a high demand and low vacancy rates, further solidifying the region's position as a leading data center market. The ongoing expansion of cloud services, increasing data generation, and the growing adoption of edge computing are projected to maintain this high growth trajectory over the coming years.

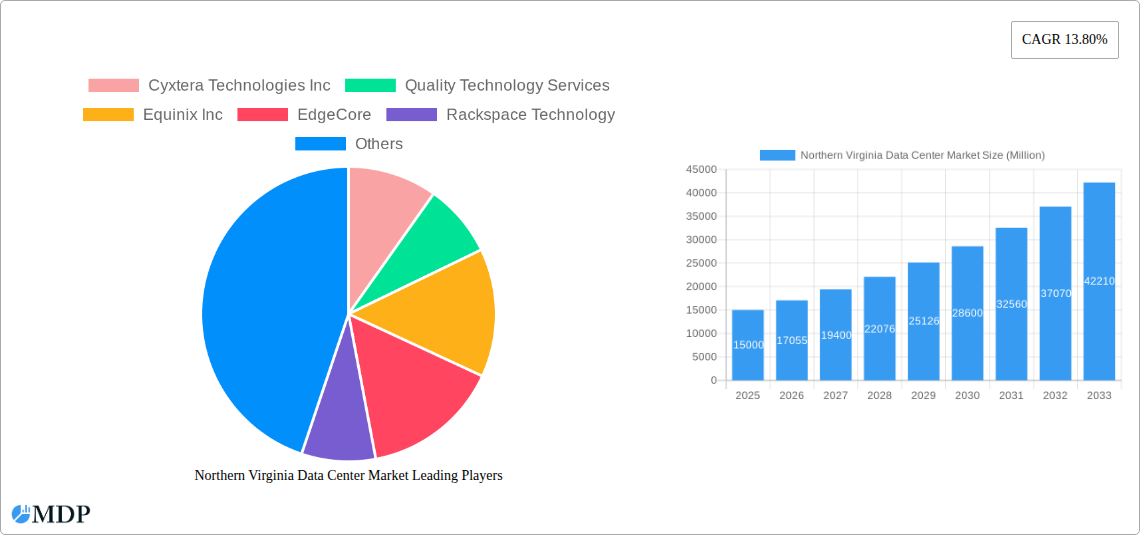

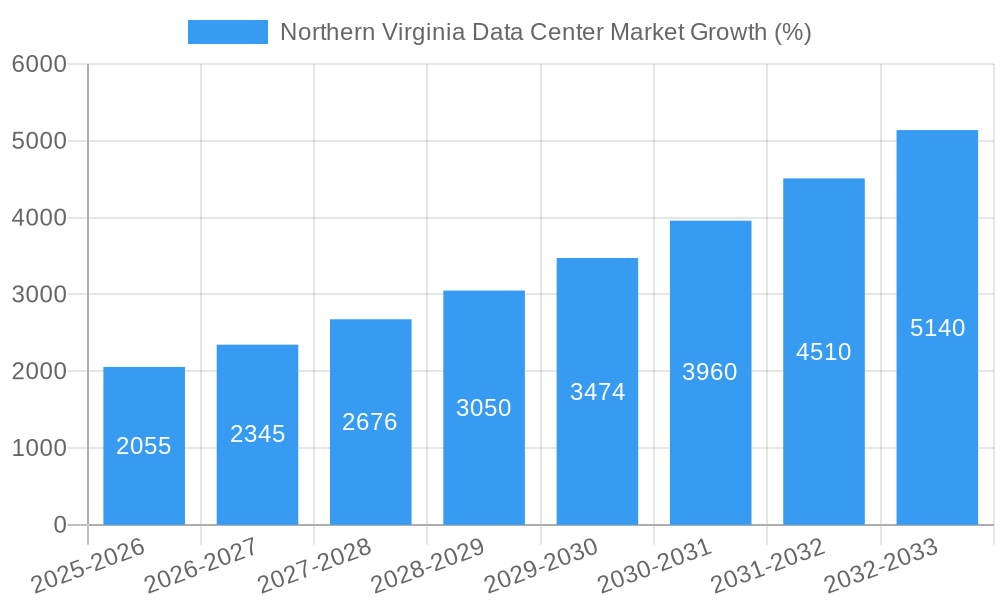

Future growth is expected to be influenced by factors such as the availability of land, power grid capacity, and the ability of the region's infrastructure to handle the increasing demand. Competition among existing providers and new entrants remains intense, driving innovation in energy efficiency, sustainability, and facility design. However, potential restraints include rising land and construction costs, regulatory hurdles, and the need for consistent upgrades to power and connectivity infrastructure. While precise market sizing for Northern Virginia is not provided, estimating based on the provided 13.80% CAGR and a hypothetical starting market size (derived from industry reports and understanding of the region's prominence), a reasonable projection suggests substantial year-on-year increases, leading to a significant market value by 2033. This continued expansion solidifies Northern Virginia's position at the forefront of the global data center landscape.

Northern Virginia Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Northern Virginia data center market, covering market dynamics, industry trends, leading segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry stakeholders, investors, and businesses seeking to understand and capitalize on the thriving Northern Virginia data center landscape. With a focus on actionable insights and key performance indicators (KPIs), this report offers a detailed examination of the market's current state and future trajectory. Expect in-depth analysis on market concentration, technological advancements, leading players, and significant growth opportunities.

Northern Virginia Data Center Market Dynamics & Concentration

The Northern Virginia data center market exhibits high concentration, with a few major players holding significant market share. Equinix Inc, Digital Realty Trust Inc, and Vantage Data Centers are among the leading providers, leveraging their extensive infrastructure and established client bases. However, the market also accommodates a diverse range of smaller and specialized providers catering to niche segments. Market share analysis reveals that the top 5 players collectively account for approximately xx% of the market, while the remaining xx% is distributed among numerous smaller operators and emerging players.

Innovation Drivers: The market is driven by constant technological advancements, including the adoption of hyperscale data centers, edge computing, and increased focus on energy efficiency.

Regulatory Framework: While generally favorable, regulatory changes related to environmental concerns and power consumption continue to influence operational strategies.

Product Substitutes: Cloud services and distributed ledger technology offer potential alternatives, although the demand for colocation facilities within Northern Virginia remains robust.

End-User Trends: The market witnesses growth across various sectors, notably cloud & IT services, government, and media & entertainment, driving demand for diverse colocation solutions.

M&A Activities: The Northern Virginia data center market has seen significant M&A activity in recent years, with a total of xx deals recorded between 2019 and 2024, signifying the growing interest and consolidation within the sector. These transactions mainly involved acquisitions of smaller data center facilities by larger players, aiming for increased market share and expanded service portfolios.

Northern Virginia Data Center Market Industry Trends & Analysis

The Northern Virginia data center market experienced robust growth in the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue in the forecast period (2025-2033), driven primarily by the increasing demand for cloud services, big data analytics, and the expansion of digital infrastructure. The market penetration of hyperscale facilities is also a significant contributing factor to this upward trend. Consumer preferences towards high availability, low latency, and advanced security features further fuel the expansion of the market. The competitive landscape is characterized by intense rivalry among major players, prompting them to invest heavily in capacity expansion, technological innovations, and strategic partnerships to maintain market leadership.

Leading Markets & Segments in Northern Virginia Data Center Market

Northern Virginia itself dominates the regional data center market, driven by its established infrastructure, connectivity, and proximity to major technology hubs.

Key Drivers:

- Abundant Power Supply: Northern Virginia enjoys access to reliable and affordable power, crucial for data center operations.

- Fiber Optic Connectivity: Extensive fiber optic networks provide high-bandwidth connectivity essential for data transmission.

- Government Support: Favorable government policies and incentives encourage investment in data center infrastructure.

- Skilled Workforce: A robust talent pool of IT professionals supports the ongoing operations and development of data centers.

Segment Dominance:

- DC Size: Large and Mega data centers account for a significant portion of the market, driven by the demands of hyperscale operators.

- Tier Type: Tier III and Tier IV facilities represent the majority of the market due to their higher reliability and redundancy.

- Absorption: Utilized capacity demonstrates a high occupancy rate, reflecting the consistent demand for data center services.

- Colocation Type: Wholesale colocation is a dominant segment, particularly catering to large enterprises and hyperscale providers.

- End User: Cloud & IT, Telecom, and Government sectors represent the highest demand for data center capacity in Northern Virginia.

Northern Virginia Data Center Market Product Developments

Recent product innovations focus on sustainability, enhanced security, and advanced connectivity solutions. Data center operators are adopting energy-efficient technologies to reduce operational costs and minimize environmental impact. Advanced security measures, such as biometric access control and multi-factor authentication, are being implemented to protect sensitive data. The integration of high-bandwidth network connectivity is another key product development driving market growth. These developments highlight the market's increasing focus on technological advancements.

Key Drivers of Northern Virginia Data Center Market Growth

The Northern Virginia data center market's growth is driven by several key factors:

- Increased Cloud Adoption: The rising demand for cloud services necessitates robust data center infrastructure.

- Expansion of Big Data Analytics: The proliferation of big data analytics requires vast data storage and processing capabilities.

- Government Initiatives: Government regulations and policies that support the growth of the data center industry.

- Technological Advancements: Innovations in data center technologies such as AI and machine learning further drive the market growth.

Challenges in the Northern Virginia Data Center Market

Challenges include:

- Land Scarcity and High Land Costs: The limited availability of suitable land in Northern Virginia drives up costs.

- Power Capacity Constraints: Meeting the growing power demand poses a challenge.

- Competition: The high level of competition among data center providers exerts pressure on pricing and profitability.

Emerging Opportunities in Northern Virginia Data Center Market

Significant opportunities lie in the deployment of edge computing, the adoption of sustainable energy solutions, and the expansion into adjacent markets, including the development of hyperscale data centers and investment in innovative technologies for enhanced operational efficiency and resiliency.

Leading Players in the Northern Virginia Data Center Market Sector

- Cyxtera Technologies Inc

- Quality Technology Services

- Equinix Inc

- EdgeCore

- Rackspace Technology

- PhoenixNAP

- Iron Mountain

- 365 data centers

- DataBank

- Evocative

- CyrusOne

- EdgeConneX Inc

- Flexential

- Cogent

- Cologix

- Evoque

- Vantage Data Center

- CoreSite

- H5 Data centers

- Digital Realty Trust Inc

- Stack Infrastructure

- NTT Ltd

Key Milestones in Northern Virginia Data Center Market Industry

- May 2023: Culpeper County approves rezoning for over 4 Million square feet of new data center construction.

- April 2023: GI Partners acquires a 98-acre data center campus in Ashburn, Virginia, highlighting continued investment in the region.

Strategic Outlook for Northern Virginia Data Center Market

The Northern Virginia data center market is poised for sustained growth driven by technological advancements, increased cloud adoption, and ongoing investments in infrastructure. Strategic partnerships, focusing on sustainable energy solutions and advanced security measures, will be crucial for maintaining a competitive edge. The continued expansion of hyperscale data centers and the growth of edge computing will further fuel market expansion in the years to come.

Northern Virginia Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Northern Virginia Data Center Market Segmentation By Geography

- 1. Virginia

Northern Virginia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Virginia

- 5.1. Market Analysis, Insights and Forecast - by DC Size

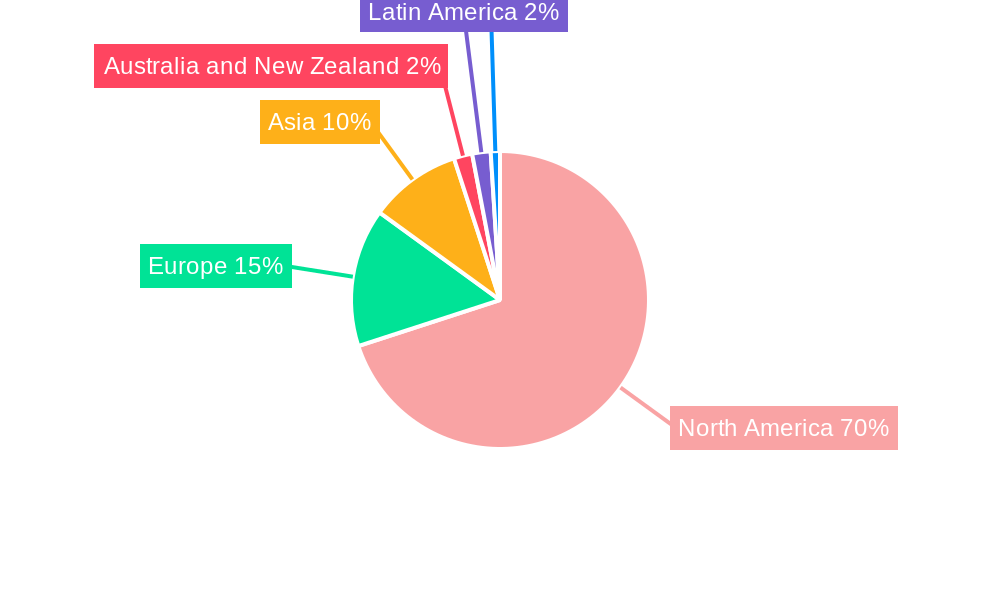

- 6. North America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Quality Technology Services

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 EdgeCore

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rackspace Technology

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PhoenixNAP

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Iron Mountain

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 365 data centers

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DataBank

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Evocative

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 CyrusOne

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 EdgeConneX Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Flexential

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Cogent

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Cologix

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Evoque

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Vantage Data Center

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 CoreSite

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 H5 Data centers

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Digital Realty Trust Inc

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.21 Stack Infrastructure

- 12.2.21.1. Overview

- 12.2.21.2. Products

- 12.2.21.3. SWOT Analysis

- 12.2.21.4. Recent Developments

- 12.2.21.5. Financials (Based on Availability)

- 12.2.22 NTT Ltd

- 12.2.22.1. Overview

- 12.2.22.2. Products

- 12.2.22.3. SWOT Analysis

- 12.2.22.4. Recent Developments

- 12.2.22.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Northern Virginia Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Northern Virginia Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Northern Virginia Data Center Market?

The projected CAGR is approximately 13.80%.

2. Which companies are prominent players in the Northern Virginia Data Center Market?

Key companies in the market include Cyxtera Technologies Inc, Quality Technology Services, Equinix Inc, EdgeCore, Rackspace Technology, PhoenixNAP, Iron Mountain, 365 data centers, DataBank, Evocative, CyrusOne, EdgeConneX Inc , Flexential, Cogent, Cologix, Evoque, Vantage Data Center, CoreSite, H5 Data centers, Digital Realty Trust Inc, Stack Infrastructure, NTT Ltd.

3. What are the main segments of the Northern Virginia Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

May 2023: Culpeper County, Virginia, may soon see the building of more than four million square feet of data centers. The Culpeper Town and County Councils have received rezoning proposals allowing the construction of about 17 structures on two campuses on the town's border alongside McDevitt Drive. According to the Culpeper Star-Exponent, the Culpeper County Planning Commission voted 7-1 last week to approve an application to rezone approximately 34.4 acres from RA (Rural Areas) to LI (Light Industrial) over Route 799 (McDevitt Drive) and Route 699 (East Chandler Street) in the StevensburgMagisterial area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Northern Virginia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Northern Virginia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Northern Virginia Data Center Market?

To stay informed about further developments, trends, and reports in the Northern Virginia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence