Key Insights

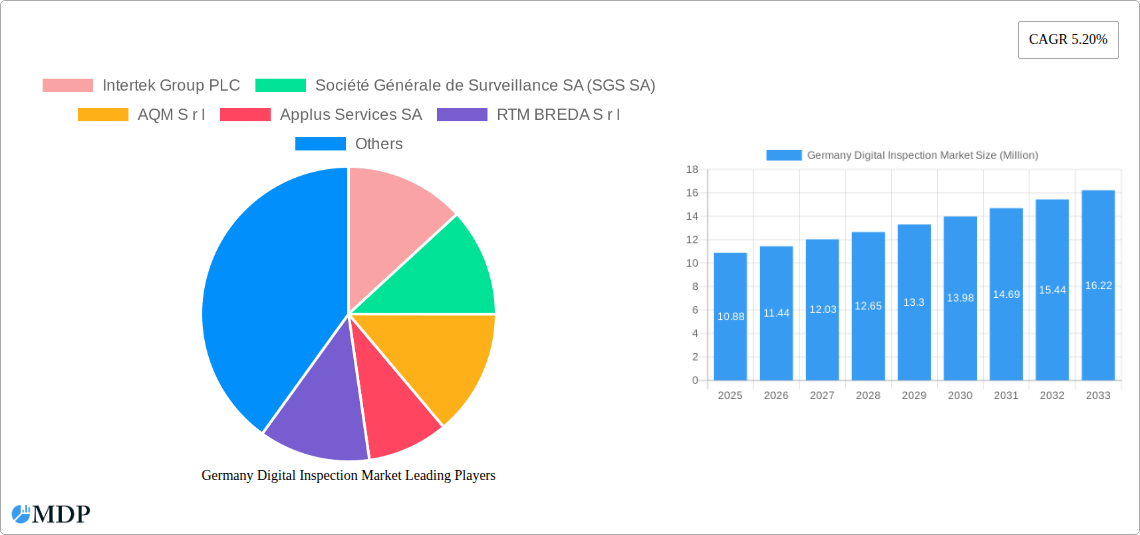

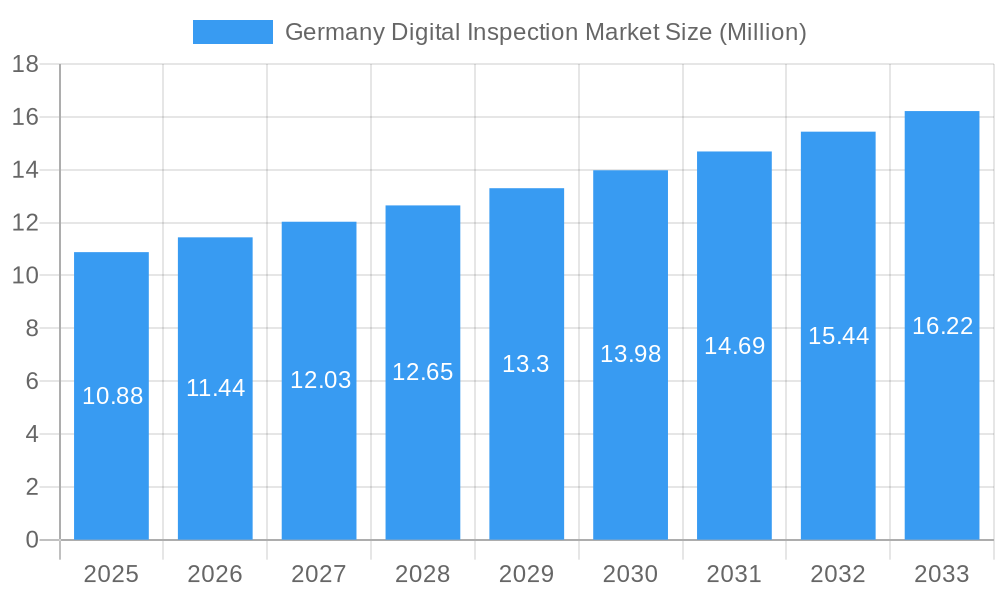

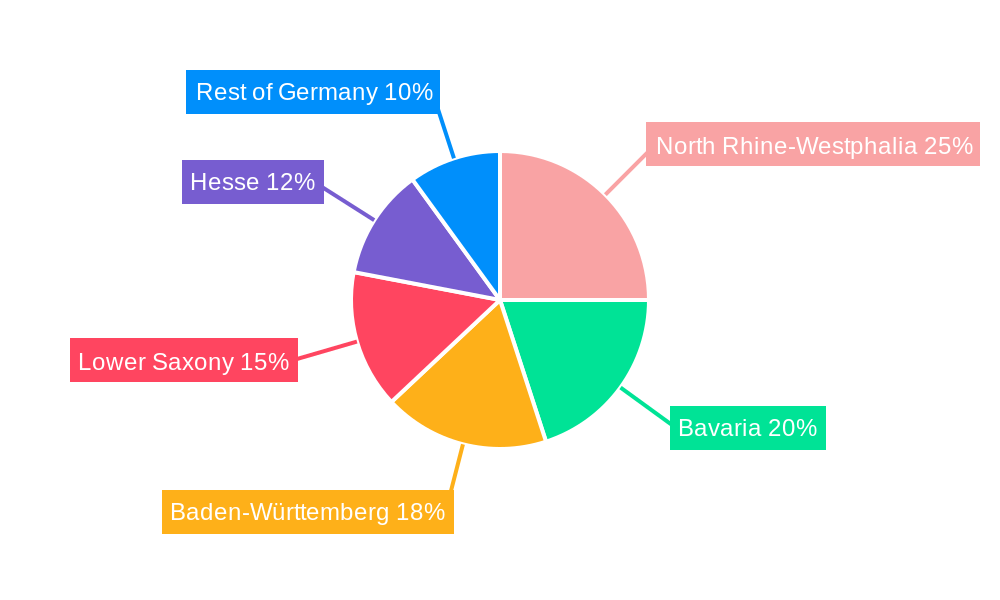

The German digital inspection market, valued at €10.88 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of Industry 4.0 technologies, including advanced sensors, AI-powered image analysis, and IoT-enabled devices, is significantly improving the efficiency and accuracy of inspection processes across various sectors. Furthermore, stringent regulatory requirements for quality control and safety in industries like automotive, food and agriculture, and manufacturing are fueling the demand for reliable and sophisticated digital inspection solutions. The rising need for real-time data analysis for predictive maintenance and proactive risk management further contributes to market growth. Germany's strong industrial base, particularly in manufacturing and automotive, provides a fertile ground for the adoption of these advanced technologies. Key players like Intertek, SGS, and TÜV SÜD are actively investing in developing and deploying cutting-edge digital inspection solutions, driving competition and innovation within the market. The regional concentration within Germany, with North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse leading the adoption, further underscores the market's potential.

Germany Digital Inspection Market Market Size (In Million)

The market segmentation reveals significant opportunities across various service types, including testing and inspection, certification, and in-house/government solutions. The dominance of outsourced services suggests a strong preference for specialized expertise and advanced technological capabilities from established players. The end-user verticals, particularly automotive, manufacturing, and food & agriculture, represent the largest market segments, reflecting the high standards of quality and safety demanded within these sectors. While challenges like high initial investment costs and the need for skilled personnel in implementing and managing digital inspection systems could act as potential restraints, the long-term benefits of improved efficiency, reduced operational costs, and enhanced safety standards are expected to outweigh these challenges, fostering continued market growth throughout the forecast period. The continued development of more sophisticated and user-friendly digital inspection tools will be crucial in sustaining this growth trajectory.

Germany Digital Inspection Market Company Market Share

Germany Digital Inspection Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany Digital Inspection Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis to project future market trends and identify lucrative investment opportunities. The market is segmented by sourcing type (outsourced, in-house/government), type of service (testing and inspection, certification), and end-user vertical (consumer goods & retail, automotive, food & agriculture, manufacturing & industrial goods, minerals & metals, oil & gas & chemicals, construction, transport, aerospace & rail, and other). The report's total market value is estimated to be xx Million in 2025, and it is expected to grow at a CAGR of xx% during the forecast period.

Germany Digital Inspection Market Market Dynamics & Concentration

The German digital inspection market exhibits a moderately concentrated landscape, with several large multinational players and numerous smaller, specialized firms competing for market share. Key market dynamics are influenced by several factors:

Market Concentration: While precise market share data for individual companies is unavailable publicly, major players such as Intertek, SGS, and TÜV SÜD command significant portions of the overall market. Smaller players cater to niche segments. We estimate the top 5 players hold approximately xx% of the market share in 2025.

Innovation Drivers: The market is driven by continuous innovation in digital technologies, including AI, machine learning, and IoT, leading to more efficient and cost-effective inspection processes. The adoption of advanced analytics for predictive maintenance is also driving growth.

Regulatory Frameworks: Stringent regulatory requirements across various sectors, including automotive, food safety, and manufacturing, compel businesses to adopt robust inspection practices, fueling market expansion. The impact of EU regulations like GDPR and the increasing emphasis on data security will continue to shape the market.

Product Substitutes: The primary substitute is traditional manual inspection methods. However, digital solutions are increasingly favored due to their superior accuracy, efficiency, and cost-effectiveness in the long term. The cost advantage of digital inspection increases as the scale of operations increases.

End-User Trends: The growing adoption of Industry 4.0 principles and the increasing need for real-time data analysis are transforming end-user preferences. Demand for digital inspection services is strongest in sectors with high safety and quality standards, particularly automotive and food & agriculture.

M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with larger players strategically acquiring smaller companies to expand their service offerings and geographic reach. The last 5 years saw approximately xx M&A deals in the German Digital Inspection Market, with an average deal size of approximately xx Million.

Germany Digital Inspection Market Industry Trends & Analysis

The German digital inspection market is experiencing robust growth, driven by several key trends:

The market is projected to experience significant growth, driven by increasing industrial automation, rising demand for quality assurance, and the growing adoption of digital technologies across various sectors. The market’s growth is significantly influenced by the high level of manufacturing output in Germany, as well as its robust regulatory compliance standards. This translates into increased demand for both outsourced and in-house inspection services. Several major trends shape this growth:

The penetration of digital inspection technologies in various industries remains comparatively low, presenting significant potential for expansion. While certain sectors are ahead in terms of adoption, others are still in the early stages of integration. The increasing awareness of potential cost savings and improved efficiency through digitalization will further propel market growth. The predicted CAGR of xx% reflects both the initial adoption rate and the potential for increased market penetration.

Technological disruptions are transforming the industry, with advancements in AI, machine learning, and big data analytics enhancing the speed, accuracy, and efficiency of inspection processes. The development of new sensor technologies, such as drones and 3D scanners, is expanding the scope of digital inspection, making it applicable across a broader range of applications. The adoption of cloud-based solutions is further accelerating growth by offering improved scalability, accessibility, and data management capabilities. Consumer preferences shift towards businesses with demonstrably high levels of quality and safety, putting increased pressure on businesses to demonstrate rigorous inspection protocols, thereby driving demand for sophisticated digital inspection systems.

Competitive dynamics within the market are characterized by both intense competition among large players and the emergence of innovative start-ups offering specialized solutions. This interplay fuels innovation and drives down prices, benefiting end-users. Large enterprises often secure contracts based on their existing infrastructure and extensive networks, while smaller players concentrate on niche market segments.

Leading Markets & Segments in Germany Digital Inspection Market

While data on regional dominance within Germany is limited, the automotive and manufacturing sectors are clearly the largest consumers of digital inspection services. This reflects the high level of technological sophistication, rigorous quality control measures, and the extensive regulatory compliance requirements in these key sectors of the German economy.

By Sourcing Type: The outsourced segment represents the largest share of the market, reflecting the preference for specialized expertise and resources among many businesses. The in-house/government segment also plays a significant role, particularly in sectors with stringent regulatory oversight.

By Type of Service: Testing and inspection services constitute the largest segment, followed by certification services. The increasing complexity of products and regulatory standards fuels the demand for comprehensive testing and validation processes.

By End-user Vertical:

- Automotive: This sector accounts for a substantial share, driven by stringent safety standards and the adoption of advanced manufacturing technologies.

- Manufacturing and Industrial Goods: The need for quality control throughout the manufacturing process and compliance with various safety standards fuels high demand within this sector.

- Food and Agriculture: Stringent food safety regulations and growing consumer awareness of food quality drive a significant demand for inspections in this sector.

Key drivers for dominance in these leading segments include:

Stringent Regulatory Environment: Germany's robust regulatory environment necessitates comprehensive inspection procedures, driving the adoption of digital solutions.

High Manufacturing Output: Germany's significant manufacturing sector creates a large market for inspection services, fueling growth across various segments.

Advanced Technological Infrastructure: Germany's advanced technological infrastructure facilitates the adoption and integration of digital inspection technologies.

Germany Digital Inspection Market Product Developments

Recent product developments emphasize advanced analytics, AI-powered defect detection, and improved data visualization. New software solutions offer streamlined workflows, better reporting, and seamless integration with existing enterprise systems. The market is increasingly seeing the adoption of IoT-enabled sensors for real-time monitoring and predictive maintenance, leading to significant improvements in efficiency and cost-effectiveness. The emphasis on user-friendly interfaces and integrated dashboards enhances accessibility and data interpretation, contributing to broader adoption across industries.

Key Drivers of Germany Digital Inspection Market Growth

Several factors contribute to the growth of the Germany Digital Inspection Market:

Technological Advancements: AI-powered solutions, improved sensor technology, and enhanced data analytics capabilities are driving efficiency and accuracy.

Stringent Regulations: Stricter quality and safety regulations across various industries necessitate rigorous inspection procedures, stimulating demand.

Economic Growth: Sustained economic growth fuels investments in infrastructure and manufacturing, consequently increasing demand for inspection services.

Challenges in the Germany Digital Inspection Market Market

The market faces several challenges:

High Initial Investment Costs: Implementing digital inspection systems requires a considerable upfront investment, which can act as a barrier for smaller businesses. The ROI can be difficult for companies with lower volumes or simpler products.

Data Security Concerns: The increasing reliance on digital data raises concerns about data security and privacy, necessitating robust security measures. Compliance with regulations like GDPR adds to the operational complexity.

Integration Challenges: Integrating new systems into existing workflows can be complex and time-consuming, requiring specialized expertise and potential disruption to existing operations.

Emerging Opportunities in Germany Digital Inspection Market

The long-term growth of the German Digital Inspection Market is fuelled by several opportunities:

The convergence of technologies like AI and IoT presents significant potential for creating more efficient and comprehensive inspection solutions. Strategic partnerships between inspection service providers and technology companies are enabling the development of innovative, tailored solutions that meet the specific needs of various industry segments. Expanding into new applications, such as drone-based inspections and predictive maintenance, will unlock further growth opportunities within this dynamic sector.

Leading Players in the Germany Digital Inspection Market Sector

- Intertek Group PLC

- Société Générale de Surveillance SA (SGS SA)

- AQM S r l

- Applus Services SA

- RTM BREDA S r l

- A/S Baltic Control Group Ltd

- TÜV SÜD Limited

- Mistras GMA - Holding GmbH

- TUV Nord

- CIS Commodity Inspection Services BV

- VIC Inspection Services Holding Ltd

- Element Materials Technology Group Limited

- DEKRA SE

- UL LLC

- Kiwa NV

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- ATG Technology Group

Key Milestones in Germany Digital Inspection Market Industry

June 2023: TÜV SÜD developed a new directional photometer for lighting system planning, offering precise 3D light distribution measurements. This enhances the precision of lighting design and evaluation.

June 2023: DAkkS accredited a biobank at Heidelberg University Hospital, the first in Germany to meet DIN EN ISO 20387 standards. This signifies a crucial step in establishing high standards for biobank operations and data management.

Strategic Outlook for Germany Digital Inspection Market Market

The future of the German Digital Inspection Market is bright, driven by continuous technological innovation and growing demand for robust quality assurance and regulatory compliance. The strategic focus will be on leveraging AI, IoT, and advanced analytics to enhance efficiency and cost-effectiveness. Strategic partnerships and acquisitions will play a pivotal role in consolidating market share and expanding into new geographical markets and industry verticals. The market is expected to see continued growth, fueled by increased automation, stringent regulatory landscapes, and rising consumer demand for high-quality products.

Germany Digital Inspection Market Segmentation

-

1. Sourcing Type

-

1.1. Outsourced

-

1.1.1. Type of Service

- 1.1.1.1. Testing and Inspection

- 1.1.1.2. Certification

-

1.1.1. Type of Service

- 1.2. In-house/Government

-

1.1. Outsourced

-

2. End-user Vertical

- 2.1. Consumer Goods and Retail

- 2.2. Automotive

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Minerals and Metals

- 2.6. Oil & Gas and Chemicals

- 2.7. Construction

- 2.8. Transport, Aerospace and Rail

- 2.9. Other End-user Verticals

Germany Digital Inspection Market Segmentation By Geography

- 1. Germany

Germany Digital Inspection Market Regional Market Share

Geographic Coverage of Germany Digital Inspection Market

Germany Digital Inspection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations and Mandates to Ensure Product Safety and Environmental Protection

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Certification to be the Fastest Growing Type of Service

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Digital Inspection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. Outsourced

- 5.1.1.1. Type of Service

- 5.1.1.1.1. Testing and Inspection

- 5.1.1.1.2. Certification

- 5.1.1.1. Type of Service

- 5.1.2. In-house/Government

- 5.1.1. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Consumer Goods and Retail

- 5.2.2. Automotive

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Minerals and Metals

- 5.2.6. Oil & Gas and Chemicals

- 5.2.7. Construction

- 5.2.8. Transport, Aerospace and Rail

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Société Générale de Surveillance SA (SGS SA)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AQM S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Applus Services SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RTM BREDA S r l

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A/S Baltic Control Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TÜV SÜD Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mistras GMA - Holding GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TUV Nord*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CIS Commodity Inspection Services BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VIC Inspection Services Holding Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Element Materials Technology Group Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DEKRA SE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 UL LLC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kiwa NV

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ALS Limited

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Bureau Veritas SA

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Eurofins Scientific SE

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 ATG Technology Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Germany Digital Inspection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Digital Inspection Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Germany Digital Inspection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Germany Digital Inspection Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Digital Inspection Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Germany Digital Inspection Market?

Key companies in the market include Intertek Group PLC, Société Générale de Surveillance SA (SGS SA), AQM S r l, Applus Services SA, RTM BREDA S r l, A/S Baltic Control Group Ltd, TÜV SÜD Limited, Mistras GMA - Holding GmbH, TUV Nord*List Not Exhaustive, CIS Commodity Inspection Services BV, VIC Inspection Services Holding Ltd, Element Materials Technology Group Limited, DEKRA SE, UL LLC, Kiwa NV, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, ATG Technology Group.

3. What are the main segments of the Germany Digital Inspection Market?

The market segments include Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations and Mandates to Ensure Product Safety and Environmental Protection.

6. What are the notable trends driving market growth?

Certification to be the Fastest Growing Type of Service.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023: The TUV SUD created and tested a new directional photometer for use in lighting system planning. The tool is the first to offer extremely precise three-dimensional measuring information on how light is spread over things in a place. Lighting designers and manufacturers can greatly benefit from this information, which will help them examine and evaluate lighting circumstances more precisely in order to create particular moods or conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Digital Inspection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Digital Inspection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Digital Inspection Market?

To stay informed about further developments, trends, and reports in the Germany Digital Inspection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence