Key Insights

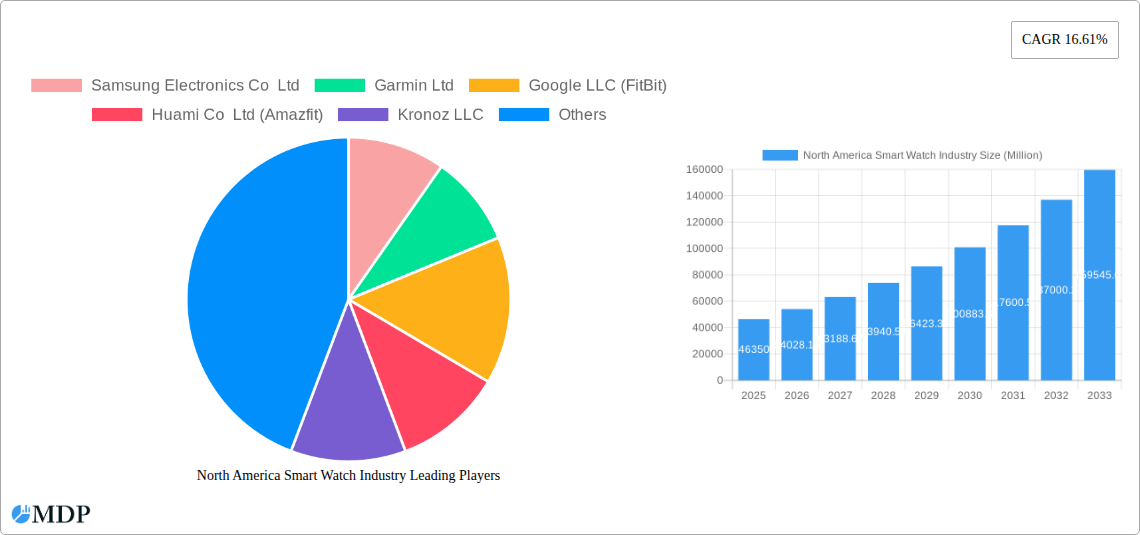

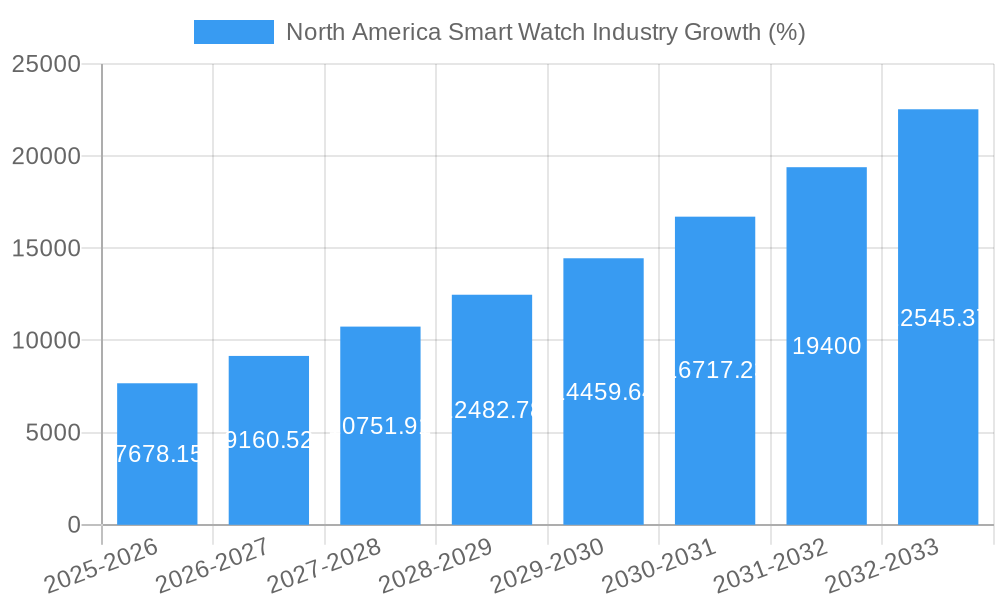

The North American smartwatch market, valued at $46.35 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 16.61% from 2025 to 2033. This surge is driven by several key factors. The increasing adoption of fitness tracking and health monitoring features appeals to a health-conscious population. Furthermore, the integration of smartwatches with smartphones and other smart devices creates a seamless connected ecosystem, enhancing user experience and driving demand. Technological advancements, such as improved battery life, enhanced display technologies (AMOLED, PMOLED), and more sophisticated health sensors (ECG, SpO2), are further fueling market expansion. The market is segmented by application (personal assistance, medical, sports, and other applications), operating systems (Watch OS, Android/Wear OS), and display type, providing diverse options to consumers. Key players like Apple, Samsung, Fitbit, and Garmin dominate the market, constantly innovating to maintain their competitive edge.

The United States and Canada represent the largest segments within North America, benefiting from high disposable incomes and a strong tech-savvy consumer base. While the market faces challenges such as the high cost of premium smartwatches and concerns about data privacy, the continuous development of innovative features and the expansion into niche applications (medical, sports) are mitigating these restraints. The forecast period (2025-2033) anticipates significant growth, particularly driven by the rising adoption of smartwatches in the healthcare sector and the proliferation of affordable yet feature-rich options. The increasing focus on personalized health management and the integration of smartwatches into corporate wellness programs are also key catalysts for future growth in this dynamic market.

North America Smart Watch Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the North America smart watch market, covering the period from 2019 to 2033. With a focus on key players like Apple, Samsung, and Garmin, the report offers valuable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic market. The report projects a market size of xx Million by 2033, driven by technological advancements and evolving consumer preferences. Download now to gain a competitive edge!

North America Smart Watch Industry Market Dynamics & Concentration

The North American smart watch market exhibits a moderately concentrated landscape, with key players like Apple, Samsung, and Garmin holding significant market share. The market share for these three companies combined is estimated at 60% in 2025. Innovation in health tracking features, improved battery life, and stylish designs are key drivers, while stringent regulatory frameworks surrounding data privacy and healthcare integration pose challenges. Product substitutes, such as basic fitness trackers, offer competition at the lower end of the market. Consumer trends show a preference for devices with advanced health monitoring, longer battery life and seamless smartphone integration. The historical period (2019-2024) witnessed approximately xx M&A deals, indicating ongoing consolidation. The forecast period (2025-2033) is expected to see a continued increase in M&A activity as companies strive for greater market share and diversification.

- Market Concentration: High, with top 3 players holding approximately 60% market share in 2025.

- Innovation Drivers: Enhanced health tracking, longer battery life, stylish designs.

- Regulatory Frameworks: Stringent data privacy regulations.

- Product Substitutes: Basic fitness trackers.

- End-User Trends: Preference for advanced features and seamless integration.

- M&A Activity: Approximately xx deals during 2019-2024, with further consolidation expected.

North America Smart Watch Industry Industry Trends & Analysis

The North American smart watch market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing adoption of wearable technology for health and fitness monitoring is a primary driver. The integration of advanced health sensors, such as ECG and SpO2 monitors, are making smartwatches increasingly attractive to health-conscious consumers. Technological disruptions, such as the development of more power-efficient processors and improved display technologies, are also contributing to market expansion. Consumer preferences are shifting towards devices with longer battery life, improved user interfaces, and stylish designs. The competitive landscape is characterized by intense rivalry among established players and emerging entrants, leading to continuous product innovation and pricing competition. Market penetration continues to grow, particularly amongst younger demographics. The current market penetration rate is estimated to be xx% in 2025, and expected to reach xx% by 2033.

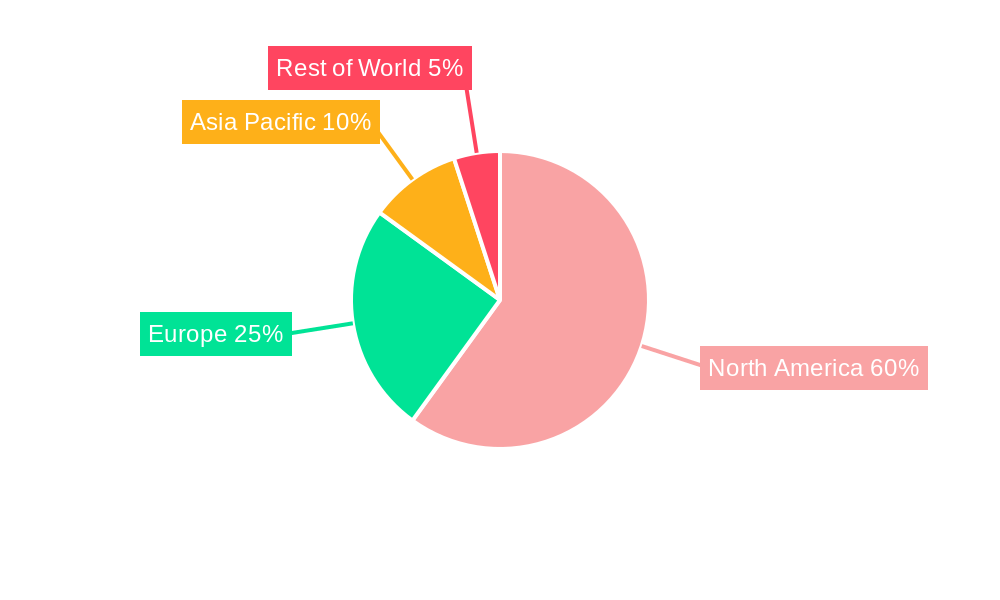

Leading Markets & Segments in North America Smart Watch Industry

The United States dominates the North American smart watch market, accounting for approximately xx% of the total market value in 2025. The strong economy, high disposable incomes, and widespread adoption of smartphones contribute to this dominance. Canada also shows significant growth, albeit at a slower pace.

- Dominant Segment: Personal Assistance remains the largest application segment due to its broad appeal, while the Medical and Sports segments are exhibiting higher growth rates.

- Key Drivers (United States):

- Strong economy and high disposable incomes.

- High smartphone penetration.

- Advanced healthcare infrastructure.

- Key Drivers (Canada):

- Growing health consciousness.

- Increasing adoption of wearable technology.

- Government initiatives promoting digital health.

The AMOLED display type holds the largest market share due to its superior image quality and energy efficiency. Android/Wear OS maintains the largest market share among operating systems, while WatchOS is closely competing in the premium segment.

North America Smart Watch Industry Product Developments

Recent product innovations focus on enhanced health and fitness tracking capabilities, including more accurate heart rate monitoring, sleep analysis, and stress level detection. Integration with other smart home devices and improved battery life are also key areas of development. Competition is driving manufacturers to offer increasingly sophisticated features and more attractive designs. The market is witnessing a shift toward more specialized devices targeting niche segments like children or specific sports activities. The recent introduction of LTE connectivity in some children's smartwatches illustrates this trend towards creating highly specific products.

Key Drivers of North America Smart Watch Industry Growth

Several factors are driving the growth of the North American smart watch market. Technological advancements, such as the development of smaller and more powerful processors, improved sensor technology, and longer battery life, have significantly enhanced the functionality and usability of smartwatches. The increasing adoption of smartphones provides a crucial ecosystem for smartwatches. Government initiatives promoting the use of wearable technology for health monitoring contribute positively to market growth. Furthermore, increasing consumer awareness of health and fitness, coupled with the growing demand for personalized healthcare solutions, is fueling demand.

Challenges in the North America Smart Watch Industry Market

The North American smart watch market faces several challenges. The high cost of premium smartwatches limits accessibility for a significant portion of the population. Supply chain disruptions and component shortages caused by global geopolitical events, can impact production and availability. Intense competition from both established players and new entrants creates pricing pressures, reducing profitability for some manufacturers.

Emerging Opportunities in North America Smart Watch Industry

The integration of advanced features such as non-invasive blood glucose monitoring and improved sleep tracking presents significant growth opportunities. The expansion into new niche markets, such as enterprise solutions for specific industries, opens new revenue streams. Strategic partnerships between smart watch manufacturers and healthcare providers can unlock access to broader markets and create new service offerings.

Leading Players in the North America Smart Watch Industry Sector

- Samsung Electronics Co Ltd

- Garmin Ltd

- Google LLC (FitBit)

- Huami Co Ltd (Amazfit)

- Kronoz LLC

- Huawei Technologies Co Ltd

- Fossil Group Inc

- Apple Inc

- Sony Corporation

Key Milestones in North America Smart Watch Industry Industry

- September 2022: Apple announces the launch of Series 8 watches, featuring advanced health features like a temperature sensor and crash detection. This significantly enhanced the appeal of Apple Watches, impacting the premium segment.

- November 2022: Garmin launches the Bounce LTE kids' smartwatch, expanding the market into a new demographic with significant growth potential. This launch showcases product diversification and a strategy to capture new markets.

Strategic Outlook for North America Smart Watch Industry Market

The North American smart watch market is poised for continued growth, driven by technological innovation, increasing health consciousness, and expanding applications. Strategic partnerships with healthcare providers and the development of more specialized devices will be key success factors. Manufacturers focusing on advanced features, improved user experiences, and seamless integration will enjoy a stronger competitive position in the years to come. The market's long-term potential remains significant, with opportunities for both established players and new entrants.

North America Smart Watch Industry Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

North America Smart Watch Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Smart Watch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness Among the Consumer

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 Augmented With Security Risks

- 3.4. Market Trends

- 3.4.1. Increase in Health Awareness among Consumers is Expected to Drive the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Smart Watch Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. United States North America Smart Watch Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Smart Watch Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Smart Watch Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Smart Watch Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Samsung Electronics Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Garmin Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Google LLC (FitBit)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Huami Co Ltd (Amazfit)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kronoz LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Huawei Technologies Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fossil Group Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Apple Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sony Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Samsung Electronics Co Ltd

List of Figures

- Figure 1: North America Smart Watch Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Smart Watch Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Smart Watch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Smart Watch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 3: North America Smart Watch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 4: North America Smart Watch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Smart Watch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Smart Watch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Smart Watch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Smart Watch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Smart Watch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Smart Watch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Smart Watch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 12: North America Smart Watch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 13: North America Smart Watch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America Smart Watch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Smart Watch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Smart Watch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Smart Watch Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Smart Watch Industry?

The projected CAGR is approximately 16.61%.

2. Which companies are prominent players in the North America Smart Watch Industry?

Key companies in the market include Samsung Electronics Co Ltd, Garmin Ltd, Google LLC (FitBit), Huami Co Ltd (Amazfit), Kronoz LLC, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Sony Corporation.

3. What are the main segments of the North America Smart Watch Industry?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness Among the Consumer.

6. What are the notable trends driving market growth?

Increase in Health Awareness among Consumers is Expected to Drive the Studied Market.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. Augmented With Security Risks.

8. Can you provide examples of recent developments in the market?

November 2022 : Garmin has launched a Bounce LTE-connected kids smartwatch With communication and location tracking technology where parents easily communicate with and locate their child. Moreover, parents can encourage an active lifestyle from a young age. Health metrics such as sleep, steps, active minutes, and fitness activities, including walking, running, biking, and pool swimming, can be tracked and viewed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Smart Watch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Smart Watch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Smart Watch Industry?

To stay informed about further developments, trends, and reports in the North America Smart Watch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence