Key Insights

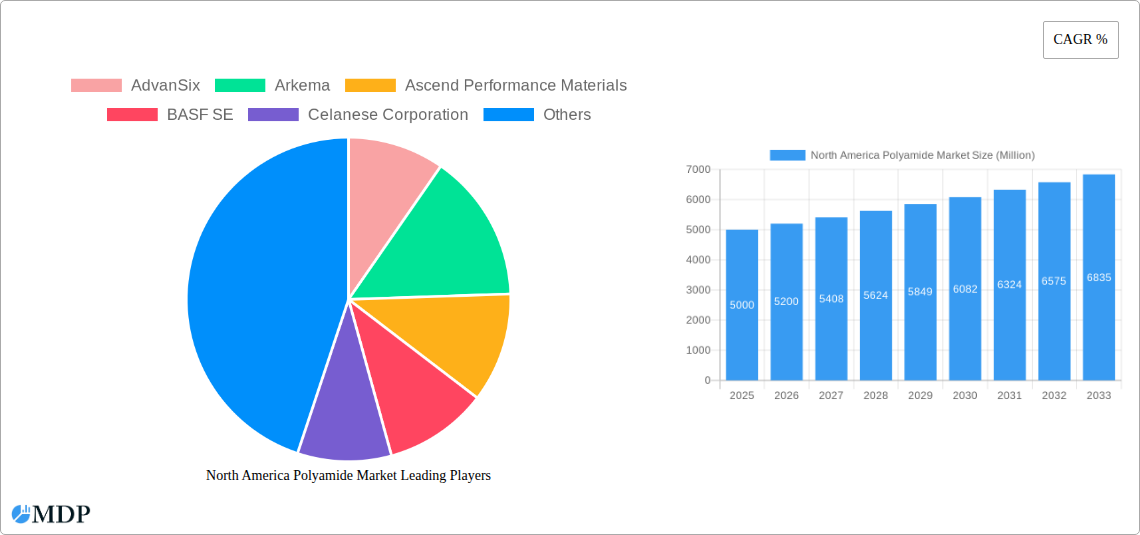

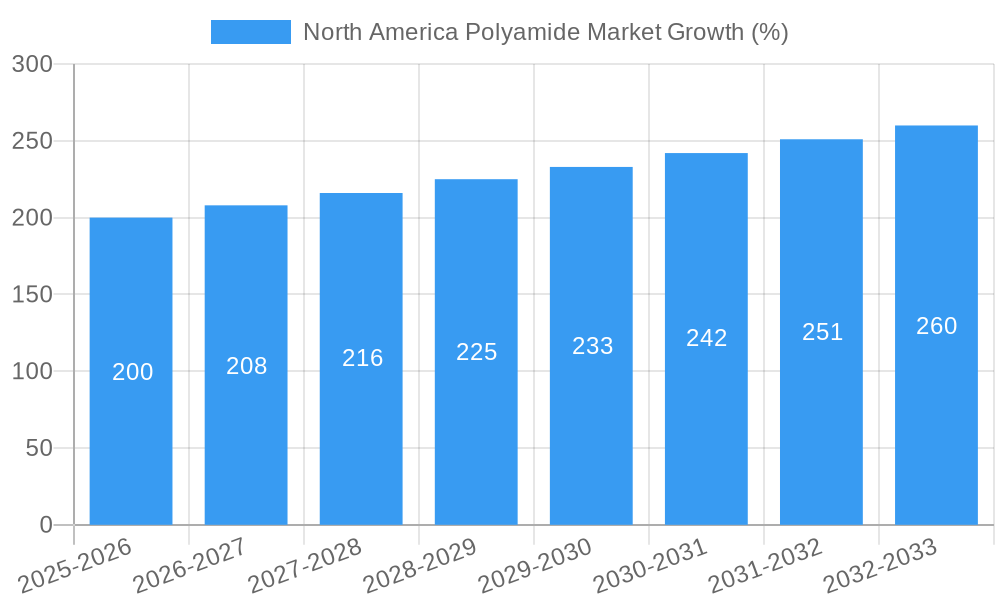

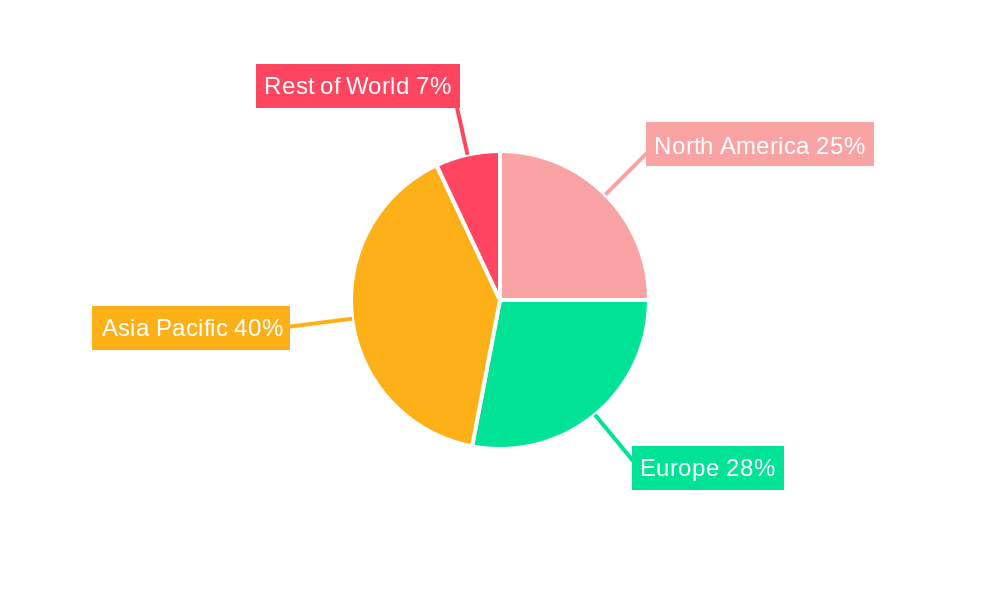

The North American polyamide market is experiencing robust growth, driven by increasing demand across diverse end-use sectors. The automotive industry's shift towards lightweighting initiatives, coupled with the expanding electronics and electrical equipment market, are significant contributors to this growth. Furthermore, the rising adoption of polyamide in consumer goods, particularly textiles and packaging, is further fueling market expansion. While precise figures for market size are unavailable, based on global trends and considering a North American market share of approximately 25% (a reasonable estimate given the region's industrial strength), a conservative estimate for the 2025 market size would be around $5 billion. Assuming a conservative compound annual growth rate (CAGR) of 4% for the forecast period (2025-2033), the market is projected to reach approximately $7.4 billion by 2033. This growth trajectory is underpinned by continuous innovation in polyamide materials, resulting in enhanced performance characteristics such as improved strength, durability, and heat resistance.

However, challenges exist. Fluctuations in raw material prices, particularly crude oil derivatives, pose a significant restraint. Supply chain disruptions and environmental concerns surrounding plastic waste also present headwinds. The market is segmented by type (PA6, PA66, others), application (automotive, electronics, textiles, packaging, etc.), and geography (US, Canada, Mexico). Key players like AdvanSix, Arkema, BASF, and Celanese are strategically investing in research and development, capacity expansion, and sustainable manufacturing practices to maintain their competitive edge and address evolving market demands. This dynamic interplay of growth drivers and restraining factors will shape the future landscape of the North American polyamide market.

North America Polyamide Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America polyamide market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, trends, and opportunities within this vital sector. Expect detailed analysis of market size, growth trajectory, competitive landscape, and future potential, enabling informed strategic planning.

North America Polyamide Market Market Dynamics & Concentration

The North America polyamide market exhibits a moderately concentrated landscape, with several key players commanding significant market share. Market concentration is influenced by factors including economies of scale in production, strong brand recognition, and extensive R&D capabilities. The market's innovative spirit is driven by the ongoing development of high-performance polyamides with enhanced properties like heat resistance, durability, and chemical resistance. Stringent regulatory frameworks concerning material safety and environmental impact also shape market dynamics. Product substitutes, such as other engineering plastics and composites, pose competitive pressure, prompting ongoing innovation. End-user trends, particularly in automotive, electronics, and packaging, significantly influence demand. Finally, mergers and acquisitions (M&A) activity is a significant force, with xx M&A deals recorded between 2019 and 2024, leading to market consolidation and reshaping competitive dynamics. Key players hold approximately xx% of the market share collectively.

North America Polyamide Market Industry Trends & Analysis

The North America polyamide market is experiencing robust growth, driven by increasing demand across diverse end-use sectors. The compound annual growth rate (CAGR) for the period 2025-2033 is estimated to be xx%, propelled by several factors. Technological advancements leading to superior material properties are a major driver, as is the rising adoption of polyamides in high-growth sectors like electric vehicles and renewable energy. Consumer preferences are shifting towards lightweight, durable, and sustainable materials, aligning perfectly with the advantages of polyamides. Competitive dynamics are intensely focused on innovation, cost optimization, and expanding market penetration. The market penetration rate for polyamides in key sectors is expected to reach xx% by 2033, reflecting strong market adoption. Furthermore, the rising focus on sustainability and circular economy principles is prompting companies to develop bio-based and recyclable polyamides, leading to a greener market.

Leading Markets & Segments in North America Polyamide Market

The [Dominant Region/Country – e.g., the United States] holds the largest market share in North America's polyamide sector. This dominance can be attributed to several factors:

- Robust Automotive Industry: A large and technologically advanced automotive sector drives significant demand for high-performance polyamides in automotive components.

- Developed Electronics Sector: The presence of major electronics manufacturers contributes to substantial polyamide consumption in electronics applications.

- Favorable Economic Policies: Supportive government policies and robust infrastructure further bolster market growth.

- Strong Consumer Spending: High levels of consumer spending translate to a greater demand for durable goods containing polyamides.

This strong foundation, coupled with ongoing technological advances and a supportive regulatory environment, ensures continued market leadership for this region/country. Other regions, while exhibiting growth, lag behind due to factors such as lower industrialization rates and less developed infrastructure. The dominant segment within the North America polyamide market is [Dominant Segment – e.g., fiber grade] due to its wide applications in textiles and other consumer goods.

North America Polyamide Market Product Developments

Recent product innovations in the North America polyamide market showcase a strong focus on enhanced material properties and application-specific designs. Manufacturers are developing high-strength, heat-resistant, and lightweight polyamide grades to cater to the demands of industries such as automotive, aerospace, and electronics. These advancements are closely tied to technological trends such as additive manufacturing and the increasing adoption of sustainable materials. The market fit for these new products is excellent, as they address crucial needs for improved performance and reduced environmental impact. These developments are driven by increasing demand for lighter weight materials, higher strength, and improved sustainability.

Key Drivers of North America Polyamide Market Growth

Several key factors are propelling the growth of the North America polyamide market. Technological advancements, including the development of high-performance grades with enhanced properties, are a major driver. The robust economic growth in North America, particularly in key end-use industries like automotive and electronics, fuels strong demand. Favorable government policies supporting sustainable materials and innovations further accelerate market growth. The increasing adoption of polyamides in electric vehicle components, renewable energy infrastructure, and advanced packaging solutions also represents a significant growth opportunity.

Challenges in the North America Polyamide Market Market

The North America polyamide market faces several challenges. Fluctuations in raw material prices, particularly oil-based feedstocks, impact production costs and profitability. Supply chain disruptions, particularly those witnessed in recent years, can lead to production delays and impact market stability. Intense competition from other engineering plastics and composite materials requires ongoing innovation and cost optimization. Furthermore, stringent environmental regulations and growing concerns about plastic waste necessitate the development of more sustainable polyamide solutions, adding to the cost and complexity of production. These factors collectively pose significant challenges to market expansion.

Emerging Opportunities in the North America Polyamide Market

The North America polyamide market presents numerous emerging opportunities. Technological breakthroughs in bio-based polyamides and recycled content utilization create pathways to a more sustainable market. Strategic partnerships between raw material suppliers, polymer manufacturers, and end-users facilitate innovation and cost efficiency. Market expansion strategies, such as exploring new applications in renewable energy and electric vehicles, further enhance growth potential. These opportunities reflect the increasing focus on sustainable solutions and innovation within the industry, fostering long-term growth.

Leading Players in the North America Polyamide Market Sector

- AdvanSix

- Arkema

- Ascend Performance Materials

- BASF SE

- Celanese Corporation

- Domo Chemicals

- DSM

- EMS-Chemie Holding AG

- Koch Industries Inc

- Polymeric Resources Corporation

Key Milestones in North America Polyamide Market Industry

- June 2022: Invista (Koch Industries Inc.) invests heavily in its South Carolina facility, expanding nylon 66 polymer capacity for the merchant market.

- November 2022: Celanese Corporation acquires DuPont's Mobility & Materials business, expanding its engineered thermoplastics portfolio.

- January 2023: DSM launches new Akulon FLX-LP and Akulon FLX40-HP polyamide grades for hydrogen storage applications.

Strategic Outlook for North America Polyamide Market Market

The future of the North America polyamide market is promising. Continued technological advancements, particularly in bio-based and recycled polyamides, will drive growth. Strategic partnerships and collaborations will play a crucial role in fostering innovation and market expansion. The increasing demand from key growth sectors like electric vehicles and renewable energy will further fuel market expansion. Focusing on sustainable solutions and addressing supply chain resilience will be key to unlocking the full potential of this dynamic market. The market is poised for significant expansion, driven by a confluence of technological progress, supportive regulatory environments, and strong end-user demand.

North America Polyamide Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Sub Resin Type

- 2.1. Aramid

- 2.2. Polyamide (PA) 6

- 2.3. Polyamide (PA) 66

- 2.4. Polyphthalamide

North America Polyamide Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Polyamide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Polyamide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Sub Resin Type

- 5.2.1. Aramid

- 5.2.2. Polyamide (PA) 6

- 5.2.3. Polyamide (PA) 66

- 5.2.4. Polyphthalamide

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AdvanSix

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arkema

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ascend Performance Materials

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Celanese Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Domo Chemicals

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DSM

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EMS-Chemie Holding AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koch Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Polymeric Resources Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AdvanSix

List of Figures

- Figure 1: North America Polyamide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Polyamide Market Share (%) by Company 2024

List of Tables

- Table 1: North America Polyamide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Polyamide Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: North America Polyamide Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 4: North America Polyamide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Polyamide Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: North America Polyamide Market Revenue Million Forecast, by Sub Resin Type 2019 & 2032

- Table 7: North America Polyamide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Polyamide Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Polyamide Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the North America Polyamide Market?

Key companies in the market include AdvanSix, Arkema, Ascend Performance Materials, BASF SE, Celanese Corporation, Domo Chemicals, DSM, EMS-Chemie Holding AG, Koch Industries Inc, Polymeric Resources Corporatio.

3. What are the main segments of the North America Polyamide Market?

The market segments include End User Industry, Sub Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: DSM introduced two new polyamide grades, Akulon FLX-LP and Akulon FLX40-HP, which will be used as liner materials and will provide robust performance in Type IV pressure vessels used for hydrogen storage.November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.June 2022: Invista, a subsidiary of Koch Industries Inc., had a polymer division called INV Nylon Polymer Americas LLC, which decided to invest heavily in its South Carolina facility, transforming the facility's production process and logistics capability from supporting carpet fiber production to a polymer-focused plant with increased supply capacity for nylon 66 polymer to the merchant market. The work was scheduled to begin later in 2022 and be completed in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Polyamide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Polyamide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Polyamide Market?

To stay informed about further developments, trends, and reports in the North America Polyamide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence