Key Insights

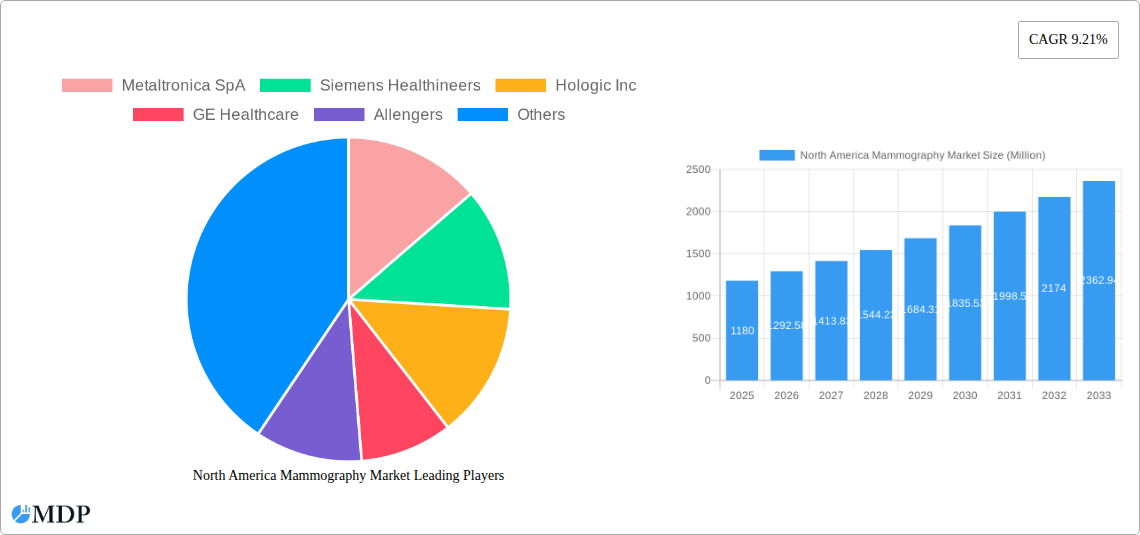

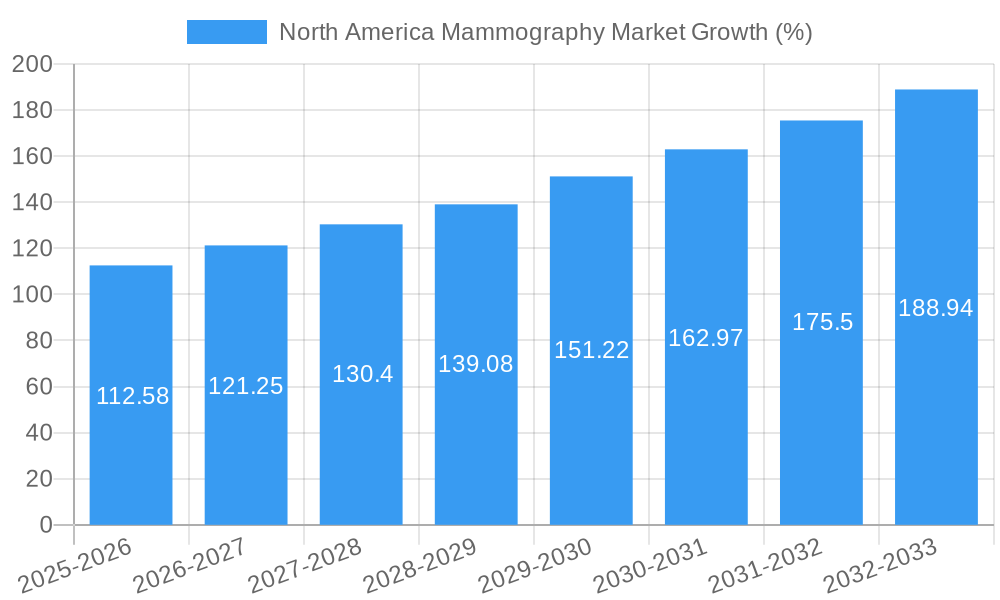

The North American mammography market, valued at $1.18 billion in 2025, is projected to experience robust growth, driven by a rising geriatric population, increased breast cancer awareness, and technological advancements in imaging systems. The 9.21% CAGR (2025-2033) indicates a significant expansion, particularly within the digital mammography segment. This segment's dominance is fueled by superior image quality, ease of storage and transmission, and reduced radiation exposure compared to analog systems. The increasing adoption of breast tomosynthesis, providing 3D images for improved lesion detection, further contributes to market growth. Hospitals and specialty clinics remain the key end-users, although the expanding diagnostic center network also fuels market demand. However, high equipment costs and the need for skilled technicians can restrain market penetration, particularly in underserved regions. Competitive landscape analysis reveals key players such as Siemens Healthineers, Hologic Inc., and GE Healthcare actively engaged in product innovation and strategic partnerships to maintain market share. The forecast period will witness a continued shift towards advanced imaging modalities and increased demand for preventative screenings, leading to sustained market expansion.

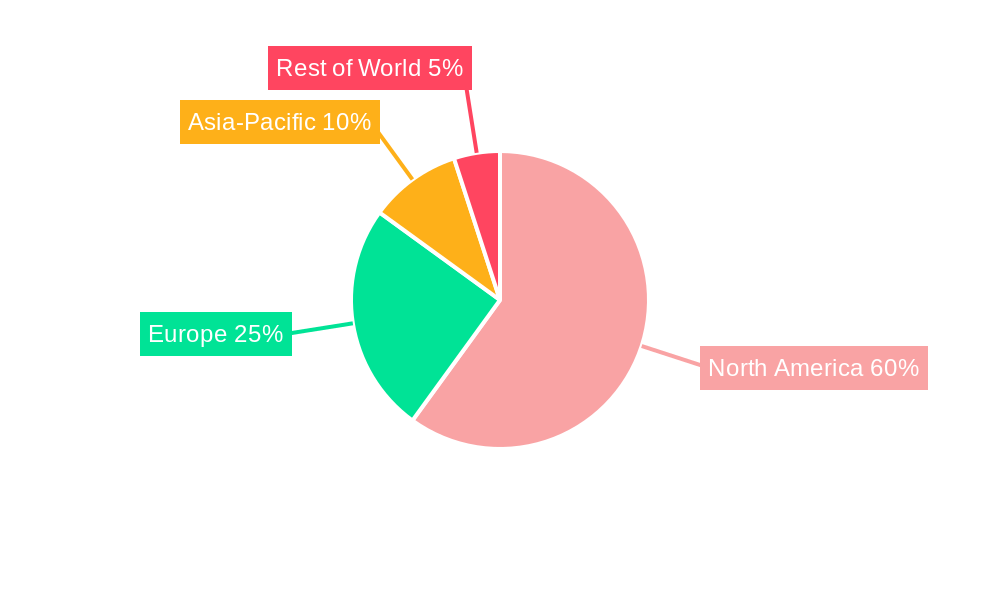

The market's geographical distribution reveals a significant concentration within the United States, owing to its larger population base and advanced healthcare infrastructure compared to Canada and Mexico. Continued investment in healthcare infrastructure and technological upgrades within North America will be key drivers for sustained market expansion. Furthermore, government initiatives aimed at promoting preventative healthcare and early cancer detection contribute positively to the market's outlook. While challenges persist in the form of high equipment costs and regulatory approvals, the overall market trajectory strongly suggests a positive growth trend throughout the forecast period (2025-2033), with digital and tomosynthesis systems leading the charge. The competitive landscape will remain dynamic, with ongoing innovation and market consolidation shaping the industry's future.

North America Mammography Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the North America mammography market, offering valuable insights for stakeholders across the healthcare industry. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future growth opportunities. The report projects a market value exceeding xx Million by 2033, driven by technological advancements and increasing awareness of breast cancer screening.

North America Mammography Market Market Dynamics & Concentration

The North America mammography market is characterized by a moderate level of concentration, with several key players holding significant market share. Market share data for 2024 reveals that Hologic Inc. and GE Healthcare collectively hold approximately xx% of the market, while other significant players like Siemens Healthineers and Fujifilm Holdings Corporation contribute substantially. The market is dynamic, influenced by several factors:

- Innovation Drivers: Continuous technological advancements, such as the development of 3D mammography (breast tomosynthesis) and AI-powered image analysis, are major drivers. These innovations enhance diagnostic accuracy and efficiency.

- Regulatory Frameworks: Regulatory changes impacting reimbursement policies and safety standards significantly influence market growth and adoption rates of new technologies.

- Product Substitutes: While few direct substitutes exist, advancements in other imaging modalities (e.g., MRI, ultrasound) present some indirect competition.

- End-User Trends: Increasing demand for advanced imaging technologies from hospitals and diagnostic centers, coupled with a rising focus on preventative healthcare, fuels market expansion.

- M&A Activities: The market has witnessed a moderate number of mergers and acquisitions (M&A) in recent years. For example, the xx M&A deals recorded in the last five years demonstrate the strategic consolidation and expansion efforts within the sector. This contributes to improved market concentration and technological integration.

North America Mammography Market Industry Trends & Analysis

The North America mammography market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by several factors: Rising prevalence of breast cancer, increasing awareness about early detection and screening, government initiatives promoting preventative healthcare, and the expanding adoption of advanced imaging technologies like digital mammography and breast tomosynthesis. Market penetration of digital systems is already high, exceeding xx%, however, the adoption of tomosynthesis systems continues to grow rapidly at xx%. Technological disruptions, particularly AI-powered image analysis and cloud-based solutions, are transforming workflow efficiencies and diagnostic capabilities. Consumer preferences are shifting towards technologically advanced systems and shorter wait times for results, driving demand for high-throughput systems and streamlined processes. The competitive landscape is intense, characterized by ongoing innovation, strategic partnerships, and investments in research and development.

Leading Markets & Segments in North America Mammography Market

The US dominates the North America mammography market, accounting for approximately xx% of the total market value in 2024. This dominance is driven by several factors:

- High Prevalence of Breast Cancer: The US has a significantly higher incidence rate of breast cancer compared to other North American countries.

- Developed Healthcare Infrastructure: A robust healthcare infrastructure with a large number of hospitals and diagnostic centers facilitates wide-scale mammography adoption.

- Favorable Reimbursement Policies: Government reimbursement policies for mammography services contribute to increased accessibility and market growth.

Dominant Segments:

- Product Type: Digital systems are the leading product segment due to their superior image quality, ease of use, and efficiency, holding more than xx% of market share. The adoption rate of Breast Tomosynthesis is also growing rapidly, projected to reach xx% market share by 2033.

- End-Users: Hospitals and diagnostic centers form the largest end-user segment, driven by their established infrastructure and the capacity to perform high-volume screenings.

North America Mammography Market Product Developments

Significant advancements in mammography technology continue to shape the market. The integration of Artificial Intelligence (AI) for improved diagnostic accuracy and reduced false positives is a prominent trend. Manufacturers are also focusing on developing systems with enhanced image quality, improved workflow efficiency, and reduced radiation dose for patients. These advancements deliver improved diagnostic performance and enhanced patient experience, directly influencing the competitive landscape and market fit of these products.

Key Drivers of North America Mammography Market Growth

Several key factors contribute to the growth of the North America mammography market:

- Technological Advancements: Innovations like digital mammography, breast tomosynthesis, and AI-driven image analysis are enhancing diagnostic accuracy and efficiency.

- Increased Awareness: Growing public awareness about breast cancer and the importance of early detection is driving screening rates.

- Government Initiatives: Government-sponsored programs promoting preventative healthcare and screening initiatives are boosting market demand.

Challenges in the North America Mammography Market Market

The market faces certain challenges including:

- High Costs: The high cost of advanced mammography systems can limit accessibility, particularly in underserved areas. This impact is estimated at a xx% reduction in adoption for certain segments.

- Regulatory Hurdles: Stringent regulatory approvals and compliance requirements can slow down the adoption of new technologies.

- Competition: The market is highly competitive, with established players vying for market share.

Emerging Opportunities in North America Mammography Market

Several emerging opportunities promise long-term growth. These include:

- AI-powered diagnostics: Integration of AI in mammography is poised to revolutionize workflow efficiency and diagnostic precision, opening opportunities for streamlined operations and improved patient outcomes.

- Telemammography: The increasing use of teleradiology and remote diagnostic services is creating opportunities for expanding access to mammography in remote areas.

- Expansion into underserved markets: Efforts to expand mammography services into underserved communities can significantly increase the market's addressable market size.

Leading Players in the North America Mammography Market Sector

- Metaltronica SpA

- Siemens Healthineers

- Hologic Inc

- GE Healthcare

- Allengers

- PLANMED OY

- Carestream Health

- Koninklijke Philips NV

- Fujifilm Holdings Corporation

- IMS GIOTTO S P A

Key Milestones in North America Mammography Market Industry

- August 2022: Intelerad Medical Systems acquired PenRad Technologies, expanding its mammography software offerings.

- May 2022: US Radiology Specialists partnered with Volpara Health, implementing advanced breast density assessment technology and patient communication software.

Strategic Outlook for North America Mammography Market Market

The North America mammography market is poised for continued growth, driven by technological innovation, increasing awareness, and favorable regulatory environments. Strategic partnerships, expansion into underserved markets, and investments in AI-driven solutions will be crucial for sustained success in this dynamic sector. The market’s future potential is significant, with opportunities for both established players and new entrants.

North America Mammography Market Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Film Screen Systems

- 1.5. Other Product Types

-

2. End Users

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Mammography Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Mammography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prevalence of Breast Cancer; Technological Advancements in the Field of Breast Imaging

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure

- 3.4. Market Trends

- 3.4.1. The Digital Mammography Segment is Expected to Account for the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Film Screen Systems

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Film Screen Systems

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Film Screen Systems

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Film Screen Systems

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. United States North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Metaltronica SpA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens Healthineers

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hologic Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 GE Healthcare

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Allengers

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PLANMED OY

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Carestream Health

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Koninklijke Philips NV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fujifilm Holdings Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 IMS GIOTTO S P A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Metaltronica SpA

List of Figures

- Figure 1: North America Mammography Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mammography Market Share (%) by Company 2024

List of Tables

- Table 1: North America Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 4: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 13: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 17: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 21: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mammography Market?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the North America Mammography Market?

Key companies in the market include Metaltronica SpA, Siemens Healthineers, Hologic Inc, GE Healthcare, Allengers, PLANMED OY, Carestream Health, Koninklijke Philips NV, Fujifilm Holdings Corporation, IMS GIOTTO S P A.

3. What are the main segments of the North America Mammography Market?

The market segments include Product Type, End Users, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Prevalence of Breast Cancer; Technological Advancements in the Field of Breast Imaging.

6. What are the notable trends driving market growth?

The Digital Mammography Segment is Expected to Account for the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure.

8. Can you provide examples of recent developments in the market?

In August 2022, Intelerad Medical Systems, a leading global provider of enterprise medical imaging solutions, acquired PenRad Technologies, Inc., a software provider for enhancing productivity for breast imaging and lung screening. The acquisition will expand Intelerad's product offerings for mammography and lung analytics, optimizing workflows for radiologists and boosting health outcomes for patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mammography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mammography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mammography Market?

To stay informed about further developments, trends, and reports in the North America Mammography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence