Key Insights

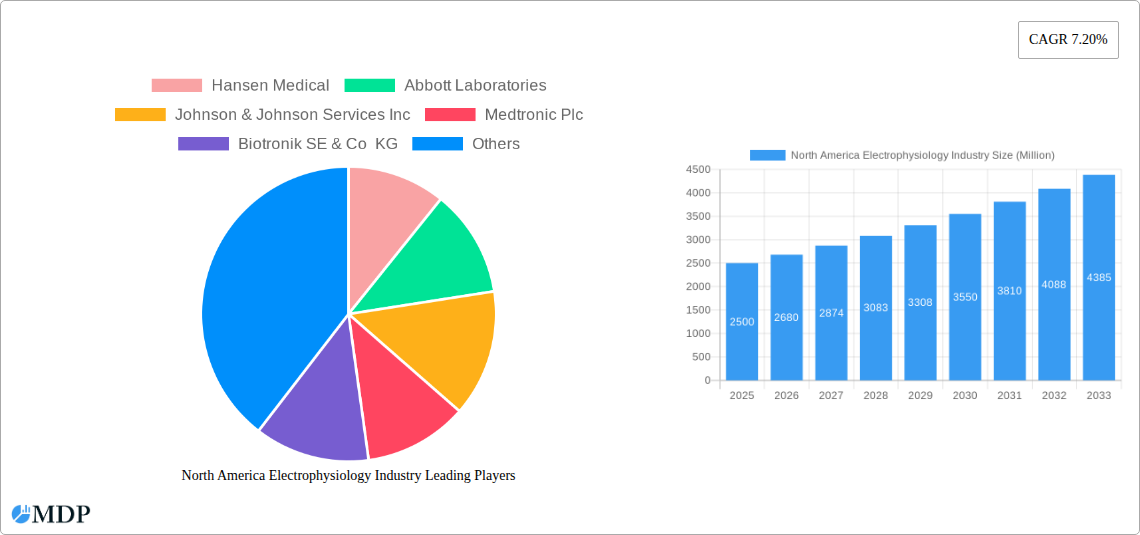

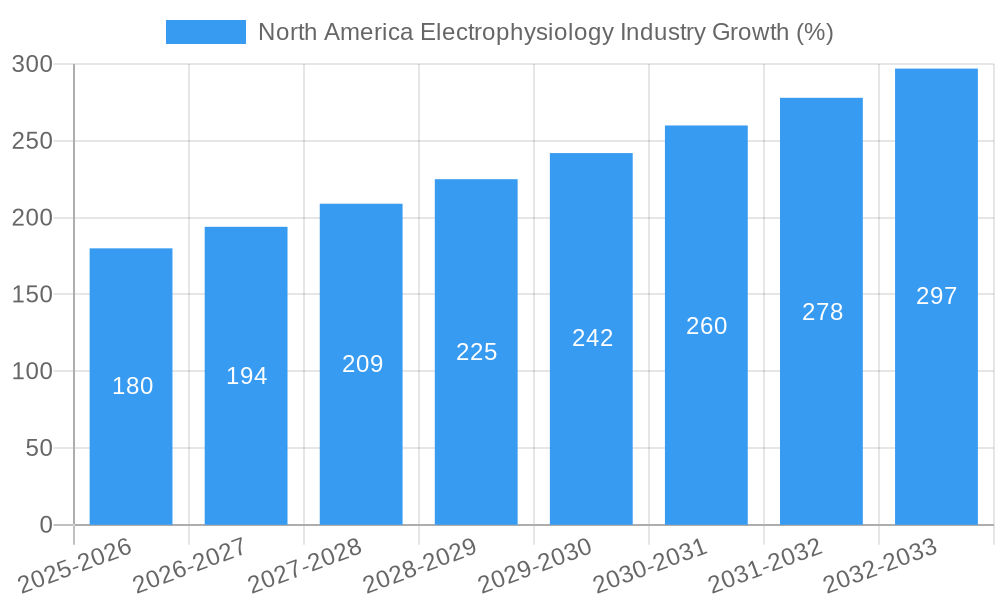

The North American electrophysiology (EP) market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 7.20% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of atrial fibrillation (AFib), a leading cause of stroke and heart failure, fuels significant demand for EP procedures and associated devices. Technological advancements, such as improved ablation catheters and diagnostic tools, enhance the efficacy and safety of EP interventions, further propelling market growth. An aging population in North America, with a concomitant increase in age-related cardiac conditions, contributes to the expanding patient pool requiring EP care. Furthermore, increased awareness among healthcare professionals and patients about EP treatment options, coupled with favorable reimbursement policies, fosters market expansion. The market is segmented by product type (ablation catheters, laboratory devices, diagnostic catheters, access devices, and other products) and target disease (AFib, atrial flutter, Wolff-Parkinson-White syndrome, atrioventricular nodal reentry tachycardia, and other diseases). The dominance of AFib as a target disease underscores the significant contribution of this condition to market growth. Leading players such as Abbott Laboratories, Boston Scientific, Medtronic, and Johnson & Johnson are actively engaged in research and development, introducing innovative EP technologies and expanding their market presence.

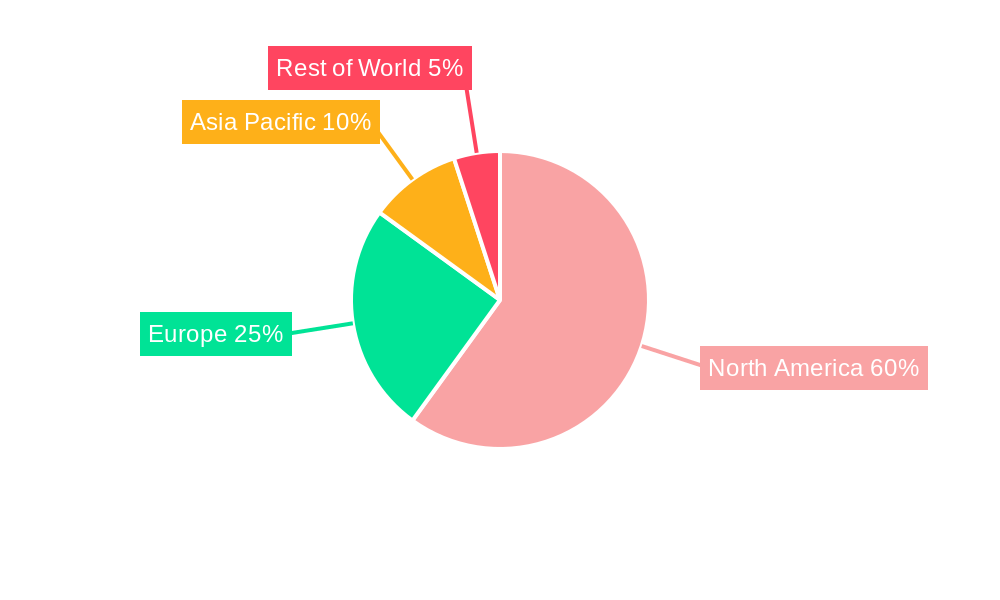

The competitive landscape is characterized by both established players and emerging companies, constantly striving to improve product offerings and capture market share. While technological advancements and favorable market dynamics present significant opportunities, the high cost of EP procedures and the potential for complications pose challenges to market expansion. The North American market currently holds a substantial share of the global EP market, largely driven by advanced healthcare infrastructure, high adoption rates of innovative technologies, and a substantial healthcare expenditure. However, regulatory hurdles and reimbursement complexities can influence market access and expansion of certain products. Future growth hinges on continued technological innovation, favorable regulatory environments, and targeted market penetration strategies, indicating a positive outlook for continued market growth in the coming years.

North America Electrophysiology Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America electrophysiology industry, covering market dynamics, leading players, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024) and incorporates current industry developments to paint a robust picture of the market landscape. Keywords: Electrophysiology, North America, Medical Devices, Cardiac Ablation, Atrial Fibrillation, Market Analysis, Market Report, Medtronic, Abbott Laboratories, Boston Scientific.

North America Electrophysiology Industry Market Dynamics & Concentration

The North American electrophysiology market is experiencing significant growth driven by factors such as an aging population, rising prevalence of cardiovascular diseases, technological advancements, and increasing demand for minimally invasive procedures. Market concentration is moderate, with several major players holding substantial market share, but also with room for smaller specialized companies to thrive. The market share of the top 5 players is estimated at 60% in 2025. Mergers and acquisitions (M&A) activity is relatively high, reflecting industry consolidation and efforts to expand product portfolios and geographical reach. Over the period 2019-2024, we observed approximately xx M&A deals in the North American electrophysiology sector. Innovation is a key driver, with companies continuously developing advanced catheters, diagnostic tools, and therapeutic devices. Regulatory frameworks, while stringent, aim to ensure safety and efficacy, fostering a balanced environment for innovation and market growth. Product substitutes are limited, given the specialized nature of electrophysiology procedures. End-user trends show a preference for minimally invasive techniques and improved outcomes, fueling demand for advanced devices.

- Market Concentration: Moderate, with top 5 players holding approximately 60% market share in 2025.

- M&A Activity: Approximately xx deals between 2019 and 2024.

- Innovation Drivers: Technological advancements in catheter design, imaging technology, and data analytics.

- Regulatory Frameworks: Stringent but supportive of innovation, focusing on patient safety and efficacy.

- End-User Trends: Preference for minimally invasive procedures and improved clinical outcomes.

North America Electrophysiology Industry Industry Trends & Analysis

The North America electrophysiology market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The rising prevalence of atrial fibrillation and other arrhythmias, coupled with an aging population, significantly increases the demand for electrophysiology procedures. Technological advancements, such as the development of sophisticated mapping systems and robotic-assisted catheters, enhance the accuracy and effectiveness of treatments, leading to improved patient outcomes. Consumer preferences are shifting towards less invasive procedures with faster recovery times, driving demand for innovative products and services. The competitive landscape is characterized by intense rivalry among established players and emerging companies, leading to continuous product innovation and market expansion. Market penetration of advanced ablation catheters is increasing steadily, reflecting the growing adoption of these technologies. The market is also witnessing increasing adoption of remote monitoring technologies, improving post-procedure patient care and data collection.

Leading Markets & Segments in North America Electrophysiology Industry

The United States dominates the North American electrophysiology market, accounting for the largest share of revenue and procedures. This dominance stems from factors such as a high prevalence of cardiovascular diseases, well-established healthcare infrastructure, and greater access to advanced medical technologies. Within product segments, ablation catheters represent the largest market share, followed by diagnostic catheters and laboratory devices. The atrial fibrillation segment is the leading target disease category, driven by its high prevalence and significant clinical burden.

Key Drivers:

- United States: High prevalence of cardiovascular diseases, advanced healthcare infrastructure, high healthcare expenditure.

- Ablation Catheters: Growing adoption of minimally invasive procedures, technological advancements in catheter design.

- Atrial Fibrillation: High prevalence, significant clinical burden, and increasing awareness.

Dominance Analysis:

The US market's dominance is expected to continue throughout the forecast period. Factors such as robust research and development activities, a strong regulatory environment supporting innovation, and increased investment in healthcare infrastructure will solidify its leading position. The ablation catheter segment's strong performance is attributable to its effectiveness in treating various arrhythmias, coupled with the ongoing development of next-generation ablation technologies. Similarly, the atrial fibrillation segment's lead reflects the high prevalence and substantial clinical impact of this condition, necessitating extensive treatment options.

North America Electrophysiology Industry Product Developments

Recent years have witnessed significant advancements in electrophysiology products, particularly in catheter technology. The development of sophisticated mapping systems and robotic-assisted catheters has improved the accuracy and effectiveness of ablation procedures. New catheter designs are focusing on minimizing trauma to surrounding tissues, enhancing procedural safety, and improving patient outcomes. These advancements, coupled with the integration of advanced imaging technologies, have expanded the clinical applications of electrophysiology procedures, leading to improved patient care. The market is also witnessing the emergence of smart catheters with integrated sensors and data analytics capabilities, allowing for real-time monitoring and personalized treatment.

Key Drivers of North America Electrophysiology Industry Growth

Several key factors are driving growth in the North American electrophysiology industry. The aging population is a significant contributor, as the risk of developing arrhythmias increases with age. Technological advancements in ablation catheters, diagnostic tools, and mapping systems enhance the accuracy and safety of procedures. The rising prevalence of cardiovascular diseases, like atrial fibrillation, fuels the demand for electrophysiology interventions. Government initiatives to improve healthcare infrastructure and access to advanced technologies also support market growth. Furthermore, increasing awareness about the importance of early diagnosis and treatment of arrhythmias plays a vital role.

Challenges in the North America Electrophysiology Industry Market

The North American electrophysiology market faces several challenges. Stringent regulatory approvals and high development costs can impede the introduction of new products. Supply chain disruptions and component shortages can impact manufacturing and distribution. Intense competition among established players necessitates continuous innovation and cost-effectiveness. The high cost of procedures can limit accessibility for certain patient populations. Furthermore, reimbursement policies and insurance coverage can affect market demand.

Emerging Opportunities in North America Electrophysiology Industry

The electrophysiology industry presents several attractive opportunities. Technological advancements like AI-powered diagnostic tools and personalized treatment strategies promise improved outcomes. Strategic partnerships between device manufacturers and healthcare providers can streamline processes and improve efficiency. Expansion into emerging markets and untapped patient populations can unlock significant growth potential. Focus on remote patient monitoring and telehealth solutions can optimize patient care and reduce healthcare costs.

Leading Players in the North America Electrophysiology Industry Sector

- Abbott Laboratories

- Johnson & Johnson Services Inc

- Medtronic Plc

- Biotronik SE & Co KG

- Boston Scientific Corporation

- Siemens Healthineers

- Nihon Kohden Corporation

- GE Healthcare (GE company)

- Hansen Medical

Key Milestones in North America Electrophysiology Industry Industry

- September 2022: Catheter Precision's merger with Ra Medical Systems strengthens the cardiac electrophysiology market and creates a publicly traded company focused on the sector.

- July 2022: Stereotaxis's CE Mark application for its MAGiC catheter signifies progress in robotically navigated cardiac ablation, potentially enhancing minimally invasive procedures.

Strategic Outlook for North America Electrophysiology Industry Market

The North America electrophysiology market is poised for substantial growth, driven by an aging population, technological advancements, and a rising prevalence of cardiovascular diseases. Strategic opportunities lie in developing innovative products, expanding into underserved markets, and forging strategic partnerships to enhance market reach. Companies focused on innovation, technological integration, and patient-centric care will be best positioned to capitalize on the market's future potential. The market’s growth will likely be influenced by the pace of technological advancements, regulatory landscape and reimbursement policies.

North America Electrophysiology Industry Segmentation

-

1. Product

- 1.1. Ablation Catheters

- 1.2. Laboratory Devices

- 1.3. Diagnostic Catheters

- 1.4. Access Devices

- 1.5. Other Products

-

2. Target Disease

- 2.1. Atrial Fibrillation

- 2.2. Atrial Flutter

- 2.3. Wolff-Parkinson-White Syndrome

- 2.4. Atrioventricular Nodal Reentry Tachycardia

- 2.5. Other Target Diseases

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Electrophysiology Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Electrophysiology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Target Diseases; Technological Advancements in the Field of Electrophysiology; Increasing Demand for Catheter Ablation Procedures

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled And Experienced Electrophysiologists; Unfavorable Healthcare Reforms

- 3.4. Market Trends

- 3.4.1. Atrial Fibrillation Segment is Expected to Hold a Major Market Share in the North America Electrophysiology Market Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Ablation Catheters

- 5.1.2. Laboratory Devices

- 5.1.3. Diagnostic Catheters

- 5.1.4. Access Devices

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Target Disease

- 5.2.1. Atrial Fibrillation

- 5.2.2. Atrial Flutter

- 5.2.3. Wolff-Parkinson-White Syndrome

- 5.2.4. Atrioventricular Nodal Reentry Tachycardia

- 5.2.5. Other Target Diseases

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Ablation Catheters

- 6.1.2. Laboratory Devices

- 6.1.3. Diagnostic Catheters

- 6.1.4. Access Devices

- 6.1.5. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Target Disease

- 6.2.1. Atrial Fibrillation

- 6.2.2. Atrial Flutter

- 6.2.3. Wolff-Parkinson-White Syndrome

- 6.2.4. Atrioventricular Nodal Reentry Tachycardia

- 6.2.5. Other Target Diseases

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Ablation Catheters

- 7.1.2. Laboratory Devices

- 7.1.3. Diagnostic Catheters

- 7.1.4. Access Devices

- 7.1.5. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Target Disease

- 7.2.1. Atrial Fibrillation

- 7.2.2. Atrial Flutter

- 7.2.3. Wolff-Parkinson-White Syndrome

- 7.2.4. Atrioventricular Nodal Reentry Tachycardia

- 7.2.5. Other Target Diseases

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Ablation Catheters

- 8.1.2. Laboratory Devices

- 8.1.3. Diagnostic Catheters

- 8.1.4. Access Devices

- 8.1.5. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Target Disease

- 8.2.1. Atrial Fibrillation

- 8.2.2. Atrial Flutter

- 8.2.3. Wolff-Parkinson-White Syndrome

- 8.2.4. Atrioventricular Nodal Reentry Tachycardia

- 8.2.5. Other Target Diseases

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Electrophysiology Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hansen Medical

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Abbott Laboratories

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Johnson & Johnson Services Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Medtronic Plc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Biotronik SE & Co KG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Boston Scientific Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Siemens Healthineers*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nihon Kohden Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 GE Healthcare (GE company)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Hansen Medical

List of Figures

- Figure 1: North America Electrophysiology Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Electrophysiology Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Electrophysiology Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Electrophysiology Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Electrophysiology Industry Revenue Million Forecast, by Target Disease 2019 & 2032

- Table 4: North America Electrophysiology Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Electrophysiology Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Electrophysiology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Electrophysiology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Electrophysiology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Electrophysiology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Electrophysiology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Electrophysiology Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 12: North America Electrophysiology Industry Revenue Million Forecast, by Target Disease 2019 & 2032

- Table 13: North America Electrophysiology Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Electrophysiology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Electrophysiology Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 16: North America Electrophysiology Industry Revenue Million Forecast, by Target Disease 2019 & 2032

- Table 17: North America Electrophysiology Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Electrophysiology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Electrophysiology Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 20: North America Electrophysiology Industry Revenue Million Forecast, by Target Disease 2019 & 2032

- Table 21: North America Electrophysiology Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Electrophysiology Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electrophysiology Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the North America Electrophysiology Industry?

Key companies in the market include Hansen Medical, Abbott Laboratories, Johnson & Johnson Services Inc, Medtronic Plc, Biotronik SE & Co KG, Boston Scientific Corporation, Siemens Healthineers*List Not Exhaustive, Nihon Kohden Corporation, GE Healthcare (GE company).

3. What are the main segments of the North America Electrophysiology Industry?

The market segments include Product, Target Disease, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Target Diseases; Technological Advancements in the Field of Electrophysiology; Increasing Demand for Catheter Ablation Procedures.

6. What are the notable trends driving market growth?

Atrial Fibrillation Segment is Expected to Hold a Major Market Share in the North America Electrophysiology Market Over The Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled And Experienced Electrophysiologists; Unfavorable Healthcare Reforms.

8. Can you provide examples of recent developments in the market?

September 2022: Catheter Precision, a medical device company focused on cardiac electrophysiology, entered a definitive merger agreement with Ra Medical Systems. After completion of the acquisition, it will become a publicly traded company with a primary focus on the cardiac electrophysiology industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electrophysiology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electrophysiology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electrophysiology Industry?

To stay informed about further developments, trends, and reports in the North America Electrophysiology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence