Key Insights

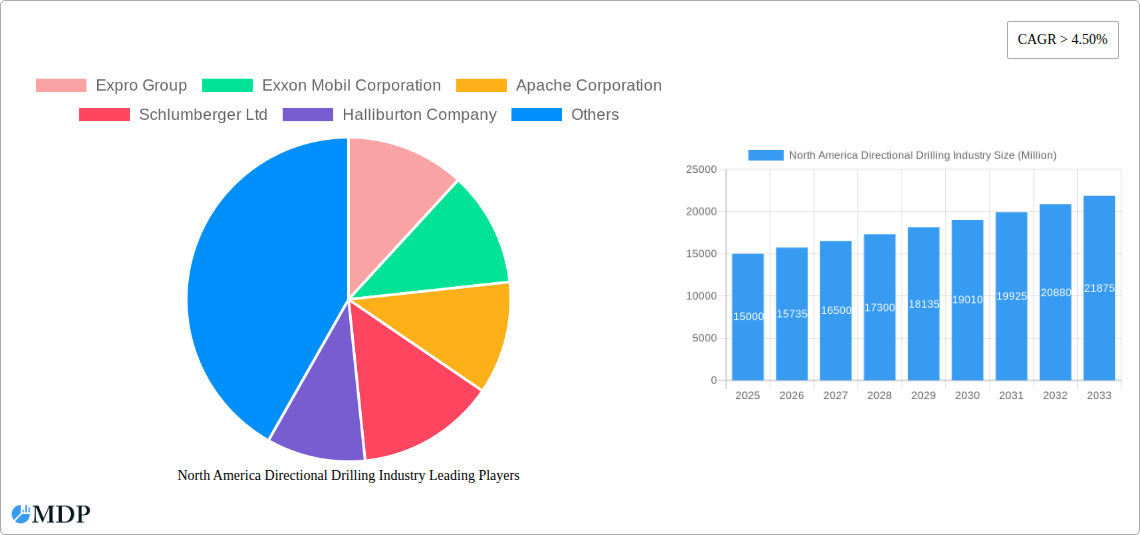

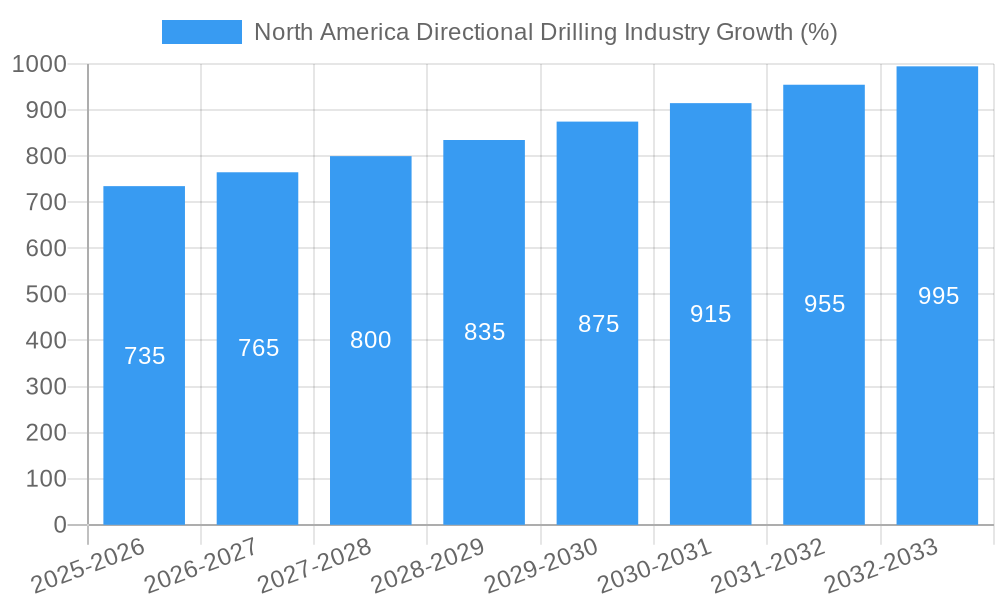

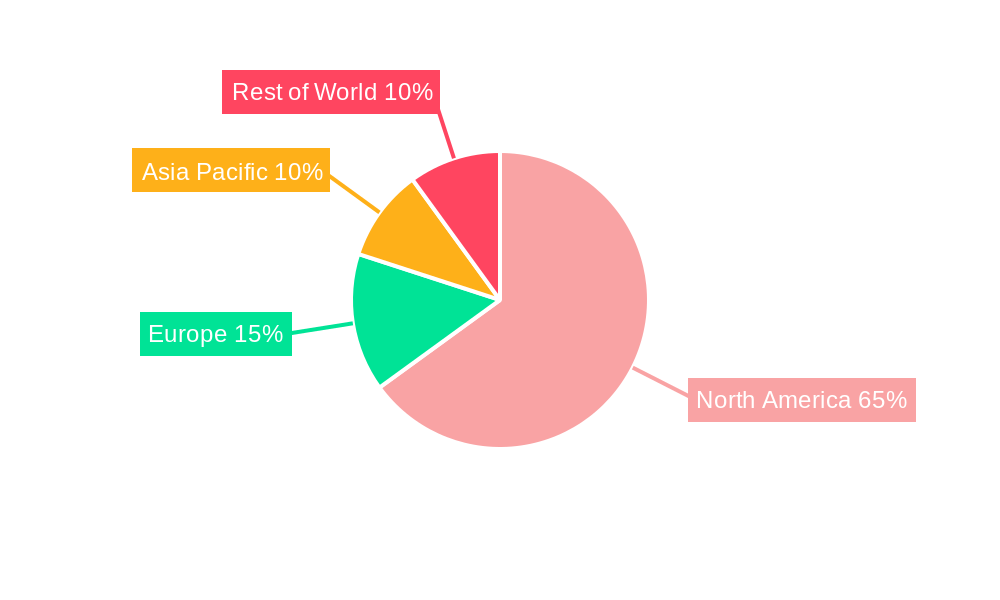

The North American directional drilling market, encompassing both onshore and offshore operations, is experiencing robust growth, fueled by increasing demand for oil and gas extraction in challenging geological formations. The market's Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2019-2033 signifies a considerable expansion, projected to reach a significant market value by 2033. Key drivers include the exploration of unconventional resources like shale gas and tight oil, necessitating advanced directional drilling technologies for efficient extraction. The adoption of Rotary Steerable Systems (RSS) over conventional methods is a prominent trend, enhancing precision and reducing overall drilling time and costs. While regulatory hurdles and environmental concerns pose some restraints, technological advancements and the persistent need for energy resources are likely to outweigh these challenges. The market is segmented into onshore and offshore deployments, with onshore currently dominating due to its accessibility and established infrastructure. Major players such as Schlumberger, Halliburton, Baker Hughes, and Expro Group are driving innovation and competition within the sector, offering a diverse range of services and technologies. The United States, with its extensive shale reserves, constitutes the largest segment within North America, followed by Canada and Mexico. The forecast period of 2025-2033 promises continued expansion, driven by ongoing investments in exploration and production activities across the region.

The North American directional drilling industry is characterized by a dynamic interplay between technological advancements and evolving energy demands. The increasing complexity of drilling projects, coupled with the need for higher efficiency and precision, has spurred the development of sophisticated RSS technologies. This trend is complemented by ongoing investments in research and development by major industry players, ensuring a continuous stream of innovations to address the challenges of accessing unconventional resources. The market’s growth is also influenced by government policies and regulations related to environmental protection and resource management. While these regulations may temporarily slow down growth, they ultimately incentivize the adoption of more sustainable and efficient drilling practices. The strategic partnerships between service providers and operators are likely to further enhance the efficiency and effectiveness of drilling operations, driving the market's expansion in the coming years. The ongoing exploration and development activities in both onshore and offshore regions will ensure the continued growth of this vital sector within the North American energy landscape.

North America Directional Drilling Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America directional drilling industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a detailed study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. The report forecasts a market valued at xx Million by 2033, representing a significant CAGR of xx% during the forecast period.

North America Directional Drilling Industry Market Dynamics & Concentration

The North American directional drilling market is characterized by a moderately concentrated landscape, with major players like Expro Group, Exxon Mobil Corporation, Apache Corporation, Schlumberger Ltd, Halliburton Company, Chevron Corporation, Weatherford International PLC, Baker Hughes Company, BP PLC, and Royal Dutch Shell PLC holding significant market share. The market share of these companies combined is estimated at approximately xx%.

The industry's dynamics are shaped by several factors:

- Innovation Drivers: Continuous advancements in Rotary Steerable Systems (RSS) and other drilling technologies are driving efficiency and reducing operational costs.

- Regulatory Frameworks: Stringent environmental regulations and safety standards influence operational practices and investment decisions.

- Product Substitutes: While directional drilling remains the dominant technique, alternative methods are continuously being developed and evaluated.

- End-User Trends: Growing demand for oil and gas, coupled with the increasing exploration of unconventional resources, fuels market growth.

- M&A Activities: The industry has witnessed a moderate number of mergers and acquisitions (xx deals in the past five years) aiming to consolidate market share and enhance technological capabilities.

North America Directional Drilling Industry Industry Trends & Analysis

The North American directional drilling market is experiencing robust growth, driven by several key factors. The increasing demand for oil and gas, particularly from unconventional resources like shale, is a primary driver. Technological advancements, such as improved RSS technology and automation, are enhancing drilling efficiency and reducing costs. Consumer preferences are shifting towards cleaner energy sources, but the demand for oil and gas remains significant in the near to mid-term future. This transition, however, also presents opportunities for directional drilling in geothermal energy projects. The competitive landscape is highly dynamic, with established players and new entrants vying for market share. This has spurred innovation and resulted in a more efficient and cost-effective service offering. The market's CAGR during the historical period (2019-2024) is estimated at xx%, with market penetration reaching xx% in 2024 across key sectors.

Leading Markets & Segments in North America Directional Drilling Industry

The onshore segment dominates the North American directional drilling market, accounting for approximately xx% of the total market value in 2024, primarily driven by extensive shale gas exploration and production activities in the United States.

Onshore Key Drivers:

- Abundant shale gas reserves in regions like the Permian Basin and Marcellus Shale.

- Favorable government policies and incentives for oil and gas exploration.

- Extensive existing infrastructure and pipeline networks.

Offshore Segment: While smaller than the onshore segment, the offshore segment is expected to witness notable growth due to continued investments in deepwater exploration projects, particularly in the Gulf of Mexico. The offshore segment currently holds an estimated xx% market share.

Service Type: Rotary Steerable Systems (RSS) are the leading service type, holding an estimated xx% market share due to their increased accuracy, efficiency, and reduced environmental impact compared to conventional methods. However, conventional methods still hold a significant share.

North America Directional Drilling Industry Product Developments

Recent product innovations focus on improving drilling accuracy, efficiency, and safety. Advancements in RSS technology, automation, and data analytics are key trends. These innovations aim to reduce operational costs, minimize environmental impact, and enhance drilling in challenging geological conditions. New materials and designs for drilling bits and tools are also emerging to further increase efficiency and durability. The market is witnessing a push towards more sustainable and environmentally friendly drilling practices.

Key Drivers of North America Directional Drilling Industry Growth

The growth of the North American directional drilling industry is propelled by several key factors: rising energy demand, the continuous exploration of unconventional oil and gas resources, technological advancements improving drilling efficiency and safety (such as improved automation), and supportive government policies encouraging energy exploration and production. The ongoing shift toward cleaner energy will provide opportunities within the geothermal energy sectors requiring directional drilling.

Challenges in the North America Directional Drilling Industry Market

The industry faces challenges, including fluctuating oil and gas prices impacting investment decisions, stringent environmental regulations increasing operational costs and complexities, supply chain disruptions affecting the availability of equipment and materials, and intense competition among service providers putting pressure on pricing. These factors can collectively lead to a decrease in overall market profitability, estimated at approximately xx% during periods of economic downturn.

Emerging Opportunities in North America Directional Drilling Industry

The long-term growth of the directional drilling industry is fueled by technological advancements in automation and data analytics, strategic partnerships between service providers and operators to optimize drilling operations, and expanding into new markets such as geothermal energy and carbon capture, utilization, and storage (CCUS) projects. These opportunities present avenues for significant growth and market expansion.

Leading Players in the North America Directional Drilling Industry Sector

- Expro Group

- Exxon Mobil Corporation

- Apache Corporation

- Schlumberger Ltd

- Halliburton Company

- Service Providers

- Chevron Corporation

- Weatherford International PLC

- Operators

- Baker Hughes Company

- BP PLC

- Royal Dutch Shell PLC

Key Milestones in North America Directional Drilling Industry Industry

- November 2021: Nabors Industries Ltd. secures a preferred drilling contractor agreement with Chesapeake Energy Corporation for US oil and gas projects.

- August 2021: Michels Canada completes the longest successful HDD installation in Canada (3540m), showcasing HDD's expanding capabilities in trenchless construction.

Strategic Outlook for North America Directional Drilling Industry Market

The North American directional drilling market holds significant growth potential, driven by technological advancements, strategic partnerships, and the expansion into new energy sectors. Focusing on sustainability, automation, and data-driven optimization will be crucial for companies to secure market leadership in the coming years. The market is poised for continued growth, offering significant opportunities for both established players and new entrants.

North America Directional Drilling Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Service Type

- 2.1. Rotary Steerable Systems (RSS)

- 2.2. Conventional

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Directional Drilling Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Directional Drilling Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Offshore Segment Expected to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Rotary Steerable Systems (RSS)

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. United States North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Rotary Steerable Systems (RSS)

- 6.2.2. Conventional

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Canada North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Rotary Steerable Systems (RSS)

- 7.2.2. Conventional

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Rest of North America North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Rotary Steerable Systems (RSS)

- 8.2.2. Conventional

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. United States North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Directional Drilling Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Expro Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Exxon Mobil Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Apache Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Schlumberger Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Halliburton Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Service Providers

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Chevron Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Weatherford International PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Operators

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Baker Hughes Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 BP PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Royal Dutch Shell PLC

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Expro Group

List of Figures

- Figure 1: North America Directional Drilling Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Directional Drilling Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Directional Drilling Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Directional Drilling Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 3: North America Directional Drilling Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: North America Directional Drilling Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Directional Drilling Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Directional Drilling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Directional Drilling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Directional Drilling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Directional Drilling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Directional Drilling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Directional Drilling Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 12: North America Directional Drilling Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 13: North America Directional Drilling Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Directional Drilling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Directional Drilling Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 16: North America Directional Drilling Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 17: North America Directional Drilling Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Directional Drilling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Directional Drilling Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 20: North America Directional Drilling Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 21: North America Directional Drilling Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Directional Drilling Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Directional Drilling Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the North America Directional Drilling Industry?

Key companies in the market include Expro Group, Exxon Mobil Corporation, Apache Corporation, Schlumberger Ltd, Halliburton Company, Service Providers, Chevron Corporation, Weatherford International PLC, Operators, Baker Hughes Company, BP PLC, Royal Dutch Shell PLC.

3. What are the main segments of the North America Directional Drilling Industry?

The market segments include Location of Deployment, Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Offshore Segment Expected to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In November 2021, Nabors Industries Ltd came into a contractual agreement with Chesapeake Energy Corporation to choose Nabors as the preferred drilling contractor for the oil and gas projects in the United States. This agreement is likely to enable the company to expand its business portfolio across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Directional Drilling Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Directional Drilling Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Directional Drilling Industry?

To stay informed about further developments, trends, and reports in the North America Directional Drilling Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence