Key Insights

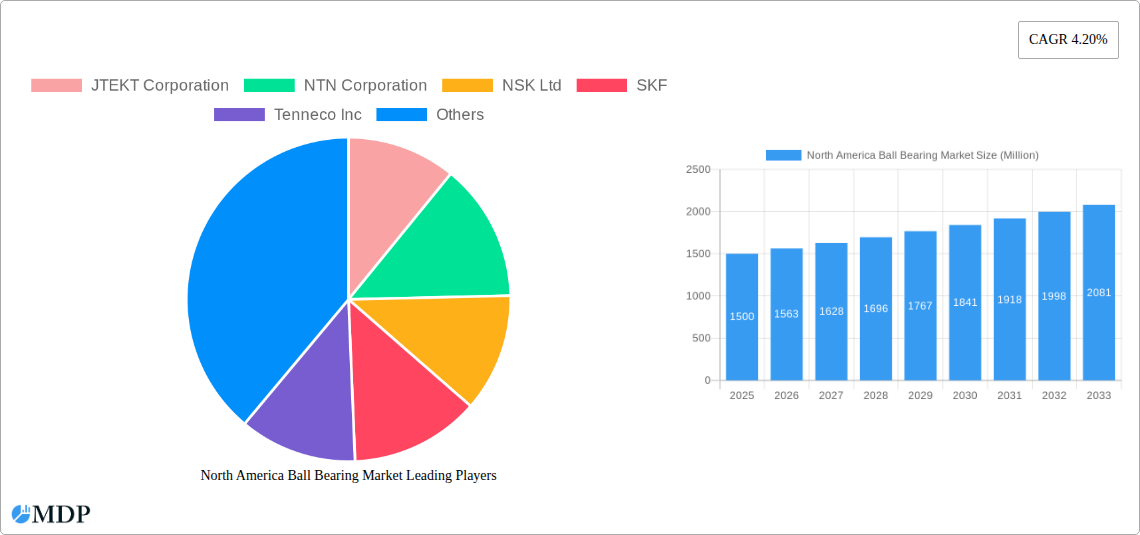

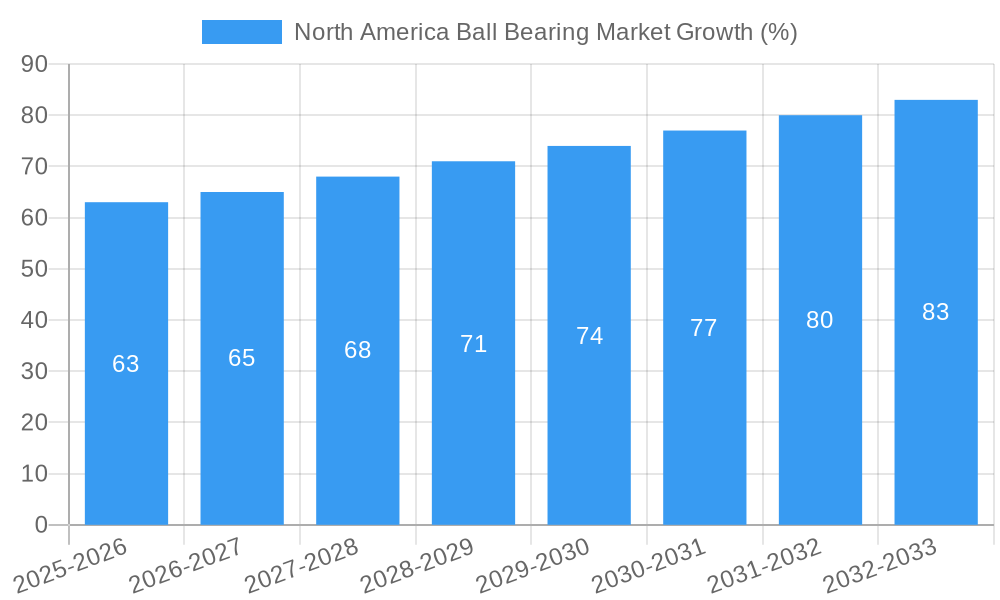

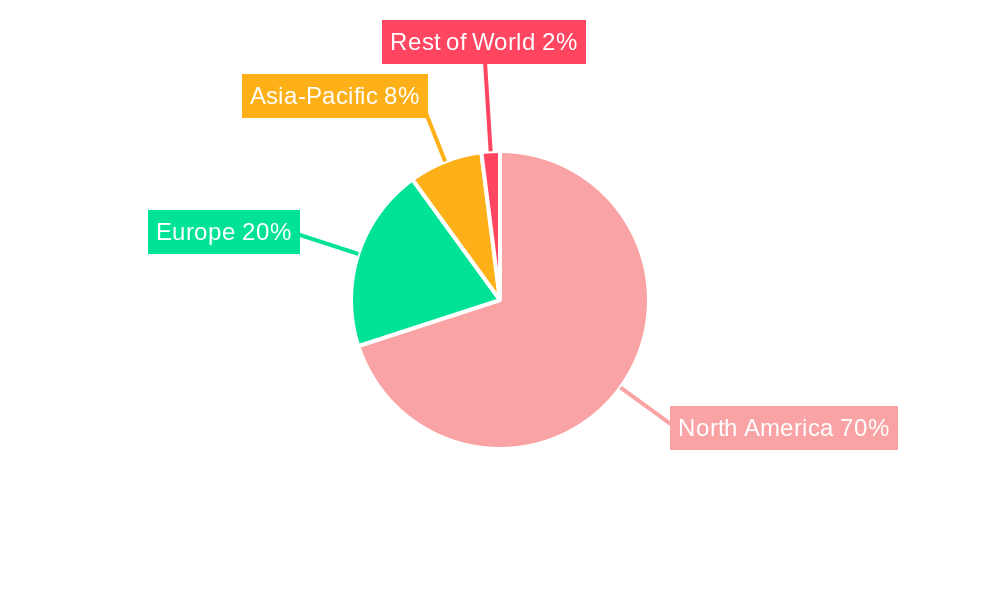

The North America ball bearing market, encompassing passenger vehicles, commercial cars, and diverse applications, is poised for steady growth. Driven by the burgeoning automotive industry, particularly the increasing demand for fuel-efficient and technologically advanced vehicles, the market is projected to expand significantly over the forecast period (2025-2033). The consistent adoption of ball bearings in various automotive components, such as transmissions, wheel hubs, and engine systems, fuels this growth. Furthermore, the expanding infrastructure development projects across the United States and Canada contribute to the demand for ball bearings in construction and industrial machinery. While supply chain disruptions and material cost fluctuations present potential challenges, the overall market outlook remains positive. Major players like JTEKT, NTN, NSK, SKF, and Schaeffler are strategically investing in research and development to enhance bearing performance and efficiency, further strengthening the market's growth trajectory. The segmentation by vehicle type (passenger and commercial) and product type (plain, rolling element, and ball bearings) offers insights into specific market niches and opportunities for targeted growth strategies. The dominance of the United States within the North American market is expected to continue, given its larger automotive manufacturing base and extensive infrastructure development.

The consistent CAGR of 4.20% suggests a sustained and predictable growth pattern. However, this growth is expected to be influenced by economic factors, technological advancements in bearing materials (e.g., ceramics), and the evolving preferences towards electric and hybrid vehicles. Competitive dynamics within the market are intense, with leading companies focusing on innovation, strategic partnerships, and geographic expansion to maintain their market share. The market is witnessing a rise in demand for high-precision and specialized ball bearings for use in robotics and automation technologies, presenting a significant opportunity for growth in the coming years. This segment's expansion will be a crucial driver of overall market growth within the forecast period. The market's resilience to economic downturns is also a contributing factor to its long-term growth potential.

North America Ball Bearing Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the North America ball bearing market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, leading players, technological advancements, and future growth prospects. Expect detailed segmentation across vehicle types (passenger vehicles, commercial cars), product types (plain bearings, rolling element bearings, ball bearings), and key North American countries (United States, Canada, Rest of North America). The market is projected to reach xx Million by 2033, presenting significant opportunities for growth and innovation.

North America Ball Bearing Market Market Dynamics & Concentration

The North America ball bearing market is characterized by a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors including economies of scale, technological expertise, and established distribution networks. The market share of the top five players is estimated to be around xx%, indicating a level of dominance by established firms. However, the emergence of innovative startups and technological advancements is gradually reshaping the competitive dynamics. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Innovation Drivers: The automotive industry's push for electric and hybrid vehicles is a major driver of innovation, fostering the development of high-speed, high-durability bearings. Furthermore, the increasing demand for automation in various industries is driving the need for more precise and reliable ball bearings.

- Regulatory Frameworks: Government regulations regarding vehicle safety and environmental standards significantly impact the market. Stringent emission standards are driving the adoption of energy-efficient bearings in automobiles.

- Product Substitutes: While ball bearings are dominant, competition exists from other bearing types, particularly in specific niche applications. The choice between bearing types often depends on factors like load capacity, speed requirements, and cost considerations.

- End-User Trends: The increasing demand for lightweight, fuel-efficient vehicles is a key driver of the market. Furthermore, the growing adoption of automation and robotics in various industries is expanding the application base for ball bearings.

- M&A Activities: While M&A activity is not overly frequent, strategic acquisitions by major players aim to enhance technological capabilities, expand market reach, and consolidate market share.

North America Ball Bearing Market Industry Trends & Analysis

The North American ball bearing market is experiencing robust growth, driven by several key factors. The automotive industry's shift towards electric vehicles (EVs) and hybrid vehicles (HVs) is a significant contributor, demanding high-performance bearings capable of handling increased speeds and loads. Technological advancements such as the development of bioplastic cages and hybrid bearings are further enhancing product capabilities and expanding market applications. The CAGR for the market during the forecast period (2025-2033) is estimated to be xx%. This growth is also fueled by the rising demand for automation and robotics across various industries, leading to increased demand for precise and reliable ball bearings. The market penetration rate of technologically advanced bearings is increasing steadily, indicating a positive shift towards higher-performance solutions. Competitive dynamics are characterized by intense rivalry among established players and increasing competition from new entrants.

Leading Markets & Segments in North America Ball Bearing Market

The United States dominates the North America ball bearing market, driven by its large automotive industry and strong manufacturing sector. Canada holds a significant, albeit smaller, share of the market. Within the product type segment, rolling element bearings and ball bearings represent the most significant segments, driven by their wide applications in automobiles and industrial machinery. Passenger vehicles currently hold a larger market share compared to commercial cars, although the commercial car segment is anticipated to experience faster growth over the forecast period.

- Key Drivers for the United States Market:

- Robust automotive manufacturing sector.

- Large industrial base and diverse applications of ball bearings.

- Strong government support for technological innovation.

- Key Drivers for the Canadian Market:

- Growing automotive industry and related supply chains.

- Expansion of industrial sectors like mining and energy.

- Dominance Analysis: The United States' dominance stems from its established automotive and industrial infrastructure, coupled with a strong emphasis on technological advancement. The large-scale manufacturing operations in the US are major consumers of ball bearings.

North America Ball Bearing Market Product Developments

Recent years have witnessed significant product innovations in the North American ball bearing market. Key developments include the introduction of hybrid deep groove ball bearings with polymer cages for high-speed applications in EVs and HVs, high-speed deep groove ball bearings for e-axle drive systems, triple-row wheel bearings for electrified powertrains, and the world's first 100% bioplastic heat-resistant cage for rolling bearings. These advancements address the increasing demand for durability, efficiency, and sustainability in diverse applications. The market is moving toward more sustainable and efficient products, reflecting a broader industry trend.

Key Drivers of North America Ball Bearing Market Growth

Several key factors are driving the growth of the North America ball bearing market. The automotive industry's transition to EVs and HVs, increasing automation across various sectors, and the rising adoption of robotics are primary drivers. Technological advancements in bearing materials and designs are enhancing performance and expanding applications. Furthermore, favorable government policies promoting sustainable manufacturing practices and infrastructure development are creating a positive environment for market growth.

Challenges in the North America Ball Bearing Market Market

The North American ball bearing market faces several challenges. Supply chain disruptions, particularly in sourcing raw materials, can lead to production delays and increased costs. Intense competition among established players can put pressure on profit margins. Moreover, fluctuating raw material prices and rising labor costs impact overall market profitability. These factors can affect the market’s growth trajectory, necessitating strategic adaptations by industry players.

Emerging Opportunities in North America Ball Bearing Market

The North America ball bearing market presents several exciting opportunities. The expansion of the EV and HV sectors creates significant demand for high-performance bearings. The growing adoption of advanced manufacturing techniques, like additive manufacturing, opens new avenues for customized bearing solutions. Strategic partnerships between ball bearing manufacturers and technology providers can accelerate innovation and enhance product offerings. The increasing focus on sustainability offers opportunities for developing eco-friendly bearings and packaging.

Leading Players in the North America Ball Bearing Market Sector

- JTEKT Corporation

- NTN Corporation

- NSK Ltd

- SKF

- Tenneco Inc

- Minebea Co Ltd

- Timken Co

- Myonic GmbH

- Schaeffler AG

- Rheinmetall Automotive

- MinebeaMitsumi Inc

Key Milestones in North America Ball Bearing Market Industry

- July 2021: JTEKT Corporation announced the development of a highly durable, highly corrosion-resistant bearing for use in hydrogen circulation pumps of fuel cell vehicles (FCVs). This signifies a move towards sustainable transportation technologies.

- October 2021: NSK Ltd. developed the world's first 100% bioplastic heat-resistant cage for rolling bearings. This addresses environmental concerns within the industry.

- February 2022: Schaeffler AG introduced the TriFinity product, a triple-row wheel bearing for electrified powertrains, enhancing efficiency in electric vehicles.

- May 2022: NTN Corporation developed high-speed deep groove ball bearings for e-axle drive systems used in electric vehicles (EVs), hybrid vehicles (HVs), and transmissions. This reflects the growing demand in the EV market.

- August 2022: SKF developed a new hybrid deep groove ball bearing with a 2-piece polymer cage for various high-speed applications including e-mobility. This is another significant contribution to the EV sector's technological advancements.

Strategic Outlook for North America Ball Bearing Market Market

The North America ball bearing market is poised for continued growth, driven by technological advancements, the rising adoption of EVs and HVs, and expanding automation across diverse industries. Strategic opportunities lie in developing innovative bearing solutions that address the demand for higher efficiency, durability, and sustainability. Companies focusing on research and development, strategic partnerships, and expansion into new markets will be well-positioned to capitalize on future growth prospects. The market's long-term outlook is optimistic, with considerable potential for expansion across diverse sectors.

North America Ball Bearing Market Segmentation

-

1. Product Type

- 1.1. Plain Bearings

- 1.2. Rolling Element Bearings

- 1.3. Ball Bearings

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Cars

North America Ball Bearing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Ball Bearing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vehicle Safety and User Convenience

- 3.3. Market Restrains

- 3.3.1. Vulnerability to Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Rolling Element Bearing hold significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Ball Bearing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Plain Bearings

- 5.1.2. Rolling Element Bearings

- 5.1.3. Ball Bearings

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Ball Bearing Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Ball Bearing Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Ball Bearing Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Ball Bearing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 JTEKT Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NTN Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NSK Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SKF

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tenneco Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Minebea Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Timken Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Myonic GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schaeffler AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rheinmetall Automotive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 MinebeaMitsumi Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 JTEKT Corporation

List of Figures

- Figure 1: North America Ball Bearing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Ball Bearing Market Share (%) by Company 2024

List of Tables

- Table 1: North America Ball Bearing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Ball Bearing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Ball Bearing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: North America Ball Bearing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Ball Bearing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Ball Bearing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Ball Bearing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Ball Bearing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Ball Bearing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Ball Bearing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: North America Ball Bearing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: North America Ball Bearing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Ball Bearing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Ball Bearing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Ball Bearing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Ball Bearing Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the North America Ball Bearing Market?

Key companies in the market include JTEKT Corporation, NTN Corporation, NSK Ltd, SKF, Tenneco Inc, Minebea Co Ltd, Timken Co, Myonic GmbH, Schaeffler AG, Rheinmetall Automotive, MinebeaMitsumi Inc.

3. What are the main segments of the North America Ball Bearing Market?

The market segments include Product Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vehicle Safety and User Convenience.

6. What are the notable trends driving market growth?

Rolling Element Bearing hold significant market share.

7. Are there any restraints impacting market growth?

Vulnerability to Cyber Attacks.

8. Can you provide examples of recent developments in the market?

In August 2022, SKF developed a new hybrid deep groove ball bearing with 2 piece polymer cage for various high-speed applications including E-mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Ball Bearing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Ball Bearing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Ball Bearing Market?

To stay informed about further developments, trends, and reports in the North America Ball Bearing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence