Key Insights

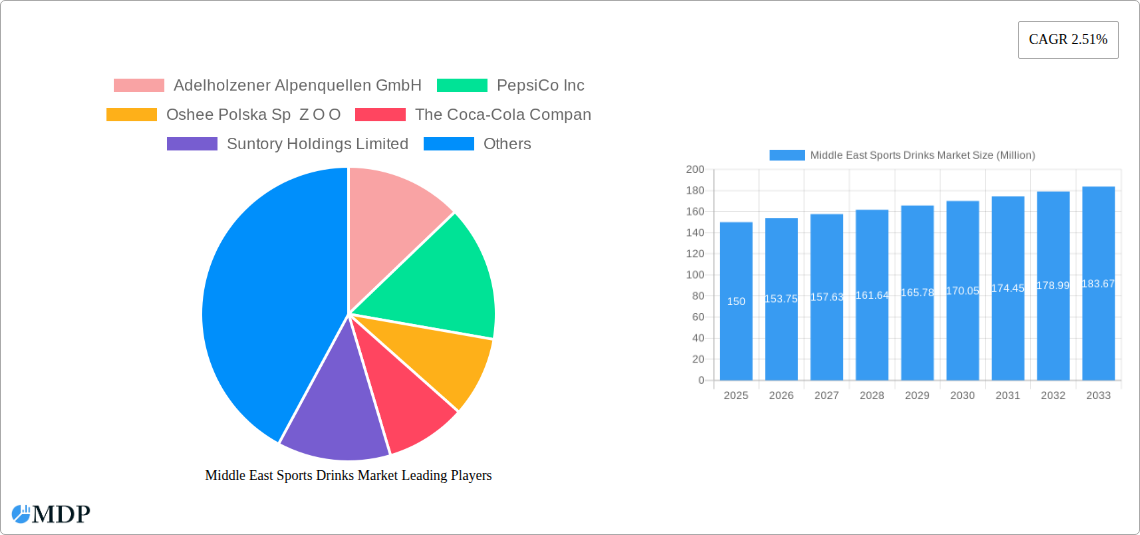

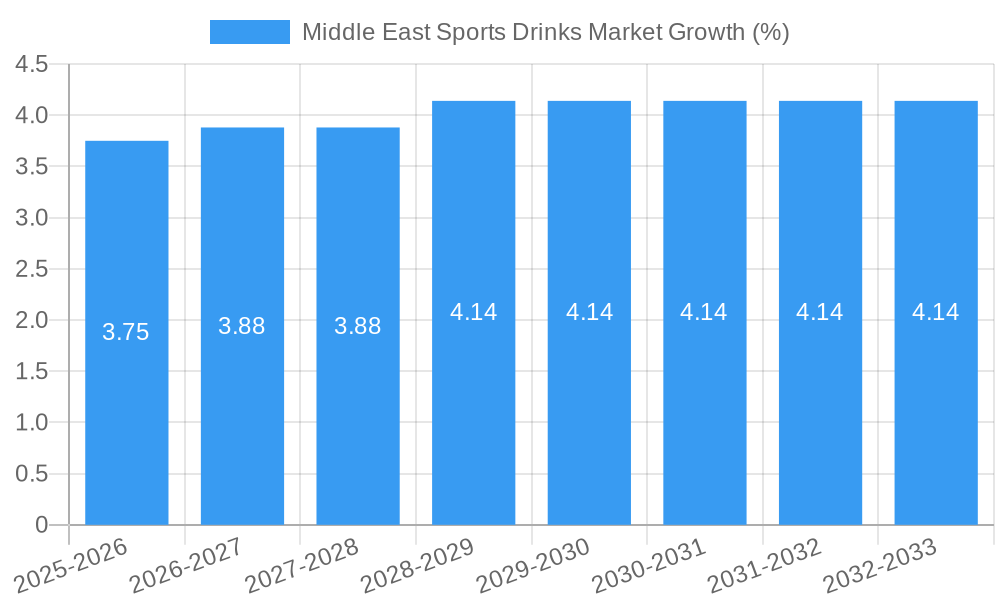

The Middle East sports drinks market, valued at approximately $XX million in 2025, is projected to experience steady growth at a Compound Annual Growth Rate (CAGR) of 2.51% from 2025 to 2033. This growth is fueled by several key factors. The rising health consciousness among the region's population, coupled with increasing participation in sports and fitness activities, particularly in the UAE, Saudi Arabia, and Qatar, is driving demand for electrolyte-enhanced waters and protein-based sports drinks. Furthermore, the expanding distribution network, particularly through convenience stores and supermarkets, enhances product accessibility. The popularity of various sporting events and fitness initiatives further stimulates market expansion. However, challenges remain, including potential health concerns associated with high sugar content in certain drinks and fluctuating raw material prices, which may restrain market growth to some extent. The segment showing the most promise is likely electrolyte-enhanced water, given the growing awareness of hydration and its importance in athletic performance and general wellness. Packaging preferences are shifting towards PET bottles for their convenience and recyclability, though metal cans maintain a strong position in the market.

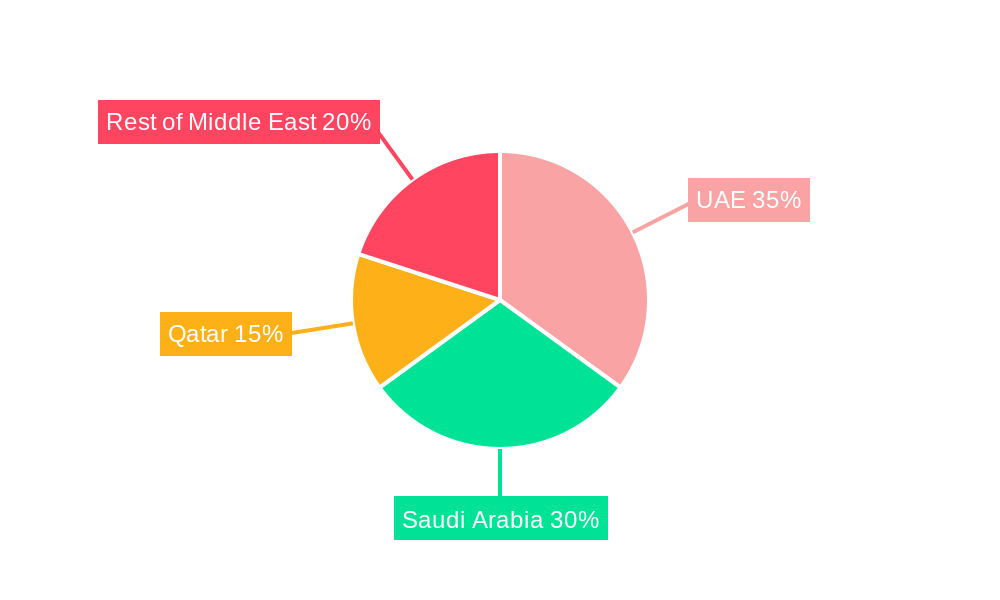

The market segmentation reveals a preference for specific product types and distribution channels across the region. While the UAE, Saudi Arabia, and Qatar dominate the market share, the "Rest of Middle East" segment displays potential for future growth, although it may require further market penetration efforts. Competitive intensity is relatively high, with both international and regional players vying for market share. Success will hinge on product innovation, strategic pricing, and effective marketing campaigns that emphasize health benefits and lifestyle alignment. Companies are likely focusing on developing functional sports drinks with added vitamins, minerals, and other performance-enhancing ingredients. Furthermore, sustainability initiatives and eco-friendly packaging will likely gain traction in the future, shaping consumer choices.

Middle East Sports Drinks Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East sports drinks market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a focus on key trends, leading players, and future growth prospects, this report is an essential resource for strategic decision-making. The market is segmented by soft drink type (Electrolyte-Enhanced Water, Hypertonic, Hypotonic, Isotonic, Protein-based Sport Drinks), packaging type (Aseptic packages, Metal Can, PET Bottles), distribution channel (Convenience Stores, Online Retail, Specialty Stores, Supermarket/Hypermarket, Others), and country (Qatar, Saudi Arabia, United Arab Emirates, Rest of Middle East). The report covers the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033), projecting a market value of xx Million by 2033.

Middle East Sports Drinks Market Market Dynamics & Concentration

The Middle East sports drinks market is characterized by a moderate level of concentration, with key players such as PepsiCo Inc, The Coca-Cola Company, and Suntory Holdings Limited holding significant market share. However, the market also witnesses considerable activity from regional and smaller players, leading to a competitive landscape. Innovation in product formulations, particularly in functional sports drinks with added vitamins and minerals, is a major driver. Stringent regulatory frameworks concerning labeling, ingredients, and health claims influence product development and marketing strategies. The market faces competition from substitute beverages like energy drinks and enhanced waters, necessitating continuous product differentiation. Growing health consciousness among consumers, particularly amongst the younger demographic, fuels demand for healthier options, driving market expansion. M&A activity in the sector is relatively moderate, with xx deals recorded between 2019 and 2024, primarily focused on expanding distribution networks and acquiring regional brands.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation Drivers: Functional ingredients, natural flavors, sustainable packaging.

- Regulatory Framework: Stringent regulations on labeling, health claims, and ingredient sourcing.

- Product Substitutes: Energy drinks, enhanced waters, fruit juices.

- End-User Trends: Growing health consciousness, preference for natural ingredients, increasing sports participation.

- M&A Activity: xx deals recorded between 2019 and 2024, focusing on distribution and brand acquisition.

Middle East Sports Drinks Market Industry Trends & Analysis

The Middle East sports drinks market exhibits a robust CAGR of xx% during the historical period (2019-2024), driven by factors such as rising disposable incomes, increased participation in sports and fitness activities, and changing consumer preferences towards healthier beverages. Technological disruptions are influencing the market through the introduction of innovative packaging formats, such as aseptic packaging for extended shelf life, and the development of functional sports drinks with tailored nutrient profiles. Consumer preferences are shifting towards low-sugar, natural, and functional beverages, compelling manufacturers to reformulate their products to meet evolving health-conscious demands. Competitive dynamics are shaped by brand loyalty, pricing strategies, and distribution network reach. Market penetration of sports drinks within the broader beverage market is estimated at xx% in 2024, projected to grow to xx% by 2033.

Leading Markets & Segments in Middle East Sports Drinks Market

The United Arab Emirates (UAE) and Saudi Arabia are the dominant markets within the Middle East sports drinks sector, contributing xx% and xx% of the total market value in 2024, respectively. This dominance stems from higher per capita incomes, a larger consumer base, and robust infrastructure.

- Key Drivers in the UAE & Saudi Arabia:

- Higher disposable incomes and spending power.

- Strong sports culture and increasing fitness awareness.

- Well-developed retail infrastructure, supporting widespread distribution.

- Government initiatives promoting health and wellness.

Dominant Segments:

- Soft Drink Type: Isotonic drinks hold the largest market share, due to their suitability for hydration during physical activity.

- Packaging Type: PET bottles dominate due to their convenience and cost-effectiveness.

- Distribution Channel: Supermarket/Hypermarkets and convenience stores are the primary distribution channels.

Rest of Middle East: This segment exhibits promising growth potential, driven by rising health awareness and increasing participation in sporting activities. However, challenges remain in terms of market penetration and infrastructure development.

Middle East Sports Drinks Market Product Developments

Recent product innovations are focused on enhancing functionality, including incorporating electrolytes, vitamins, and natural ingredients. Manufacturers are increasingly emphasizing the use of sustainable packaging materials and exploring convenient formats such as single-serve pouches and ready-to-drink bottles. These developments aim to cater to consumer demand for healthier, more convenient, and environmentally friendly options. The competitive advantage lies in creating unique product formulations, employing targeted marketing campaigns, and strengthening distribution networks.

Key Drivers of Middle East Sports Drinks Market Growth

The growth of the Middle East sports drinks market is driven by multiple factors. Rising health awareness and increasing participation in fitness activities are leading consumers to seek performance-enhancing and hydrating beverages. Government initiatives promoting health and wellness further fuel market expansion. Economic growth and rising disposable incomes contribute to increased spending on premium and functional beverages. Technological advancements in product formulations, packaging, and distribution further stimulate market growth.

Challenges in the Middle East Sports Drinks Market Market

The Middle East sports drinks market faces several challenges. Stringent regulatory hurdles concerning product labeling and health claims can hinder product launches and marketing efforts. Supply chain disruptions and fluctuations in raw material prices impact production costs and profitability. Intense competition from established players and the emergence of new brands necessitate robust marketing and differentiation strategies. Furthermore, consumer preference shifts towards healthier alternatives can impact the demand for traditional, high-sugar sports drinks.

Emerging Opportunities in Middle East Sports Drinks Market

The Middle East sports drinks market presents several lucrative opportunities. Technological advancements in personalized nutrition and functional ingredients, allowing for the creation of tailored products, are promising. Strategic partnerships with sports organizations and fitness influencers enhance brand visibility and market penetration. Expanding into untapped markets within the region and exploring new distribution channels like online retail open up significant growth avenues.

Leading Players in the Middle East Sports Drinks Market Sector

- Adelholzener Alpenquellen GmbH

- PepsiCo Inc

- Oshee Polska Sp Z O O

- The Coca-Cola Company

- Suntory Holdings Limited

- iPro Sport Holdings Limited

- Otsuka Holdings Co Ltd

- Canopy Growth Corporation

- Congo Brands

- Sapporo Holdings Limited

Key Milestones in Middle East Sports Drinks Market Industry

- February 2024: Pepsi Gatorade partners with top-tier Saudi Arabian soccer, enhancing brand visibility and market reach.

- January 2022: iPRO launches vitamin-enhanced sports drinks in UAE Carrefour stores, expanding its retail presence.

- August 2020: PepsiCo (Gatorade) collaborates with Usain Bolt at Expo 2020 Dubai, promoting healthy lifestyles and brand awareness.

Strategic Outlook for Middle East Sports Drinks Market Market

The future of the Middle East sports drinks market looks promising. Continued growth is expected, fueled by rising health consciousness, increasing urbanization, and a growing preference for convenient, functional beverages. Strategic initiatives such as product diversification, strategic partnerships, and investments in research and development are crucial for securing a competitive advantage and capitalizing on emerging opportunities within this dynamic market.

Middle East Sports Drinks Market Segmentation

-

1. Soft Drink Type

- 1.1. Electrolyte-Enhanced Water

- 1.2. Hypertonic

- 1.3. Hypotonic

- 1.4. Isotonic

- 1.5. Protein-based Sport Drinks

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Sub Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Retail

- 3.3. Specialty Stores

- 3.4. Supermarket/Hypermarket

- 3.5. Others

Middle East Sports Drinks Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Sports Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Electrolyte-Enhanced Water

- 5.1.2. Hypertonic

- 5.1.3. Hypotonic

- 5.1.4. Isotonic

- 5.1.5. Protein-based Sport Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Retail

- 5.3.3. Specialty Stores

- 5.3.4. Supermarket/Hypermarket

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. United Arab Emirates Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Sports Drinks Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Adelholzener Alpenquellen GmbH

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PepsiCo Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Oshee Polska Sp Z O O

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Coca-Cola Compan

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Suntory Holdings Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 iPro Sport Holdings Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Otsuka Holdings Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Canopy Growth Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Congo Brands

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sapporo Holdings Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Adelholzener Alpenquellen GmbH

List of Figures

- Figure 1: Middle East Sports Drinks Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Sports Drinks Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Sports Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Sports Drinks Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Middle East Sports Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Middle East Sports Drinks Market Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 5: Middle East Sports Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East Sports Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Qatar Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Israel Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oman Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East Sports Drinks Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 15: Middle East Sports Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 16: Middle East Sports Drinks Market Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 17: Middle East Sports Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kuwait Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Oman Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Bahrain Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Jordan Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Lebanon Middle East Sports Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Sports Drinks Market?

The projected CAGR is approximately 2.51%.

2. Which companies are prominent players in the Middle East Sports Drinks Market?

Key companies in the market include Adelholzener Alpenquellen GmbH, PepsiCo Inc, Oshee Polska Sp Z O O, The Coca-Cola Compan, Suntory Holdings Limited, iPro Sport Holdings Limited, Otsuka Holdings Co Ltd, Canopy Growth Corporation, Congo Brands, Sapporo Holdings Limited.

3. What are the main segments of the Middle East Sports Drinks Market?

The market segments include Soft Drink Type, Packaging Type, Sub Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

February 2024: Pepsi Gatorade has entered into a partnership with the top tier of Saudi Arabian soccer, becoming its official sports drink partner. The collaboration is focused on enhancing the matchday experience for fans through a series of activations and events.January 2022: iPRO launched a range of sports drinks in Carrefour stores across the United Arab Emirates. The company claims that it contains 100% of the daily recommended vitamin C intake, along with added B vitamins.August 2020: Through a partnership with the Sports, Fitness, and Wellbeing Hub at Expo 2020 Dubai, PepsiCo, through its Gatorade brand, collaborated with Usain Bolt to leverage the global influence of Expo 2020 Dubai for supporting healthy lifestyles and inclusive sports and wellness. As part of this partnership, a public 1.45 km Family Run was scheduled to raise funds for the Al Noor Rehabilitation & Welfare Association.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Sports Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Sports Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Sports Drinks Market?

To stay informed about further developments, trends, and reports in the Middle East Sports Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence