Key Insights

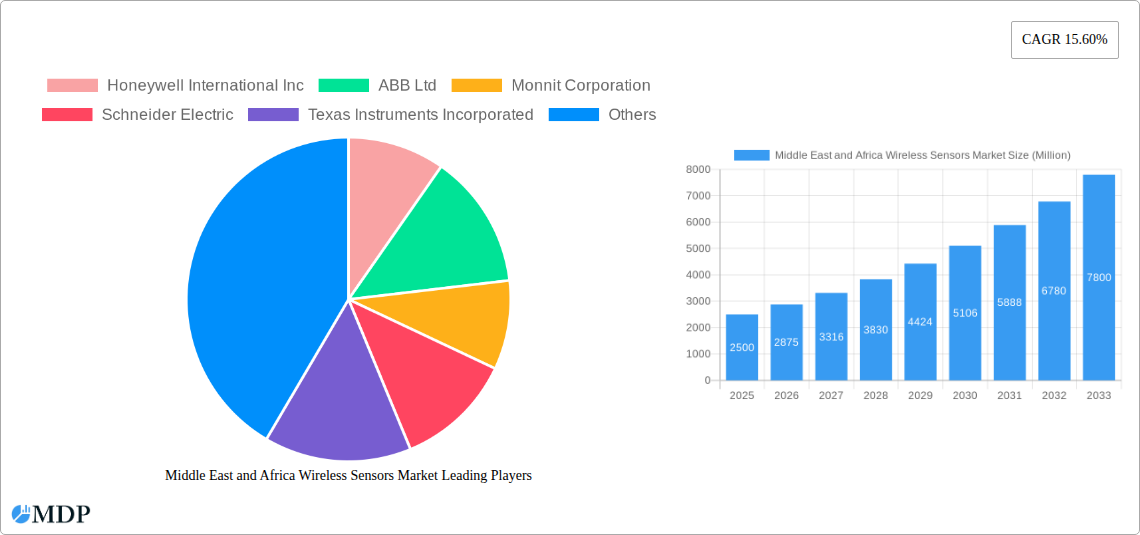

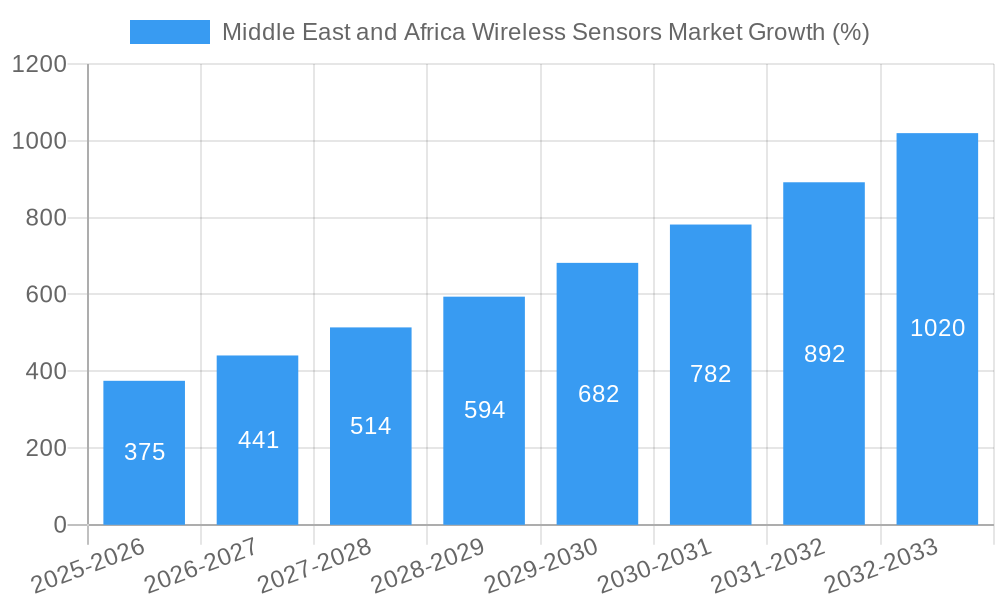

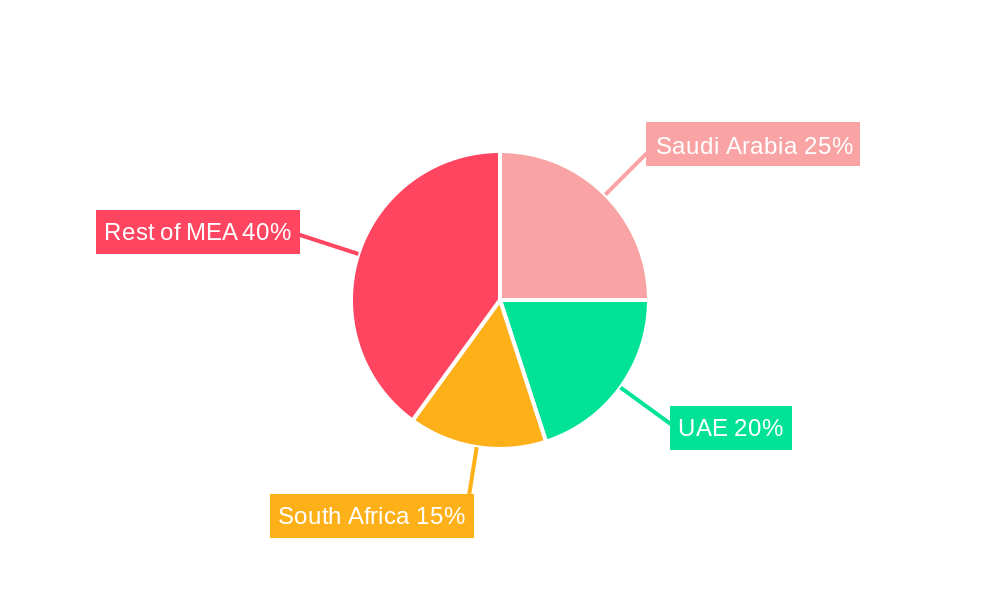

The Middle East and Africa (MEA) wireless sensors market is experiencing robust growth, driven by increasing adoption across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 15.60% from 2019 to 2024 indicates significant expansion, projected to continue into the forecast period (2025-2033). Key drivers include the burgeoning automotive industry, particularly in countries like South Africa and the UAE, which demands sophisticated sensor technologies for advanced driver-assistance systems (ADAS) and autonomous vehicles. Furthermore, the healthcare sector's growth, coupled with increasing investments in smart infrastructure and the Internet of Things (IoT) across the region, fuels demand for wireless sensors in remote patient monitoring, medical equipment, and smart hospitals. The energy and power sector, striving for efficiency improvements and grid modernization, also presents a significant opportunity for wireless sensor deployments for monitoring and optimizing energy consumption. While regulatory hurdles and technological complexities might pose some challenges, the overall market outlook remains positive, with substantial growth potential across various segments, including pressure, temperature, chemical, and gas sensors. The market is segmented by type, end-user industry, and geography, with South Africa, the UAE, and Saudi Arabia emerging as key regional players. The presence of established players like Honeywell, ABB, and Siemens, alongside emerging regional companies, signifies a competitive yet dynamic landscape with opportunities for both established and new entrants.

The significant growth in the MEA wireless sensor market is further propelled by government initiatives promoting technological advancement and digital transformation. Investment in smart cities and infrastructure projects across the region creates substantial demand for sophisticated monitoring systems, leveraging wireless sensor networks for real-time data acquisition and analysis. Within the segments, the automotive sector is expected to maintain its dominant position due to the increasing penetration of connected cars and the rising demand for enhanced safety features. The healthcare sector is also witnessing considerable growth driven by rising healthcare expenditure and the increasing prevalence of chronic diseases. Specific growth in Africa can be attributed to increased investment in infrastructure development, coupled with government support for technological advancements. However, challenges such as uneven infrastructure development across certain regions of Africa may impede growth in some areas. Despite these challenges, the long-term outlook for the MEA wireless sensor market remains strongly positive, driven by technological innovations, increasing connectivity, and growing industrialization across the region.

Middle East & Africa Wireless Sensors Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Wireless Sensors Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, and future growth trajectories. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Middle East and Africa Wireless Sensors Market Market Dynamics & Concentration

The Middle East and Africa Wireless Sensors Market is characterized by a moderately consolidated landscape, with several key players holding significant market share. However, the market is witnessing increased competition from new entrants and disruptive technologies. Market concentration is expected to shift slightly over the forecast period due to mergers and acquisitions (M&A) activity and the emergence of innovative solutions. The market share of the top 5 players is estimated at xx% in 2025. Innovation drivers include the increasing adoption of Industry 4.0, the rising demand for automation across various sectors, and advancements in wireless communication technologies (e.g., LoRaWAN, NB-IoT). Regulatory frameworks, while generally supportive of technological advancements, vary across different countries within the region, posing some challenges to market standardization. Product substitutes, such as wired sensors, are facing increasing competition due to the cost-effectiveness and flexibility offered by wireless solutions. End-user trends indicate a strong preference for wireless sensors due to their ease of installation, reduced maintenance needs, and improved data accessibility. M&A activity is expected to remain moderately active, with an estimated xx deals per year over the forecast period, primarily focused on expanding product portfolios and geographic reach. This will likely consolidate the market further.

Middle East and Africa Wireless Sensors Market Industry Trends & Analysis

The Middle East and Africa Wireless Sensors Market is experiencing robust growth, driven by several key factors. The increasing adoption of smart city initiatives, particularly in major urban centers like Dubai and Johannesburg, fuels demand for wireless sensors in infrastructure monitoring, environmental management, and public safety. The burgeoning automotive industry across the region, coupled with the rapid advancement of autonomous vehicle technology, is a significant growth driver. Similarly, the healthcare sector's increasing investment in advanced medical equipment and remote patient monitoring solutions contributes considerably to market expansion. The energy and power sector's adoption of smart grids and renewable energy sources also requires vast deployments of wireless sensors for efficient monitoring and management. Technological disruptions, such as the Internet of Things (IoT) and advancements in sensor technologies, are further accelerating market growth. Consumer preferences lean towards robust, low-power, and easily deployable solutions. Competitive dynamics are characterized by both intense rivalry amongst established players and the emergence of niche players specializing in specific applications. The market penetration rate for wireless sensors is increasing steadily, projected to reach xx% by 2033.

Leading Markets & Segments in Middle East and Africa Wireless Sensors Market

The Saudi Arabia and UAE markets currently dominate the Middle East and Africa Wireless Sensors Market, driven by substantial government investments in infrastructure development and technological advancement. South Africa is a significant player in the African market, followed by Nigeria and Kenya.

By Type: The temperature sensor segment holds the largest market share, owing to its wide applicability across diverse sectors. Pressure sensors and chemical/gas sensors are also experiencing strong growth.

By End-user Industry: The automotive, healthcare, and energy and power sectors are major consumers of wireless sensors, with substantial growth projected in these segments.

Key Drivers for Dominant Regions:

- Saudi Arabia & UAE: Strong government support for technological innovation, substantial investments in infrastructure, and a thriving oil and gas sector.

- South Africa: Growing industrial sector, relatively developed infrastructure compared to other African nations, and increased focus on smart city initiatives.

- Nigeria & Kenya: Rapidly growing economies, increasing urbanization, and a rising demand for improved infrastructure.

The Rest of Middle East and Africa region presents considerable untapped potential, fueled by ongoing infrastructure investments and rising industrialization.

Middle East and Africa Wireless Sensors Market Product Developments

Recent product innovations focus on enhanced accuracy, improved power efficiency, and advanced data analytics capabilities. The integration of artificial intelligence (AI) and machine learning (ML) into wireless sensor platforms is transforming data analysis and decision-making processes. This trend enables real-time insights, predictive maintenance, and optimized operational efficiency across diverse applications. The market favors solutions that offer seamless integration with existing IT infrastructures and robust security features.

Key Drivers of Middle East and Africa Wireless Sensors Market Growth

Several factors drive the growth of the Middle East and Africa Wireless Sensors Market. Technological advancements, such as low-power wide-area networks (LPWAN) and improved sensor technology, reduce deployment costs and enhance data transmission capabilities. Government initiatives promoting digital transformation and smart city projects across the region spur demand for wireless sensors. Economic growth in various sectors, particularly automotive, healthcare, and energy, fuels investment in automation and remote monitoring solutions. Furthermore, stringent environmental regulations and a rising awareness of sustainability are driving the adoption of sensors for efficient resource management and emissions monitoring.

Challenges in the Middle East and Africa Wireless Sensors Market Market

The Middle East and Africa Wireless Sensors Market faces some challenges. The high initial investment costs for large-scale deployments can be a barrier for some organizations. Supply chain disruptions and the availability of skilled labor for installation and maintenance are potential bottlenecks. Furthermore, the security and privacy concerns surrounding data transmission in wireless sensor networks require careful attention. Regulatory inconsistencies across different countries in the region can complicate market standardization and deployment.

Emerging Opportunities in Middle East and Africa Wireless Sensors Market

Significant growth opportunities exist in the Middle East and Africa Wireless Sensors Market. The expansion of 5G networks will dramatically improve data transmission speeds and bandwidth, enabling the deployment of more sophisticated wireless sensor networks. Strategic partnerships between sensor manufacturers and technology integrators will further accelerate market penetration. The rising focus on precision agriculture and smart farming presents a lucrative opportunity for the application of wireless sensors in optimizing crop yields and resource management. Lastly, the expansion of IoT applications across various industries will drive significant demand for wireless sensors.

Leading Players in the Middle East and Africa Wireless Sensors Market Sector

- Honeywell International Inc

- ABB Ltd

- Monnit Corporation

- Schneider Electric

- Texas Instruments Incorporated

- Pasco Scientific

- Emerson Electric Co

- Siemens AG

- Phoenix Sensors LLC

- *List Not Exhaustive

Key Milestones in Middle East and Africa Wireless Sensors Market Industry

- June 2020: ABB announced a wireless condition monitoring solution for rotating equipment, reducing installation costs and complexity.

- January 2021: Swift Sensors launched a secure wireless vaccine storage unit monitoring system, addressing critical cold chain management needs.

Strategic Outlook for Middle East and Africa Wireless Sensors Market Market

The Middle East and Africa Wireless Sensors Market exhibits significant growth potential over the next decade. Strategic opportunities exist for companies focusing on developing innovative, cost-effective, and easily deployable wireless sensor solutions. Partnerships with technology integrators and local distributors will be crucial for expanding market reach and penetrating new segments. A strong focus on data security and addressing regulatory hurdles will be vital for sustained growth. The continued adoption of smart city initiatives and the expansion of IoT applications will drive further market expansion, making it an attractive sector for investment and innovation.

Middle East and Africa Wireless Sensors Market Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Chemical and Gas Sensor

- 1.4. Position and Proximity Sensor

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Energy and Power

- 2.5. Food and Beverage

- 2.6. Other End-user Industries

Middle East and Africa Wireless Sensors Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Wireless Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation)

- 3.3. Market Restrains

- 3.3.1. False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 3.4. Market Trends

- 3.4.1. Position and proximity sensor is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Chemical and Gas Sensor

- 5.1.4. Position and Proximity Sensor

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy and Power

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ABB Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Monnit Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Schneider Electric

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Texas Instruments Incorporated

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pasco Scientific

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Emerson Electric Co

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Siemens AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Phoenix Sensors LLC*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Middle East and Africa Wireless Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Wireless Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Middle East and Africa Wireless Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Saudi Arabia Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Israel Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Qatar Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Kuwait Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Oman Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bahrain Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Jordan Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Lebanon Middle East and Africa Wireless Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Wireless Sensors Market?

The projected CAGR is approximately 15.60%.

2. Which companies are prominent players in the Middle East and Africa Wireless Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Monnit Corporation, Schneider Electric, Texas Instruments Incorporated, Pasco Scientific, Emerson Electric Co, Siemens AG, Phoenix Sensors LLC*List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Wireless Sensors Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation).

6. What are the notable trends driving market growth?

Position and proximity sensor is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems.

8. Can you provide examples of recent developments in the market?

January 2021 - Swift Sensors, a provider of industrial IoT sensor solutions, announced the launch of its secure wireless vaccine storage unit monitoring and alert system to enable medical facilities and pharmacies to monitor COVID-19 vaccine storage temperatures remotely, automate data logging, and respond quickly in case of an equipment problem or power failure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Wireless Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Wireless Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Wireless Sensors Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Wireless Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence