Key Insights

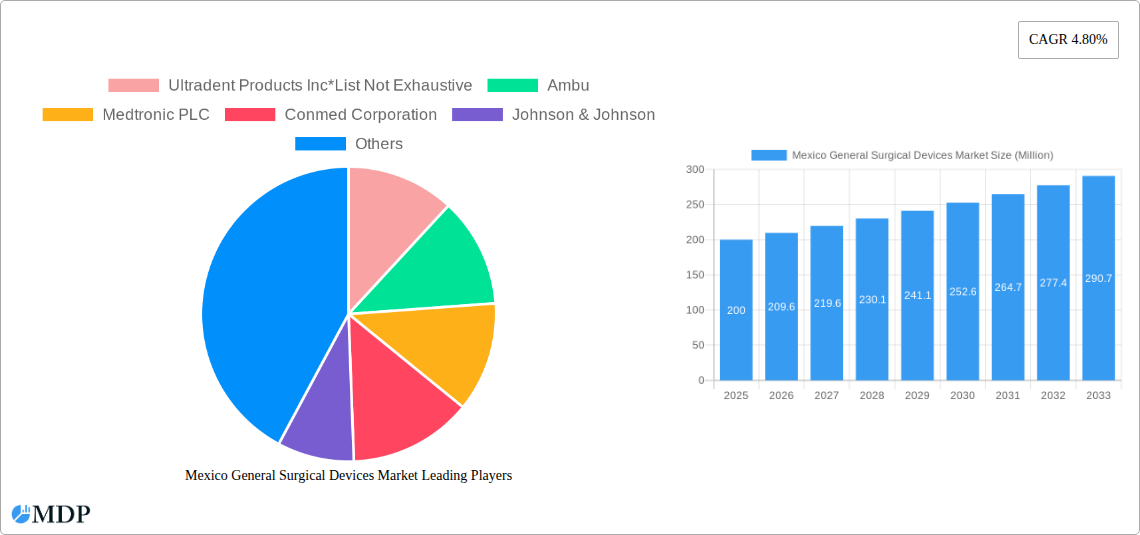

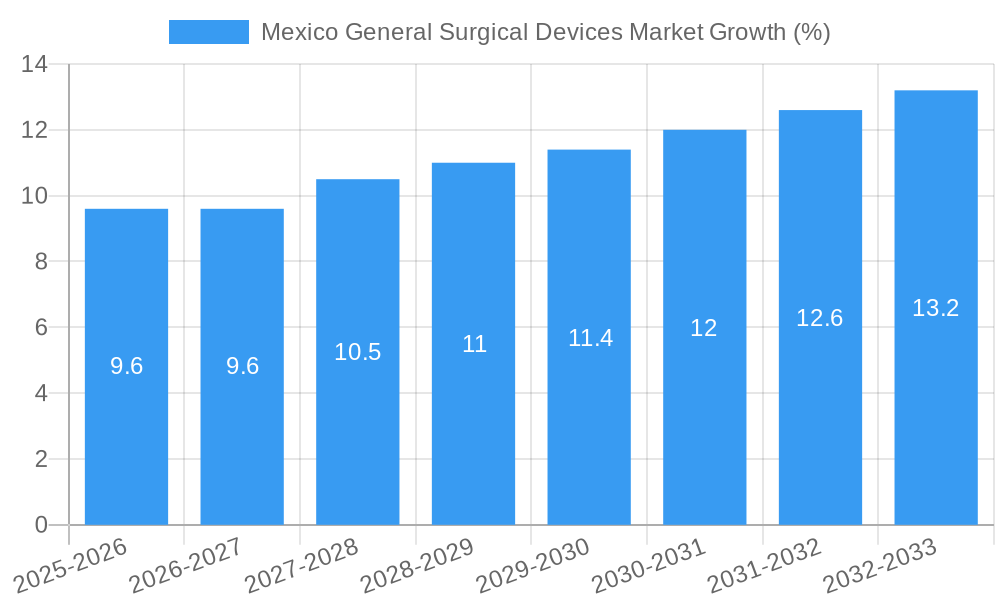

The Mexico general surgical devices market, valued at approximately $XXX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.80% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the rising prevalence of chronic diseases necessitating surgical interventions, coupled with an aging population, contributes significantly to increased demand. Secondly, advancements in minimally invasive surgical techniques, such as laparoscopy, are driving adoption of sophisticated devices offering improved patient outcomes and shorter recovery times. Furthermore, government initiatives focused on improving healthcare infrastructure and access to advanced medical technologies within Mexico are bolstering market growth. The market is segmented by product type (handheld devices, laparoscopic devices, electrosurgical devices, wound closure devices, trocars and access devices, and other products) and application (gynecology and urology, cardiology, orthopedics, neurology, and other applications). The increasing preference for minimally invasive procedures is boosting demand for laparoscopic and electrosurgical devices, while the growing geriatric population fuels demand for wound closure devices.

However, certain challenges hinder market growth. High costs associated with advanced surgical devices can limit accessibility, particularly in lower-income segments of the population. Additionally, stringent regulatory requirements and the need for skilled surgical professionals might pose barriers to market penetration for new players. Despite these constraints, the long-term outlook for the Mexico general surgical devices market remains positive, driven by continuous technological advancements, increasing healthcare expenditure, and growing awareness about the benefits of minimally invasive surgeries. Key players such as Ultradent Products Inc., Ambu, Medtronic PLC, Conmed Corporation, Johnson & Johnson, B. Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, and Integer Holdings Corporation are strategically positioned to capitalize on this growth, focusing on product innovation, strategic partnerships, and expanding distribution networks to cater to the growing demand. The market's future success depends on addressing affordability concerns and ensuring the availability of well-trained surgical personnel.

Mexico General Surgical Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Mexico General Surgical Devices market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete understanding of market dynamics, trends, and future projections. The market is estimated to be valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Mexico General Surgical Devices Market Market Dynamics & Concentration

The Mexican General Surgical Devices market exhibits a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as regulatory approvals, technological advancements, and strategic mergers and acquisitions (M&A). The market witnessed xx M&A deals between 2019 and 2024. Innovation is a key driver, with companies constantly developing advanced surgical devices to meet evolving clinical needs and enhance surgical procedures. Stringent regulatory frameworks, primarily overseen by COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios), play a critical role in shaping market dynamics. The market also sees competition from substitute products, including minimally invasive procedures and alternative therapies. End-user trends, particularly the increasing adoption of advanced surgical techniques and the growing preference for minimally invasive surgeries, are significantly impacting market growth.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: The number of M&A deals is projected to increase to xx by 2033, driven by consolidation and expansion strategies.

- Regulatory Landscape: COFEPRIS regulations influence product approvals and market entry strategies.

- Substitute Products: Competition from minimally invasive techniques and alternative treatments affects market growth.

- End-User Trends: The increasing preference for minimally invasive surgery drives demand for laparoscopic and handheld devices.

Mexico General Surgical Devices Market Industry Trends & Analysis

The Mexican General Surgical Devices market is experiencing robust growth, fueled by several key factors. The rising prevalence of chronic diseases, an aging population, and increasing healthcare expenditure are significant drivers. Technological advancements, including the introduction of robotic surgery systems and minimally invasive devices, are revolutionizing surgical procedures, boosting market demand. Consumer preferences are shifting towards minimally invasive and less-invasive techniques, leading to increased adoption of laparoscopic devices and handheld instruments. The competitive landscape is characterized by intense competition among established players and emerging companies, leading to innovation and price competition. The market demonstrates a high growth trajectory, primarily attributed to factors like increased government investments in healthcare infrastructure, improving access to healthcare services, and growing awareness among patients about advanced surgical procedures. The market is expected to experience a CAGR of xx% during the forecast period, driven primarily by these trends and the growth in the number of surgical procedures performed. Market penetration of advanced surgical devices, such as robotic surgery systems, is gradually increasing.

Leading Markets & Segments in Mexico General Surgical Devices Market

The Mexican General Surgical Devices market is geographically diverse, but significant growth is observed in urban centers with well-established healthcare infrastructure. By product segment, laparoscopic devices and handheld surgical instruments dominate the market, fueled by the increasing demand for minimally invasive surgeries. Within applications, the gynecology and urology segments lead the market.

Key Drivers for Dominant Segments:

- Laparoscopic Devices: Driven by the rising adoption of minimally invasive procedures across various surgical specialties.

- Handheld Devices: High demand for versatility and cost-effectiveness in various surgical procedures.

- Gynecology and Urology: High prevalence of related diseases and growing demand for minimally invasive procedures.

Dominance Analysis:

The growth in the laparoscopic device segment is primarily attributed to the advantages of minimally invasive surgeries, such as reduced patient trauma, shorter recovery times, and reduced hospital stays. The high demand for handheld devices is due to their versatility across surgical specialties. The gynecology and urology segment's dominance reflects the high incidence of related conditions in Mexico and the suitability of minimally invasive procedures for many of these conditions.

Mexico General Surgical Devices Market Product Developments

Recent product innovations focus on enhancing precision, minimizing invasiveness, and improving patient outcomes. Technological trends include the incorporation of advanced imaging, robotics, and AI for enhanced surgical precision and efficiency. New product launches emphasize improved ergonomics, reduced complication rates, and compatibility with existing surgical workflows. This focus on enhanced features and patient benefits aligns perfectly with the evolving needs of the market.

Key Drivers of Mexico General Surgical Devices Market Growth

Several factors drive growth in the Mexican General Surgical Devices market. Rising healthcare expenditure, an aging population, and increased prevalence of chronic diseases are significant contributors. Technological advancements, particularly in minimally invasive surgery, are further boosting market growth. Government initiatives to improve healthcare infrastructure and accessibility also play a key role. Finally, the increasing awareness among patients regarding advanced surgical techniques enhances the demand for modern surgical devices.

Challenges in the Mexico General Surgical Devices Market Market

The market faces challenges such as high costs associated with advanced surgical devices, stringent regulatory approvals, and potential supply chain disruptions. Competition from both domestic and international players adds to the challenges. These factors could potentially constrain market growth to a certain extent, particularly in segments requiring expensive or high-technology products. Limited access to healthcare in certain regions further impacts the market's reach.

Emerging Opportunities in Mexico General Surgical Devices Market

Growth opportunities lie in leveraging technological advancements, such as the integration of AI and robotics in surgical devices. Strategic partnerships with healthcare providers and government initiatives aimed at increasing healthcare access can unlock further market potential. Expansion into underserved regions and the development of cost-effective solutions for minimally invasive procedures present significant growth avenues.

Leading Players in the Mexico General Surgical Devices Market Sector

- Ultradent Products Inc

- Ambu

- Medtronic PLC

- Conmed Corporation

- Johnson & Johnson

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Integer Holdings Corporation

Key Milestones in Mexico General Surgical Devices Market Industry

- September 2022: Nordson MEDICAL opened a Medical Device Manufacturing Center of Excellence in Tecate, Mexico, signifying increased investment in the region.

- October 2022: Ambu established a large manufacturing plant in Ciudad Juárez, Mexico, strengthening its North American supply chain and production capacity.

Strategic Outlook for Mexico General Surgical Devices Market Market

The Mexican General Surgical Devices market holds significant long-term growth potential. Strategic opportunities exist for companies focusing on innovation, technological advancements, and strategic partnerships. Expansion into underserved areas and the development of affordable, high-quality surgical devices are key to future success. A focus on meeting the evolving needs of healthcare providers and patients will be critical for sustained market growth.

Mexico General Surgical Devices Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electro Surgical Devices

- 1.4. Wound Closure Devices

- 1.5. Trocars and Access Devices

- 1.6. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopaedic

- 2.4. Neurology

- 2.5. Other Applications

Mexico General Surgical Devices Market Segmentation By Geography

- 1. Mexico

Mexico General Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally Invasive Devices; Technological Advancements in General Surgical Devices; Rising Unmet Healthcare Needs

- 3.3. Market Restrains

- 3.3.1. High Capital Expenses Needed to Produce Surgical Equipment

- 3.4. Market Trends

- 3.4.1. Handheld Devices Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico General Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electro Surgical Devices

- 5.1.4. Wound Closure Devices

- 5.1.5. Trocars and Access Devices

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopaedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ultradent Products Inc*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ambu

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Medtronic PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conmed Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B Braun Melsungen AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stryker Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Integer Holdings Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ultradent Products Inc*List Not Exhaustive

List of Figures

- Figure 1: Mexico General Surgical Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico General Surgical Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Mexico General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Mexico General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Mexico General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Mexico General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico General Surgical Devices Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Mexico General Surgical Devices Market?

Key companies in the market include Ultradent Products Inc*List Not Exhaustive, Ambu, Medtronic PLC, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Integer Holdings Corporation.

3. What are the main segments of the Mexico General Surgical Devices Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally Invasive Devices; Technological Advancements in General Surgical Devices; Rising Unmet Healthcare Needs.

6. What are the notable trends driving market growth?

Handheld Devices Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Capital Expenses Needed to Produce Surgical Equipment.

8. Can you provide examples of recent developments in the market?

September 2022: Nordson MEDICAL, a global integrated solutions partner for the design, engineering and manufacturing of complex medical devices and components announced the official opening of its Tecate, Mexico, Medical Device Manufacturing Center of Excellence. The event was marked with a ribbon cutting ceremony with representatives from the local government and Nordson leadership in attendance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico General Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico General Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico General Surgical Devices Market?

To stay informed about further developments, trends, and reports in the Mexico General Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence