Key Insights

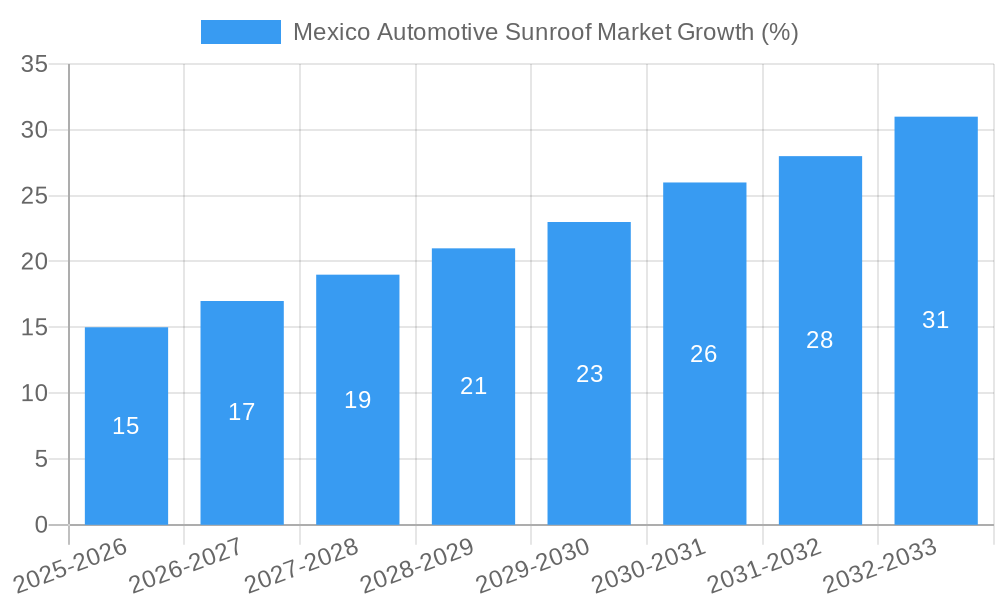

The Mexico automotive sunroof market is experiencing robust growth, driven by increasing demand for luxury vehicles and rising consumer preference for enhanced vehicle aesthetics and comfort. The market's Compound Annual Growth Rate (CAGR) exceeding 10% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several factors, including rising disposable incomes in Mexico, a growing middle class with increased purchasing power, and the expanding presence of major automotive manufacturers in the region. The preference for panoramic sunroofs and tilt-and-slide sunroofs over built-in sunroofs is also contributing to market expansion. Key players like Magna International, Webasto, and Inalfa Roof Systems are leveraging this trend, offering innovative sunroof designs and technologies to cater to consumer demand. The market is segmented by material type (glass and fabric) and sunroof type (built-in, tilt-and-slide, and panoramic). While glass sunroofs currently dominate, the fabric sunroof segment is showing promising growth, driven by cost-effectiveness and lightweight design considerations. The continued expansion of the automotive industry in Mexico, coupled with favorable government policies supporting domestic manufacturing, is further bolstering the growth outlook for the automotive sunroof market.

Looking ahead to 2033, the Mexico automotive sunroof market is projected to maintain its strong growth momentum, primarily due to ongoing vehicle production increases and an expected rise in consumer spending on vehicle upgrades and premium features. The market will continue to see innovation in sunroof technologies, focusing on improved safety, noise reduction, and energy efficiency. Competition among major players will remain intense, with a focus on product differentiation and strategic partnerships to penetrate the market. While challenges such as economic fluctuations and material cost increases could potentially impact growth, the overall outlook for the Mexico automotive sunroof market remains highly positive, presenting significant opportunities for industry participants. The increasing integration of advanced features like smart glass and automated sunroof controls further expands the market potential.

Mexico Automotive Sunroof Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico automotive sunroof market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, trends, and future growth potential. Key players like Magna International Inc, Webasto SE, and Inalfa Roof Systems Group BV are analyzed, alongside segment breakdowns by material type (glass, fabric) and sunroof type (built-in, tilt & slide, panoramic). Maximize your understanding of this dynamic market and gain a competitive edge with this essential resource.

Mexico Automotive Sunroof Market Market Dynamics & Concentration

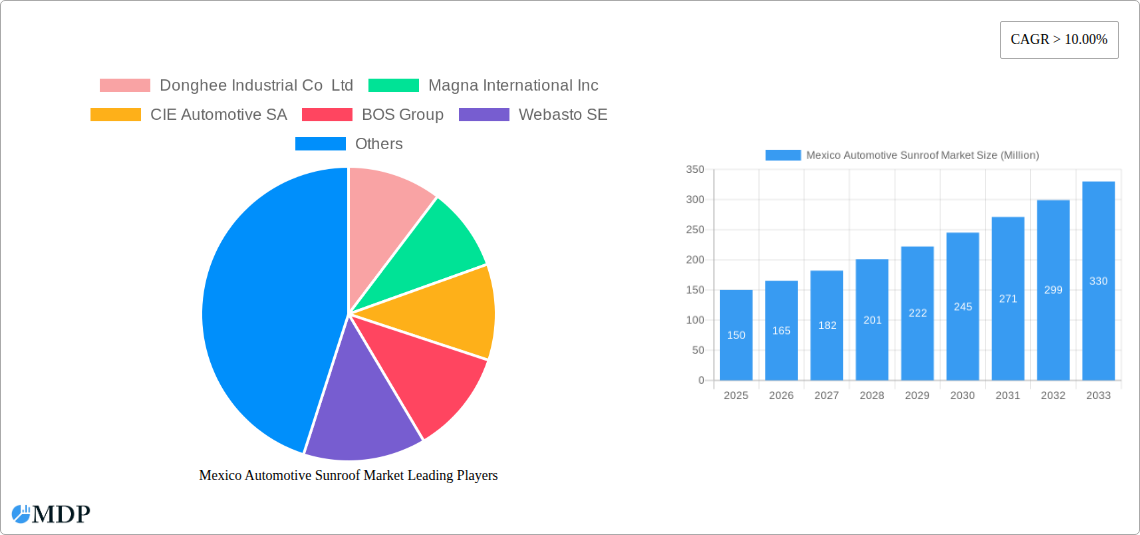

The Mexico automotive sunroof market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top five players in 2025 is estimated at 65%, indicating some consolidation. Innovation in sunroof technology, including lightweight materials and advanced features like panoramic sunroofs with integrated lighting and climate control, is a major driver. The regulatory environment, particularly concerning safety and emissions, plays a significant role. Product substitutes, such as large panoramic windshields, are limited, owing to cost and structural constraints. End-user preferences are shifting toward enhanced comfort, safety, and aesthetic appeal, leading to demand for sophisticated sunroof systems. M&A activity within the industry has been moderate, with approximately 5 deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold approximately 65% market share (2025 estimate).

- Innovation Drivers: Lightweight materials, panoramic sunroofs with advanced features.

- Regulatory Framework: Safety and emissions standards influence design and manufacturing.

- Product Substitutes: Limited due to cost and technical challenges.

- End-User Trends: Preference for comfort, safety, and aesthetic features.

- M&A Activity: Approximately 5 deals between 2019-2024.

Mexico Automotive Sunroof Market Industry Trends & Analysis

The Mexico automotive sunroof market is experiencing robust growth, driven by the increasing demand for passenger vehicles, particularly in the SUV and luxury car segments. The market’s Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. This growth is fueled by rising disposable incomes, improving infrastructure, and a growing middle class. Technological advancements, such as the introduction of smart sunroofs with features like automatic dimming and climate control, are further enhancing market expansion. Consumer preferences are shifting towards premium features, including panoramic sunroofs offering improved visibility and passenger comfort. The competitive landscape is characterized by both domestic and international players, leading to innovation and price competitiveness. Market penetration for sunroofs in the Mexican automotive sector stands at approximately xx% in 2025.

Leading Markets & Segments in Mexico Automotive Sunroof Market

The automotive sunroof market in Mexico is predominantly driven by the passenger vehicle segment, especially SUVs and luxury vehicles. Within the material types, glass sunroofs maintain a significant lead due to their superior aesthetic appeal and durability, representing approximately 75% of the market in 2025. The tilt and slide sunroof type enjoys the highest demand due to its versatility and affordability, accounting for approximately 60% of the market share in 2025. Panoramic sunroofs, however, are witnessing the fastest growth rate, owing to increasing consumer preference for premium features.

- Key Drivers for Glass Sunroofs: Superior aesthetics, durability, and established market presence.

- Key Drivers for Tilt and Slide Sunroofs: Versatility, affordability, and widespread adoption.

- Key Drivers for Panoramic Sunroofs: Growing demand for luxury and premium features.

- Regional Dominance: Market growth is concentrated in major urban areas with higher vehicle ownership rates.

Mexico Automotive Sunroof Market Product Developments

Recent product innovations focus on enhancing features and incorporating smart technology. Manufacturers are developing lighter-weight sunroofs using advanced materials to improve fuel efficiency. The integration of advanced safety features like impact sensors and improved noise insulation are key areas of focus. These advancements directly cater to consumer preferences for comfort, safety, and aesthetic enhancements, thus shaping the competitive landscape. The market is also witnessing the emergence of sunroofs with integrated solar panels, contributing to sustainability efforts within the automotive industry.

Key Drivers of Mexico Automotive Sunroof Market Growth

The growth of the Mexico automotive sunroof market is primarily driven by several factors. Rising disposable incomes and a growing middle class are stimulating demand for premium vehicles equipped with advanced features like sunroofs. Furthermore, government initiatives supporting automotive manufacturing and infrastructure development contribute positively. Technological advancements, such as the development of lightweight and energy-efficient sunroof systems, are also vital drivers of market expansion. The preference for improved comfort, safety, and enhanced vehicle aesthetics further fuels market growth.

Challenges in the Mexico Automotive Sunroof Market Market

The Mexico automotive sunroof market faces challenges such as fluctuations in raw material prices, particularly glass and other specialized materials. Supply chain disruptions and logistical complexities can impact the timely delivery of components and finished products. Intense competition from both domestic and international manufacturers puts pressure on pricing and profit margins. Stringent regulatory standards and evolving safety regulations require continuous investment in research and development to meet compliance requirements. These factors collectively influence the overall profitability and competitiveness of players in the market, and need to be strategically managed.

Emerging Opportunities in Mexico Automotive Sunroof Market

The future of the Mexico automotive sunroof market holds substantial opportunities. The increasing adoption of electric and hybrid vehicles presents a significant avenue for growth, as these vehicles often incorporate premium features including sunroofs. Strategic partnerships between sunroof manufacturers and automotive OEMs can lead to increased product integration and market penetration. Technological advancements, such as the incorporation of advanced materials and smart functionalities into sunroofs, will drive innovation and demand. Expansion into niche markets like commercial vehicles and the after-market sector can also offer substantial growth potential.

Leading Players in the Mexico Automotive Sunroof Market Sector

- Donghee Industrial Co Ltd

- Magna International Inc

- CIE Automotive SA

- BOS Group

- Webasto SE

- Aisin Seiki Co Ltd

- Automotive Sunroof-Customcraft (ASC) Inc

- Yachiyo Industry Co Ltd

- Inteva Products

- Inalfa Roof Systems Group BV

Key Milestones in Mexico Automotive Sunroof Market Industry

- 2020: Introduction of a new lightweight sunroof model by Magna International Inc.

- 2021: Aisin Seiki Co Ltd expands manufacturing capacity in Mexico.

- 2022: New regulations concerning sunroof safety standards are implemented.

- 2023: Strategic partnership between Webasto SE and a major Mexican automotive OEM.

- 2024: Launch of a new panoramic sunroof model with integrated solar panels.

Strategic Outlook for Mexico Automotive Sunroof Market Market

The Mexico automotive sunroof market exhibits strong potential for growth in the coming years, driven by increasing vehicle production, rising consumer demand for premium features, and ongoing technological advancements. Strategic opportunities exist in the development of innovative, lightweight, and energy-efficient sunroof systems. Focus on expanding market reach through strategic partnerships and exploring new applications in various vehicle segments will contribute to significant growth. The market is poised for sustained expansion, making it an attractive sector for investment and strategic partnerships.

Mexico Automotive Sunroof Market Segmentation

-

1. Material Type

- 1.1. Glass

- 1.2. Fabric

-

2. Sunroof Type

- 2.1. Built-in Sunroof

- 2.2. Tilt and slide sunroof

- 2.3. Panoramic Sunroof

Mexico Automotive Sunroof Market Segmentation By Geography

- 1. Mexico

Mexico Automotive Sunroof Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Sedan sales driving the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Automotive Sunroof Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Glass

- 5.1.2. Fabric

- 5.2. Market Analysis, Insights and Forecast - by Sunroof Type

- 5.2.1. Built-in Sunroof

- 5.2.2. Tilt and slide sunroof

- 5.2.3. Panoramic Sunroof

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Donghee Industrial Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Magna International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CIE Automotive SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BOS Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Webasto SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aisin Seiki Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Automotive Sunroof-Customcraft (ASC) Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yachiyo Industry Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Inteva Products

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Inalfa Roof Systems Group BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Donghee Industrial Co Ltd

List of Figures

- Figure 1: Mexico Automotive Sunroof Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Automotive Sunroof Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Automotive Sunroof Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Automotive Sunroof Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Mexico Automotive Sunroof Market Revenue Million Forecast, by Sunroof Type 2019 & 2032

- Table 4: Mexico Automotive Sunroof Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Automotive Sunroof Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico Automotive Sunroof Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Mexico Automotive Sunroof Market Revenue Million Forecast, by Sunroof Type 2019 & 2032

- Table 8: Mexico Automotive Sunroof Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Automotive Sunroof Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Mexico Automotive Sunroof Market?

Key companies in the market include Donghee Industrial Co Ltd, Magna International Inc, CIE Automotive SA, BOS Group, Webasto SE, Aisin Seiki Co Ltd, Automotive Sunroof-Customcraft (ASC) Inc, Yachiyo Industry Co Ltd, Inteva Products, Inalfa Roof Systems Group BV.

3. What are the main segments of the Mexico Automotive Sunroof Market?

The market segments include Material Type, Sunroof Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Sedan sales driving the Market Demand.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Automotive Sunroof Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Automotive Sunroof Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Automotive Sunroof Market?

To stay informed about further developments, trends, and reports in the Mexico Automotive Sunroof Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence