Key Insights

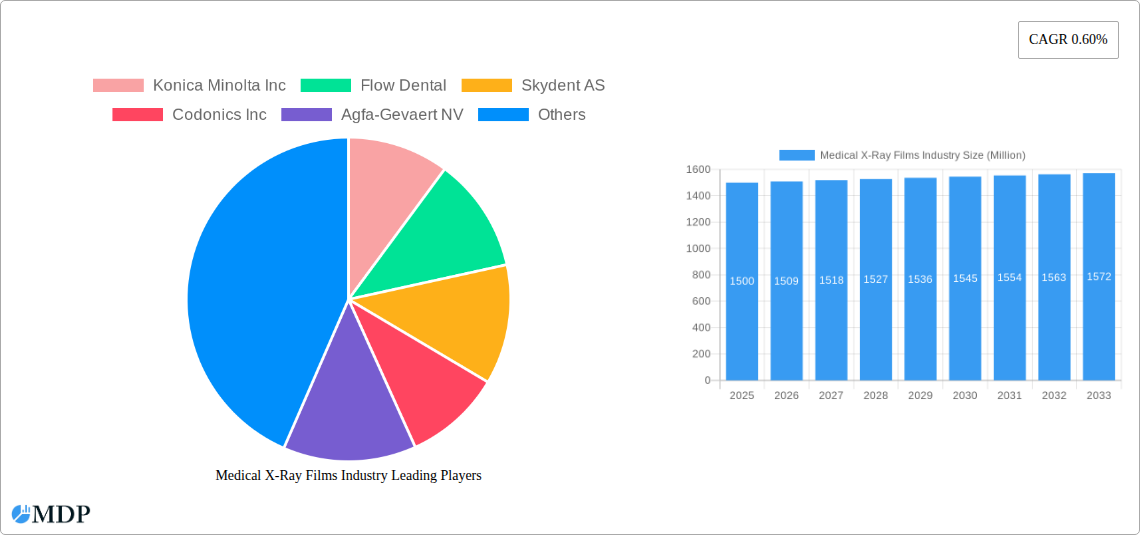

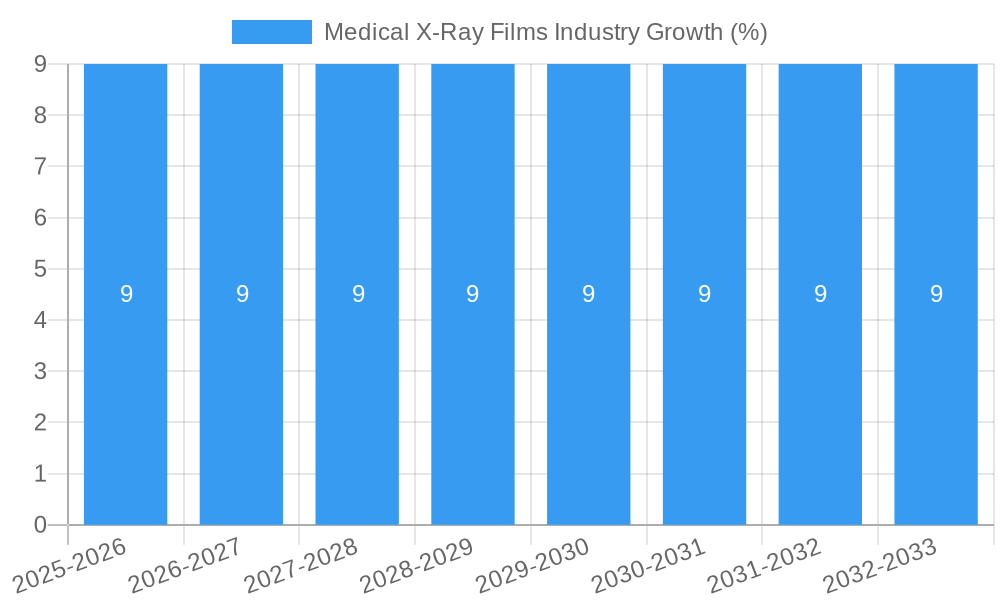

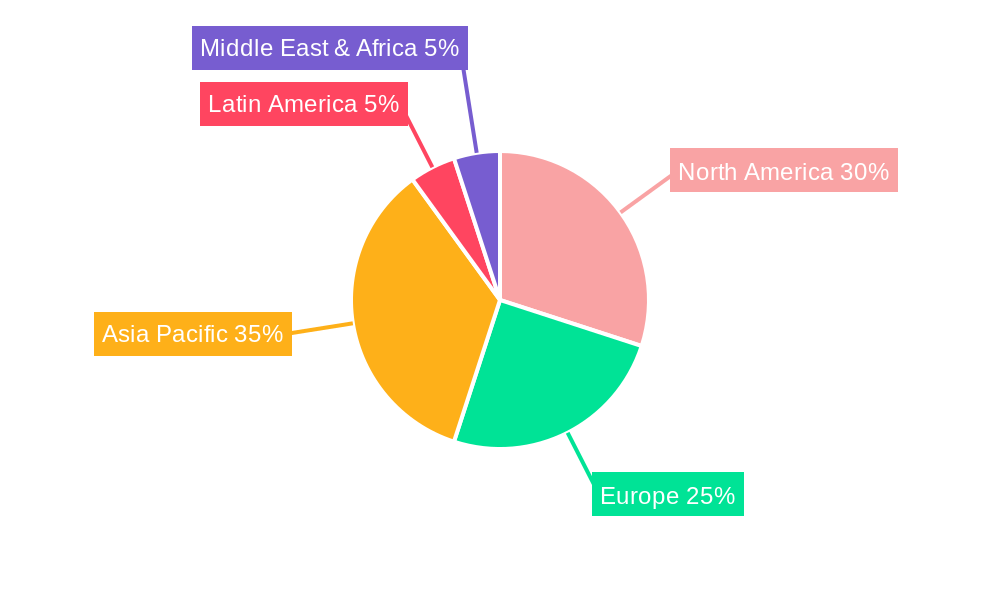

The medical X-ray film market, while facing challenges from digital imaging technologies, maintains a niche presence, particularly in developing regions and specific applications where cost-effectiveness and established infrastructure are paramount. The market's relatively low CAGR of 0.60% reflects this steady but slow growth trajectory from 2019-2033. Drivers include the continued need for cost-effective imaging solutions in resource-constrained settings, particularly in regions like Asia-Pacific and Latin America where digital infrastructure may be limited. The continued use of X-ray film in specific medical procedures and certain anatomical examinations, where film provides unique advantages in image interpretation and archival, also contribute to market persistence. However, restraints include the ongoing and pervasive adoption of digital X-ray systems offering superior image quality, faster processing times, and enhanced diagnostic capabilities. This transition is a major factor suppressing the overall market growth. Segmentation reveals that diagnostic centers, hospitals, and research/educational institutions represent the key end-users, with hospitals likely holding the largest share due to their high volume of imaging procedures. Competition among key players like Konica Minolta, Agfa-Gevaert, and Fujifilm involves strategic pricing, targeted regional focus, and efforts to retain existing customer bases in niche segments.

Looking ahead to 2033, while the market will continue to experience modest growth, the long-term trend points towards a decline in market share as digital imaging consolidates its dominance. The geographic distribution of the market likely reflects this trend, with developed regions (North America and Europe) showing a smaller market share compared to developing nations. However, even in developing regions, the transition to digital imaging is anticipated, though potentially at a slower pace due to cost considerations and infrastructure limitations. Market players will need to adapt by focusing on specific niche applications and regions where film remains a viable solution, emphasizing cost-effectiveness and providing reliable supply chains to maintain their presence in the market.

Medical X-Ray Films Market Report: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the global Medical X-Ray Films market, offering crucial insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this study unveils market dynamics, trends, leading players, and future growth opportunities. The report's data-driven approach, leveraging extensive primary and secondary research, provides actionable intelligence for strategic decision-making. Expect detailed breakdowns of market segmentation (by end-user), regional performance, and competitive landscapes, making it an indispensable resource for industry professionals, investors, and researchers. The estimated market size in 2025 is valued at $xx Million and projected to reach $xx Million by 2033, demonstrating substantial growth potential.

Medical X-Ray Films Industry Market Dynamics & Concentration

The global medical X-ray films market, while facing competition from digital imaging, retains significance, particularly in niche applications. Market concentration is moderate, with several key players holding significant but not dominant shares. Innovation is driven by the need for improved image quality, reduced radiation exposure, and enhanced workflow efficiency. Regulatory frameworks, particularly those concerning radiation safety and medical device approvals, heavily influence market operations. Product substitutes, such as digital X-ray systems, are impacting market growth, necessitating adaptation and innovation from film manufacturers. End-user trends reflect a gradual shift towards digital technologies, although film maintains relevance in specific contexts. M&A activity in the sector has been relatively low in recent years (xx deals between 2019-2024), with most activity focused on strategic partnerships and technology licensing.

- Market Share: The top five players collectively hold approximately 60% of the market share in 2025.

- M&A Activity: A total of xx M&A deals were recorded during the historical period (2019-2024).

- Innovation Drivers: Improved image quality, reduced radiation, enhanced workflow.

- Regulatory Impact: Stringent safety regulations influence market entry and product development.

- Substitute Products: Digital X-ray systems exert competitive pressure.

Medical X-Ray Films Industry Industry Trends & Analysis

The medical X-ray films market is experiencing a complex interplay of growth drivers and challenges. While the overall market is contracting due to the rise of digital imaging, specific niche segments continue to show resilience. The market's CAGR during the forecast period (2025-2033) is estimated to be -xx%, primarily driven by the continuous adoption of digital radiography. Technological disruptions, specifically the ongoing transition to digital systems, remain the most significant influence. Consumer preferences shift towards faster, more efficient, and digitally accessible imaging solutions. Competitive dynamics are shaped by the need for manufacturers to adapt to changing market needs and find innovative ways to retain their market share. Market penetration of digital radiology continues to grow, gradually reducing the demand for traditional X-ray films.

Leading Markets & Segments in Medical X-Ray Films Industry

While the global market for medical x-ray films is declining, certain regional markets and segments exhibit greater resilience. Hospitals remain the largest end-user segment, followed by diagnostic centers. The Research and Educational Institutions segment maintains a steady but smaller market share.

Key Drivers:

- Hospitals: High volume of procedures, established infrastructure, and existing workflows that favor film-based systems in certain applications.

- Diagnostic Centers: Similar to hospitals, but potentially with a greater emphasis on cost-effectiveness and efficiency, driving the need for newer, faster film technologies.

- Research and Educational Institutions: Demand driven by specific research projects or educational needs for hands-on learning with traditional film-based technologies.

Dominance Analysis:

North America historically held the largest market share, mainly due to a strong healthcare infrastructure and higher healthcare spending. However, this market share is expected to decline at a similar rate to the global average due to the rapid increase in digital imaging uptake.

Medical X-Ray Films Industry Product Developments

Recent product innovations in medical X-ray films focus on enhancing image quality while minimizing radiation exposure. Manufacturers are exploring new film compositions and processing techniques to improve resolution, contrast, and speed. Competitive advantages are derived from offering specialized films for specific applications (e.g., mammography, dental radiography) and by integrating film processing with digital workflow systems. These innovations are aimed at extending the lifespan of this technology despite the ongoing trend toward digital imaging.

Key Drivers of Medical X-Ray Films Industry Growth

Despite the overall decline, residual growth in the medical x-ray films market is driven by several factors: the affordability and accessibility of film-based systems in certain developing regions, continued usage in specialized applications (such as archiving or situations with limited power access), and the retention of certain established workflows in the hospitals that resist the complete shift to digital radiography.

Challenges in the Medical X-Ray Films Industry Market

The industry faces significant challenges, primarily the disruptive impact of digital imaging technologies. The shift to digital systems significantly reduces demand for film. Supply chain issues, especially concerning raw materials, can impact production and costs. Intense competition from digital imaging companies adds to the pressure. These factors collectively contribute to the decline in market size and revenue for traditional X-ray film manufacturers.

Emerging Opportunities in Medical X-Ray Films Industry

Despite the challenges, opportunities remain in niche applications where film's advantages outweigh digital's benefits. Strategic partnerships with digital imaging providers to offer hybrid solutions are a potential growth strategy. Focusing on developing regions with limited access to sophisticated digital technologies might offer promising expansion opportunities.

Leading Players in the Medical X-Ray Films Industry Sector

- Konica Minolta Inc

- Flow Dental

- Skydent AS

- Codonics Inc

- Agfa-Gevaert NV

- Carestream Health Inc

- Foma Bohemia Ltd

- Sony Corporation

- Fujifilm Holdings Corporation

Key Milestones in Medical X-Ray Films Industry Industry

- 2020: Several key players announced strategic partnerships to integrate film-based systems with digital workflows.

- 2022: A significant reduction in production capacity among leading manufacturers was reported.

- 2023: Introduction of new film formulations focusing on improved resolution.

- 2024: Regulatory changes in certain regions impacted the availability and pricing of medical X-ray films.

Strategic Outlook for Medical X-Ray Films Industry Market

The future of the medical X-ray films market lies in identifying and capitalizing on niche applications. Strategic partnerships, focusing on specialized segments, and exploring emerging markets will be key to mitigating the decline and achieving sustainable growth in the long-term. While complete market dominance by digital technology is expected, opportunities exist for strategic players to focus on cost-effective and specialized solutions for underserved markets.

Medical X-Ray Films Industry Segmentation

-

1. End User

- 1.1. Diagnostic Centers

- 1.2. Hospitals

- 1.3. Research and Educational Institutions

Medical X-Ray Films Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Spain

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. United Arab Emirates

- 6.2. South Africa

- 6.3. Rest of Middle East

Medical X-Ray Films Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Continued Adoption of Traditional X-ray Equipment in Developing Economies

- 3.3. Market Restrains

- 3.3.1. ; Emergence of Digital Radiography and Flat Panel Detector Technology

- 3.4. Market Trends

- 3.4.1. Diagnostic Centers Segment is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Diagnostic Centers

- 5.1.2. Hospitals

- 5.1.3. Research and Educational Institutions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.2.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Diagnostic Centers

- 6.1.2. Hospitals

- 6.1.3. Research and Educational Institutions

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Diagnostic Centers

- 7.1.2. Hospitals

- 7.1.3. Research and Educational Institutions

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Diagnostic Centers

- 8.1.2. Hospitals

- 8.1.3. Research and Educational Institutions

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Diagnostic Centers

- 9.1.2. Hospitals

- 9.1.3. Research and Educational Institutions

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Diagnostic Centers

- 10.1.2. Hospitals

- 10.1.3. Research and Educational Institutions

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Saudi Arabia Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by End User

- 11.1.1. Diagnostic Centers

- 11.1.2. Hospitals

- 11.1.3. Research and Educational Institutions

- 11.1. Market Analysis, Insights and Forecast - by End User

- 12. North America Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 France

- 13.1.3 Spain

- 13.1.4 Rest of Europe

- 14. Asia Pacific Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 India

- 14.1.2 China

- 14.1.3 Japan

- 15. Latin America Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Mexico

- 15.1.2 Brazil

- 15.1.3 Rest of Latin America

- 16. Middle East Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Saudi Arabia Medical X-Ray Films Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 South Africa

- 17.1.3 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Konica Minolta Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Flow Dental

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Skydent AS

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Codonics Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Agfa-Gevaert NV

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Carestream Health Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Foma Bohemia Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Sony Corporation

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Fujifilm Holdings Corporation

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Medical X-Ray Films Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Medical X-Ray Films Industry Share (%) by Company 2024

List of Tables

- Table 1: Medical X-Ray Films Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Medical X-Ray Films Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Medical X-Ray Films Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Medical X-Ray Films Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 5: Medical X-Ray Films Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Medical X-Ray Films Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: United States Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Canada Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: France Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Spain Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: India Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: China Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: China Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Japan Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Japan Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Mexico Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Brazil Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Brazil Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of Latin America Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Latin America Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 45: United Arab Emirates Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: United Arab Emirates Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: South Africa Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Medical X-Ray Films Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Medical X-Ray Films Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 53: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: United States Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: United States Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Canada Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Canada Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Medical X-Ray Films Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 60: Medical X-Ray Films Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 61: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 63: United Kingdom Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: United Kingdom Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: France Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: France Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Spain Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Spain Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Rest of Europe Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Europe Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Medical X-Ray Films Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 72: Medical X-Ray Films Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 73: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 75: India Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: India Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: China Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: China Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Japan Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Japan Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: Medical X-Ray Films Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 82: Medical X-Ray Films Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 83: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 84: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 85: Mexico Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Mexico Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Brazil Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Brazil Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Rest of Latin America Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Rest of Latin America Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Medical X-Ray Films Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 92: Medical X-Ray Films Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 93: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 94: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 95: Medical X-Ray Films Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 96: Medical X-Ray Films Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 97: Medical X-Ray Films Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 98: Medical X-Ray Films Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 99: United Arab Emirates Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: United Arab Emirates Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: South Africa Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: South Africa Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 103: Rest of Middle East Medical X-Ray Films Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Rest of Middle East Medical X-Ray Films Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical X-Ray Films Industry?

The projected CAGR is approximately 0.60%.

2. Which companies are prominent players in the Medical X-Ray Films Industry?

Key companies in the market include Konica Minolta Inc, Flow Dental, Skydent AS, Codonics Inc, Agfa-Gevaert NV, Carestream Health Inc, Foma Bohemia Ltd, Sony Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the Medical X-Ray Films Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Continued Adoption of Traditional X-ray Equipment in Developing Economies.

6. What are the notable trends driving market growth?

Diagnostic Centers Segment is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; Emergence of Digital Radiography and Flat Panel Detector Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical X-Ray Films Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical X-Ray Films Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical X-Ray Films Industry?

To stay informed about further developments, trends, and reports in the Medical X-Ray Films Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence