Key Insights

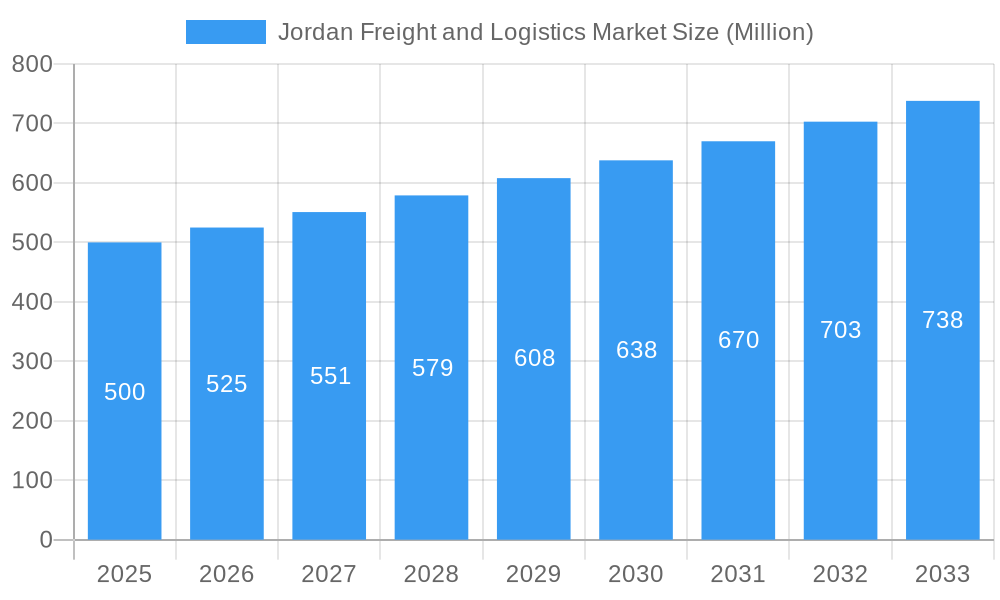

The Jordanian freight and logistics market is experiencing robust expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3%. This growth is underpinned by escalating e-commerce penetration, ongoing infrastructure enhancements, and a thriving manufacturing and construction sector. Key market segments include freight transport, warehousing, and value-added services, with manufacturing, automotive, and distributive trade as significant drivers. Jordan's strategic location and participation in regional supply chains further bolster its position. While global factors such as fuel price volatility and geopolitical dynamics present challenges, a positive economic outlook and government support for logistics infrastructure development signal sustained market expansion. The competitive landscape features both global entities like FedEx and Bollore Logistics, and local players such as Target Logistic Services and Nile International Freight Services, fostering a dynamic market environment. The market's diverse structure offers opportunities across various service types and end-user industries, catering to both large corporations and specialized providers. With a market size of 17.96 billion in the base year 2025, the market is poised for significant future growth. Opportunities are emerging for niche service providers in sectors like healthcare and pharmaceuticals, and for those leveraging technological advancements in automation and digital logistics.

Jordan Freight and Logistics Market Market Size (In Billion)

The projected growth of the Jordanian freight and logistics market is a result of improved regional connectivity, increasing consumer demand, and economic diversification. Strategic collaborations between local and international firms will be crucial. Companies are expected to prioritize operational efficiency, technology adoption, and specialized service offerings to gain competitive advantages. The surge in e-commerce and last-mile delivery services, especially in urban areas, presents substantial growth potential. Government initiatives to attract foreign investment and streamline trade will foster a conducive environment for market expansion, solidifying Jordan's role as a regional logistics hub. The increasing emphasis on supply chain resilience and sustainability will drive demand for innovative and environmentally conscious logistics solutions.

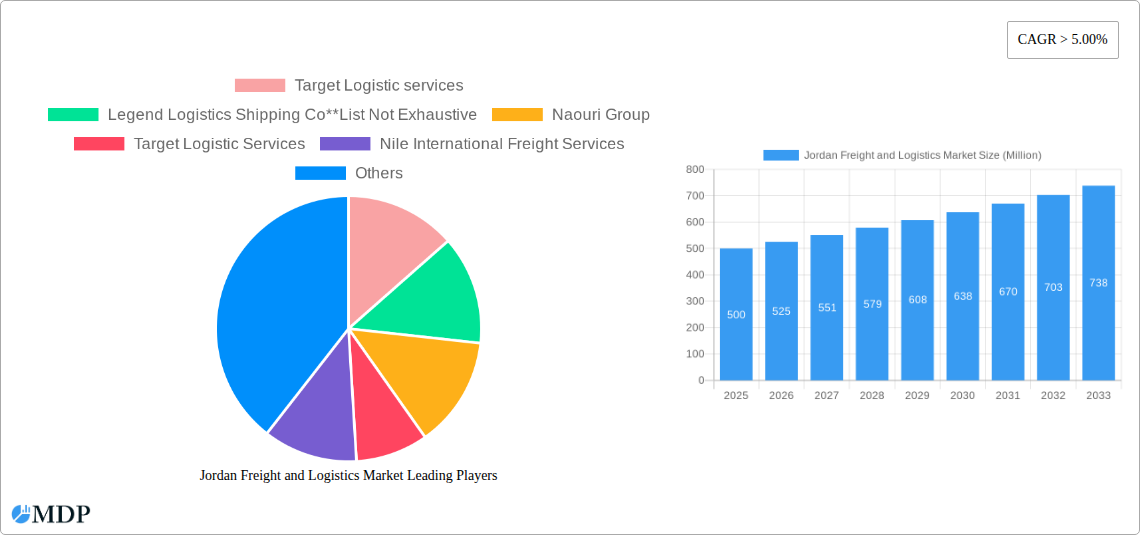

Jordan Freight and Logistics Market Company Market Share

Jordan Freight and Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Jordan freight and logistics market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study unravels market dynamics, trends, and future opportunities within this rapidly evolving sector. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, helping businesses navigate the complexities of the Jordanian freight and logistics landscape.

Jordan Freight and Logistics Market Market Dynamics & Concentration

This section delves into the competitive landscape of the Jordanian freight and logistics market, analyzing market concentration, innovation, regulatory frameworks, and M&A activity. The market is characterized by a mix of large multinational players and smaller, regional operators. The market share of the top five players is estimated to be around xx% in 2025, with a projected increase to xx% by 2033. Several factors contribute to this dynamic environment:

- Innovation Drivers: The adoption of advanced technologies like blockchain, AI, and IoT is driving efficiency improvements.

- Regulatory Frameworks: Government regulations related to customs and transportation significantly impact market operations. Recent amendments to these regulations are expected to xx the market growth.

- Product Substitutes: The increasing popularity of e-commerce is driving demand for faster and more efficient delivery solutions, pressuring traditional logistics providers to adapt.

- End-User Trends: Growth in specific sectors like manufacturing and e-commerce is impacting demand for specific logistics services.

- M&A Activities: The market has witnessed xx M&A deals in the last five years, indicating consolidation amongst players seeking to expand their market reach and service offerings. This activity is expected to continue.

The report further quantifies the market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and analyzes the impact of these dynamic factors on overall market growth.

Jordan Freight and Logistics Market Industry Trends & Analysis

This section provides a detailed analysis of the key trends shaping the Jordanian freight and logistics market. The market is experiencing robust growth, driven by several factors:

The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is fueled by factors such as the expansion of e-commerce, increasing cross-border trade, and rising investments in infrastructure development. Technological disruptions, including the adoption of automation and digitization, are streamlining operations and enhancing efficiency. Consumer preferences are shifting towards faster and more reliable delivery services, influencing the competitive dynamics and pushing companies to innovate. Market penetration of advanced logistics technologies is expected to reach xx% by 2033, contributing significantly to overall efficiency gains.

Leading Markets & Segments in Jordan Freight and Logistics Market

This section identifies the leading segments and their key growth drivers:

By Function:

- Freight Transport: Road freight dominates, driven by extensive road networks and the flexibility it provides. Rail freight is expected to experience moderate growth due to ongoing investments in railway infrastructure.

- Freight Forwarding: The demand for freight forwarding services is increasing with the rise in international trade, pushing this sector's growth.

- Warehousing: Modern, efficient warehousing facilities are becoming essential to meet the needs of growing e-commerce and manufacturing sectors.

- Value-Added Services: Services such as packaging, labeling, and inventory management are gaining prominence to cater to the changing needs of clients.

- Other Services: This segment includes specialized services like customs brokerage, which is crucial for facilitating international trade.

By End-User:

- Manufacturing and Automotive: This sector is a significant driver, requiring efficient logistics solutions for raw materials and finished goods.

- Oil and Gas: This sector necessitates specialized handling and transportation due to the nature of the products.

- Mining and Quarrying: Logistics play a vital role in transporting raw materials, requiring robust and reliable solutions.

- Construction: Efficient logistics are crucial for timely delivery of construction materials, which has significant impact on this sector's growth.

- Distributive Trade (Wholesale and Retail): The boom in e-commerce necessitates sophisticated and rapid logistics capabilities.

- Healthcare and Pharmaceutical: This sector demands strict compliance with temperature control and other regulations, leading to higher value-added service requirements.

- Others End Users: This includes telecommunications, amongst other industries that require varying logistical support.

Economic policies promoting infrastructure development and investments in logistics infrastructure are key drivers, particularly for road and rail transport. The strong growth in e-commerce significantly boosts the warehousing and freight forwarding segments.

The report provides a detailed analysis of each segment's market size, growth rate, and key drivers.

Jordan Freight and Logistics Market Product Developments

The Jordan freight and logistics market is witnessing the adoption of cutting-edge technologies, including AI-powered route optimization, drone delivery for specific applications, and blockchain for enhanced supply chain transparency. These innovations streamline processes, improve efficiency, and provide competitive advantages to companies adopting them. This is especially relevant to smaller companies striving to remain competitive in this rapidly developing market.

Key Drivers of Jordan Freight and Logistics Market Growth

Key drivers include:

- Economic Growth: Jordan's overall economic growth fuels the need for efficient logistics solutions.

- E-commerce Boom: The rapid expansion of online shopping is increasing demand for reliable delivery services.

- Government Initiatives: Government investments in infrastructure and logistics projects are supporting market expansion.

- Technological Advancements: The adoption of advanced technologies is enhancing efficiency and reducing costs.

Challenges in the Jordan Freight and Logistics Market Market

Challenges include:

- Infrastructure Limitations: While improvements are ongoing, certain aspects of infrastructure still pose challenges to operations.

- Regulatory Hurdles: Navigating complex regulations can increase operational costs and complexities.

- Competition: The market is competitive, requiring companies to continuously innovate and differentiate their services to maintain a strong market position.

- Geopolitical factors: Regional instability can disrupt operations and impact trade flows. These challenges could lead to xx% reduction in annual growth in a severe scenario.

Emerging Opportunities in Jordan Freight and Logistics Market

Emerging opportunities include:

- Technological Innovation: The adoption of automation and AI offers significant potential for increasing efficiency and improving service quality.

- Strategic Partnerships: Collaborations between logistics providers and technology firms can lead to innovative solutions.

- Market Expansion: Expanding into new markets and serving a wider range of industries presents growth opportunities.

- Focus on Sustainability: Growing environmental concerns are creating demand for green logistics solutions, presenting an opportunity for businesses to adopt sustainable practices.

Leading Players in the Jordan Freight and Logistics Market Sector

- Target Logistic services

- Legend Logistics Shipping Co

- Naouri Group

- Target Logistic Services

- Nile International Freight Services

- FedEx (FedEx)

- Seven Seas Logistics Company

- Bollore Logistics (Bollore Logistics)

- Golden Ways for Logistics

Key Milestones in Jordan Freight and Logistics Market Industry

- 2020: Introduction of new customs regulations impacted market operations.

- 2022: Significant investment in port infrastructure announced, boosting capacity.

- 2023: Several major logistics providers expanded their warehousing facilities.

- 2024: A key player acquired a smaller competitor, leading to market consolidation. (Further milestones will be included in the final report)

Strategic Outlook for Jordan Freight and Logistics Market Market

The Jordan freight and logistics market is poised for significant growth, driven by technological advancements, increased e-commerce activity, and ongoing infrastructure developments. Companies that leverage technology, embrace sustainability initiatives, and focus on building strong customer relationships are best positioned to capitalize on this potential. The focus on supply chain resilience and diversification is expected to be a key strategic priority for many market participants.

Jordan Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Services

-

1.1. Freight Transport

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Construction

- 2.4. Distributive Trade (Wholesale and Retail)

- 2.5. Healthcare and Pharmaceutical

- 2.6. Others EndUsers (Telecommunications, etc.)

Jordan Freight and Logistics Market Segmentation By Geography

- 1. Jordan

Jordan Freight and Logistics Market Regional Market Share

Geographic Coverage of Jordan Freight and Logistics Market

Jordan Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand from Consumers Driving the Market4.; Expanding E-Commerce Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Adequate Infrastructure Hindering the Market

- 3.4. Market Trends

- 3.4.1. Saudi Arabia's PIF makes market-boosting investments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Jordan Freight and Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Construction

- 5.2.4. Distributive Trade (Wholesale and Retail)

- 5.2.5. Healthcare and Pharmaceutical

- 5.2.6. Others EndUsers (Telecommunications, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Jordan

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Target Logistic services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Legend Logistics Shipping Co**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Naouri Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Target Logistic Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nile International Freight Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Seven Seas Logistics Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bollore Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Golden Ways for Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Target Logistic services

List of Figures

- Figure 1: Jordan Freight and Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Jordan Freight and Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Jordan Freight and Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 2: Jordan Freight and Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Jordan Freight and Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Jordan Freight and Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 5: Jordan Freight and Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Jordan Freight and Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Jordan Freight and Logistics Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Jordan Freight and Logistics Market?

Key companies in the market include Target Logistic services, Legend Logistics Shipping Co**List Not Exhaustive, Naouri Group, Target Logistic Services, Nile International Freight Services, FedEx, Seven Seas Logistics Company, Bollore Logistics, Golden Ways for Logistics.

3. What are the main segments of the Jordan Freight and Logistics Market?

The market segments include Function, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand from Consumers Driving the Market4.; Expanding E-Commerce Driving the Market.

6. What are the notable trends driving market growth?

Saudi Arabia's PIF makes market-boosting investments.

7. Are there any restraints impacting market growth?

4.; Lack of Adequate Infrastructure Hindering the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Jordan Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Jordan Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Jordan Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the Jordan Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence