Key Insights

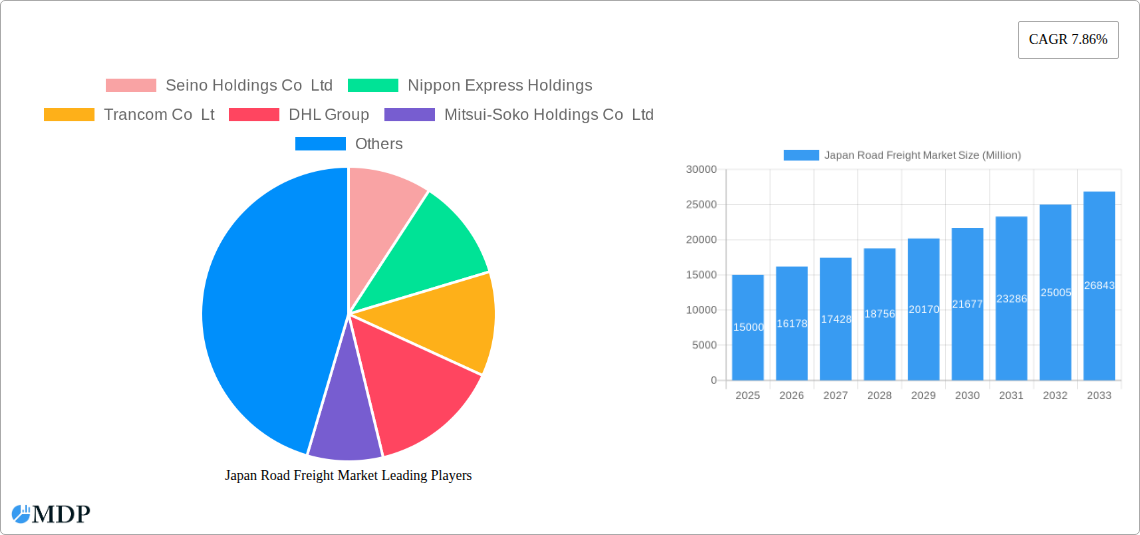

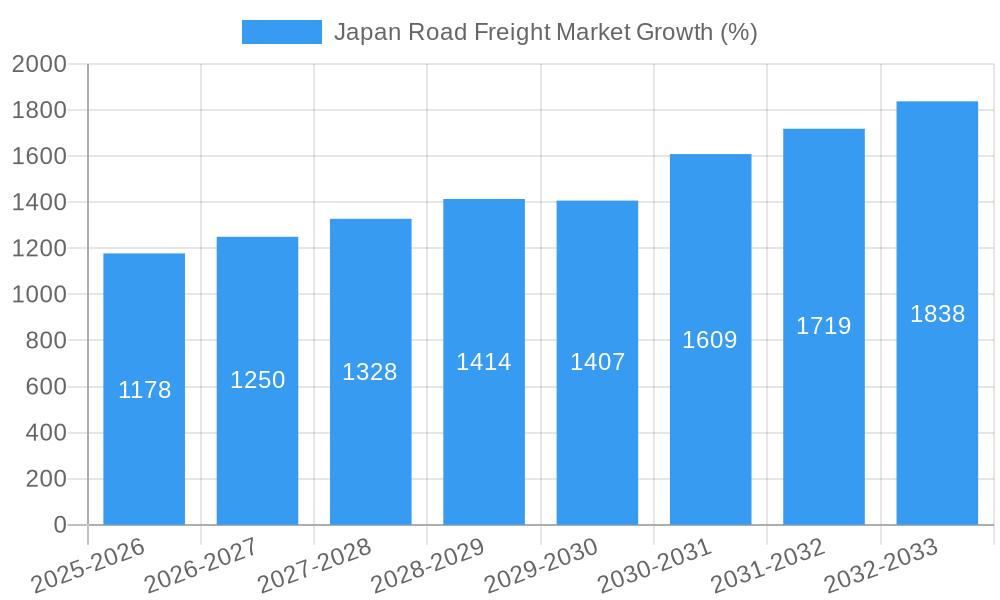

The Japan road freight market, valued at approximately ¥15 trillion (assuming a market size "XX" in the millions translates to a reasonable figure in Yen given the scale of the Japanese economy) in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.86% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector significantly increases demand for efficient last-mile delivery solutions, a segment well-served by road freight. Simultaneously, growth in key industries like manufacturing, construction, and retail contributes to higher freight volumes. Increased urbanization and a shift towards just-in-time inventory management further bolster market growth. However, challenges such as driver shortages, rising fuel costs, and stringent environmental regulations pose potential restraints. The market is segmented by goods configuration (fluid vs. solid), temperature control needs, end-user industries (agriculture, manufacturing, oil and gas, etc.), destination (domestic), truckload specifications (FTL and LTL), containerization, and distance (long haul vs. short haul). This segmentation highlights the market's diverse nature and provides valuable insights for strategic planning.

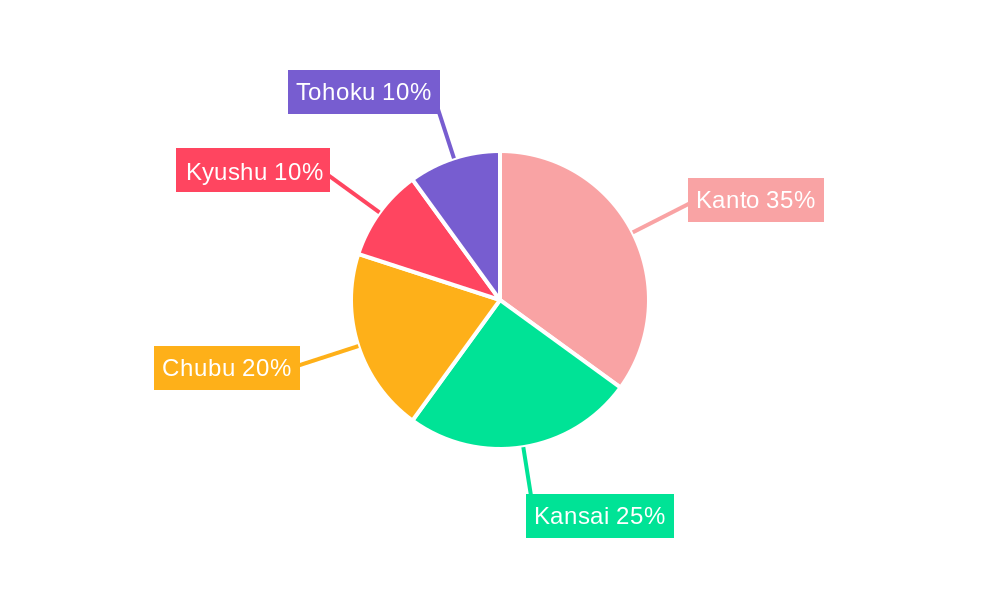

The dominance of major players like Seino Holdings, Nippon Express, and DHL underscores the competitive landscape. Regional variations exist, with Kanto, Kansai, and Chubu regions likely holding the largest market shares due to their higher population density and industrial activity. The ongoing modernization of logistics infrastructure, including the investment in advanced technologies like GPS tracking and route optimization software, is expected to improve efficiency and further stimulate market growth. The forecast period (2025-2033) promises considerable opportunities for established players and new entrants alike, particularly those focusing on specialized services or innovative solutions addressing the identified challenges. Understanding the interplay between these drivers, restraints, and segmentation details is crucial for success in this dynamic market.

Japan Road Freight Market Report: 2019-2033

Unlocking Growth in Japan's Thriving Logistics Sector: A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the Japan Road Freight Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, trends, and future potential. The study encompasses key segments, including goods configuration, temperature control, end-user industries, truckload specifications, containerization, and distance, offering a granular understanding of market performance and growth drivers. The report analyzes the activities of leading players like Seino Holdings Co Ltd, Nippon Express Holdings, and DHL Group, providing a competitive landscape overview and identifying key opportunities.

Key Highlights:

- Market Size & Forecast: The report details the market size (in Millions) for the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering a clear picture of market evolution and future growth potential.

- Segment Analysis: A detailed breakdown of key segments, including goods configuration (Fluid Goods, Solid Goods), temperature control (Non-Temperature Controlled, Temperature Controlled), end-user industries (Agriculture, Fishing, Forestry, Construction, Manufacturing, Oil & Gas, Mining & Quarrying, Wholesale & Retail Trade, Others), destination (Domestic), truckload specification (FTL, LTL), containerization (Containerized, Non-Containerized), and distance (Long Haul, Short Haul).

- Competitive Landscape: Analysis of key players, including market share, competitive strategies, and recent developments.

- Growth Drivers & Challenges: Identification of major growth drivers and market challenges, offering actionable insights for strategic planning.

Japan Road Freight Market Market Dynamics & Concentration

The Japan road freight market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory frameworks. The market is characterized by intense competition, particularly among larger companies like Seino Holdings Co Ltd and Nippon Express Holdings, which actively pursue strategic partnerships and acquisitions to expand their market reach and service offerings. Innovation drivers include the adoption of advanced technologies such as telematics, GPS tracking, and route optimization software. The regulatory environment, while generally supportive of the industry, presents challenges relating to environmental regulations and labor laws. Product substitutes, such as rail freight and air freight, constrain market growth to some degree, while the increasing preference for efficient and reliable delivery solutions among end-users drives demand. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded in the past five years, reflecting a focus on strategic consolidation and expansion. Major players consistently strive for improved operational efficiency and technological integration to gain a competitive edge. The market share of the top 5 players is estimated to be xx% in 2025, showcasing the high concentration level.

Japan Road Freight Market Industry Trends & Analysis

The Japan road freight market is experiencing steady growth, driven by factors such as increasing e-commerce penetration, robust manufacturing activity, and rising consumer demand for faster and more reliable deliveries. The CAGR for the period 2025-2033 is estimated to be xx%, reflecting the dynamic nature of the industry. Technological disruptions such as the adoption of autonomous vehicles and the Internet of Things (IoT) are reshaping the industry landscape, enhancing efficiency and optimizing logistics operations. Consumer preferences are shifting towards sustainable and environmentally friendly transportation solutions, putting pressure on companies to adopt greener practices. The competitive dynamics are intense, with companies constantly seeking to differentiate their services through superior technology, efficient operations, and enhanced customer service. Market penetration of advanced technologies like telematics is steadily increasing, with an estimated xx% penetration rate in 2025. This growth is fuelled by the need for better fleet management, real-time tracking, and improved delivery optimization. Government initiatives promoting sustainable transportation are also shaping industry practices and driving the adoption of cleaner technologies.

Leading Markets & Segments in Japan Road Freight Market

Dominant Regions/Segments: The domestic market dominates the overall road freight landscape in Japan, driven by strong domestic consumption and a well-established infrastructure network. The manufacturing sector accounts for the largest share of end-user industries, due to Japan's robust manufacturing base and intricate supply chains. Within goods configuration, solid goods constitute the largest segment, reflecting the prevalence of manufactured goods and general merchandise in the logistics sector. Full-Truck-Load (FTL) is the predominant truckload specification, signifying the efficiency of moving larger volumes of cargo. The majority of freight is containerized, highlighting the importance of standardization and efficient handling in the transport process. Short-haul transportation within Japan represents a major portion of the market, given the country's geographical characteristics and dense population centers.

Key Drivers:

- Robust Economic Growth: Japan's steady economic expansion fuels demand for goods transportation.

- Developed Infrastructure: An extensive highway network facilitates efficient road freight movement.

- Government Support: Policies encouraging logistics efficiency positively impact market growth.

- E-commerce Boom: The rise of online retail increases demand for last-mile delivery services.

Japan Road Freight Market Product Developments

Recent product innovations in the Japan road freight market center on improving efficiency, sustainability, and transparency. This includes the integration of advanced telematics and GPS tracking systems, route optimization software, and the use of electric and hybrid vehicles to reduce carbon emissions. Companies are also developing innovative solutions for temperature-sensitive goods transportation, enhancing supply chain reliability for pharmaceuticals and other perishable products. The adoption of digital platforms for freight booking and tracking increases transparency and enhances customer experience. These developments directly address market needs for improved efficiency, cost reduction, and environmentally conscious logistics solutions, fostering greater competitiveness within the industry.

Key Drivers of Japan Road Freight Market Growth

Several factors contribute to the growth of the Japan road freight market. The ongoing expansion of e-commerce necessitates efficient and reliable last-mile delivery solutions, boosting demand. Simultaneously, government initiatives promoting infrastructure development and technological advancements, including autonomous vehicles and IoT-based logistics, further accelerate market expansion. The thriving manufacturing sector, coupled with a robust domestic consumption pattern, continues to drive significant demand for efficient road freight services. These combined elements create a fertile ground for market growth and increased investment in innovative logistics solutions.

Challenges in the Japan Road Freight Market Market

The Japan road freight market faces challenges such as a shrinking workforce, increasing labor costs, and stringent environmental regulations, potentially leading to higher operating expenses for companies. Infrastructure limitations, particularly in certain regions, can cause bottlenecks and delays. Competition is intense, creating pressure on profit margins. The overall impact of these challenges is estimated to reduce market growth by approximately xx% during the forecast period. Addressing these challenges requires strategic investment in automation, technological upgrades, and workforce development initiatives.

Emerging Opportunities in Japan Road Freight Market

The Japan road freight market presents significant long-term growth opportunities. The increasing adoption of automation and the Internet of Things (IoT) will create new efficiencies and enhance service offerings. Strategic partnerships among logistics providers and technology firms will drive innovation and market expansion. Government investments in infrastructure modernization, particularly in areas with capacity constraints, will create further opportunities for expansion. The focus on sustainable transportation solutions opens avenues for companies that adopt environmentally conscious practices.

Leading Players in the Japan Road Freight Market Sector

- Seino Holdings Co Ltd

- Nippon Express Holdings

- Trancom Co Lt

- DHL Group

- Mitsui-Soko Holdings Co Ltd

- Konoike Group

- Sankyu Inc

- Fukuyama Transporting Co Ltd

- Hitachi Transport System

- K R S Corporation

Key Milestones in Japan Road Freight Market Industry

- May 2024: Nippon Express expands its e-NX Quote digital forwarding service to 35 countries/regions, including a CO2 emissions calculation function. This significantly enhances the company's global reach and strengthens its commitment to sustainability.

- January 2024: DHL Japan's GoGreen Plus contract with SCREEN Semiconductor Solutions showcases the growing adoption of sustainable aviation fuel (SAF) for reducing carbon emissions within the logistics sector. This highlights a crucial industry trend toward environmentally conscious operations.

- November 2023: Nippon Express Holdings' partnership with Cryoport Systems expands its capabilities in cryogenic transport services for the pharmaceutical industry. This strategic move strengthens its position in the specialized transportation market.

Strategic Outlook for Japan Road Freight Market Market

The Japan road freight market holds significant long-term potential. Continued investment in technological advancements, including automation and data analytics, will drive efficiency and growth. Strategic partnerships and mergers & acquisitions will reshape the competitive landscape, creating larger and more diversified players. A focus on sustainability and reduced carbon emissions will be crucial for long-term success, driving adoption of greener technologies and practices. The market's future will be defined by companies that effectively leverage technological innovation, adapt to evolving regulatory environments, and meet the changing demands of consumers and businesses.

Japan Road Freight Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Japan Road Freight Market Segmentation By Geography

- 1. Japan

Japan Road Freight Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for efficient transportation4.; Growing eCommerce industry

- 3.3. Market Restrains

- 3.3.1. 4.; Intense competition affecting the market4.; Fluctuating fuel prices

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Road Freight Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Kanto Japan Road Freight Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Road Freight Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Road Freight Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Road Freight Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Road Freight Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Seino Holdings Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nippon Express Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trancom Co Lt

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DHL Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsui-Soko Holdings Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Konoike Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sankyu Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fukuyama Transporting Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hitachi Transport System

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 K R S Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Seino Holdings Co Ltd

List of Figures

- Figure 1: Japan Road Freight Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Road Freight Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Road Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Road Freight Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Japan Road Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Japan Road Freight Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Japan Road Freight Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Japan Road Freight Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Japan Road Freight Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Japan Road Freight Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Japan Road Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Japan Road Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Kanto Japan Road Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kansai Japan Road Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Chubu Japan Road Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kyushu Japan Road Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Tohoku Japan Road Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Road Freight Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 17: Japan Road Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 18: Japan Road Freight Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 19: Japan Road Freight Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 20: Japan Road Freight Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 21: Japan Road Freight Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 22: Japan Road Freight Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 23: Japan Road Freight Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Road Freight Market?

The projected CAGR is approximately 7.86%.

2. Which companies are prominent players in the Japan Road Freight Market?

Key companies in the market include Seino Holdings Co Ltd, Nippon Express Holdings, Trancom Co Lt, DHL Group, Mitsui-Soko Holdings Co Ltd, Konoike Group, Sankyu Inc, Fukuyama Transporting Co Ltd, Hitachi Transport System, K R S Corporation.

3. What are the main segments of the Japan Road Freight Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for efficient transportation4.; Growing eCommerce industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Intense competition affecting the market4.; Fluctuating fuel prices.

8. Can you provide examples of recent developments in the market?

May 2024: Nippon Express will be expanding the number of countries and regions covered by its e-NX Quote digital forwarding service, which allows users to get quotes online, to 35 countries/regions starting with a January 31 launch in Japan. The service also now includes a CO2 emissions calculation function.January 2024: DHL Japan and SCREEN Semiconductor Solutions Co., Ltd. announced that they have signed a long-term contract for GoGreen Plus, a transportation service that reduces (inset) CO2 emissions associated with transportation through the use of sustainable aviation fuel (SAF).November 2023: Nippon Express Holdings has entered into a strategic partnership with Cryoport Systems, a group company of the US-based specialized pharmaceutical carrier Cryoport, Inc., to provide the global pharmaceutical industry with cryogenic (-150°C or lower) transport services for cellular raw materials and regenerative medicine products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Road Freight Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Road Freight Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Road Freight Market?

To stay informed about further developments, trends, and reports in the Japan Road Freight Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence