Key Insights

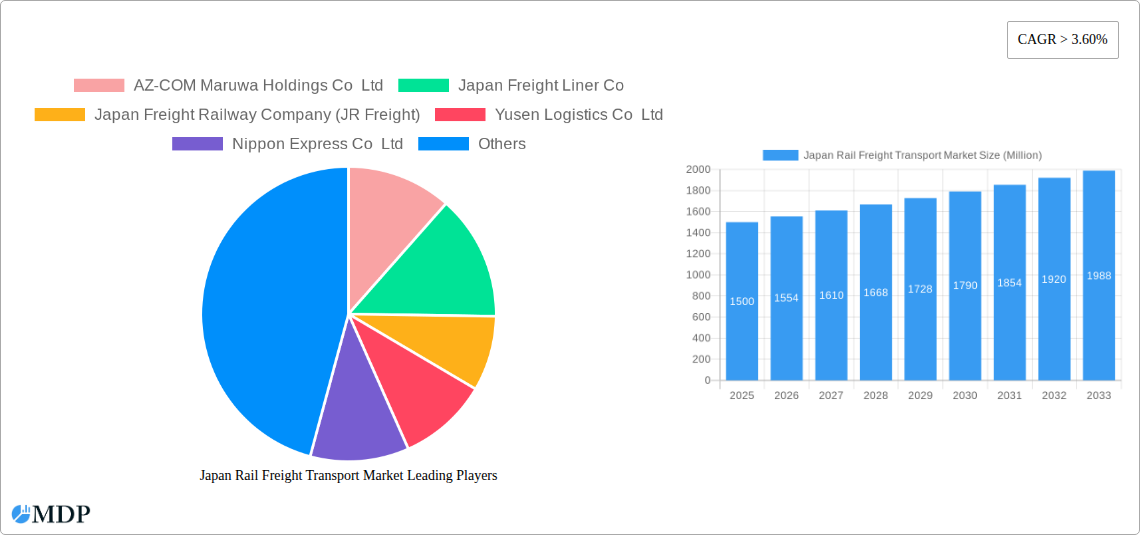

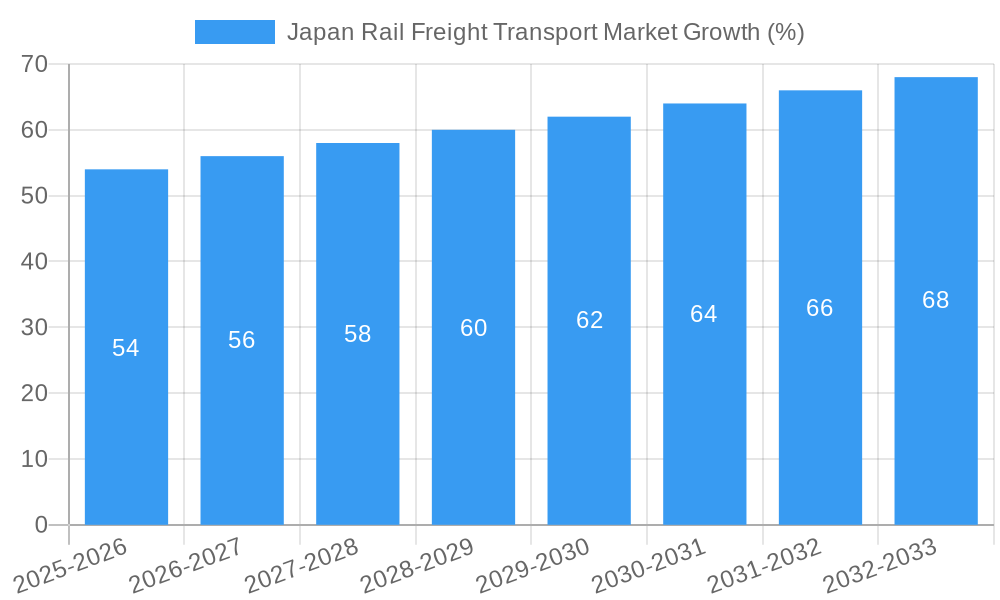

The Japan Rail Freight Transport market, valued at approximately ¥1.5 trillion (assuming a reasonable market size based on a CAGR of 3.6% and industry trends) in 2025, is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.6% from 2025 to 2033. Several key drivers fuel this expansion. Increasing e-commerce activity necessitates efficient and reliable inland transportation, boosting demand for rail freight services. Furthermore, government initiatives promoting sustainable logistics and reducing reliance on road transport are creating a favorable regulatory environment. The rising cost of road transport and associated congestion in major urban areas like Kanto and Kansai are also compelling businesses to shift towards rail, a more cost-effective and environmentally friendly alternative for long-haul transportation. The market is segmented by cargo type (containerized, non-containerized, liquid bulk) and service type (transportation, allied services). Containerized intermodal transport is a major segment, benefiting from the growing integration of rail networks with port facilities. Leading players like JR Freight, Nippon Express, and Yusen Logistics are strategically investing in infrastructure upgrades and advanced technologies to enhance efficiency and service offerings. Challenges include aging infrastructure in certain regions and competition from other modes of transport. However, ongoing investments and technological advancements, such as automation and improved tracking systems, are mitigating these challenges.

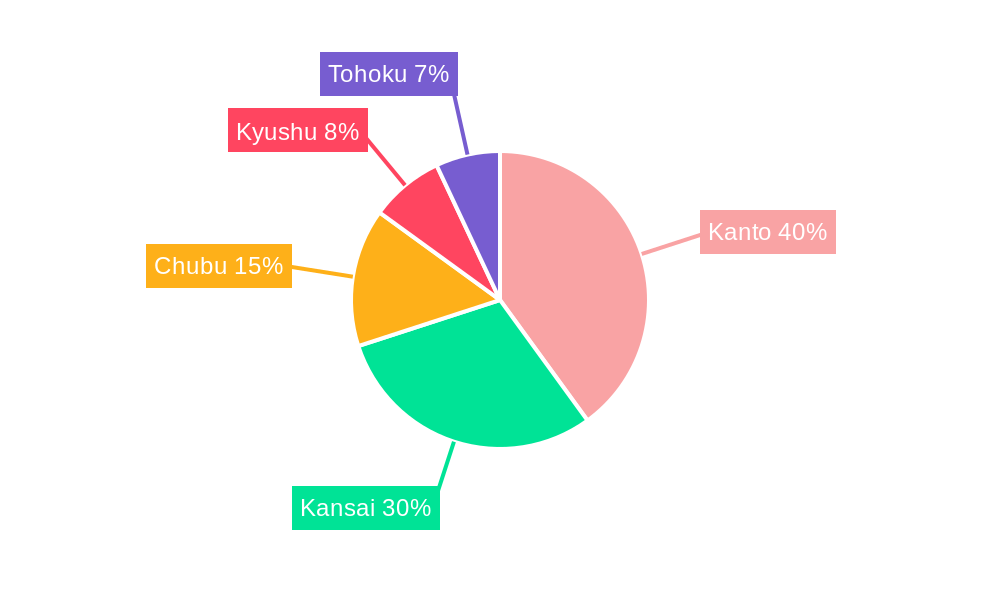

The regional distribution of the market reflects Japan's economic geography, with Kanto and Kansai regions dominating due to their high concentration of industrial and commercial activities. However, growth is anticipated in other regions like Chubu and Kyushu as infrastructure improves and economic activity diversifies. The forecast period (2025-2033) suggests a considerable expansion of the market, driven by continuous improvements in railway infrastructure, technological advancements in rail transport, and a growing preference for sustainable and efficient logistics solutions. This growth trajectory is likely to attract further investment and competition within the sector, leading to improved services and further market expansion. The market's future depends on the successful implementation of government policies promoting sustainable logistics, the effective management of existing infrastructure, and continued innovation in the sector.

Japan Rail Freight Transport Market Report: 2019-2033

Dive deep into the dynamic landscape of the Japan Rail Freight Transport Market with this comprehensive report, offering invaluable insights for industry stakeholders. This detailed analysis covers the period from 2019 to 2033, with a focus on the key trends, drivers, challenges, and opportunities shaping this crucial sector. Expect in-depth coverage of market size (in Millions), key players, and segment-specific growth projections, enabling you to make informed strategic decisions.

Japan Rail Freight Transport Market Market Dynamics & Concentration

The Japan Rail Freight Transport market exhibits a moderately concentrated structure, with a handful of major players commanding significant market share. JR Freight holds the largest share, estimated at xx%, followed by Nippon Express Co Ltd (xx%) and Yusen Logistics Co Ltd (xx%). The market's dynamics are influenced by several key factors:

- Innovation Drivers: Technological advancements in rolling stock, logistics management systems, and intermodal transport are driving efficiency and capacity improvements. The introduction of autonomous vehicles and digital tracking systems is reshaping operational practices.

- Regulatory Frameworks: Government regulations concerning safety, environmental compliance, and infrastructure development significantly impact market operations and growth. Policies promoting sustainable transportation and efficient logistics play a crucial role.

- Product Substitutes: Road and sea freight transportation pose a competitive challenge to rail freight, particularly for shorter distances or specific cargo types. However, rail’s cost-effectiveness and environmental advantages over long distances continue to ensure its relevance.

- End-User Trends: The growth of e-commerce and increasing demand for faster and more reliable delivery times are placing pressure on the market to adapt and improve its speed and efficiency. Shifting industrial production patterns influence freight volume distribution among various segments.

- M&A Activities: The market has witnessed a moderate level of merger and acquisition activity in recent years, primarily focused on consolidating market share and expanding service offerings. The number of M&A deals has averaged xx per year between 2019 and 2024.

Japan Rail Freight Transport Market Industry Trends & Analysis

The Japan Rail Freight Transport market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key industry trends:

The increasing demand for efficient and reliable transportation solutions across various sectors, particularly manufacturing, retail, and agriculture, significantly contributes to market expansion. Technological advancements in rail infrastructure and operational systems, encompassing the use of advanced tracking technologies and automated systems, boost efficiency and capacity. This efficiency increase, combined with a growing emphasis on sustainable logistics solutions, enhances rail freight's competitiveness compared to other modes of transport. Furthermore, government investments in railway infrastructure development and regulatory reforms aimed at streamlining operations contribute to market growth. Competitive dynamics play a vital role, with established players constantly seeking to optimize their service offerings and expand their reach, while new entrants strive to carve out their niche. Consumer preferences for faster delivery times and enhanced supply chain visibility also influence the industry. Market penetration of rail freight across diverse sectors continues to increase, but it faces an ongoing challenge from competitive modes of transportation and associated logistical hurdles.

Leading Markets & Segments in Japan Rail Freight Transport Market

The Containerized (Intermodal) segment dominates the Japan Rail Freight Transport market by Cargo Type, accounting for xx% of the total market value in 2025. This is primarily due to:

- Key Drivers:

- Efficient Logistics: Intermodal transport offers seamless integration between rail and other modes, ensuring efficient end-to-end delivery.

- Cost-Effectiveness: The economies of scale and reduced handling costs associated with containerized transport make it attractive for various cargo types.

- Improved Supply Chain Visibility: Container tracking technologies enhance the monitoring of goods throughout their transit, providing better control over the supply chain.

The Transportation segment holds the largest share in the Service Type category, representing xx% of the total market in 2025. The dominance of this segment can be attributed to the basic transportation of goods being the core function of the industry.

Japan Rail Freight Transport Market Product Developments

Recent product developments focus on enhancing efficiency and sustainability. Innovations in rolling stock, such as lighter and more fuel-efficient locomotives, are improving cost-effectiveness. Investment in advanced telematics and sensor technologies enables real-time monitoring of cargo and infrastructure, improving safety and reducing operational delays. The emphasis on developing eco-friendly solutions reflects the increasing regulatory pressure and growing environmental awareness within the industry. These advancements are key to securing market fit and maintaining competitive advantages.

Key Drivers of Japan Rail Freight Transport Market Growth

Several key factors are driving the growth of the Japan Rail Freight Transport market. Technological advancements, such as the adoption of automation and digitization in logistics operations, boost efficiency and capacity. Economic growth and increasing industrial activity fuel demand for freight transportation services. Government policies supporting infrastructure development and environmental sustainability encourage investment in rail transport.

Challenges in the Japan Rail Freight Transport Market Market

The market faces challenges including high infrastructure costs, potential capacity constraints on certain routes, and competition from other modes of transport. Regulatory hurdles and associated compliance costs can also impact profitability. Supply chain disruptions caused by unforeseen events (e.g., natural disasters, geopolitical uncertainties) pose significant risks. These factors collectively influence the overall competitiveness of rail freight transport within the Japanese logistics industry.

Emerging Opportunities in Japan Rail Freight Transport Market

The market presents significant opportunities for long-term growth. Emerging technologies, such as blockchain for enhanced supply chain security and AI for optimizing logistics operations, offer potential for market expansion. Strategic partnerships between rail operators and logistics providers create value-added solutions. Expansion into underserved regions and diversification of service offerings unlock new market segments, fostering overall growth within the sector.

Leading Players in the Japan Rail Freight Transport Market Sector

- AZ-COM Maruwa Holdings Co Ltd

- Japan Freight Liner Co

- Japan Freight Railway Company (JR Freight)

- Yusen Logistics Co Ltd

- Nippon Express Co Ltd

- FESCO

- MAERSK

- Seino Transportation Co Ltd

- Kamigumi Co Ltd

- Japan Freight Railway Co

Key Milestones in Japan Rail Freight Transport Market Industry

September 2022: FESCO Transportation Group launches FESCO Trans China Railway, a new intermodal service connecting Japan to Uzbekistan via China and Kazakhstan. This milestone expands market reach and highlights the potential for intercontinental rail freight transport.

February 2022: A new cold chain train service connecting Japan with Europe via the Trans-Siberian route is introduced, demonstrating the growing demand for temperature-sensitive goods transport via rail and the strategic partnerships enabling such ventures.

Strategic Outlook for Japan Rail Freight Transport Market Market

The Japan Rail Freight Transport market holds substantial future potential, driven by ongoing technological advancements, robust infrastructure development, and rising e-commerce activity. Strategic partnerships, diversification of services, and expansion into emerging market segments offer considerable growth opportunities. Companies that adapt to evolving consumer demands and successfully navigate regulatory landscapes will be best positioned to thrive in this dynamic market.

Japan Rail Freight Transport Market Segmentation

-

1. Cargo Type

- 1.1. Containerized (Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Service Type

- 2.1. Transportation

- 2.2. Services Allied to Transportation

Japan Rail Freight Transport Market Segmentation By Geography

- 1. Japan

Japan Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Urban Population4.; Rising Processed Food Products

- 3.3. Market Restrains

- 3.3.1. 4.; Equipment Breakdown

- 3.4. Market Trends

- 3.4.1. Increase in demand for sustainable transport of goods driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 5.1.1. Containerized (Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Transportation

- 5.2.2. Services Allied to Transportation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 6. Kanto Japan Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AZ-COM Maruwa Holdings Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Japan Freight Liner Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Japan Freight Railway Company (JR Freight)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yusen Logistics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nippon Express Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FESCO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MAERSK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seino Transportation Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kamigumi Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Japan Freight Railway Co **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AZ-COM Maruwa Holdings Co Ltd

List of Figures

- Figure 1: Japan Rail Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Rail Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 3: Japan Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Japan Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 12: Japan Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 13: Japan Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Rail Freight Transport Market?

The projected CAGR is approximately > 3.60%.

2. Which companies are prominent players in the Japan Rail Freight Transport Market?

Key companies in the market include AZ-COM Maruwa Holdings Co Ltd, Japan Freight Liner Co, Japan Freight Railway Company (JR Freight), Yusen Logistics Co Ltd, Nippon Express Co Ltd, FESCO, MAERSK, Seino Transportation Co Ltd, Kamigumi Co Ltd, Japan Freight Railway Co **List Not Exhaustive.

3. What are the main segments of the Japan Rail Freight Transport Market?

The market segments include Cargo Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Urban Population4.; Rising Processed Food Products.

6. What are the notable trends driving market growth?

Increase in demand for sustainable transport of goods driving the market.

7. Are there any restraints impacting market growth?

4.; Equipment Breakdown.

8. Can you provide examples of recent developments in the market?

September 2022: FESCO Transportation Group has launched, a brand-new intermodal service that has begun travelling from Japan to Uzbekistan through China and Kazakhstan. Its name is FESCO Trans China Railway, and it connects the nations by train and water. At the Kazakh-Chinese logistics facility in the city of Lianyungang, the initial shipment of 18 forty-foot containers that were delivered from port Yokohama is already in place. On September 30th, containers are supposed to be sent out by rail.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Japan Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence