Key Insights

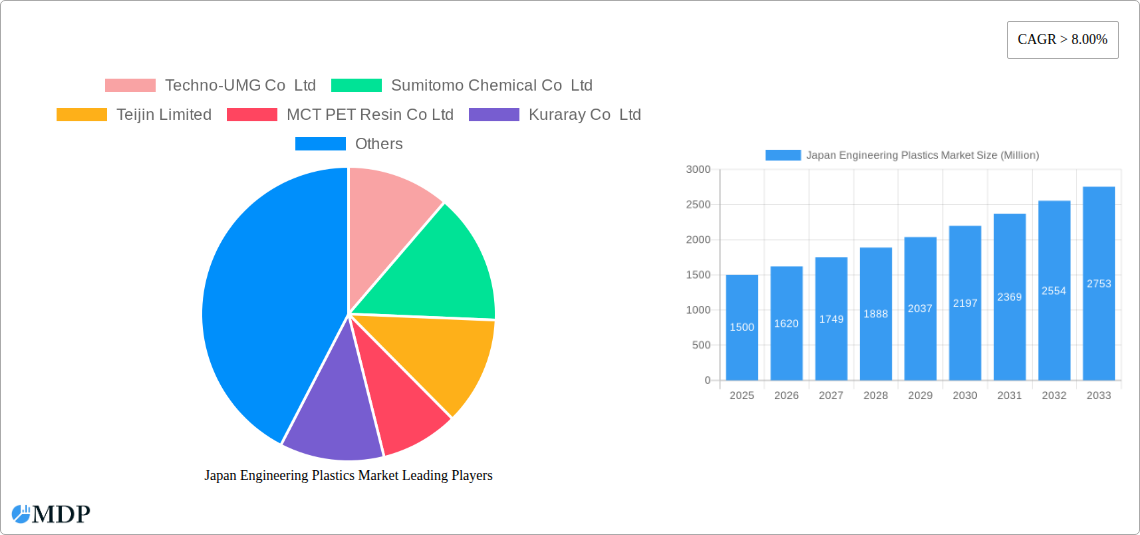

The Japan engineering plastics market is experiencing robust growth, fueled by a compound annual growth rate (CAGR) exceeding 8% from 2019 to 2024 and projected to continue this trajectory through 2033. This expansion is driven primarily by the increasing demand from key end-use industries such as automotive, electronics, and aerospace within Japan. The automotive sector's push for lightweighting and improved fuel efficiency is a significant contributor, necessitating the adoption of high-performance engineering plastics. Similarly, the electronics industry's demand for durable and reliable components, particularly in consumer electronics and industrial automation, is driving significant consumption. The building and construction sector, while a smaller contributor compared to automotive and electronics, also shows promising growth potential as innovative materials are increasingly incorporated into infrastructure and high-rise buildings. Several factors contribute to the market's dynamism, including technological advancements leading to the development of novel materials with superior properties and government initiatives promoting sustainable manufacturing practices.

The market segmentation reveals a diverse landscape. While the exact market shares of individual resin types (Fluoropolymer, Polyphthalamide, PBT, PC, PEEK, PET, PI, PMMA, POM, ABS and SAN) are not provided, we can infer that fluoropolymers, known for their exceptional chemical resistance, and high-performance materials such as PEEK, are likely commanding premium price points and driving a significant portion of market value. Similarly, the regional distribution across Japan, focusing on industrial hubs like Kanto, Kansai, and Chubu, reflects established manufacturing concentrations. Competitive intensity remains high, with prominent players like Sumitomo Chemical, Teijin, and Asahi Kasei vying for market share through product innovation and strategic partnerships. The forecast period (2025-2033) anticipates continued growth, driven by ongoing technological innovation and expanding application areas within the aforementioned end-use industries. This growth is likely to be moderated by factors such as fluctuating raw material prices and economic conditions.

Japan Engineering Plastics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan Engineering Plastics Market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for stakeholders across the engineering plastics value chain. Expect detailed data and analysis on market size (in Million), CAGR, and market share, driving informed decision-making.

Japan Engineering Plastics Market Market Dynamics & Concentration

The Japan engineering plastics market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors like technological advancements, stringent regulatory frameworks, and the availability of substitute materials. Innovation is a key driver, with companies continuously developing high-performance engineering plastics catering to the demanding needs of various end-user industries. The regulatory landscape, focusing on environmental sustainability and material safety, significantly impacts market dynamics. Companies are increasingly adopting sustainable manufacturing practices and developing eco-friendly materials. The market witnesses frequent mergers and acquisitions (M&A) activities as companies strategize for growth and expansion.

- Market Share: The top five players hold approximately xx% of the market share in 2025, while the remaining share is distributed among numerous smaller players. This concentration is expected to remain relatively stable throughout the forecast period.

- M&A Activity: The number of M&A deals in the Japan engineering plastics market has averaged xx per year during the historical period (2019-2024), signifying a moderate level of consolidation.

- Innovation Drivers: Growing demand for lightweight, high-strength, and heat-resistant materials in automotive and aerospace applications is a key driver of innovation.

- Regulatory Frameworks: Stringent environmental regulations and safety standards are driving the development of sustainable and bio-based engineering plastics.

- Product Substitutes: Competition from alternative materials like metal alloys and composites is a factor influencing market dynamics, with engineering plastics needing to demonstrate superior properties and cost-effectiveness.

- End-User Trends: The increasing adoption of advanced technologies in diverse sectors like electronics and automotive is fuelling the demand for specialized engineering plastics.

Japan Engineering Plastics Market Industry Trends & Analysis

The Japan engineering plastics market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by factors such as increasing demand from automotive, electronics, and aerospace sectors, coupled with technological advancements that continuously improve material properties and broaden applications. Consumer preference for lighter, more durable, and environmentally friendly products is further stimulating market expansion. Technological disruptions, such as the rise of additive manufacturing (3D printing), are opening new avenues for engineering plastic usage. Intense competition among existing players and the entry of new market participants are shaping the competitive dynamics. Market penetration of high-performance engineering plastics like PEEK and PI is growing steadily, reflecting demand for superior material characteristics in high-end applications. The shift towards sustainable materials, including bio-based engineering plastics, represents a significant trend with increasing consumer awareness of environmental concerns.

Leading Markets & Segments in Japan Engineering Plastics Market

Within the Japan engineering plastics market, the automotive and electronics sectors represent the leading end-user industries, exhibiting substantial growth and market share. The automotive industry's continuous drive to improve fuel efficiency and enhance vehicle safety through lightweighting is a key driver. The electronics industry's requirement for high-performance materials in consumer electronics, industrial equipment, and communication infrastructure also contributes significantly.

- Leading End-User Industries:

- Automotive: High demand for lightweight materials, enhanced performance, and improved fuel economy.

- Electrical & Electronics: Need for high-performance materials for consumer electronics, communication equipment, and industrial machinery.

- Leading Resin Types:

- Polybutylene Terephthalate (PBT): Wide usage in automotive and electrical components due to its high strength and dimensional stability.

- Polycarbonate (PC): Popular in various applications due to its excellent optical clarity, impact resistance, and heat resistance.

The growth of these leading segments is propelled by favorable economic policies supporting technological advancements and infrastructure development in Japan. The ongoing investments in infrastructure projects, particularly in transportation and construction, create significant demand for high-performance engineering plastics. Dominance of these segments is expected to continue during the forecast period, driven by continuous technological advancements within these industries and associated applications.

Japan Engineering Plastics Market Product Developments

Recent product developments highlight advancements in both material properties and application-specific formulations. Companies are focusing on enhancing material properties such as strength, heat resistance, and chemical resistance. There is a noticeable trend toward developing eco-friendly and bio-based engineering plastics to cater to growing environmental concerns. Innovations in additive manufacturing are expanding the range of applications for engineering plastics. The market is witnessing a shift toward customized solutions tailored to specific customer requirements and niche applications.

Key Drivers of Japan Engineering Plastics Market Growth

Technological advancements are a major driver, leading to the development of high-performance engineering plastics with improved properties and expanded applications. Economic growth and infrastructure development, especially in automotive and electronics sectors, fuel demand. Favorable government policies supporting technological innovation and sustainable manufacturing further accelerate market growth.

Challenges in the Japan Engineering Plastics Market Market

Fluctuations in raw material prices represent a significant challenge, impacting production costs and profitability. Intense competition among established players and the entry of new entrants put pressure on margins. Stringent environmental regulations and safety standards necessitate compliance investments, increasing operational costs. Supply chain disruptions caused by global events can affect availability and lead times.

Emerging Opportunities in Japan Engineering Plastics Market

Emerging opportunities stem from growing demand for lightweight and high-strength materials in various industries, including aerospace and renewable energy. Strategic partnerships and collaborations among players offer potential for innovation and market expansion. The increasing focus on sustainable and bio-based materials presents opportunities for companies committed to environmental responsibility.

Leading Players in the Japan Engineering Plastics Market Sector

- Techno-UMG Co Ltd

- Sumitomo Chemical Co Ltd

- Teijin Limited

- MCT PET Resin Co Ltd

- Kuraray Co Ltd

- Daikin Industries Ltd

- Asahi Kasei Corporation

- Mitsubishi Chemical Corporation

- Toray Industries Inc

- UBE Corporatio

- Kureha Corporation

- Daicel Corporation

- PBI Advanced Materials Co Ltd

- Polyplastics-Evonik Corporation

- AGC Inc

Key Milestones in Japan Engineering Plastics Market Industry

- August 2022: Mitsui Chemicals and Teijin Limited formed a joint venture to produce and supply biomass polycarbonate resins across Japan. This signifies a move towards sustainable materials and expands the market for bio-based engineering plastics.

- August 2022: Toray Industries Inc. introduced Toraypearl PA6, a high-strength, heat-resistant, and smooth material for 3D printing. This innovation expands the applications of PA6 in additive manufacturing.

- October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers enhancing carbon fiber-reinforced thermoplastic composites. This signifies advancements in material properties, improving performance in automobiles, aircraft, and other applications.

Strategic Outlook for Japan Engineering Plastics Market Market

The Japan engineering plastics market presents strong growth potential driven by technological advancements, increasing demand from key end-user sectors, and a shift towards sustainable materials. Strategic opportunities exist for companies focusing on innovation, strategic partnerships, and expansion into niche applications. Companies adopting sustainable practices and developing eco-friendly materials are poised to capitalize on the growing consumer demand for environmentally responsible products. The continued emphasis on lightweighting in various applications will drive demand for high-performance engineering plastics.

Japan Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Japan Engineering Plastics Market Segmentation By Geography

- 1. Japan

Japan Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Electronics and Electrical Industries; Demand for Lightweight Materials

- 3.3. Market Restrains

- 3.3.1. Engineering plastics are generally more expensive than traditional materials

- 3.4. Market Trends

- 3.4.1. Growing focus on developing sustainable and bio-based engineering plastics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Kanto Japan Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Techno-UMG Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sumitomo Chemical Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teijin Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MCT PET Resin Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kuraray Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Daikin Industries Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Asahi Kasei Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mitsubishi Chemical Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Toray Industries Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UBE Corporatio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kureha Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Daicel Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 PBI Advanced Materials Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Polyplastics-Evonik Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AGC Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Techno-UMG Co Ltd

List of Figures

- Figure 1: Japan Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Japan Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: Japan Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 5: Japan Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 6: Japan Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 7: Japan Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Japan Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Japan Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Kanto Japan Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kanto Japan Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Kansai Japan Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kansai Japan Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Chubu Japan Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chubu Japan Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Kyushu Japan Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kyushu Japan Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Tohoku Japan Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tohoku Japan Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Japan Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 22: Japan Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 23: Japan Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 24: Japan Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 25: Japan Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Japan Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Engineering Plastics Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Japan Engineering Plastics Market?

Key companies in the market include Techno-UMG Co Ltd, Sumitomo Chemical Co Ltd, Teijin Limited, MCT PET Resin Co Ltd, Kuraray Co Ltd, Daikin Industries Ltd, Asahi Kasei Corporation, Mitsubishi Chemical Corporation, Toray Industries Inc, UBE Corporatio, Kureha Corporation, Daicel Corporation, PBI Advanced Materials Co Ltd, Polyplastics-Evonik Corporation, AGC Inc.

3. What are the main segments of the Japan Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Electronics and Electrical Industries; Demand for Lightweight Materials.

6. What are the notable trends driving market growth?

Growing focus on developing sustainable and bio-based engineering plastics.

7. Are there any restraints impacting market growth?

Engineering plastics are generally more expensive than traditional materials.

8. Can you provide examples of recent developments in the market?

October 2022: AGC Inc. introduced Fluon+ Composites functionalized fluoropolymers that improve the performance of carbon fiber-reinforced thermoplastic (CFRP and CFRTP) composites used in automobiles, aircraft, sports products, and printed circuit boards.August 2022: Toray Industries Inc. introduced Toraypearl PA6, which claims to provide outstanding high strength, heat resistance, and surface smoothness for powder bed fusion 3D printers.August 2022: Mitsui Chemicals and Teijin Limited formed a joint venture to produce and supply biomass polycarbonate resins across Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Japan Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence