Key Insights

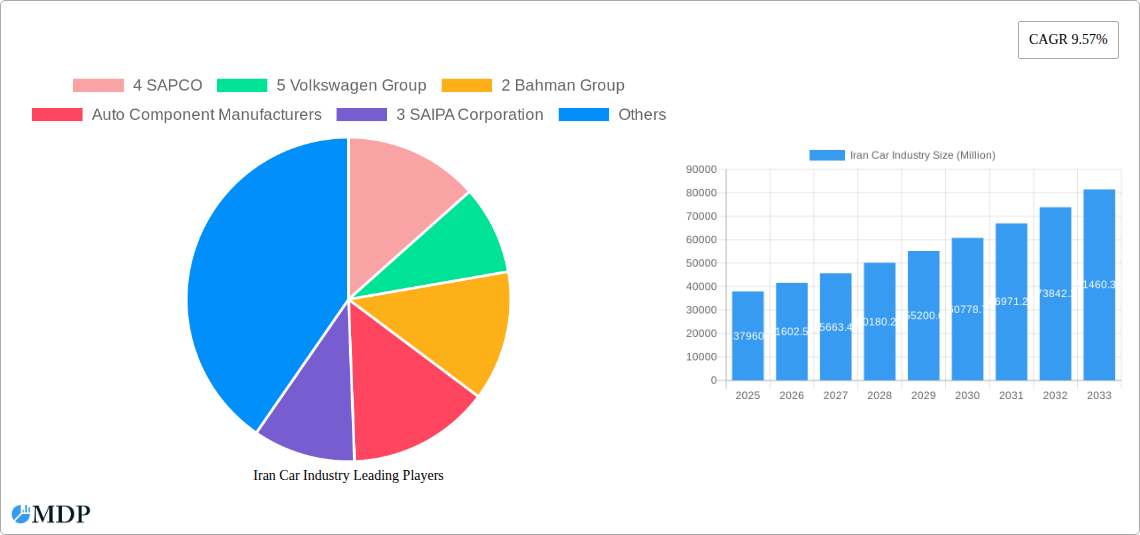

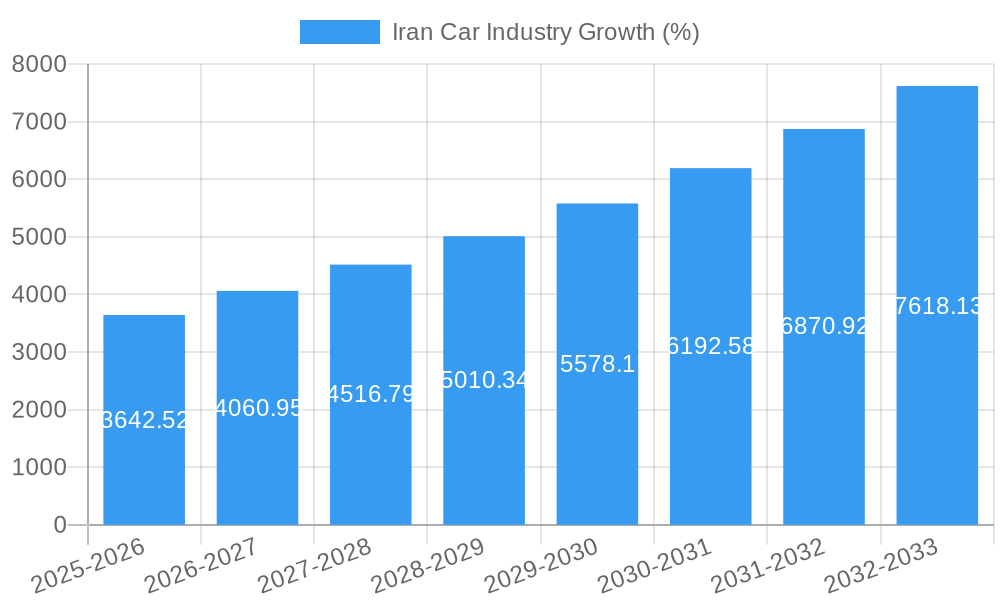

The Iranian car industry, valued at $37.96 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 9.57% from 2025 to 2033. This expansion is driven by several factors. Firstly, a growing middle class and rising disposable incomes are fueling increased demand for personal vehicles, particularly passenger cars. Secondly, government initiatives aimed at infrastructure development and modernization are creating a more favorable environment for the automotive sector. Finally, increasing urbanization and the need for efficient transportation solutions contribute to the market's positive outlook. Key players like Iran Khodro (IKCO), SAIPA Corporation, and the Volkswagen Group are major contributors to the market's size and growth, alongside significant contributions from auto component manufacturers and other manufacturers. The industry is segmented by vehicle type (passenger cars, commercial vehicles, motorcycles) and manufacturer type (auto ancillaries, engine, other manufacturing types), allowing for targeted analysis and strategic investments. While challenges exist, such as economic volatility and international sanctions, the long-term forecast suggests a significant expansion in the Iranian car market.

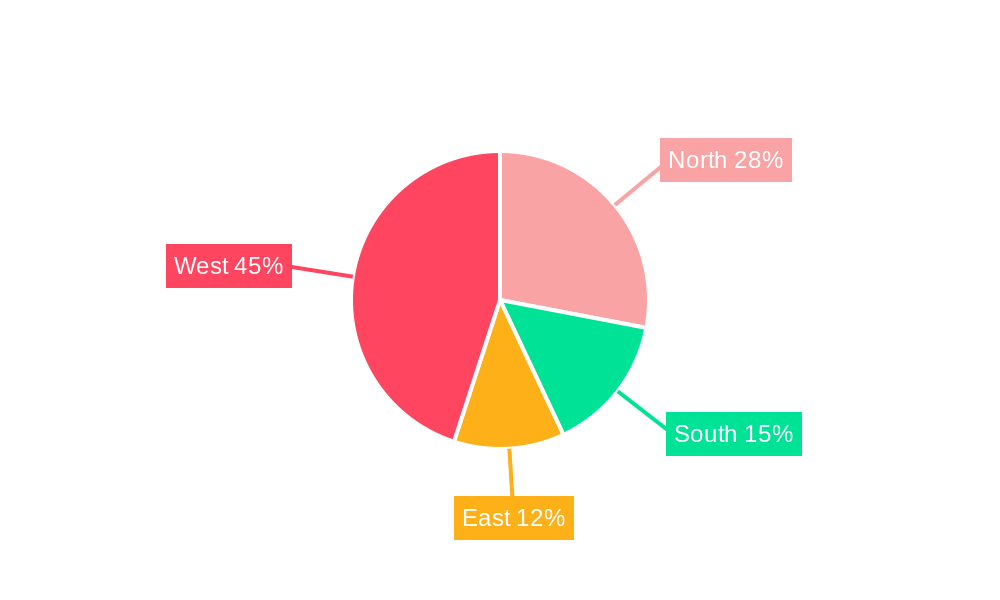

The regional distribution within Iran itself presents opportunities for further segmentation and tailored marketing strategies. While precise regional data is unavailable, it's reasonable to assume that more developed areas in the North and West would exhibit higher demand than less-developed regions in the East and South. This requires further granular investigation to understand individual regional growth and influence marketing strategies. The forecast period of 2025-2033 provides ample time for market participants to capitalize on emerging opportunities and adjust strategies to navigate any challenges or potential economic shifts within Iran's political and economic landscape. The historical data (2019-2024) will serve as a benchmark for comparison against future performance and provides valuable context for trend analysis. The continued growth of the Iranian car industry depends on maintaining stability, improving infrastructure, and attracting foreign investment, while navigating potential external political and economic uncertainties.

Iran Car Industry: Market Analysis & Forecast Report (2019-2033)

This comprehensive report provides a detailed analysis of the Iranian car industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, leading players, and future growth opportunities, this report covers the period from 2019 to 2033, utilizing 2025 as the base and estimated year. Discover key trends, challenges, and opportunities shaping this dynamic sector.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Iran Car Industry Market Dynamics & Concentration

The Iranian car industry, valued at xx Million USD in 2024, is characterized by a moderate level of market concentration. Iran Khodro (IKCO) and SAIPA Corporation hold significant market share, while other players like Bahman Group, Pars Khodro, and Renault Pars compete intensely in various segments. The market is influenced by fluctuating government regulations impacting import/export, domestic production, and consumer spending. Innovation is driven by the need for fuel efficiency and technological advancements, though sanctions and limited access to global technology present challenges. The industry faces pressure from substitute transportation options like motorcycles and public transport, particularly within urban areas. End-user trends show growing preference for SUVs and crossovers, alongside a persistent demand for affordable vehicles. M&A activity has been relatively low in recent years, with xx major deals recorded between 2019 and 2024, reflecting the challenges of operating within a sanctioned economy.

- Market Share: IKCO and SAIPA dominate with a combined xx% market share in 2024.

- M&A Activity: xx major deals between 2019 and 2024.

- Regulatory Framework: Significant influence on import/export, production, and pricing.

- Product Substitutes: Motorcycles and public transport pose competitive threats.

Iran Car Industry Industry Trends & Analysis

The Iranian car industry demonstrates a complex interplay of factors driving growth and shaping its trajectory. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was approximately xx%, driven primarily by pent-up demand after periods of economic instability and sanctions. However, market penetration remains relatively low compared to global standards. Technological disruption is limited by sanctions and limited access to global innovation. Consumer preferences shift towards fuel-efficient vehicles and improved safety features, but affordability remains a key consideration. Competitive dynamics are highly localized, with domestic players competing on price and features. Challenges in accessing international financing and technology hinder rapid expansion.

Leading Markets & Segments in Iran Car Industry

The Iranian car market is predominantly domestic, with passenger cars constituting the largest segment (xx Million units in 2024), followed by commercial vehicles (xx Million units) and motorcycles (xx Million units). By manufacturer type, Auto Ancillaries are crucial for the supply chain, while engine manufacturing is largely concentrated among major automobile manufacturers. Other manufacturing types play a supporting role. The leading region is Tehran and surrounding provinces, driven by higher population density and economic activity.

- Key Drivers for Passenger Cars: Growing middle class, urbanization, and improving road infrastructure.

- Key Drivers for Commercial Vehicles: Expansion of logistics and transportation networks.

- Key Drivers for Motorcycles: Affordability and suitability for urban commuting.

- Dominant Segment: Passenger cars represent the largest segment.

Iran Car Industry Product Developments

Recent years have seen a focus on improving fuel efficiency and incorporating basic safety features into new models. Technological advancements are gradual, mainly due to import restrictions, limiting access to advanced technologies. However, domestic manufacturers continue to make efforts in improving engine technology and design. New model launches by IKCO and SAIPA aim to cater to evolving consumer preferences within budgetary constraints. The market fit is primarily focused on fulfilling the demand for affordable, reliable vehicles.

Key Drivers of Iran Car Industry Growth

The Iranian car industry's future growth is contingent upon several key factors: Government policies supporting domestic manufacturing and promoting investment, the relaxation of sanctions, increased access to international technology, improved infrastructure, and rising consumer purchasing power. Strategic partnerships with international automakers, if sanctions are lifted, could also play a vital role in modernizing production capabilities.

Challenges in the Iran Car Industry Market

The Iranian car market faces persistent challenges, including sanctions which limit access to global technology and components, leading to increased production costs and supply chain disruptions. Fluctuating currency exchange rates add further economic uncertainty. Stringent emission regulations, while essential, increase production costs, affecting affordability. Competition among domestic manufacturers is intense, putting pressure on profit margins.

Emerging Opportunities in Iran Car Industry

Despite existing challenges, the Iranian car industry presents opportunities for long-term growth. Relaxation of sanctions could attract foreign investment, enabling technology transfers and enhancing manufacturing efficiency. The expanding middle class and improving infrastructure are major growth drivers. Furthermore, the government's focus on developing domestic capabilities in electric vehicles represents a significant potential opportunity.

Leading Players in the Iran Car Industry Sector

- Iran Khodro (IKCO)

- SAIPA Corporation

- Bahman Group

- Pars Khodro

- Renault Pars

- SAPCO

- Monavari Brothers Industrial Group

- Hyundai Motor Company

- Kia Motors Corporation

- Volkswagen Group

- IPM

- Sazeh Gostar

- Auto Component Manufacturers

- Automobile Manufacturers

Key Milestones in Iran Car Industry Industry

- October 2022: Iran Khodro Company (IKCO) unveils its TF21 model, signifying product diversification efforts.

- July 2023: Skoda's return to the Iranian market after a four-decade absence, reflecting revised car import regulations.

Strategic Outlook for Iran Car Industry Market

The future of the Iranian car industry hinges on overcoming existing challenges. Increased access to global technology and capital, coupled with government support for domestic manufacturing, will be crucial in driving sustainable growth. Strategic alliances with international players could be instrumental in modernizing the sector and accessing advanced technologies. The potential for growth remains significant, particularly with the expanding middle class and the government's focus on infrastructure development.

Iran Car Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. Motorcycles

-

2. Manufacturer Type

- 2.1. Auto Ancillaries

- 2.2. Engine

- 2.3. Other Manufacturing Types

Iran Car Industry Segmentation By Geography

- 1. Iran

Iran Car Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in The Passenger Car Sales Across the Region

- 3.3. Market Restrains

- 3.3.1. Transportation Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Growing Passenger Car Sales to Have Positive Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. Motorcycles

- 5.2. Market Analysis, Insights and Forecast - by Manufacturer Type

- 5.2.1. Auto Ancillaries

- 5.2.2. Engine

- 5.2.3. Other Manufacturing Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 4 SAPCO

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 5 Volkswagen Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Bahman Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Auto Component Manufacturers

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 3 SAIPA Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Automobile Manufacturers

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 4 Renault Pars

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 5 IPM

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 6 Hyundai Motor Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 3 Monavari Brothers Industrial Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 1 Iran Khodro (IKCO)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 7 Kia Motors Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 1 Sazeh Gostar

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 2 Pars Khodro

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 4 SAPCO

List of Figures

- Figure 1: Iran Car Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Car Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Car Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Iran Car Industry Revenue Million Forecast, by Manufacturer Type 2019 & 2032

- Table 4: Iran Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Iran Car Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Iran Car Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Iran Car Industry Revenue Million Forecast, by Manufacturer Type 2019 & 2032

- Table 12: Iran Car Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Car Industry?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Iran Car Industry?

Key companies in the market include 4 SAPCO, 5 Volkswagen Group, 2 Bahman Group, Auto Component Manufacturers, 3 SAIPA Corporation, Automobile Manufacturers, 4 Renault Pars, 5 IPM, 6 Hyundai Motor Company, 3 Monavari Brothers Industrial Group, 1 Iran Khodro (IKCO), 7 Kia Motors Corporation, 1 Sazeh Gostar, 2 Pars Khodro.

3. What are the main segments of the Iran Car Industry?

The market segments include Vehicle Type, Manufacturer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in The Passenger Car Sales Across the Region.

6. What are the notable trends driving market growth?

Growing Passenger Car Sales to Have Positive Impact on the Market.

7. Are there any restraints impacting market growth?

Transportation Infrastructure Development.

8. Can you provide examples of recent developments in the market?

July 2023: Volkswagen's wholly-owned Czech subsidiary, Skoda, was poised to make a comeback in Iran's auto market after an absence of four decades. The reintroduction of five Skoda models to Iranian showrooms follows a revision of the country's car import regulations, which now permit the importation of new and used cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Car Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Car Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Car Industry?

To stay informed about further developments, trends, and reports in the Iran Car Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence