Key Insights

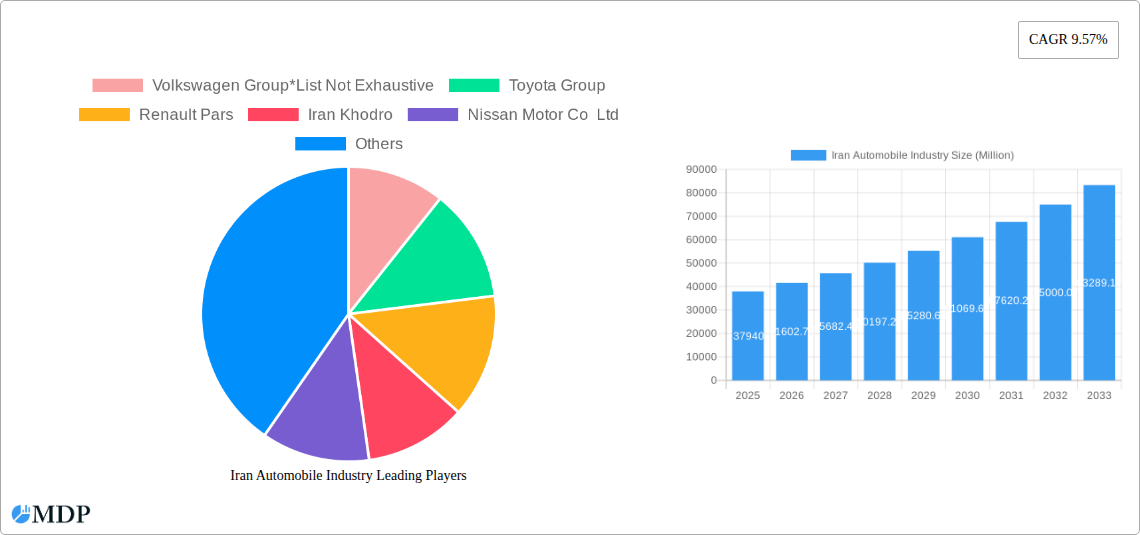

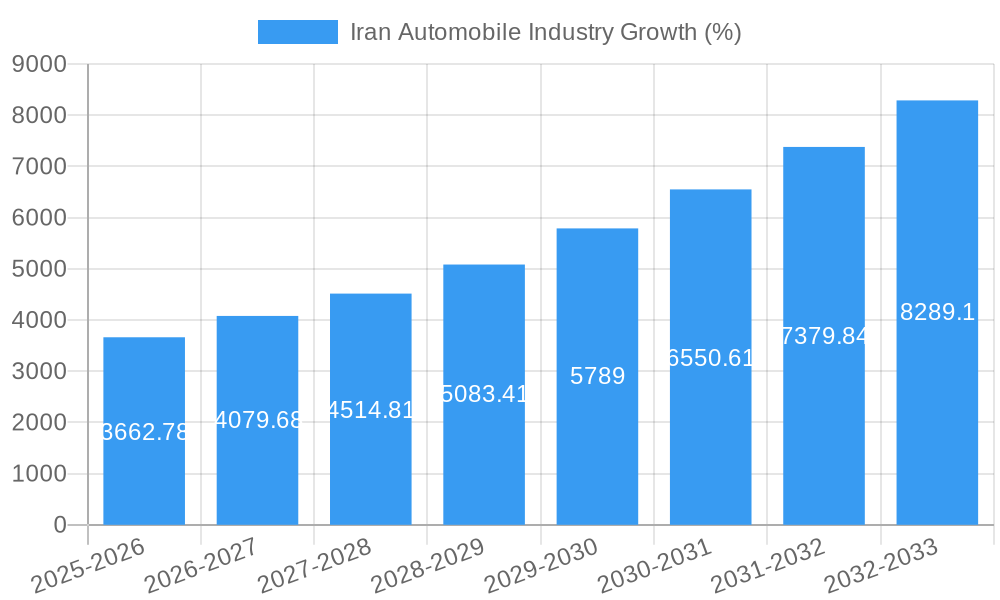

The Iranian automobile industry, valued at $37.94 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 9.57% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a growing middle class and increasing urbanization are driving demand for personal vehicles, particularly passenger cars. Secondly, government initiatives aimed at modernizing infrastructure and supporting domestic auto manufacturing contribute significantly to market expansion. Furthermore, the ongoing development of electric vehicle (EV) technology presents a significant opportunity for growth, albeit currently a smaller segment compared to internal combustion engine (ICE) vehicles. However, challenges remain. Sanctions and economic volatility continue to influence market stability, impacting investment and supply chains. Additionally, competition from established international players and the need to enhance technological capabilities within the domestic industry pose ongoing hurdles. The market is segmented by vehicle type (passenger and commercial) and fuel type (ICE and electric), with passenger vehicles currently dominating the market share. Key players include both domestic giants like Iran Khodro and SAIPA Group, and international manufacturers such as Volkswagen, Toyota, and Renault, highlighting a blend of domestic strength and international competition shaping the sector's trajectory.

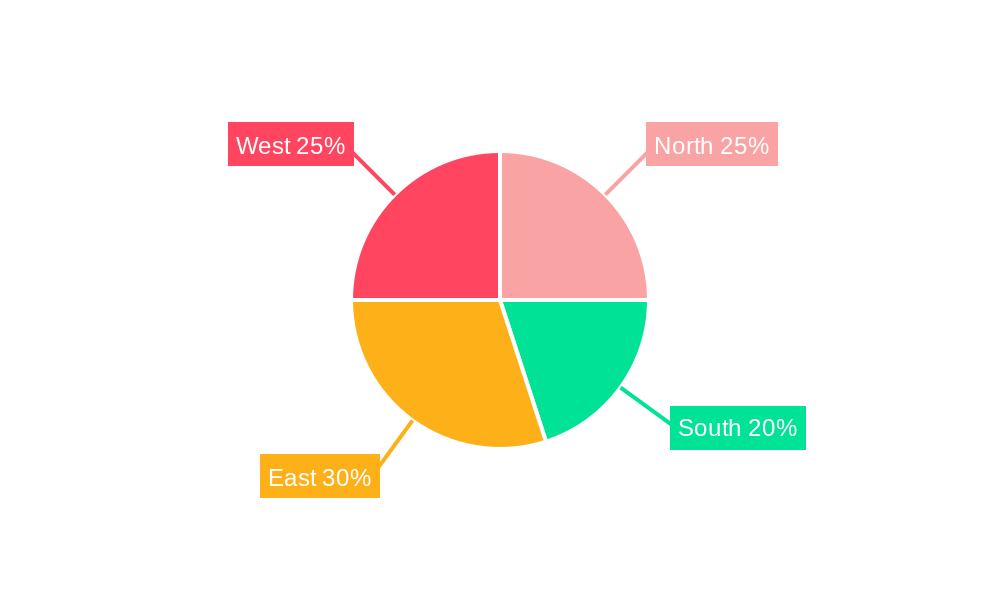

The regional distribution across North, South, East, and West Iran reflects varying levels of economic activity and infrastructure development, influencing market penetration in different zones. While precise regional breakdowns are unavailable, it is reasonable to expect that more developed regions will show greater demand. The forecast period (2025-2033) will likely see a shift in market dynamics, with a gradual increase in EV adoption driven by government policies and environmental concerns, alongside continued growth in the more established ICE vehicle sector. The historical period (2019-2024) likely presented significant challenges due to external factors, resulting in lower growth before the substantial projected increase beginning in 2025. Successful navigation of these challenges and strategic investments in technology and infrastructure will determine the full potential of the Iranian automobile industry's growth in the coming years.

Iran Automobile Industry: 2019-2033 Market Report - Unlocking Growth Potential in a Dynamic Market

This comprehensive report provides a detailed analysis of the Iranian automobile industry's market dynamics, trends, and growth prospects from 2019 to 2033. Featuring a meticulous examination of key players, segments, and challenges, this report is an invaluable resource for industry stakeholders, investors, and strategists seeking to navigate this evolving landscape. With a focus on market size (in Millions), CAGR, and market share, this report offers actionable insights and forecasts to inform strategic decision-making. The study period covers 2019–2033, with 2025 as the base and estimated year. The forecast period spans 2025–2033, and the historical period encompasses 2019–2024.

Iran Automobile Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, regulatory environment, and market trends impacting the Iranian automobile industry. Market concentration is assessed through the analysis of market share held by key players such as Volkswagen Group, Toyota Group, Renault Pars, Iran Khodro, Nissan Motor Co Ltd, Brilliance Automobile Group, Hyundai Kia Automotive Group, and SAIPA Group. The report examines the impact of innovation, specifically in electric vehicle technology and fuel efficiency improvements, on market dynamics. Furthermore, the evolving regulatory framework, including emission standards and safety regulations, is evaluated for its influence on market growth. The analysis also considers the impact of substitute products (e.g., public transportation, motorcycles) and evolving consumer preferences. Finally, M&A activity within the industry during the study period (2019-2024) is reviewed, quantifying the number of deals and their impact on market concentration. For example, the xx M&A deals recorded between 2019 and 2024 resulted in a xx% increase in market consolidation, with the top 5 players controlling approximately xx% of the market share in 2024.

- Market Share Analysis: Detailed breakdown of market share by major players.

- M&A Activity: Analysis of mergers and acquisitions, including deal counts and their impact on market structure.

- Regulatory Landscape: Evaluation of the impact of government policies and regulations.

- Innovation Drivers: Assessment of technological advancements and their influence on the market.

- End-User Trends: Analysis of changing consumer preferences and their effects on demand.

Iran Automobile Industry Industry Trends & Analysis

This section offers a comprehensive overview of the Iranian automobile industry's recent and projected growth trajectory, focusing on market drivers, technological disruptions, consumer behavior, and competitive dynamics. The report will delve into the factors driving market expansion, including economic growth, rising disposable incomes, and government initiatives to stimulate the automotive sector. The analysis incorporates specific metrics, such as CAGR (Compound Annual Growth Rate) and market penetration rates for passenger and commercial vehicles across different fuel types. The report will address technological disruptions such as the growing adoption of electric and hybrid vehicles, as well as the impact of digitalization and connected car technologies. It will also analyze consumer preferences in terms of vehicle type, fuel type, features, and brand loyalty, highlighting the shifting landscape of customer demands. Finally, the competitive dynamics will be assessed, considering strategies adopted by key players, including pricing strategies, product differentiation, and marketing campaigns. The projected CAGR for the Iranian automobile market from 2025 to 2033 is estimated at xx%, with passenger vehicles exhibiting a xx% CAGR and commercial vehicles at xx%. Market penetration of electric vehicles is projected to reach xx% by 2033.

Leading Markets & Segments in Iran Automobile Industry

This section pinpoints the leading regions, countries, and segments within the Iranian automobile market based on vehicle type (passenger and commercial) and fuel type (IC engine and electric). The analysis focuses on the key factors driving the dominance of specific segments, such as economic policies, infrastructural development, and consumer preferences. Dominance will be examined using market size, growth rate, and contribution to overall industry revenue.

- Passenger Vehicles: Analysis of factors driving growth within the passenger vehicle segment, including demographic shifts, increasing urbanization, and financing options.

- Commercial Vehicles: Analysis of market drivers such as infrastructure projects, e-commerce growth, and government policies related to logistics and transportation.

- IC Engine Vehicles: Market share analysis and outlook for internal combustion engine vehicles, considering environmental regulations and fuel availability.

- Electric Vehicles: Assessment of the emerging electric vehicle market, including factors such as government incentives, charging infrastructure, and technological advancements.

Iran Automobile Industry Product Developments

This section briefly outlines recent product innovations and technological advancements within the Iranian automobile industry, highlighting key features, applications, and competitive advantages. This includes analysis of advancements in engine technology, safety features, infotainment systems, and autonomous driving capabilities. The focus will be on assessing market fit and the competitive landscape shaped by these innovations. For example, the introduction of xx new models with improved fuel efficiency and safety features has significantly impacted market share in the xx segment.

Key Drivers of Iran Automobile Industry Growth

The growth of the Iranian automobile industry is propelled by several key factors, including government support through incentives and infrastructure development, increasing disposable incomes and consumer demand, and the expansion of the country's road networks. Furthermore, technological advancements in vehicle manufacturing, and the potential for increased regional trade and export opportunities are key contributors to the positive outlook.

Challenges in the Iran Automobile Industry Market

The Iranian automobile industry faces significant challenges, including sanctions impacting access to global technologies and components. Supply chain disruptions and currency fluctuations cause production costs to rise and hamper growth. Intense competition both domestically and from imported vehicles further limits the industry's expansion. These challenges result in a xx% increase in production costs and a xx% decrease in export volumes compared to pre-sanctions levels.

Emerging Opportunities in Iran Automobile Industry

Despite the challenges, opportunities exist for growth. The growing emphasis on domestic production, coupled with potential investments in electric vehicle technology and strategic partnerships with international companies, could significantly boost the sector. Furthermore, exploring export markets and developing niche vehicle segments present additional growth avenues. The development of local supply chains and the introduction of new technologies can unlock significant market potential.

Leading Players in the Iran Automobile Industry Sector

- Volkswagen Group

- Toyota Group

- Renault Pars

- Iran Khodro

- Nissan Motor Co Ltd

- Brilliance Automobile Group

- Hyundai Kia Automotive Group

- SAIPA Group

Key Milestones in Iran Automobile Industry Industry

- 2020: Implementation of stricter emission standards.

- 2021: Launch of the first domestically produced electric vehicle by xx.

- 2022: Significant investment in automotive manufacturing facilities by xx.

- 2023: xx partnered with a foreign company for technology transfer.

- 2024: Government introduced incentives for EV adoption.

(Further milestones will be added based on available data)

Strategic Outlook for Iran Automobile Industry Market

The Iranian automobile industry's future hinges on overcoming existing challenges and capitalizing on emerging opportunities. By focusing on technological innovation, fostering strategic partnerships, and adapting to evolving consumer preferences, the sector can unlock substantial growth potential in the coming years. The focus on domestic production and the adoption of new technologies such as EVs will be crucial in shaping the future landscape of the industry. This creates a significant market opportunity for companies that can successfully navigate the challenges and meet the evolving needs of the Iranian market.

Iran Automobile Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. IC Engines

- 2.2. Electric

Iran Automobile Industry Segmentation By Geography

- 1. Iran

Iran Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. IC Engines

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Volkswagen Group*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toyota Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Renault Pars

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Iran Khodro

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nissan Motor Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Brilliance Automobile Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hyundai Kia Automotive Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAIPA Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Volkswagen Group*List Not Exhaustive

List of Figures

- Figure 1: Iran Automobile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Automobile Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Iran Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Iran Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: Iran Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Automobile Industry?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Iran Automobile Industry?

Key companies in the market include Volkswagen Group*List Not Exhaustive, Toyota Group, Renault Pars, Iran Khodro, Nissan Motor Co Ltd, Brilliance Automobile Group, Hyundai Kia Automotive Group, SAIPA Group.

3. What are the main segments of the Iran Automobile Industry?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Passenger Car Segment to Witness Highest Growth.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Automobile Industry?

To stay informed about further developments, trends, and reports in the Iran Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence