Key Insights

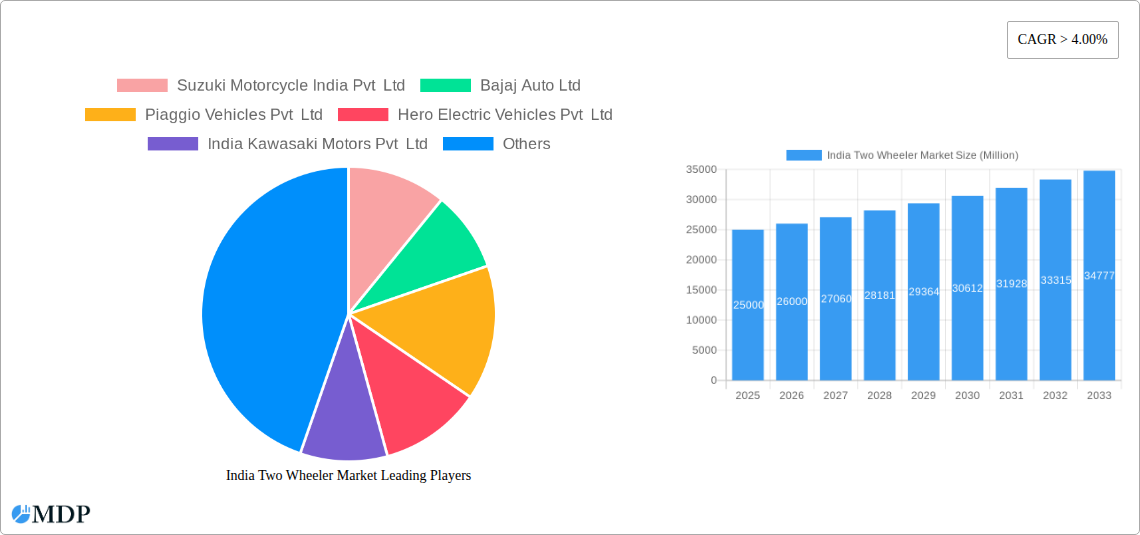

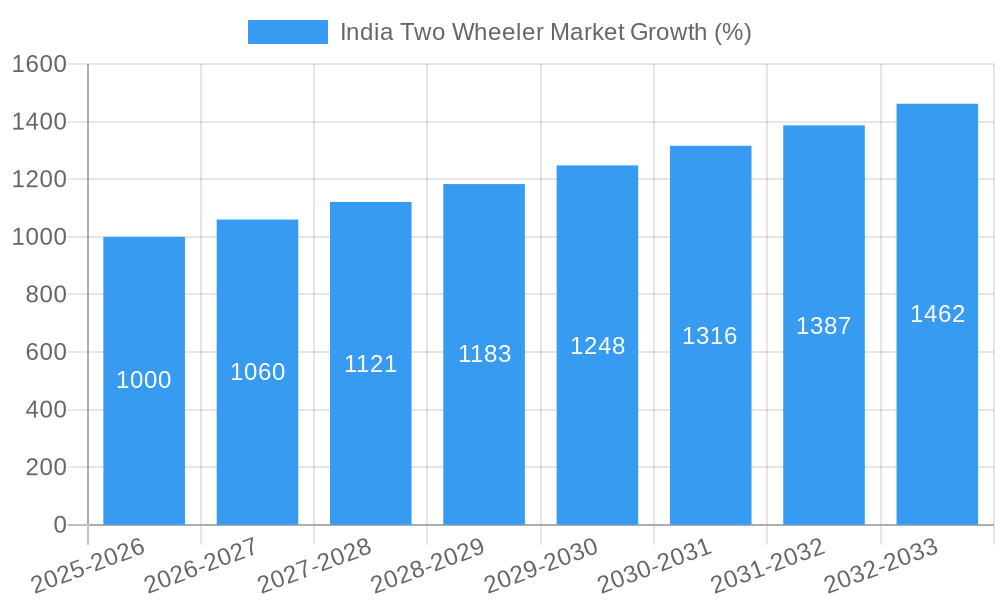

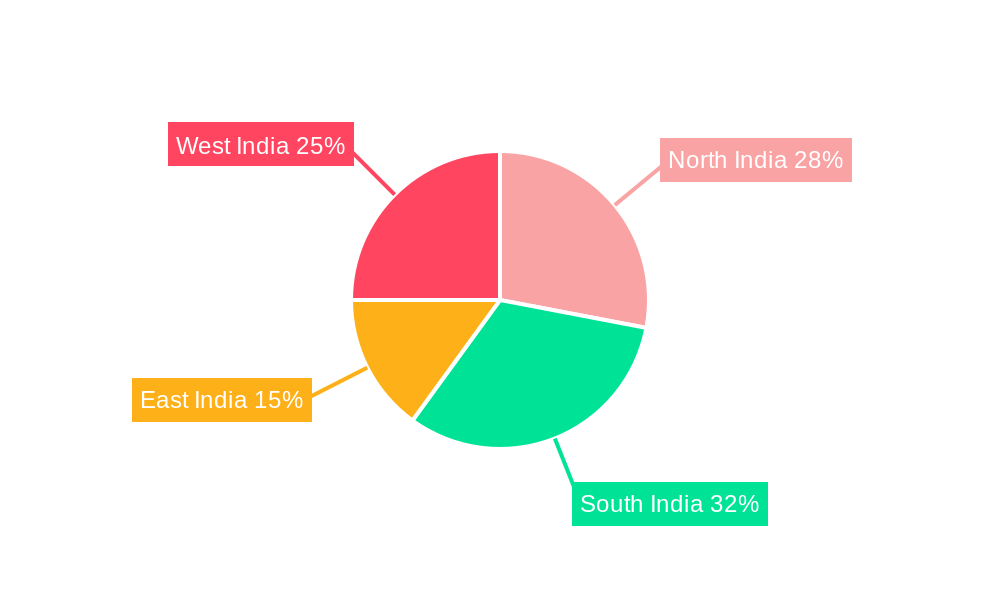

The Indian two-wheeler market, a dynamic sector characterized by a robust presence of both established and emerging players, exhibits substantial growth potential. With a CAGR exceeding 4% and a market size in the millions (precise figures requiring further specification for accurate analysis), the market is driven by increasing urbanization, rising disposable incomes, and a growing preference for personal mobility solutions. The segment is witnessing a significant shift towards electric vehicles (EVs) fueled by government initiatives promoting green transportation and increasing consumer awareness regarding environmental concerns. However, challenges such as high initial costs of EVs, limited charging infrastructure, and range anxiety continue to restrain widespread EV adoption. The internal combustion engine (ICE) segment, while mature, still holds a significant market share, primarily driven by affordability and wide accessibility. Competition is intense, with major players like Hero MotoCorp, Bajaj Auto, Honda Motorcycle & Scooter India, TVS Motor Company, and emerging EV brands like Ola Electric and Ather Energy vying for market dominance. Geographical variations exist, with regional disparities in infrastructure, income levels, and consumer preferences impacting sales across North, South, East, and West India. Future growth will likely be shaped by technological advancements in battery technology, improvements in charging infrastructure, and innovative financing options for EVs.

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace compared to the historical period (2019-2024) as the market matures. Successful players will need to adapt to evolving consumer preferences, focusing on value propositions that address concerns surrounding price, range, and charging infrastructure. Strategic alliances, technological innovations, and effective marketing strategies will be key to achieving sustained growth in this competitive landscape. Government policies influencing incentives and regulations related to EVs will play a critical role in shaping the trajectory of the market in the coming years. Further research is needed to analyze the specific contribution of each segment (ICE vs. Electric) and regional breakdown for a more precise market valuation and projection.

India Two Wheeler Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India two-wheeler market, covering the period 2019-2033. With a focus on key market players like Hero MotoCorp, Bajaj Auto, and emerging electric vehicle (EV) manufacturers such as Ola Electric and Ather Energy, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report incorporates extensive data analysis, including market size estimations (in Millions), CAGR projections, and segment-wise breakdowns to provide a holistic view of this dynamic market.

India Two Wheeler Market Market Dynamics & Concentration

The Indian two-wheeler market is characterized by intense competition and a complex interplay of factors driving its growth and evolution. Market concentration is high, with a few major players commanding significant market share. However, the emergence of electric vehicles (EVs) is disrupting the traditional landscape, creating new opportunities and challenges. Innovation in battery technology, charging infrastructure, and vehicle design is crucial for growth in the EV segment.

- Market Share: Hero MotoCorp and Bajaj Auto historically hold the largest market shares in the ICE (Internal Combustion Engine) segment. The exact figures for 2024 are xx Million and xx Million respectively, while the EV segment is witnessing rapid changes in market share due to new entrants.

- M&A Activities: The recent merger of Mahindra Two Wheelers with its parent company signifies a trend of consolidation within the industry. The number of M&A deals in the past five years is estimated at xx, driven by the need for increased scale and technological capabilities.

- Regulatory Frameworks: Government initiatives promoting EVs, such as subsidies and tax benefits, are significant drivers of market growth, while emission norms impact ICE vehicle manufacturing.

- Product Substitutes: The rise of EVs presents a significant challenge to traditional ICE two-wheelers, increasing the competition and pressuring manufacturers to innovate.

- End-User Trends: Growing urbanization, rising disposable incomes, and changing consumer preferences (towards fuel efficiency and eco-friendly vehicles) are shaping demand.

India Two Wheeler Market Industry Trends & Analysis

The Indian two-wheeler market exhibits strong growth potential, driven by several factors. The CAGR for the period 2025-2033 is projected at xx%, with the EV segment showing significantly higher growth compared to the ICE segment. Market penetration of EVs is increasing rapidly, although the ICE segment still dominates the overall market. Technological advancements in battery technology, charging solutions, and vehicle connectivity are impacting consumer preferences. Increasing competition among both established and new EV manufacturers is fostering innovation and driving down prices. The market is also witnessing a gradual shift towards premium and technologically advanced products, driven by rising incomes and changing consumer preferences. The overall market size in 2025 is estimated at xx Million units, and it is expected to reach xx Million units by 2033. This growth is fueled by factors such as increasing urbanization, rising disposable incomes, and supportive government policies.

Leading Markets & Segments in India Two Wheeler Market

The Indian two-wheeler market is geographically diverse, with significant variations in regional demand. However, the urban centers contribute significantly to sales, particularly for premium and technologically advanced products.

Dominant Segments:

- ICE (Internal Combustion Engine): This segment continues to hold the largest market share, although its dominance is being challenged by the growing EV segment. Key drivers include affordability, widespread fuel availability, and familiarity amongst consumers.

- Hybrid and Electric Vehicles (EVs): This segment is experiencing exponential growth, driven by government incentives, rising environmental concerns, and advancements in battery technology. Key drivers include:

- Government Policies: Subsidies, tax breaks, and the establishment of charging infrastructure are boosting EV adoption.

- Infrastructure Development: Increased charging infrastructure is crucial for the widespread acceptance of EVs.

- Technological Advancements: Improvements in battery technology, range, and charging speed are making EVs more attractive.

The dominance of ICE is slowly being eroded by EVs due to technological advancements and government support, but the ICE segment still holds a considerable lead, especially in rural areas. The overall market is expected to see a gradual transition toward electric mobility in the coming years.

India Two Wheeler Market Product Developments

The two-wheeler market is witnessing significant product innovation across both ICE and EV segments. Manufacturers are focusing on fuel efficiency, enhanced safety features, improved connectivity, and premium design elements. In the EV segment, the focus is on improving battery technology, range, and charging infrastructure. Features such as smart connectivity, advanced display units, and innovative designs are becoming increasingly popular, enhancing the customer experience and creating competitive advantages in this growing market.

Key Drivers of India Two Wheeler Market Growth

Several factors are driving the growth of the India two-wheeler market. These include:

- Rising Disposable Incomes: Increased purchasing power is fueling demand, especially in the rural markets.

- Government Initiatives: Policies supporting EV adoption, infrastructure development, and emission control norms are significantly impacting market growth.

- Technological Advancements: Innovations in engine technology, battery technology, and vehicle connectivity are making two-wheelers more efficient, safer, and appealing to consumers.

Challenges in the India Two Wheeler Market Market

The Indian two-wheeler market faces certain challenges:

- Supply Chain Disruptions: Global supply chain issues can impact production and availability.

- Competition: Intense competition from both domestic and international players is pressuring margins and driving the need for continuous innovation.

- Regulatory Hurdles: Navigating complex regulatory frameworks related to emissions and safety standards can pose challenges for manufacturers. The impact of these factors on the overall market size is estimated to be around xx Million units by 2033.

Emerging Opportunities in India Two Wheeler Market

The future of the Indian two-wheeler market is bright. Technological advancements such as improved battery technology and charging infrastructure will further drive EV adoption. Strategic partnerships between manufacturers and technology companies will facilitate the development of innovative products and services. Expanding into new markets and tapping into the growing demand for affordable and efficient transportation solutions will present significant opportunities for companies to make the most of these changes.

Leading Players in the India Two Wheeler Market Sector

- Suzuki Motorcycle India Pvt Ltd

- Bajaj Auto Ltd

- Piaggio Vehicles Pvt Ltd

- Hero Electric Vehicles Pvt Ltd

- India Kawasaki Motors Pvt Ltd

- Okinawa Autotech Pvt Ltd

- AMPERE VEHICLES PRIVATE LIMITED

- Hero MotoCorp Ltd

- Royal Enfield

- Honda Motorcycle & Scooter India Pvt Ltd

- Yamaha Motor India Pvt Ltd

- Mahindra Two Wheelers Ltd

- TVS Motor Company Limited

- REVOLT Intellicorp Pvt Ltd

- Ola Electric Mobility Pvt Ltd

- Ather Energy Pvt Ltd

Key Milestones in India Two Wheeler Market Industry

- August 2023: Ola Electric launched the S1X electric scooter, priced at INR 79,999, offering two battery options (2 kWh and 3 kWh) with ranges of 91 km and 151 km respectively. This launch signifies Ola’s commitment to expanding its presence in the affordable EV segment.

- August 2023: Mahindra & Mahindra Ltd. approved the merger of Mahindra Heavy Engines Limited (MHEL), Mahindra Two Wheelers Limited (MTWL), and Trringo.com Limited (TCL), streamlining its operations and focusing resources. This consolidation could impact the competitive landscape within the industry.

- July 2023: Okinawa Autotech launched an upgraded version of its OKHI-90 electric scooter with improved technology and features. This reflects the continuous efforts by EV manufacturers to enhance product offerings.

Strategic Outlook for India Two Wheeler Market Market

The future of the Indian two-wheeler market is promising, with continued growth driven by rising disposable incomes, supportive government policies, and technological advancements in both ICE and EV segments. Strategic partnerships and investments in research and development are expected to play a pivotal role in shaping the industry's future. The market's long-term potential is significant, with opportunities for both established players and new entrants to capitalize on the changing consumer preferences and expanding market demand. The focus will continue to be on offering affordable, efficient, and technologically advanced vehicles that cater to a wide range of consumer needs.

India Two Wheeler Market Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

- 1.2. ICE

India Two Wheeler Market Segmentation By Geography

- 1. India

India Two Wheeler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.1.2. ICE

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Suzuki Motorcycle India Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bajaj Auto Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Piaggio Vehicles Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hero Electric Vehicles Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 India Kawasaki Motors Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Okinawa Autotech Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AMPERE VEHICLES PRIVATE LIMITED

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hero MotoCorp Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Royal Enfield

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Honda Motorcycle & Scooter India Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yamaha Motor India Pvt Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mahindra Two Wheelers Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 TVS Motor Company Limited

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 REVOLT Intellicorp Pvt Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Ola Electric Mobility Pvt Ltd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Ather Energy Pvt Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Suzuki Motorcycle India Pvt Ltd

List of Figures

- Figure 1: India Two Wheeler Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Two Wheeler Market Share (%) by Company 2024

List of Tables

- Table 1: India Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: India Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 10: India Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Two Wheeler Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India Two Wheeler Market?

Key companies in the market include Suzuki Motorcycle India Pvt Ltd, Bajaj Auto Ltd, Piaggio Vehicles Pvt Ltd, Hero Electric Vehicles Pvt Ltd, India Kawasaki Motors Pvt Ltd, Okinawa Autotech Pvt Ltd, AMPERE VEHICLES PRIVATE LIMITED, Hero MotoCorp Ltd, Royal Enfield, Honda Motorcycle & Scooter India Pvt Ltd, Yamaha Motor India Pvt Ltd, Mahindra Two Wheelers Ltd, TVS Motor Company Limited, REVOLT Intellicorp Pvt Ltd, Ola Electric Mobility Pvt Ltd, Ather Energy Pvt Ltd.

3. What are the main segments of the India Two Wheeler Market?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: Ola Electric launched S1X for INR 79,999. Ola S1X will be offered in two battery capacities 2-kWh and 3-kWh. The 2-kWh variant will have a range of 91 km while the 3-kWh will have a 151 km range. The scooter has a 3.5-inch segmented display, the physical key unlocks and comes Without smart connectivity.August 2023: Mahindra & Mahindra Ltd. announced that its board of directors approved the scheme of merger by absorption of Mahindra Heavy Engines Limited (MHEL) and Mahindra Two Wheelers Limited (MTWL) and Trringo.com Limited (TCL), wholly owned subsidiaries of the company, with the company and their respective shareholders.July 2023: Okinawa Autotech launched the new and advanced version of its ‘OKHI-90' electric scooter with an AIS-156 amendment 3 compliant battery pack, next-gen motor, and improved technology features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Two Wheeler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Two Wheeler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Two Wheeler Market?

To stay informed about further developments, trends, and reports in the India Two Wheeler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence