Key Insights

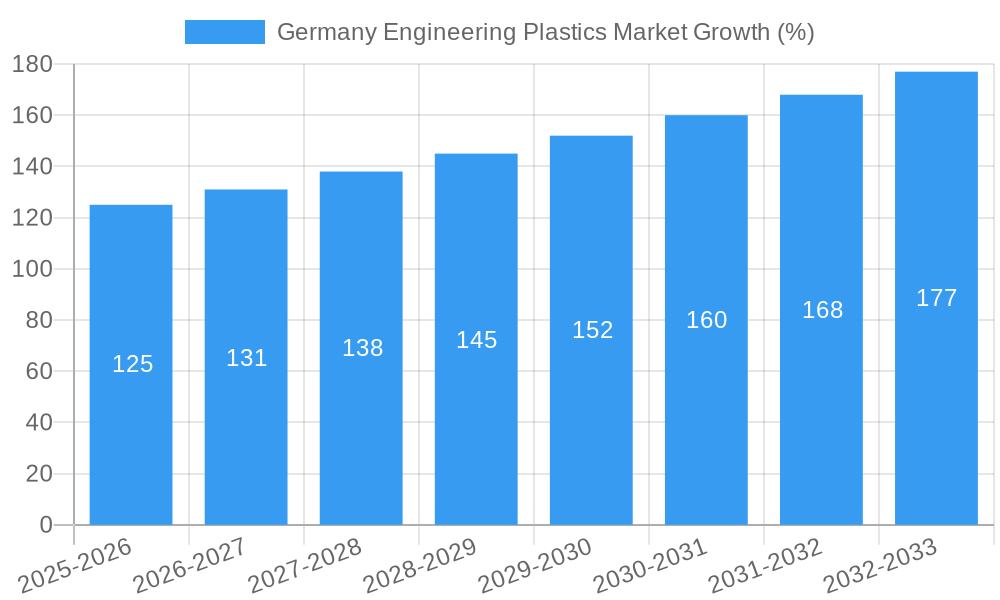

The German engineering plastics market exhibits robust growth, driven by the country's strong automotive, electrical & electronics, and packaging sectors. The market's expansion is fueled by increasing demand for lightweight, high-performance materials in these industries, coupled with ongoing technological advancements leading to the development of innovative engineering plastic solutions. A Compound Annual Growth Rate (CAGR) of, let's assume, 5% from 2025 to 2033, suggests a consistently expanding market, despite potential restraints such as fluctuating raw material prices and environmental concerns regarding plastic waste. This growth is further supported by Germany's commitment to sustainable manufacturing practices, driving the adoption of bio-based and recycled engineering plastics. The automotive industry, a significant consumer of engineering plastics, is undergoing a transition towards electric vehicles, creating a demand for materials with enhanced thermal and electrical properties. This trend, along with the growth of the electronics sector and increasing demand for sophisticated packaging solutions, contributes to the overall market expansion.

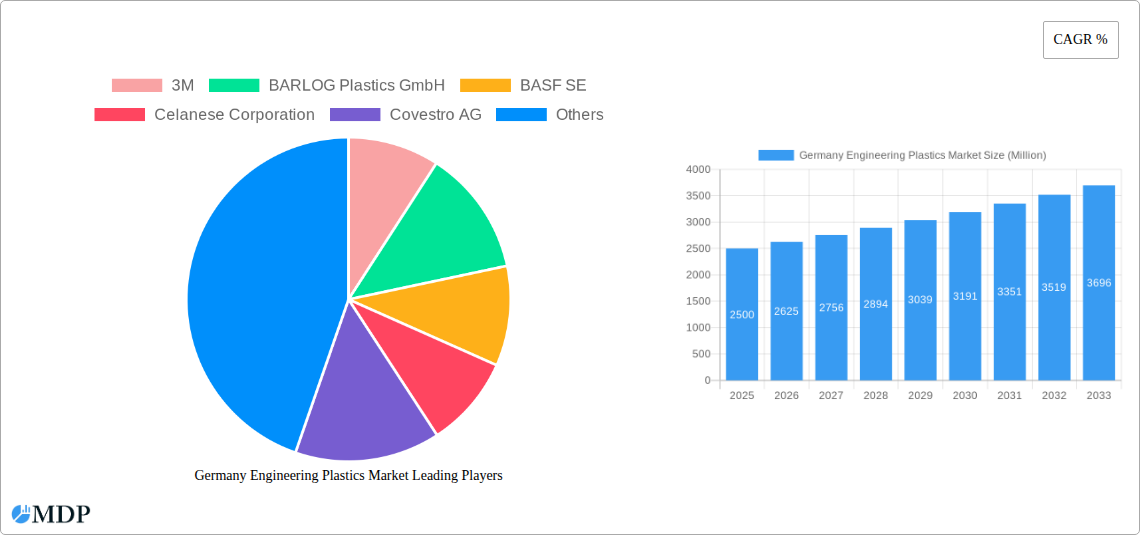

While specific segmental data is unavailable, we can infer that segments like Polyamides (PA), Polycarbonates (PC), and Polypropylene (PP) likely represent significant portions of the market due to their widespread applications in various industries. Major players such as BASF SE, Covestro AG, and Ineos are crucial in shaping the market dynamics through their production capacity, research & development efforts, and strategic partnerships. The competitive landscape is characterized by both established multinational corporations and specialized regional players, leading to a dynamic interplay of innovation and competition. The projected market value in 2025, assuming a reasonably sized market given the presence of major players and industry significance, could be estimated in the range of €2-3 billion (or $2.2-3.3 Billion USD), with consistent growth throughout the forecast period.

Germany Engineering Plastics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany engineering plastics market, covering market dynamics, industry trends, leading players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for industry stakeholders, investors, and strategic decision-makers seeking actionable insights into this dynamic market. The German engineering plastics market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Germany Engineering Plastics Market Market Dynamics & Concentration

The German engineering plastics market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and access to raw materials. Innovation drives market growth, with companies continuously developing new materials with enhanced properties to cater to diverse applications. Stringent regulatory frameworks, particularly concerning environmental sustainability and product safety, shape the market's trajectory. The presence of substitute materials, such as metals and composites, exerts competitive pressure. End-user trends, particularly in the automotive, electronics, and healthcare sectors, significantly influence demand. Mergers and acquisitions (M&A) activities have played a role in consolidating the market. In the historical period (2019-2024), approximately xx M&A deals were recorded, leading to changes in market share distribution. For example, the xx% market share held by BASF SE in 2024 is a result of both organic growth and acquisitions.

- Market Share Concentration: Top 5 players hold approximately xx% of the market share in 2024.

- M&A Activity: xx deals recorded between 2019-2024.

- Key Innovation Drivers: Sustainability, lightweighting, enhanced performance.

- Regulatory Influences: REACH regulations, waste management directives.

- Substitute Materials: Metals, composites, bioplastics.

Germany Engineering Plastics Market Industry Trends & Analysis

The German engineering plastics market is experiencing robust growth, driven by increasing demand across various end-use sectors. The automotive industry, a major consumer, is pushing for lightweighting and fuel efficiency, fueling demand for high-performance engineering plastics. Technological advancements, such as the development of bio-based and recycled plastics, are transforming the market. Consumer preferences towards sustainable products are driving the adoption of eco-friendly engineering plastics. The competitive landscape is characterized by intense rivalry among established players and emerging companies, leading to continuous innovation and price competition. The market penetration of high-performance plastics, such as PEEK and PPS, is steadily increasing, driven by their superior properties. The CAGR for the market from 2019-2024 was xx%, reflecting robust growth.

Leading Markets & Segments in Germany Engineering Plastics Market

The automotive sector dominates the German engineering plastics market, accounting for approximately xx% of total consumption in 2024. This dominance is attributable to several factors:

- Strong Automotive Manufacturing Base: Germany is a global leader in automotive manufacturing.

- Government Support for Green Technologies: Incentives promote lightweighting and fuel efficiency.

- Technological Advancements: Continuous innovation in automotive engineering drives demand for advanced plastics.

Other key segments include:

- Electrical and Electronics: Growth driven by miniaturization trends and demand for durable materials.

- Healthcare: Growing demand for medical devices and implants.

- Packaging: Increasing demand for lightweight and barrier-property plastics.

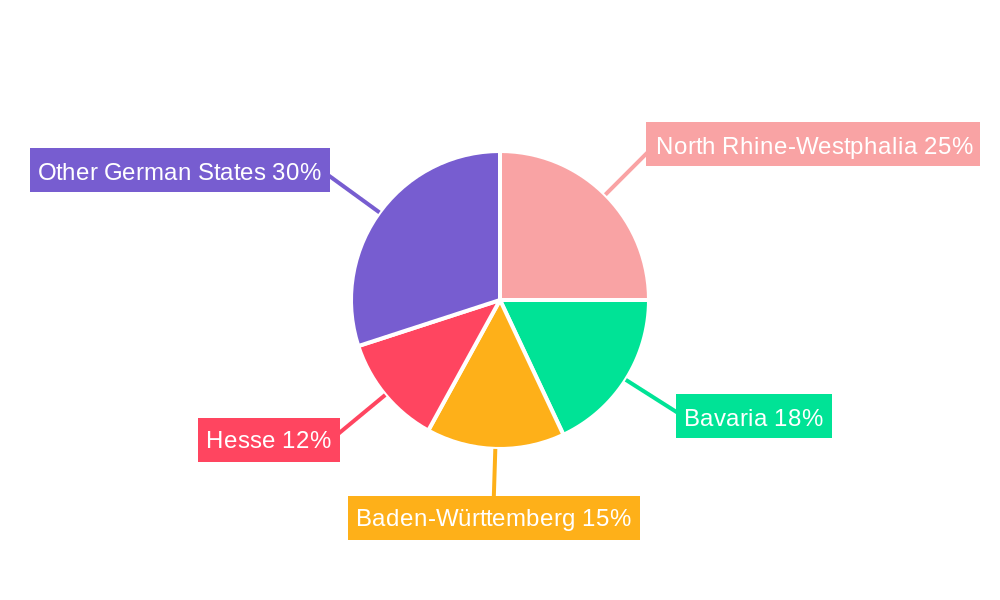

The South region of Germany holds the largest market share due to its strong concentration of automotive and manufacturing facilities.

Germany Engineering Plastics Market Product Developments

Recent product innovations emphasize sustainability, performance enhancement, and specific application needs. For example, the introduction of bio-based and recycled plastics caters to growing environmental concerns. Companies are developing materials with improved thermal stability, chemical resistance, and mechanical strength to meet the demands of high-performance applications. The market is witnessing a rise in specialized engineering plastics designed for specific industries, like the healthcare sector. Technological trends such as additive manufacturing (3D printing) are also driving product development.

Key Drivers of Germany Engineering Plastics Market Growth

Several factors fuel the growth of the German engineering plastics market. Technological advancements, leading to the development of high-performance materials with enhanced properties, are a primary driver. The automotive industry's focus on lightweighting and fuel efficiency boosts demand for advanced plastics. Government initiatives promoting sustainable materials and reducing carbon footprints further propel market expansion. The increasing use of plastics in various applications across multiple industries contributes to sustained growth.

Challenges in the Germany Engineering Plastics Market Market

The German engineering plastics market faces challenges such as fluctuating raw material prices, impacting production costs. Supply chain disruptions, exacerbated by geopolitical factors, can lead to production delays and shortages. Intense competition among established players and new entrants puts pressure on profit margins. Stringent environmental regulations necessitate compliance costs, adding to operational expenses. These factors collectively impact the market's overall growth trajectory. The impact of supply chain issues in 2022 led to a xx% increase in production costs.

Emerging Opportunities in Germany Engineering Plastics Market

The German engineering plastics market presents several promising long-term growth opportunities. Technological breakthroughs, such as the development of biodegradable and compostable plastics, are opening new avenues. Strategic partnerships between material suppliers and end-users facilitate innovation and market penetration. Expansion into emerging applications, particularly in renewable energy and medical technology, offers substantial growth potential. Government initiatives supporting the circular economy and promoting sustainable materials will drive market expansion in the coming years.

Leading Players in the Germany Engineering Plastics Market Sector

- 3M

- BARLOG Plastics GmbH

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- DuBay Polymer GmbH

- Equipolymers

- Evonik Industries AG

- Grupa Azoty S A

- Indorama Ventures Public Company Limited

- INEOS

- LANXESS

- Röhm GmbH

- Trinse

Key Milestones in Germany Engineering Plastics Market Industry

- October 2022: BASF SE introduced two new sustainable POM products, Ultraform LowPCF (Low Product Carbon Footprint) and Ultraform BMB (Biomass Balance), to reduce the carbon footprint, save fossil resources, and support the reduction of greenhouse gas (GHG) emissions.

- November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont, expanding its engineered thermoplastics portfolio.

- February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications.

Strategic Outlook for Germany Engineering Plastics Market Market

The German engineering plastics market is poised for continued growth, driven by technological innovation, sustainable material adoption, and expanding end-use applications. Strategic partnerships, investments in research and development, and focused market expansion strategies will be key to success. The market's future hinges on addressing environmental concerns while meeting the performance demands of various sectors. Companies that embrace sustainability and technological advancements are best positioned to capitalize on emerging opportunities.

Germany Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Germany Engineering Plastics Market Segmentation By Geography

- 1. Germany

Germany Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 3M

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BARLOG Plastics GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Celanese Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Covestro AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Domo Chemicals

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DuBay Polymer GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Equipolymers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evonik Industries AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grupa Azoty S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indorama Ventures Public Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 INEOS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LANXESS

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Röhm GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Trinse

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 3M

List of Figures

- Figure 1: Germany Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Germany Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Germany Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Germany Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 7: Germany Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Engineering Plastics Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Germany Engineering Plastics Market?

Key companies in the market include 3M, BARLOG Plastics GmbH, BASF SE, Celanese Corporation, Covestro AG, Domo Chemicals, DuBay Polymer GmbH, Equipolymers, Evonik Industries AG, Grupa Azoty S A, Indorama Ventures Public Company Limited, INEOS, LANXESS, Röhm GmbH, Trinse.

3. What are the main segments of the Germany Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.October 2022: BASF SE introduced two new sustainable POM products, Ultraform LowPCF (Low Product Carbon Footprint) and Ultraform BMB (Biomass Balance), to reduce the carbon footprint, save fossil resources, and support the reduction of greenhouse gas (GHG) emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Germany Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence