Key Insights

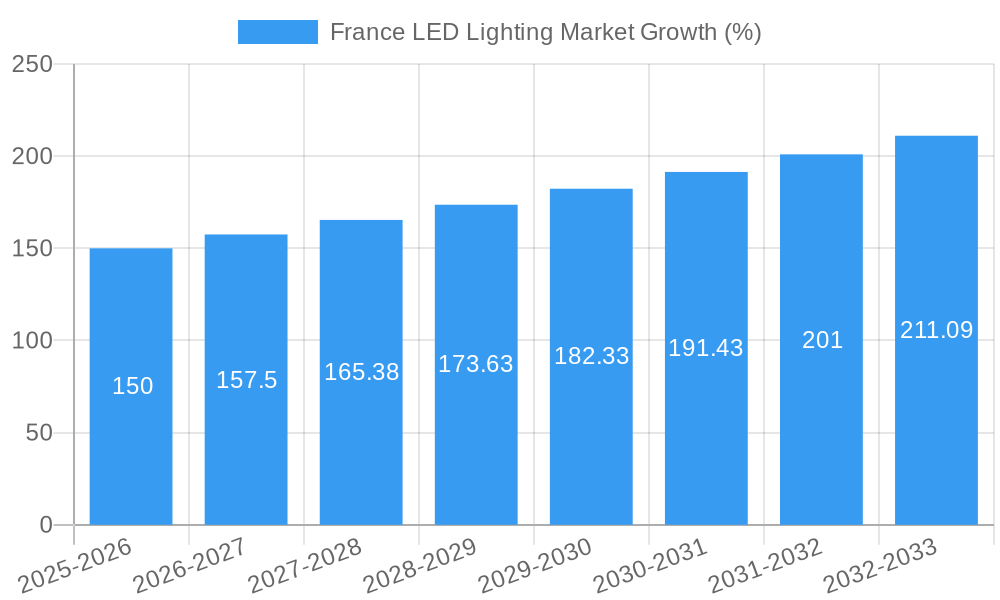

The France LED lighting market is experiencing robust growth, driven by increasing government initiatives promoting energy efficiency, a rising awareness of environmental sustainability among consumers, and the decreasing cost of LED technology. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033), exceeding the global average due to strong government support for green initiatives and a relatively high level of disposable income within the French population. Key segments within the market, including commercial, residential, and industrial lighting applications, are all contributing to this expansion. The preference for smart lighting solutions and the integration of IoT technology are further fueling market growth, with consumers and businesses seeking greater control and energy optimization. Competition is intense, with both domestic and international players vying for market share, leading to innovative product development and competitive pricing. This competitive landscape benefits consumers through a wider selection of high-quality, energy-efficient LED lighting solutions at increasingly affordable prices.

Despite the positive outlook, the market faces some challenges. While the initial investment cost of LED lighting may be higher than traditional options, the long-term cost savings from reduced energy consumption are a significant incentive for adoption. Furthermore, potential supply chain disruptions and fluctuations in raw material prices could impact profitability. However, ongoing technological advancements, particularly in areas such as improved LED efficiency and smart lighting functionalities, are anticipated to mitigate these challenges and further stimulate market growth. The continued focus on sustainable development and government incentives should ensure the continued expansion of the French LED lighting market, positioning France as a leader in the adoption of energy-efficient lighting technologies within Europe.

France LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France LED lighting market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Discover key trends, leading players, and emerging opportunities in the French LED lighting landscape.

France LED Lighting Market Market Dynamics & Concentration

The French LED lighting market exhibits a moderately concentrated landscape, with key players like Signify (Philips), OSRAM GmbH, and Valeo holding significant market share. However, the market is also characterized by the presence of several regional and specialized players, fostering competition and innovation. Market concentration is further shaped by ongoing mergers and acquisitions (M&A) activity, with an estimated xx M&A deals recorded between 2019 and 2024. Innovation is driven by stringent EU energy efficiency regulations, consumer demand for smart lighting solutions, and the ongoing development of advanced LED technologies. The market faces competition from traditional lighting technologies, although LED's superior energy efficiency and lifespan provide a strong competitive advantage. End-user trends show a growing preference for energy-efficient and smart lighting solutions in both residential and commercial applications.

- Market Share: Signify (Philips) holds an estimated xx% market share, followed by OSRAM GmbH at xx% and Valeo at xx%.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024.

- Regulatory Framework: Stringent EU energy efficiency regulations are a key driver of market growth.

- Product Substitutes: Traditional lighting technologies like fluorescent and incandescent lamps remain a substitute, though their market share is declining.

France LED Lighting Market Industry Trends & Analysis

The France LED lighting market is experiencing robust growth, driven by factors such as increasing energy efficiency regulations, rising consumer awareness of environmental issues, and technological advancements in LED technology. The market’s Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033). Market penetration of LED lighting is steadily increasing, reaching an estimated xx% in 2025 and projected to exceed xx% by 2033. Technological disruptions, such as the introduction of smart lighting systems and connected lighting solutions, are significantly impacting market dynamics. Consumer preferences are shifting towards energy-efficient, long-lasting, and smart lighting solutions that offer enhanced convenience and customization. Competitive dynamics are characterized by innovation, product differentiation, and strategic partnerships to capture market share.

Leading Markets & Segments in France LED Lighting Market

The French LED lighting market is segmented into various applications, including residential, commercial, industrial, and outdoor lighting. While exact segment breakdowns require further detailed market research, the commercial segment is expected to be the dominant force, driven by the high concentration of businesses and the demand for energy-efficient and aesthetically pleasing lighting solutions in office spaces, retail stores, and other commercial establishments. Key drivers for this dominance include government initiatives promoting energy efficiency in commercial buildings and the increasing adoption of smart lighting systems for improved operational efficiency and cost savings. The residential segment is also experiencing significant growth, fueled by rising consumer awareness of energy savings and the availability of affordable LED lighting options.

- Key Drivers for Commercial Segment Dominance:

- Government incentives for energy-efficient building upgrades.

- Growing adoption of smart lighting systems.

- Demand for aesthetically pleasing and functional lighting solutions.

France LED Lighting Market Product Developments

Recent product developments in the French LED lighting market highlight a strong emphasis on energy efficiency, smart features, and innovative designs. Manufacturers are focusing on creating LED solutions that meet the increasingly stringent EU energy efficiency standards, with a significant push towards A-class LED products. The integration of smart technology, such as motion sensors and connectivity features, is also gaining traction, allowing for personalized lighting control and optimized energy consumption. Furthermore, advancements in LED chip technology are leading to improved light quality, longer lifespan, and enhanced aesthetic appeal.

Key Drivers of France LED Lighting Market Growth

Several factors are contributing to the growth of the France LED lighting market. Firstly, stringent government regulations promoting energy efficiency are compelling businesses and consumers to adopt LED lighting. Secondly, the increasing cost of electricity incentivizes the switch to energy-efficient LED solutions. Thirdly, technological advancements continually improve the performance, lifespan, and affordability of LED lights. Lastly, rising consumer awareness of environmental issues and sustainability drives the demand for eco-friendly lighting options.

Challenges in the France LED Lighting Market Market

The French LED lighting market faces challenges such as intense competition from established and emerging players, price pressure from low-cost imports, and potential supply chain disruptions. Regulatory hurdles and compliance costs can also impact market profitability. The overall impact of these challenges on market growth is estimated to be approximately xx% reduction in projected growth by 2033.

Emerging Opportunities in France LED Lighting Market

The French LED lighting market presents significant long-term growth opportunities. The increasing adoption of smart lighting systems, coupled with advancements in Internet of Things (IoT) technology, will create new avenues for market expansion. Strategic partnerships between lighting manufacturers and technology companies will further enhance innovation and product development. Moreover, the growth of sustainable and eco-friendly building practices offers potential for greater market penetration of high-efficiency LED lighting solutions.

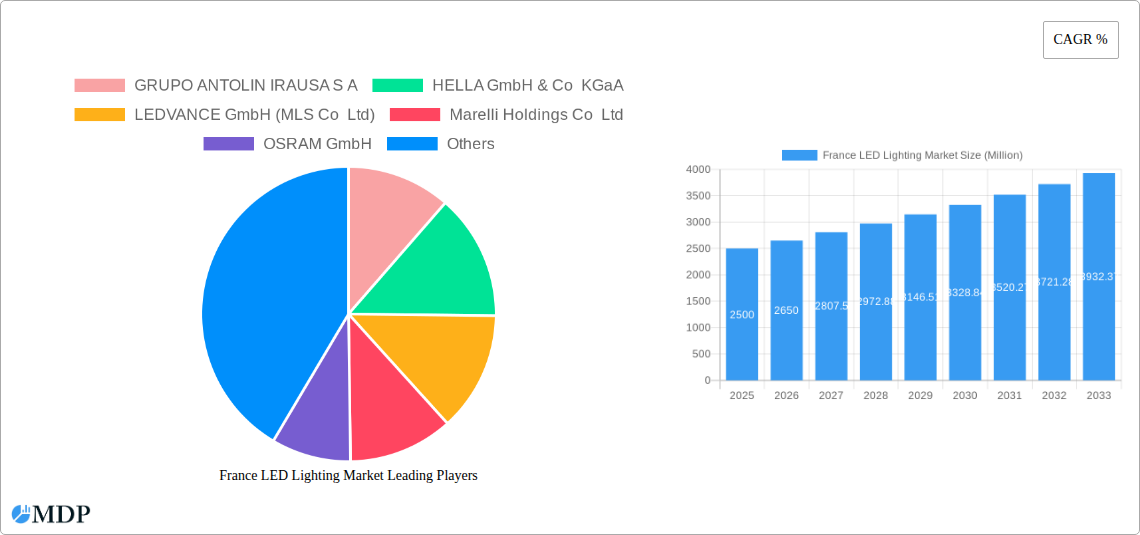

Leading Players in the France LED Lighting Market Sector

- GRUPO ANTOLIN IRAUSA S A

- HELLA GmbH & Co KGaA (HELLA)

- LEDVANCE GmbH (MLS Co Ltd) (LEDVANCE)

- Marelli Holdings Co Ltd (Marelli)

- OSRAM GmbH (OSRAM)

- Signify (Philips) (Signify)

- Thorn Lighting Ltd (Zumtobel Group) (Zumtobel Group)

- TRILUX GmbH & Co KG (TRILUX)

- Valeo (Valeo)

- VIGNAL GROU

Key Milestones in France LED Lighting Market Industry

- August 2022: Signify introduced an A-class LED tube, consuming 60% less energy than a standard Philips LED, aligning with the new EU energy labeling framework.

- September 2022: Signify launched new features and products for its WiZ smart lighting system, including SpaceSense motion detection technology.

- March 2023: Valeo, with 588 patent applications in 2022, emerged as a leading innovator in high-definition lighting systems for enhanced road safety. Valeo's R&D spending amounted to 10.4% of its turnover in 2022.

Strategic Outlook for France LED Lighting Market Market

The France LED lighting market is poised for sustained growth, driven by ongoing technological advancements, increasing environmental awareness, and supportive government policies. Strategic opportunities lie in developing and marketing energy-efficient and smart lighting solutions tailored to specific market segments. Companies focused on innovation, sustainability, and strategic partnerships are best positioned to capitalize on the market's long-term growth potential. The projected market value by 2033 is estimated to reach xx Million.

France LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

-

2. Outdoor Lighting

- 2.1. Public Places

- 2.2. Streets and Roadways

- 2.3. Others

-

3. Automotive Utility Lighting

- 3.1. Daytime Running Lights (DRL)

- 3.2. Directional Signal Lights

- 3.3. Headlights

- 3.4. Reverse Light

- 3.5. Stop Light

- 3.6. Tail Light

- 3.7. Others

-

4. Automotive Vehicle Lighting

- 4.1. 2 Wheelers

- 4.2. Commercial Vehicles

- 4.3. Passenger Cars

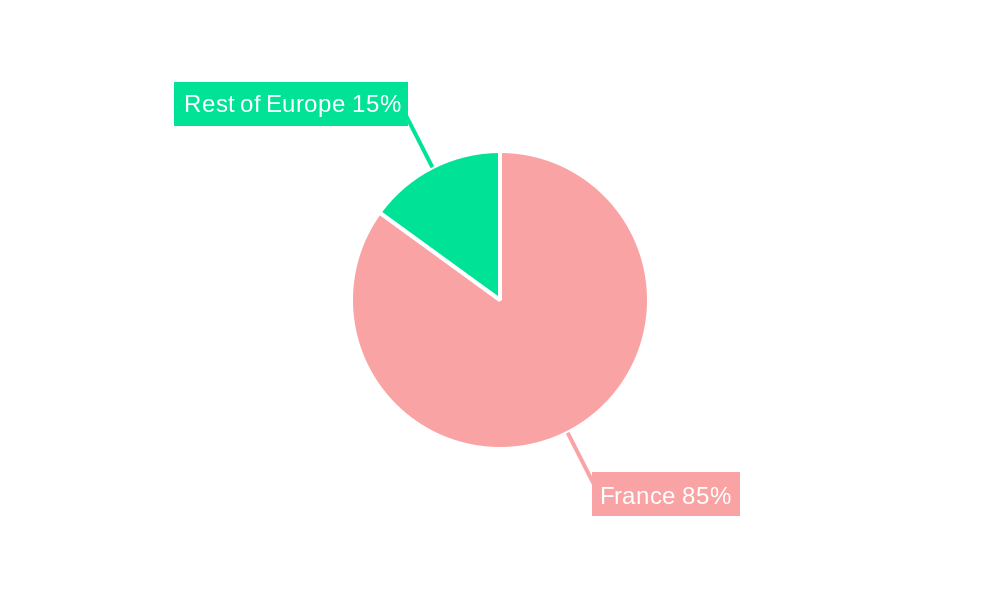

France LED Lighting Market Segmentation By Geography

- 1. France

France LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.2.1. Public Places

- 5.2.2. Streets and Roadways

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.3.1. Daytime Running Lights (DRL)

- 5.3.2. Directional Signal Lights

- 5.3.3. Headlights

- 5.3.4. Reverse Light

- 5.3.5. Stop Light

- 5.3.6. Tail Light

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.4.1. 2 Wheelers

- 5.4.2. Commercial Vehicles

- 5.4.3. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. France

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 GRUPO ANTOLIN IRAUSA S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HELLA GmbH & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LEDVANCE GmbH (MLS Co Ltd)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marelli Holdings Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OSRAM GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Signify (Philips)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thorn Lighting Ltd (Zumtobel Group)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TRILUX GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valeo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VIGNAL GROU

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GRUPO ANTOLIN IRAUSA S A

List of Figures

- Figure 1: France LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: France LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 3: France LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 4: France LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 5: France LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 6: France LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: France LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 8: France LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 9: France LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 10: France LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 11: France LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France LED Lighting Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the France LED Lighting Market?

Key companies in the market include GRUPO ANTOLIN IRAUSA S A, HELLA GmbH & Co KGaA, LEDVANCE GmbH (MLS Co Ltd), Marelli Holdings Co Ltd, OSRAM GmbH, Signify (Philips), Thorn Lighting Ltd (Zumtobel Group), TRILUX GmbH & Co KG, Valeo, VIGNAL GROU.

3. What are the main segments of the France LED Lighting Market?

The market segments include Indoor Lighting, Outdoor Lighting, Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: With 588 patent applications filed in 2022, Valeo is the prominent French patent filer at the European Patent Office. Valeo's patents in 2022 included the creation of technology to provide enhanced safety to road users through high-definition lighting systems. In 2022, Valeo’s R&D effort amounted to 10.4% of the Group’s turnover.September 2022: Signify introduced a new app, features, and products for its WiZ smart lighting system to enhance users’ daily convenience. The new offerings include SpaceSense, a motion detection technology for lighting systems that don’t require any sensor to be installed.August 2022: Signify introduced an A-class LED tube, which consumes 60% less energy than a standard Philips LED. The MASTER LEDtube UE expands the energy-efficient products that meet the A-grade criteria of the new EU energy labeling and eco-design framework through technological innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France LED Lighting Market?

To stay informed about further developments, trends, and reports in the France LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence