Key Insights

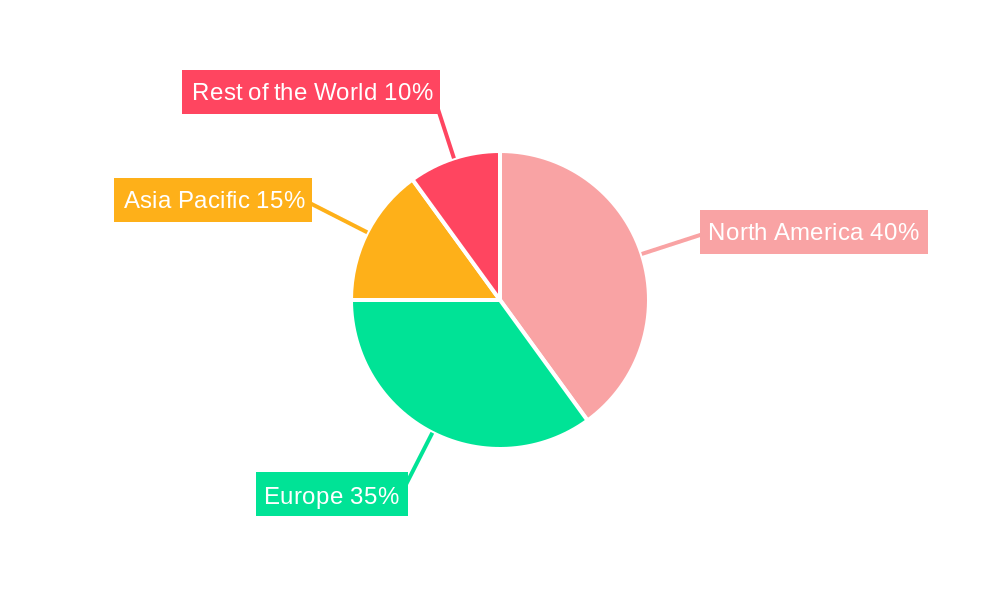

The global food truck market, valued at $4.15 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing popularity of street food and diverse culinary experiences fuels demand for mobile food vendors. Consumers appreciate the convenience, affordability, and unique offerings often found in food trucks, particularly among younger demographics. Furthermore, lower overhead costs compared to traditional restaurants make food truck businesses more accessible to entrepreneurs, fostering market expansion. Technological advancements, such as mobile payment systems and online ordering platforms, are enhancing customer experience and operational efficiency. The market segmentation reveals significant traction across various vehicle types, with vans and trailers holding larger shares due to their versatility and cost-effectiveness. The food truck market caters to a broad range of applications, including fast food, vegan/meat alternatives, and bakeries, reflecting evolving consumer preferences and dietary trends. North America and Europe currently dominate the market, owing to established food truck cultures and higher disposable incomes. However, Asia-Pacific is emerging as a rapidly growing region, fueled by urbanization and a burgeoning middle class.

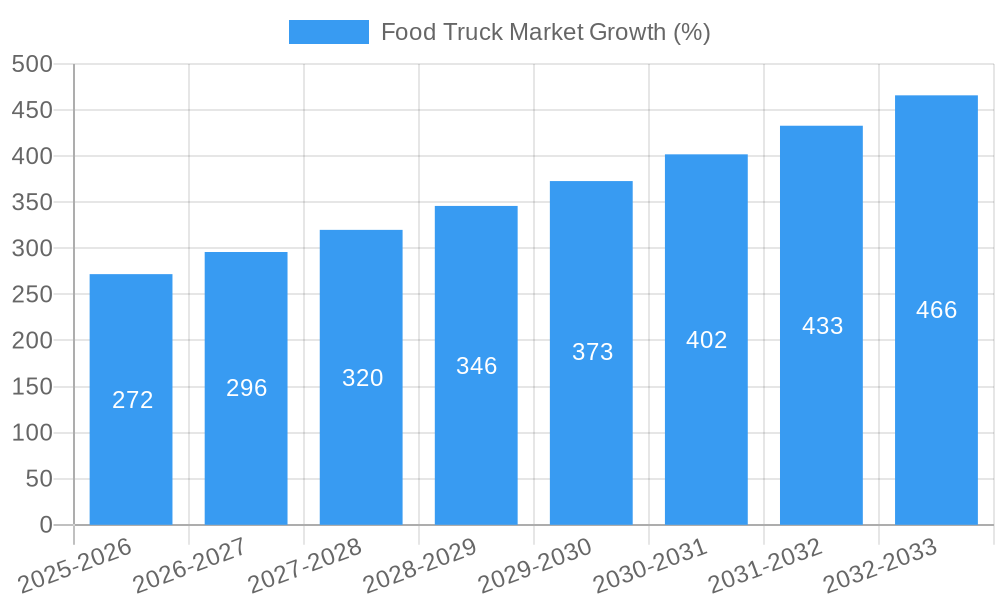

While the market enjoys positive momentum, challenges remain. Stringent regulations regarding food safety and permits across different regions can pose operational hurdles for food truck businesses. Competition within the market is also intensifying, requiring vendors to constantly innovate and offer unique value propositions. Fluctuations in food prices and economic downturns can impact profitability. However, the overall market outlook remains optimistic, projected to maintain a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033. This growth trajectory will be largely influenced by continued consumer preference for convenient, affordable, and diverse food options, coupled with ongoing technological advancements that enhance both the consumer and vendor experience. The market's segmentation by vehicle size (up to 14 feet and above 14 feet) allows for targeted analyses of specific needs within different segments.

Food Truck Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Food Truck Market, offering invaluable insights for industry stakeholders, investors, and entrepreneurs. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Food Truck Market Market Dynamics & Concentration

The Food Truck Market exhibits a moderately concentrated landscape, with key players such as The Fud Trailer Company, Foodtrucker Engineering LL, MSM Catering Manufacturing Inc, M&R SPECIALTY TRAILERS AND TRUCKS, Prestige Food Trucks, Futuristo Trailers, VS VEICOLI SPECIALI, United Food Trucks United LLC, and Food Truck Company BV holding significant market share. Market concentration is influenced by factors like brand recognition, technological advancements, and economies of scale. The market share of the top 5 players is estimated at xx%, indicating a competitive yet fragmented market.

Innovation is a key driver, with ongoing developments in vehicle design, food preparation technologies, and sustainable solutions. Regulatory frameworks concerning food safety, vehicle licensing, and operational permits vary across regions, significantly impacting market growth. Product substitutes, such as traditional restaurants and online food delivery services, pose a competitive challenge. However, the unique appeal of food trucks – offering convenience, variety, and a unique dining experience – continues to drive demand. End-user trends, particularly the rise of health-conscious consumers and demand for diverse culinary options, are reshaping the market. M&A activity within the sector has been relatively modest, with approximately xx deals recorded in the historical period (2019-2024), signifying consolidation and strategic expansion among existing players.

- Market Concentration: Moderately Concentrated

- Top 5 Players Market Share: xx%

- M&A Deal Count (2019-2024): xx

Food Truck Market Industry Trends & Analysis

The Food Truck Market is experiencing robust growth, driven by several key factors. The increasing popularity of street food and casual dining experiences fuels demand. Technological disruptions, such as mobile payment systems and online ordering platforms, enhance convenience and accessibility. Changing consumer preferences, especially the demand for diverse cuisines and personalized dining experiences, further boost the market's expansion. The market's CAGR from 2025 to 2033 is projected at xx%, with market penetration expected to reach xx% by 2033 in developed economies. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to innovations in food offerings, vehicle designs, and business models. The market shows a high level of dynamism, shaped by shifting consumer tastes, evolving technologies, and fluctuating economic conditions.

Leading Markets & Segments in Food Truck Market

The North American market currently holds a dominant position in the global Food Truck Market, driven by factors including strong consumer demand, a supportive regulatory environment, and a thriving entrepreneurial ecosystem. Within the market, the "Trailers" segment by type holds the largest market share, followed by "Trucks". The "Above 14 Feet" size segment demonstrates higher growth potential than the "Up to 14 Feet" segment. The "Fast Food" application type remains the most dominant sector, though the vegan and meat plant segments are demonstrating substantial growth.

Key Drivers in North America:

- High disposable income

- Favorable regulatory environment

- Strong entrepreneurial culture

- Developed infrastructure

Dominant Segments:

- Type: Trailers

- Size: Above 14 Feet

- Application Type: Fast Food

Food Truck Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and customer experience. This includes the integration of advanced cooking technologies, eco-friendly materials, and mobile payment systems. Fuel cell technology, as showcased by Toyota's FCV Express Diner, represents a significant technological advancement in reducing environmental impact and improving operational efficiency. The market is also witnessing the emergence of customized food truck designs tailored to specific culinary needs and brand identities.

Key Drivers of Food Truck Market Growth

Several factors fuel the growth of the Food Truck Market. Technological advancements, particularly in mobile payment systems and food preparation technologies, enhance operational efficiency and customer convenience. Favorable economic conditions in several regions, coupled with rising disposable incomes, boost consumer spending on food services. Supportive government policies and streamlined regulatory processes in certain areas promote market expansion. The trend towards experiential dining and the growing demand for diverse culinary options further contribute to the market's growth trajectory.

Challenges in the Food Truck Market Market

The Food Truck Market faces several challenges. Stricter food safety regulations and licensing requirements in some regions can increase operational costs and entry barriers. Fluctuations in the price of raw materials and fuel impact profitability. Intense competition from established restaurants and other food service providers exerts pressure on margins and market share. Finding suitable locations with sufficient foot traffic and necessary utilities poses an ongoing obstacle for many food truck operators.

Emerging Opportunities in Food Truck Market

Significant opportunities lie ahead for the Food Truck Market. Technological breakthroughs, such as automated food preparation systems and smart kitchen technologies, promise increased efficiency and reduced labor costs. Strategic partnerships between food truck operators and technology companies can unlock innovative business models and enhance customer experiences. Expansion into new geographical markets with growing demand for diverse food options presents substantial growth potential. Furthermore, the integration of sustainable practices and eco-friendly technologies can enhance the market's appeal to environmentally conscious consumers.

Leading Players in the Food Truck Market Sector

- The Fud Trailer Company

- Foodtrucker Engineering LL

- MSM Catering Manufacturing Inc

- M&R SPECIALTY TRAILERS AND TRUCKS

- Prestige Food Trucks

- Futuristo Trailers

- VS VEICOLI SPECIALI

- United Food Trucks United LLC

- Food Truck Company BV

Key Milestones in Food Truck Market Industry

- June 2023: Volta Trucks partners with METRO Germany, deploying all-electric vehicles for sustainable food delivery.

- June 2023: Hyzon Motors and Performance Food Group agree on five fuel-cell electric vehicles (FCEVs) for distribution.

- April 2023: Toyota showcases its FCV Express Diner, a hydrogen fuel cell food truck concept, highlighting potential applications.

- June 2022: GAZ introduces new food truck models on the GAZelle NN chassis, offering flexible layout options.

Strategic Outlook for Food Truck Market Market

The Food Truck Market presents a compelling investment opportunity, driven by its adaptability, innovation, and responsiveness to evolving consumer preferences. Strategic partnerships, technological advancements, and market expansion into new geographical areas will be crucial drivers of future growth. Companies focusing on sustainable practices, enhanced customer experiences, and technological integration are well-positioned to capitalize on the market's significant potential. The market is poised for continued expansion, shaped by ongoing innovation and evolving consumer demands.

Food Truck Market Segmentation

-

1. Type

- 1.1. Vans

- 1.2. Trailers

- 1.3. Trucks

- 1.4. Other Types

-

2. Size

- 2.1. Up to 14 Feet

- 2.2. Above 14 Feet

-

3. Application Type

- 3.1. Fast Food

- 3.2. Vegan and Meat Plant

- 3.3. Bakery

- 3.4. Other Applications

Food Truck Market Segmentation By Geography

-

1. North America

- 1.1. United States Of America

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Saudi Arabia

- 4.3. United Arab Emirates

- 4.4. South Africa

Food Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Fast Food is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increase in the Online Food Deliveries May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Fast Food is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vans

- 5.1.2. Trailers

- 5.1.3. Trucks

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Size

- 5.2.1. Up to 14 Feet

- 5.2.2. Above 14 Feet

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Fast Food

- 5.3.2. Vegan and Meat Plant

- 5.3.3. Bakery

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Vans

- 6.1.2. Trailers

- 6.1.3. Trucks

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Size

- 6.2.1. Up to 14 Feet

- 6.2.2. Above 14 Feet

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Fast Food

- 6.3.2. Vegan and Meat Plant

- 6.3.3. Bakery

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Vans

- 7.1.2. Trailers

- 7.1.3. Trucks

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Size

- 7.2.1. Up to 14 Feet

- 7.2.2. Above 14 Feet

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Fast Food

- 7.3.2. Vegan and Meat Plant

- 7.3.3. Bakery

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Vans

- 8.1.2. Trailers

- 8.1.3. Trucks

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Size

- 8.2.1. Up to 14 Feet

- 8.2.2. Above 14 Feet

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Fast Food

- 8.3.2. Vegan and Meat Plant

- 8.3.3. Bakery

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Vans

- 9.1.2. Trailers

- 9.1.3. Trucks

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Size

- 9.2.1. Up to 14 Feet

- 9.2.2. Above 14 Feet

- 9.3. Market Analysis, Insights and Forecast - by Application Type

- 9.3.1. Fast Food

- 9.3.2. Vegan and Meat Plant

- 9.3.3. Bakery

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States Of America

- 10.1.2 Canada

- 10.1.3 Mexico

- 10.1.4 Rest of North America

- 11. Europe Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Food Truck Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Saudi Arabia

- 13.1.3 United Arab Emirates

- 13.1.4 South Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 The Fud Trailer Company

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Foodtrucker Engineering LL

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 MSM Catering Manufacturing Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 M&R SPECIALTY TRAILERS AND TRUCKS

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Prestige Food Trucks

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Futuristo Trailers

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 VS VEICOLI SPECIALI

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 United Food Trucks United LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Food Truck Company BV

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 The Fud Trailer Company

List of Figures

- Figure 1: Global Food Truck Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Food Truck Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Food Truck Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Food Truck Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Food Truck Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Food Truck Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Food Truck Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Food Truck Market Revenue (Million), by Size 2024 & 2032

- Figure 13: North America Food Truck Market Revenue Share (%), by Size 2024 & 2032

- Figure 14: North America Food Truck Market Revenue (Million), by Application Type 2024 & 2032

- Figure 15: North America Food Truck Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 16: North America Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Food Truck Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Food Truck Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Food Truck Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Food Truck Market Revenue (Million), by Size 2024 & 2032

- Figure 21: Europe Food Truck Market Revenue Share (%), by Size 2024 & 2032

- Figure 22: Europe Food Truck Market Revenue (Million), by Application Type 2024 & 2032

- Figure 23: Europe Food Truck Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 24: Europe Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Food Truck Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Food Truck Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Food Truck Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Food Truck Market Revenue (Million), by Size 2024 & 2032

- Figure 29: Asia Pacific Food Truck Market Revenue Share (%), by Size 2024 & 2032

- Figure 30: Asia Pacific Food Truck Market Revenue (Million), by Application Type 2024 & 2032

- Figure 31: Asia Pacific Food Truck Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 32: Asia Pacific Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Food Truck Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Food Truck Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Food Truck Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Food Truck Market Revenue (Million), by Size 2024 & 2032

- Figure 37: Rest of the World Food Truck Market Revenue Share (%), by Size 2024 & 2032

- Figure 38: Rest of the World Food Truck Market Revenue (Million), by Application Type 2024 & 2032

- Figure 39: Rest of the World Food Truck Market Revenue Share (%), by Application Type 2024 & 2032

- Figure 40: Rest of the World Food Truck Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Food Truck Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Food Truck Market Revenue Million Forecast, by Size 2019 & 2032

- Table 4: Global Food Truck Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 5: Global Food Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Of America Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Saudi Arabia Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: United Arab Emirates Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Food Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Food Truck Market Revenue Million Forecast, by Size 2019 & 2032

- Table 31: Global Food Truck Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 32: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Of America Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Mexico Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of North America Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Food Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Food Truck Market Revenue Million Forecast, by Size 2019 & 2032

- Table 39: Global Food Truck Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 40: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Germany Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: France Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Italy Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Spain Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Food Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global Food Truck Market Revenue Million Forecast, by Size 2019 & 2032

- Table 49: Global Food Truck Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 50: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: India Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: China Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Food Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Food Truck Market Revenue Million Forecast, by Size 2019 & 2032

- Table 58: Global Food Truck Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 59: Global Food Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Saudi Arabia Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: United Arab Emirates Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: South Africa Food Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Truck Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Food Truck Market?

Key companies in the market include The Fud Trailer Company, Foodtrucker Engineering LL, MSM Catering Manufacturing Inc, M&R SPECIALTY TRAILERS AND TRUCKS, Prestige Food Trucks, Futuristo Trailers, VS VEICOLI SPECIALI, United Food Trucks United LLC, Food Truck Company BV.

3. What are the main segments of the Food Truck Market?

The market segments include Type, Size, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Fast Food is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Increasing Consumption of Fast Food is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Increase in the Online Food Deliveries May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Volta Trucks announced a partnership with METRO Germany, a major international food wholesaler. The 16-tonne all-electric Volta Zero will be deployed for METRO in North Rhine-Westphalia. It will be expanded to Bavaria and Berlin as more vehicles join the fleet as METRO Germany plans to expand its delivery fleet sustainably.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Truck Market?

To stay informed about further developments, trends, and reports in the Food Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence