Key Insights

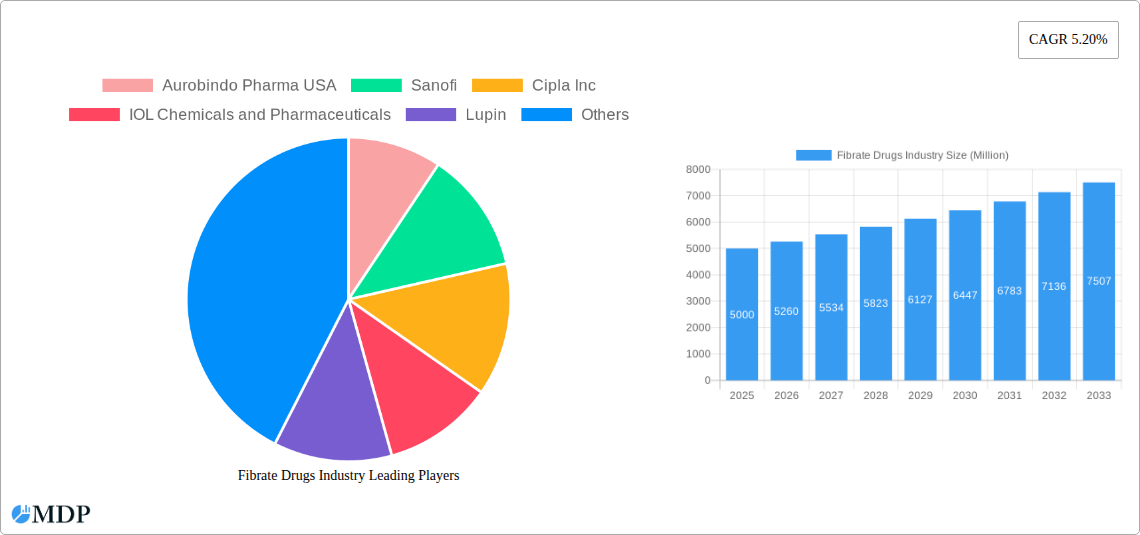

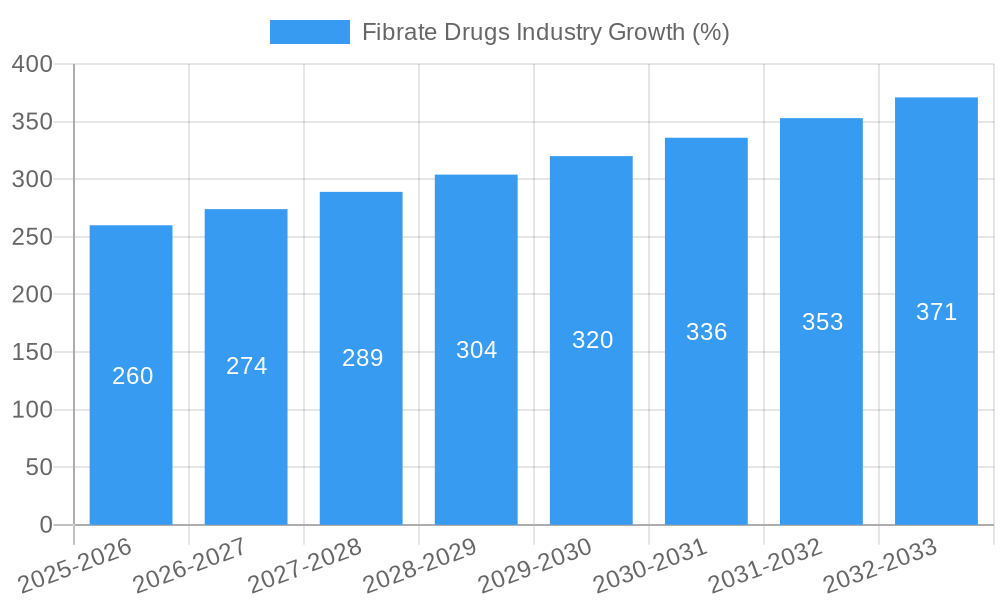

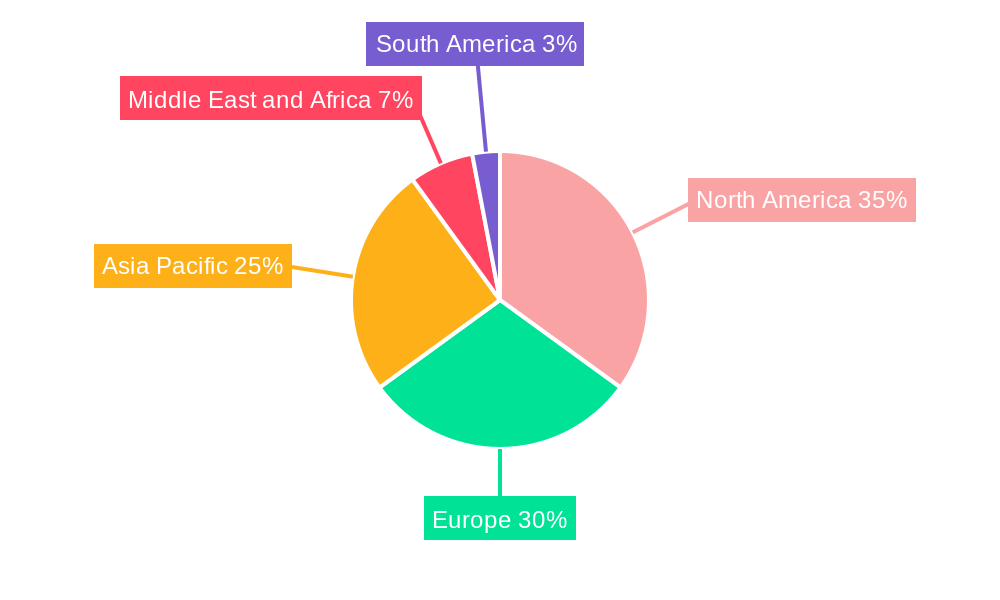

The Fibrate Drugs market, encompassing clofibrate, gemfibrozil, fenofibrate, and other drugs, is projected to experience steady growth, driven by a rising prevalence of dyslipidemia and cardiovascular diseases globally. The market size in 2025 is estimated at $5 billion, considering typical market values for similar pharmaceutical segments and a CAGR of 5.20%. This growth is fueled by increasing awareness of cardiovascular health, improved diagnostics, and an aging population in key regions such as North America and Europe. The branded segment currently holds a significant market share, but the generic segment is expected to witness robust growth due to cost-effectiveness and increasing generic drug approvals. Distribution channels are diverse, with hospital and retail pharmacies maintaining significant shares, while online pharmacy channels are rapidly expanding, driven by convenience and accessibility. Potential restraints include the emergence of newer lipid-lowering therapies and concerns regarding the side effects associated with some fibrate drugs, particularly myopathy. Competitive landscape is intense, with major players like Sanofi, Aurobindo Pharma, Cipla, and Lupin competing through brand differentiation, pricing strategies, and geographical expansion. The Asia-Pacific region, characterized by a large and growing population coupled with increasing healthcare expenditure, offers considerable growth potential.

Looking forward to 2033, the market is projected to grow significantly exceeding $7 billion, driven by sustained demand and the ongoing development of new formulations and delivery systems for fibrate drugs. Despite the presence of newer alternatives, fibrates remain a cornerstone treatment for dyslipidemia in specific patient populations, ensuring sustained market demand. Continued investment in research and development focusing on minimizing side effects, combined with effective marketing and distribution strategies, will be key success factors for market participants. The growing prevalence of chronic diseases in developing economies presents substantial opportunities for market expansion, particularly within the generic drug segment. Regional variations will be influenced by factors such as healthcare infrastructure, regulatory environments, and pricing policies.

Fibrate Drugs Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Fibrate Drugs industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period 2019-2033, with a focus on the 2025 market and forecasts extending to 2033. We analyze market dynamics, leading players, key trends, and future growth opportunities, incorporating data-driven analysis and actionable insights to navigate the evolving landscape of the Fibrate Drugs market. The global market size is predicted to reach xx Million by 2033.

Keywords: Fibrate Drugs, Clofibrate, Gemfibrozil, Fenofibrate, Pharmaceutical Industry, Market Analysis, Market Forecast, Industry Trends, Competitive Landscape, Aurobindo Pharma, Sanofi, Cipla, Lupin, Mylan, Abbott, Sun Pharma, Macleods Pharma, Zydus Cadila, Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Generic Drugs, Branded Drugs, Market Growth, CAGR, Market Share, M&A Activity.

Fibrate Drugs Industry Market Dynamics & Concentration

The Fibrate Drugs market exhibits a moderately concentrated structure, with key players such as Aurobindo Pharma USA, Sanofi, Cipla Inc, and others holding significant market share. However, the presence of numerous smaller players creates a competitive landscape. Market concentration is further influenced by factors such as regulatory approvals, pricing strategies, and the prevalence of generic vs. branded drugs. Innovation in drug delivery systems and the development of novel fibrate formulations are key drivers, while regulatory changes impacting drug approvals and pricing pose significant challenges. Product substitutes, such as statins and other lipid-lowering agents, compete for market share, influencing overall market dynamics. End-user trends, including a growing awareness of cardiovascular health and an aging population, contribute to market growth. M&A activities are expected to remain moderate during the forecast period, with xx deals predicted between 2025 and 2033.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2025.

- Innovation Drivers: Development of novel formulations, improved drug delivery systems, and combination therapies.

- Regulatory Framework: Stringent regulatory requirements influencing drug approvals and pricing.

- Product Substitutes: Statins and other lipid-lowering therapies compete for market share.

- End-User Trends: Growing awareness of cardiovascular health and aging population driving demand.

- M&A Activities: Predicted xx M&A deals between 2025-2033.

Fibrate Drugs Industry Industry Trends & Analysis

The Fibrate Drugs market is expected to witness a CAGR of xx% during the forecast period (2025-2033), driven by several factors. Increased prevalence of cardiovascular diseases globally is a significant market driver. Technological advancements leading to improved drug efficacy and safety also contribute to market growth. Consumer preferences increasingly favor convenient and affordable treatment options, influencing the demand for generic fibrate drugs. Intense competition among existing players and the entry of new players are shaping market dynamics. Market penetration of fibrate drugs is anticipated to reach xx% by 2033, with growth largely driven by emerging markets. The increasing adoption of online pharmacies for convenient drug procurement also presents a growing avenue for market expansion.

Leading Markets & Segments in Fibrate Drugs Industry

The North American market is projected to dominate the Fibrate Drugs industry throughout the forecast period due to high healthcare expenditure and the prevalence of cardiovascular diseases. Within this region, the United States is expected to be the largest market. The retail pharmacy distribution channel holds a significant share, driven by high patient accessibility. Gemfibrozil and Fenofibrate are the leading drugs, while the generic segment holds a larger market share compared to the branded segment.

- Key Drivers for North American Dominance:

- High healthcare expenditure.

- High prevalence of cardiovascular diseases.

- Well-established healthcare infrastructure.

- Distribution Channel: Retail Pharmacy (xx Million), Hospital Pharmacy (xx Million), Online Pharmacy (xx Million)

- Leading Drugs: Gemfibrozil (xx Million), Fenofibrate (xx Million), Clofibrate (xx Million)

- Product Type: Generic (xx Million), Branded (xx Million)

Fibrate Drugs Industry Product Developments

Recent product innovations focus on enhancing drug efficacy, improving tolerability, and developing novel formulations. Technological advancements in drug delivery systems are aimed at optimizing therapeutic outcomes and patient compliance. These developments contribute to enhanced market competitiveness, attracting patients and healthcare providers alike. The focus is on creating products with superior efficacy, safety profiles, and convenient administration methods to meet the growing demand in this market.

Key Drivers of Fibrate Drugs Industry Growth

Several factors are propelling the growth of the Fibrate Drugs industry. Technological advancements in drug delivery and formulation are leading to more effective and safer drugs. The increasing prevalence of cardiovascular diseases globally necessitates the use of these drugs. Favorable economic conditions in many regions are increasing healthcare spending, facilitating market expansion. Supportive regulatory policies also stimulate market growth by easing approvals and facilitating market access.

Challenges in the Fibrate Drugs Industry Market

The Fibrate Drugs market faces challenges including stringent regulatory hurdles for new drug approvals, which increase development costs and timelines. Supply chain disruptions impact drug availability and pricing, creating market instability. Intense competition from existing and emerging players puts pressure on profit margins and market share. The potential for adverse drug reactions necessitates robust safety monitoring, increasing operational costs. These challenges necessitate strategic planning and proactive risk management by industry players.

Emerging Opportunities in Fibrate Drugs Industry

Significant long-term growth opportunities exist in the Fibrate Drugs market. Technological breakthroughs in drug delivery and formulation are leading to innovations, opening new avenues for market expansion. Strategic partnerships and collaborations offer opportunities to enhance product development and market reach. Expanding into emerging markets with high unmet medical needs presents considerable growth potential. These opportunities will allow companies to establish a strong foothold and drive long-term success.

Leading Players in the Fibrate Drugs Industry Sector

- Aurobindo Pharma USA

- Sanofi

- Cipla Inc

- IOL Chemicals and Pharmaceuticals

- Lupin

- Mylan Inc

- Abbott

- Sun Pharmaceutical Industries Ltd

- Macleods Pharmaceuticals Ltd

- Zydus Cadila

- Socosur Chem

- Unnati Pharmaceuticals Pvt Ltd

Key Milestones in Fibrate Drugs Industry Industry

- December 2022: Esperion's Cholesterol-lowering trial accepted at ACC.23/WCC. This signifies progress in fibrate drug research and development.

- October 2022: United Therapeutics Corporation announced data from the EXPEDITE study highlighting the interaction between gemfibrozil and Orenitram. This highlights potential drug interactions and necessitates careful clinical management.

Strategic Outlook for Fibrate Drugs Industry Market

The Fibrate Drugs market holds substantial future potential, driven by the increasing prevalence of cardiovascular diseases and ongoing research and development efforts. Strategic partnerships and collaborations will play a critical role in driving innovation and market expansion. Focusing on the development of novel formulations and drug delivery systems will provide a competitive advantage. Companies can leverage the growth of online pharmacies to broaden their reach and improve patient access. These strategies offer opportunities for significant growth in the coming years.

Fibrate Drugs Industry Segmentation

-

1. Drug

- 1.1. Clofibrate

- 1.2. Gemfibrozil

- 1.3. Fenofibrate

- 1.4. Other Drugs

-

2. Product type

- 2.1. Branded

- 2.2. Generic

-

3. Distribution channel

- 3.1. Hospital and Retail Pharmacy

- 3.2. Online pharmacy

Fibrate Drugs Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Fibrate Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cardiovascular Diseases Cases; High Investment in the Research and Development of Drugs

- 3.3. Market Restrains

- 3.3.1. Frequent Product Recalls/Discontinuation; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Fenofibrate Segment is Expected to Hold Major Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Clofibrate

- 5.1.2. Gemfibrozil

- 5.1.3. Fenofibrate

- 5.1.4. Other Drugs

- 5.2. Market Analysis, Insights and Forecast - by Product type

- 5.2.1. Branded

- 5.2.2. Generic

- 5.3. Market Analysis, Insights and Forecast - by Distribution channel

- 5.3.1. Hospital and Retail Pharmacy

- 5.3.2. Online pharmacy

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. North America Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Clofibrate

- 6.1.2. Gemfibrozil

- 6.1.3. Fenofibrate

- 6.1.4. Other Drugs

- 6.2. Market Analysis, Insights and Forecast - by Product type

- 6.2.1. Branded

- 6.2.2. Generic

- 6.3. Market Analysis, Insights and Forecast - by Distribution channel

- 6.3.1. Hospital and Retail Pharmacy

- 6.3.2. Online pharmacy

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. Europe Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Clofibrate

- 7.1.2. Gemfibrozil

- 7.1.3. Fenofibrate

- 7.1.4. Other Drugs

- 7.2. Market Analysis, Insights and Forecast - by Product type

- 7.2.1. Branded

- 7.2.2. Generic

- 7.3. Market Analysis, Insights and Forecast - by Distribution channel

- 7.3.1. Hospital and Retail Pharmacy

- 7.3.2. Online pharmacy

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Asia Pacific Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Clofibrate

- 8.1.2. Gemfibrozil

- 8.1.3. Fenofibrate

- 8.1.4. Other Drugs

- 8.2. Market Analysis, Insights and Forecast - by Product type

- 8.2.1. Branded

- 8.2.2. Generic

- 8.3. Market Analysis, Insights and Forecast - by Distribution channel

- 8.3.1. Hospital and Retail Pharmacy

- 8.3.2. Online pharmacy

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. Middle East and Africa Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Drug

- 9.1.1. Clofibrate

- 9.1.2. Gemfibrozil

- 9.1.3. Fenofibrate

- 9.1.4. Other Drugs

- 9.2. Market Analysis, Insights and Forecast - by Product type

- 9.2.1. Branded

- 9.2.2. Generic

- 9.3. Market Analysis, Insights and Forecast - by Distribution channel

- 9.3.1. Hospital and Retail Pharmacy

- 9.3.2. Online pharmacy

- 9.1. Market Analysis, Insights and Forecast - by Drug

- 10. South America Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Drug

- 10.1.1. Clofibrate

- 10.1.2. Gemfibrozil

- 10.1.3. Fenofibrate

- 10.1.4. Other Drugs

- 10.2. Market Analysis, Insights and Forecast - by Product type

- 10.2.1. Branded

- 10.2.2. Generic

- 10.3. Market Analysis, Insights and Forecast - by Distribution channel

- 10.3.1. Hospital and Retail Pharmacy

- 10.3.2. Online pharmacy

- 10.1. Market Analysis, Insights and Forecast - by Drug

- 11. North America Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Europe Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Asia Pacific Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. Middle East and Africa Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. South America Fibrate Drugs Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Aurobindo Pharma USA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Sanofi

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Cipla Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 IOL Chemicals and Pharmaceuticals

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lupin

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mylan Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Abbott

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sun Pharmaceutical Industries Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Macleods Pharmaceuticals Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Zydus Cadila

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Socosur Chem

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Unnati Pharmaceuticals Pvt Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Aurobindo Pharma USA

List of Figures

- Figure 1: Global Fibrate Drugs Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Fibrate Drugs Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: Middle East and Africa Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Fibrate Drugs Industry Revenue (Million), by Drug 2024 & 2032

- Figure 24: North America Fibrate Drugs Industry Volume (K Unit), by Drug 2024 & 2032

- Figure 25: North America Fibrate Drugs Industry Revenue Share (%), by Drug 2024 & 2032

- Figure 26: North America Fibrate Drugs Industry Volume Share (%), by Drug 2024 & 2032

- Figure 27: North America Fibrate Drugs Industry Revenue (Million), by Product type 2024 & 2032

- Figure 28: North America Fibrate Drugs Industry Volume (K Unit), by Product type 2024 & 2032

- Figure 29: North America Fibrate Drugs Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 30: North America Fibrate Drugs Industry Volume Share (%), by Product type 2024 & 2032

- Figure 31: North America Fibrate Drugs Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 32: North America Fibrate Drugs Industry Volume (K Unit), by Distribution channel 2024 & 2032

- Figure 33: North America Fibrate Drugs Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 34: North America Fibrate Drugs Industry Volume Share (%), by Distribution channel 2024 & 2032

- Figure 35: North America Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 37: North America Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Fibrate Drugs Industry Revenue (Million), by Drug 2024 & 2032

- Figure 40: Europe Fibrate Drugs Industry Volume (K Unit), by Drug 2024 & 2032

- Figure 41: Europe Fibrate Drugs Industry Revenue Share (%), by Drug 2024 & 2032

- Figure 42: Europe Fibrate Drugs Industry Volume Share (%), by Drug 2024 & 2032

- Figure 43: Europe Fibrate Drugs Industry Revenue (Million), by Product type 2024 & 2032

- Figure 44: Europe Fibrate Drugs Industry Volume (K Unit), by Product type 2024 & 2032

- Figure 45: Europe Fibrate Drugs Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 46: Europe Fibrate Drugs Industry Volume Share (%), by Product type 2024 & 2032

- Figure 47: Europe Fibrate Drugs Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 48: Europe Fibrate Drugs Industry Volume (K Unit), by Distribution channel 2024 & 2032

- Figure 49: Europe Fibrate Drugs Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 50: Europe Fibrate Drugs Industry Volume Share (%), by Distribution channel 2024 & 2032

- Figure 51: Europe Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 53: Europe Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Fibrate Drugs Industry Revenue (Million), by Drug 2024 & 2032

- Figure 56: Asia Pacific Fibrate Drugs Industry Volume (K Unit), by Drug 2024 & 2032

- Figure 57: Asia Pacific Fibrate Drugs Industry Revenue Share (%), by Drug 2024 & 2032

- Figure 58: Asia Pacific Fibrate Drugs Industry Volume Share (%), by Drug 2024 & 2032

- Figure 59: Asia Pacific Fibrate Drugs Industry Revenue (Million), by Product type 2024 & 2032

- Figure 60: Asia Pacific Fibrate Drugs Industry Volume (K Unit), by Product type 2024 & 2032

- Figure 61: Asia Pacific Fibrate Drugs Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 62: Asia Pacific Fibrate Drugs Industry Volume Share (%), by Product type 2024 & 2032

- Figure 63: Asia Pacific Fibrate Drugs Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 64: Asia Pacific Fibrate Drugs Industry Volume (K Unit), by Distribution channel 2024 & 2032

- Figure 65: Asia Pacific Fibrate Drugs Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 66: Asia Pacific Fibrate Drugs Industry Volume Share (%), by Distribution channel 2024 & 2032

- Figure 67: Asia Pacific Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Asia Pacific Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 69: Asia Pacific Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Asia Pacific Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa Fibrate Drugs Industry Revenue (Million), by Drug 2024 & 2032

- Figure 72: Middle East and Africa Fibrate Drugs Industry Volume (K Unit), by Drug 2024 & 2032

- Figure 73: Middle East and Africa Fibrate Drugs Industry Revenue Share (%), by Drug 2024 & 2032

- Figure 74: Middle East and Africa Fibrate Drugs Industry Volume Share (%), by Drug 2024 & 2032

- Figure 75: Middle East and Africa Fibrate Drugs Industry Revenue (Million), by Product type 2024 & 2032

- Figure 76: Middle East and Africa Fibrate Drugs Industry Volume (K Unit), by Product type 2024 & 2032

- Figure 77: Middle East and Africa Fibrate Drugs Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 78: Middle East and Africa Fibrate Drugs Industry Volume Share (%), by Product type 2024 & 2032

- Figure 79: Middle East and Africa Fibrate Drugs Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 80: Middle East and Africa Fibrate Drugs Industry Volume (K Unit), by Distribution channel 2024 & 2032

- Figure 81: Middle East and Africa Fibrate Drugs Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 82: Middle East and Africa Fibrate Drugs Industry Volume Share (%), by Distribution channel 2024 & 2032

- Figure 83: Middle East and Africa Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East and Africa Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 85: Middle East and Africa Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East and Africa Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

- Figure 87: South America Fibrate Drugs Industry Revenue (Million), by Drug 2024 & 2032

- Figure 88: South America Fibrate Drugs Industry Volume (K Unit), by Drug 2024 & 2032

- Figure 89: South America Fibrate Drugs Industry Revenue Share (%), by Drug 2024 & 2032

- Figure 90: South America Fibrate Drugs Industry Volume Share (%), by Drug 2024 & 2032

- Figure 91: South America Fibrate Drugs Industry Revenue (Million), by Product type 2024 & 2032

- Figure 92: South America Fibrate Drugs Industry Volume (K Unit), by Product type 2024 & 2032

- Figure 93: South America Fibrate Drugs Industry Revenue Share (%), by Product type 2024 & 2032

- Figure 94: South America Fibrate Drugs Industry Volume Share (%), by Product type 2024 & 2032

- Figure 95: South America Fibrate Drugs Industry Revenue (Million), by Distribution channel 2024 & 2032

- Figure 96: South America Fibrate Drugs Industry Volume (K Unit), by Distribution channel 2024 & 2032

- Figure 97: South America Fibrate Drugs Industry Revenue Share (%), by Distribution channel 2024 & 2032

- Figure 98: South America Fibrate Drugs Industry Volume Share (%), by Distribution channel 2024 & 2032

- Figure 99: South America Fibrate Drugs Industry Revenue (Million), by Country 2024 & 2032

- Figure 100: South America Fibrate Drugs Industry Volume (K Unit), by Country 2024 & 2032

- Figure 101: South America Fibrate Drugs Industry Revenue Share (%), by Country 2024 & 2032

- Figure 102: South America Fibrate Drugs Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fibrate Drugs Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fibrate Drugs Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Fibrate Drugs Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 4: Global Fibrate Drugs Industry Volume K Unit Forecast, by Drug 2019 & 2032

- Table 5: Global Fibrate Drugs Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 6: Global Fibrate Drugs Industry Volume K Unit Forecast, by Product type 2019 & 2032

- Table 7: Global Fibrate Drugs Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 8: Global Fibrate Drugs Industry Volume K Unit Forecast, by Distribution channel 2019 & 2032

- Table 9: Global Fibrate Drugs Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Fibrate Drugs Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Global Fibrate Drugs Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 22: Global Fibrate Drugs Industry Volume K Unit Forecast, by Drug 2019 & 2032

- Table 23: Global Fibrate Drugs Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 24: Global Fibrate Drugs Industry Volume K Unit Forecast, by Product type 2019 & 2032

- Table 25: Global Fibrate Drugs Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 26: Global Fibrate Drugs Industry Volume K Unit Forecast, by Distribution channel 2019 & 2032

- Table 27: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Canada Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Mexico Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Global Fibrate Drugs Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 36: Global Fibrate Drugs Industry Volume K Unit Forecast, by Drug 2019 & 2032

- Table 37: Global Fibrate Drugs Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 38: Global Fibrate Drugs Industry Volume K Unit Forecast, by Product type 2019 & 2032

- Table 39: Global Fibrate Drugs Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 40: Global Fibrate Drugs Industry Volume K Unit Forecast, by Distribution channel 2019 & 2032

- Table 41: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Germany Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: United Kingdom Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: United Kingdom Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: France Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Italy Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Spain Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Rest of Europe Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Europe Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Global Fibrate Drugs Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 56: Global Fibrate Drugs Industry Volume K Unit Forecast, by Drug 2019 & 2032

- Table 57: Global Fibrate Drugs Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 58: Global Fibrate Drugs Industry Volume K Unit Forecast, by Product type 2019 & 2032

- Table 59: Global Fibrate Drugs Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 60: Global Fibrate Drugs Industry Volume K Unit Forecast, by Distribution channel 2019 & 2032

- Table 61: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 63: China Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: China Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Japan Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Japan Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: India Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: India Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Australia Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Australia Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: South Korea Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Korea Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Rest of Asia Pacific Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Asia Pacific Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Global Fibrate Drugs Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 76: Global Fibrate Drugs Industry Volume K Unit Forecast, by Drug 2019 & 2032

- Table 77: Global Fibrate Drugs Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 78: Global Fibrate Drugs Industry Volume K Unit Forecast, by Product type 2019 & 2032

- Table 79: Global Fibrate Drugs Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 80: Global Fibrate Drugs Industry Volume K Unit Forecast, by Distribution channel 2019 & 2032

- Table 81: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: GCC Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: GCC Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: South Africa Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: South Africa Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Rest of Middle East and Africa Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Rest of Middle East and Africa Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Global Fibrate Drugs Industry Revenue Million Forecast, by Drug 2019 & 2032

- Table 90: Global Fibrate Drugs Industry Volume K Unit Forecast, by Drug 2019 & 2032

- Table 91: Global Fibrate Drugs Industry Revenue Million Forecast, by Product type 2019 & 2032

- Table 92: Global Fibrate Drugs Industry Volume K Unit Forecast, by Product type 2019 & 2032

- Table 93: Global Fibrate Drugs Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 94: Global Fibrate Drugs Industry Volume K Unit Forecast, by Distribution channel 2019 & 2032

- Table 95: Global Fibrate Drugs Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 96: Global Fibrate Drugs Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 97: Brazil Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Brazil Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Argentina Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Argentina Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: Rest of South America Fibrate Drugs Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Rest of South America Fibrate Drugs Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fibrate Drugs Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Fibrate Drugs Industry?

Key companies in the market include Aurobindo Pharma USA, Sanofi, Cipla Inc, IOL Chemicals and Pharmaceuticals, Lupin, Mylan Inc, Abbott, Sun Pharmaceutical Industries Ltd, Macleods Pharmaceuticals Ltd, Zydus Cadila, Socosur Chem, Unnati Pharmaceuticals Pvt Ltd.

3. What are the main segments of the Fibrate Drugs Industry?

The market segments include Drug, Product type, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cardiovascular Diseases Cases; High Investment in the Research and Development of Drugs.

6. What are the notable trends driving market growth?

Fenofibrate Segment is Expected to Hold Major Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Frequent Product Recalls/Discontinuation; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In December 2022, Esperion announced that the landmark Cholesterol lowering via NEXLETOL Bempedoic acid, fibrate drugs, an ACL-inhibiting Regimen outcomes trial, has been accepted as a late-breaking clinical trial at ACC.23/WCC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fibrate Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fibrate Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fibrate Drugs Industry?

To stay informed about further developments, trends, and reports in the Fibrate Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence