Key Insights

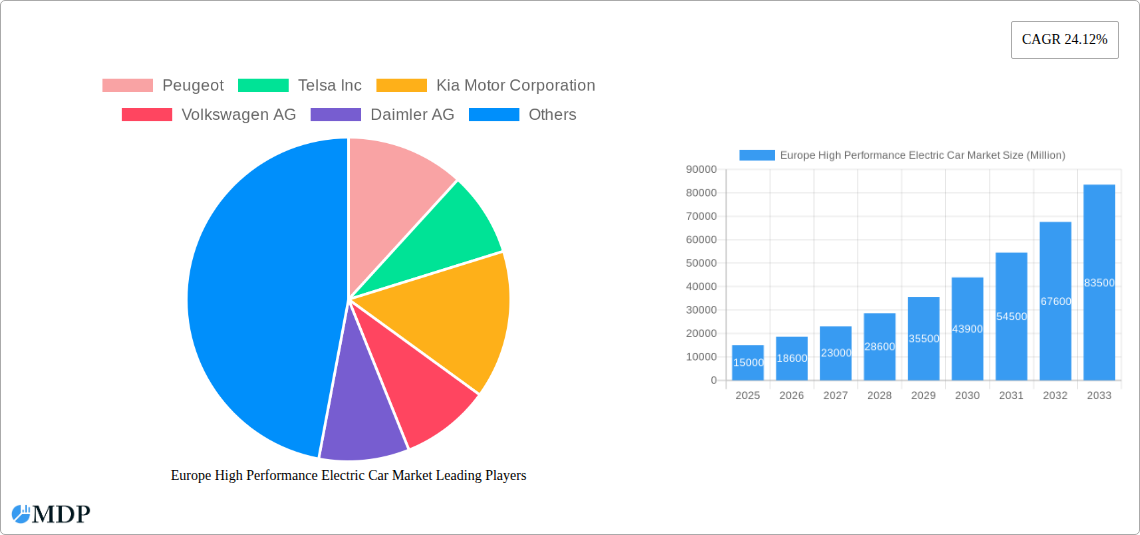

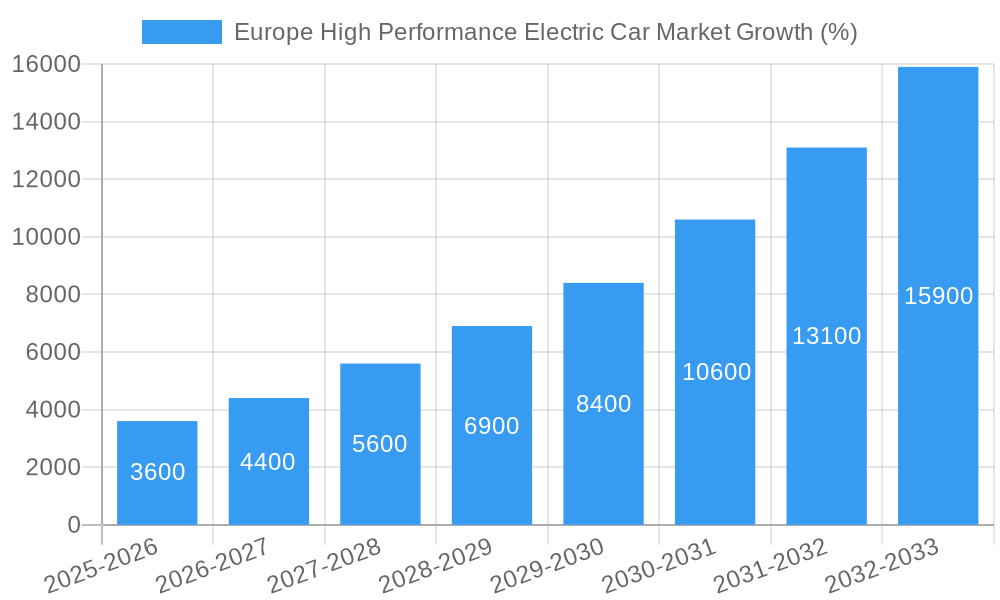

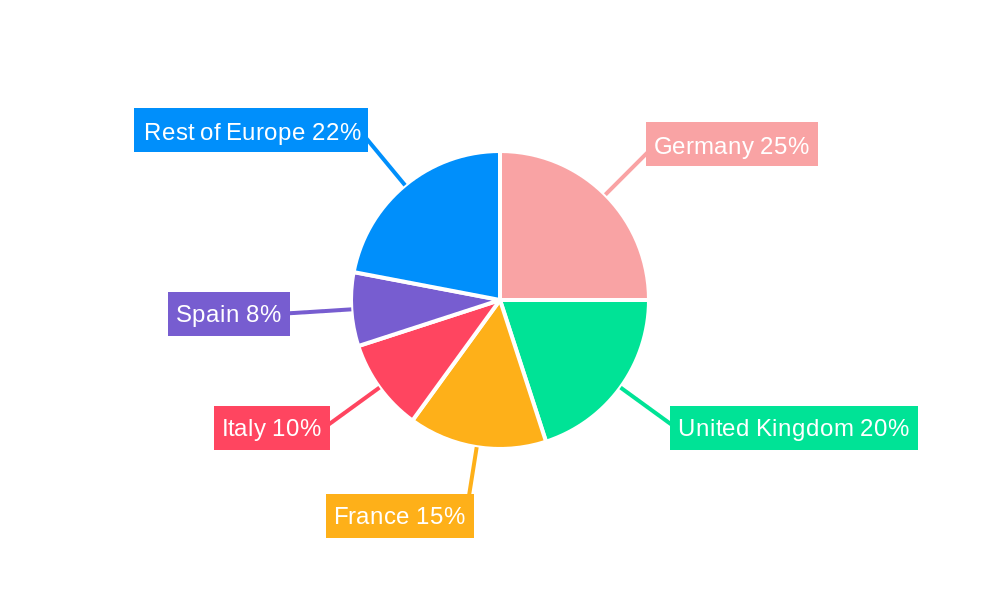

The European high-performance electric car market is experiencing robust growth, fueled by increasing environmental concerns, stringent emission regulations, and advancements in battery technology. The market, currently valued at an estimated €15 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 24.12% from 2025 to 2033. This surge is driven by several key factors. Firstly, the rising popularity of electric vehicles (EVs) among environmentally conscious consumers is a significant driver. Secondly, government incentives and subsidies aimed at promoting EV adoption are accelerating market penetration. Thirdly, technological breakthroughs, particularly in battery technology, are enhancing the performance, range, and affordability of high-performance electric cars. The segment encompassing battery electric vehicles (BEVs) is expected to dominate the market share due to their superior performance and environmental benefits compared to plug-in hybrids. Germany, the United Kingdom, and France are currently the leading markets within Europe, reflecting their established automotive industries and supportive regulatory environments. However, other countries like Italy and Spain are poised for significant growth as EV infrastructure develops and consumer awareness increases. Competition among established automotive manufacturers such as Volkswagen, BMW, and Tesla, along with emerging players like Rimac, is intensifying, leading to innovation and price competitiveness.

Despite the promising outlook, challenges remain. High initial purchase prices compared to traditional internal combustion engine (ICE) vehicles continue to pose a barrier to widespread adoption. Range anxiety, concerns about charging infrastructure availability and charging times, and the long-term environmental impact of battery production and disposal are also factors that need to be addressed to fully unlock the market’s potential. Nevertheless, ongoing improvements in battery technology, expanding charging networks, and increased consumer familiarity with EVs are expected to mitigate these challenges, ensuring the sustained expansion of the European high-performance electric car market over the forecast period. The market segmentation by vehicle type (passenger cars and commercial vehicles) reveals a stronger initial growth in passenger cars, though commercial vehicle adoption is expected to increase significantly in the later years of the forecast period due to fleet electrification initiatives and government regulations.

Europe High Performance Electric Car Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe High Performance Electric Car Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a meticulous examination of market dynamics, trends, and future projections, this report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast. The report unveils key market drivers, challenges, and opportunities, alongside detailed segment analysis and profiles of leading players such as Peugeot, Tesla Inc, Kia Motor Corporation, Volkswagen AG, Daimler AG, Nissan Motor Company Ltd, Renault, BMW Group, Mitsubishi Motors Corporation, Rimac Automobili, and Ford Motor Company. The market size is projected to reach xx Million by 2033.

Europe High Performance Electric Car Market Market Dynamics & Concentration

The European high-performance electric car market is experiencing dynamic growth fueled by stringent emission regulations, increasing consumer preference for eco-friendly vehicles, and advancements in battery technology. Market concentration is relatively high, with established automakers holding significant market share. However, the emergence of new entrants and disruptive technologies is gradually shifting the competitive landscape.

- Market Concentration: The top 5 players command approximately xx% of the market share in 2025, indicating a moderately consolidated market.

- Innovation Drivers: Significant investments in R&D are driving innovation in battery technology, charging infrastructure, and vehicle performance, leading to improved range, power, and charging times.

- Regulatory Frameworks: Stringent emission regulations across European countries are compelling automakers to accelerate the development and adoption of electric vehicles, thereby creating a favorable market environment.

- Product Substitutes: While high-performance internal combustion engine (ICE) vehicles remain a primary substitute, their appeal is waning due to rising fuel costs and environmental concerns.

- End-User Trends: Consumers are increasingly prioritizing sustainable transportation options, leading to a surge in demand for high-performance electric vehicles.

- M&A Activities: The number of M&A deals in the sector increased to xx in 2024, reflecting the industry's consolidation and strategic expansion efforts. These deals primarily focus on securing battery technology, charging infrastructure, and enhancing research capabilities.

Europe High Performance Electric Car Market Industry Trends & Analysis

The European high-performance electric car market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is attributed to several factors:

The market penetration of high-performance electric vehicles is steadily increasing, driven by technological advancements that are continuously improving vehicle performance, range, and charging speed. Consumer preferences are shifting towards sustainable and technologically advanced vehicles, leading to increased demand for electric models offering superior performance and features. The competitive landscape is highly dynamic, with established automakers and new entrants vying for market share through product innovation and strategic partnerships. Government incentives and supportive policies further encourage market expansion.

Leading Markets & Segments in Europe High Performance Electric Car Market

Germany, the United Kingdom, and France are the leading markets for high-performance electric cars in Europe.

By Drive Type: Battery or Pure Electric vehicles are expected to dominate the market, driven by superior performance and longer range capabilities compared to plug-in hybrids.

By Vehicle Type: Passenger cars currently comprise the largest segment, but the commercial vehicle segment is poised for significant growth driven by the increasing adoption of electric delivery vans and trucks.

By Country:

- Germany: Strong government support for electric mobility and a robust automotive manufacturing base drive market leadership.

- United Kingdom: Rising environmental concerns and government initiatives promoting electric vehicles are fueling market growth.

- France: Government incentives and investments in charging infrastructure are stimulating demand for high-performance electric cars.

- Italy, Spain, and Rest of Europe: These markets are experiencing slower, but steady growth due to factors such as increasing consumer awareness and improving charging infrastructure.

Key Drivers:

- Economic policies: Government subsidies, tax breaks, and other incentives significantly influence purchase decisions.

- Infrastructure development: Expansion of charging networks is crucial for enhancing consumer confidence and adoption rates.

Europe High Performance Electric Car Market Product Developments

Recent product developments highlight a focus on enhancing vehicle performance, range, and charging capabilities. Manufacturers are integrating advanced battery technologies, optimizing aerodynamics, and implementing innovative charging solutions to improve the overall driving experience. The integration of sophisticated infotainment systems and driver-assistance features are also key differentiators in the competitive landscape. The market is witnessing a clear trend towards more powerful, efficient, and technologically advanced high-performance electric vehicles.

Key Drivers of Europe High Performance Electric Car Market Growth

The growth of the European high-performance electric car market is driven by a confluence of factors:

- Technological advancements: Innovations in battery technology, electric motor design, and charging infrastructure are improving vehicle performance and reducing range anxiety.

- Stringent emission regulations: Governments across Europe are imposing stricter emission standards, pushing automakers to transition towards electric vehicles.

- Economic incentives: Government subsidies and tax breaks are making electric vehicles more affordable and attractive to consumers.

Challenges in the Europe High Performance Electric Car Market Market

The market faces several challenges, including:

- High initial purchase price: Electric vehicles still have a higher upfront cost compared to ICE vehicles, limiting their accessibility to a wider range of consumers.

- Limited charging infrastructure: Inadequate charging infrastructure remains a barrier to widespread adoption, particularly in less densely populated areas.

- Battery technology limitations: Challenges related to battery range, charging time, and lifespan still need to be addressed.

Emerging Opportunities in Europe High Performance Electric Car Market

The market presents several promising opportunities:

- Technological breakthroughs: Advancements in solid-state battery technology promise to revolutionize the industry, offering enhanced energy density, faster charging times, and improved safety.

- Strategic partnerships: Collaborations between automakers, technology companies, and energy providers are crucial for developing integrated solutions for electric mobility.

- Market expansion into new segments: The potential for growth in the commercial vehicle and luxury segments remains significant.

Leading Players in the Europe High Performance Electric Car Market Sector

- Peugeot

- Tesla Inc

- Kia Motor Corporation

- Volkswagen AG

- Daimler AG

- Nissan Motor Company Ltd

- Renault

- BMW Group

- Mitsubishi Motors Corporation

- Rimac Automobili

- Ford Motor Company

Key Milestones in Europe High Performance Electric Car Market Industry

- June 2023: Mercedes-Benz revealed the AMG EQE 53 4MATIC+ SUV, showcasing advancements in electric vehicle adaptability and performance.

- May 2023: Aston Martin's collaboration with Bowers & Wilkins highlights the growing focus on enhancing the in-car experience for high-performance electric vehicles.

- August 2022: ZF Friedrichshafen AG's showcasing of modern mobility innovations underscores the ongoing advancements in electric powertrain technology for commercial vehicles.

- July 2022: Ford's launch of the F-150 Raptor R demonstrates the continued consumer demand for high-performance vehicles, even within the electric vehicle segment.

Strategic Outlook for Europe High Performance Electric Car Market Market

The future of the European high-performance electric car market looks promising. Continued technological advancements, coupled with supportive government policies and increasing consumer demand for sustainable transportation options, are poised to drive significant market expansion in the coming years. Strategic partnerships and investments in charging infrastructure will further accelerate market growth and create new opportunities for players in the industry. The market is likely to see an increased focus on innovation, sustainability, and consumer-centric features.

Europe High Performance Electric Car Market Segmentation

-

1. Drive Type

- 1.1. Plug-in Hybrid

- 1.2. Battery or Pure Electric

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Europe High Performance Electric Car Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe High Performance Electric Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Luxury Vehicles is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of the Vehicle may Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Luxury Vehicles is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 5.1.1. Plug-in Hybrid

- 5.1.2. Battery or Pure Electric

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 6. Germany Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe High Performance Electric Car Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Peugeot

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Telsa Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Kia Motor Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Volkswagen AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Daimler AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Nissan Motor Company Ltd *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Renault

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BMW Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitsubishi Motors Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rimac Automobili

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ford Motor Company

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Peugeot

List of Figures

- Figure 1: Europe High Performance Electric Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe High Performance Electric Car Market Share (%) by Company 2024

List of Tables

- Table 1: Europe High Performance Electric Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe High Performance Electric Car Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 3: Europe High Performance Electric Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Europe High Performance Electric Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe High Performance Electric Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe High Performance Electric Car Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 14: Europe High Performance Electric Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Europe High Performance Electric Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe High Performance Electric Car Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe High Performance Electric Car Market?

The projected CAGR is approximately 24.12%.

2. Which companies are prominent players in the Europe High Performance Electric Car Market?

Key companies in the market include Peugeot, Telsa Inc, Kia Motor Corporation, Volkswagen AG, Daimler AG, Nissan Motor Company Ltd *List Not Exhaustive, Renault, BMW Group, Mitsubishi Motors Corporation, Rimac Automobili, Ford Motor Company.

3. What are the main segments of the Europe High Performance Electric Car Market?

The market segments include Drive Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Luxury Vehicles is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Increasing Demand of Luxury Vehicles is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

High Cost of the Vehicle may Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

June 2023: Mercedes-Benz revealed the AMG EQE 53 4MATIC+ SUV. Mercedes-AMG's latest model stands out as the most adaptable electric vehicle in their lineup, combining a customizable cabin with a performance-oriented drive concept.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe High Performance Electric Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe High Performance Electric Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe High Performance Electric Car Market?

To stay informed about further developments, trends, and reports in the Europe High Performance Electric Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence