Key Insights

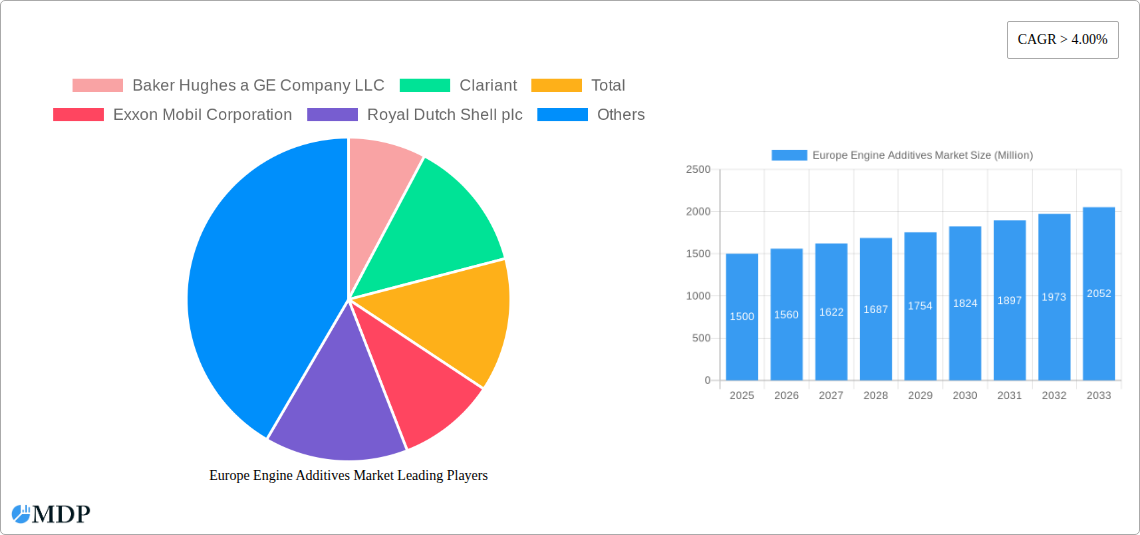

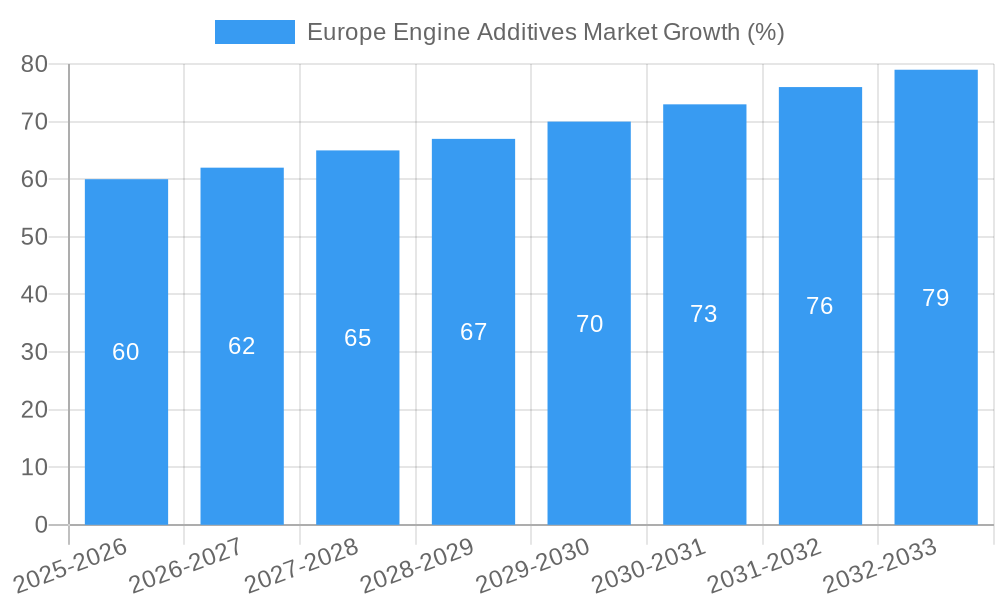

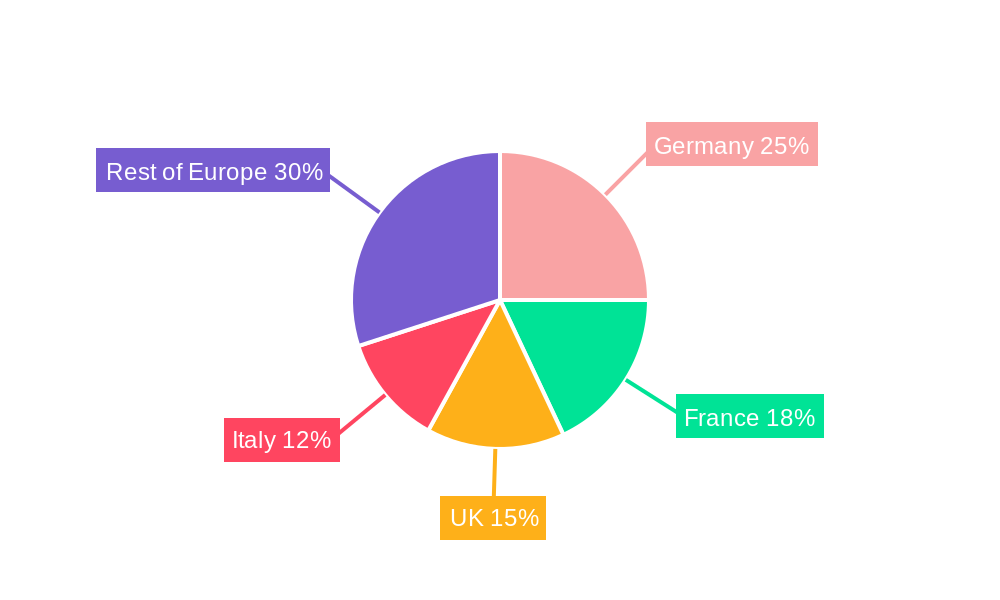

The European engine additives market, valued at approximately €1.5 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. Stringent emission regulations across Europe are compelling vehicle manufacturers to incorporate advanced engine additives that enhance fuel efficiency and reduce harmful emissions. The rising adoption of advanced engine technologies, such as direct injection systems and turbocharging, further necessitates the use of specialized additives to mitigate potential issues like deposit formation and wear. Growth is also fueled by increasing vehicle ownership and the expanding commercial vehicle fleet within the region, particularly in Germany, France, and the UK, which are major contributors to the market's overall size. The market segmentation reveals strong demand across various additive types, including deposit control agents, cetane improvers crucial for diesel engines, and lubricity additives essential for reducing friction and wear. Different applications like diesel, gasoline, and jet fuel further diversify the market, catering to the specific needs of diverse engine types. While the market faces some restraints, such as price fluctuations of raw materials and potential technological advancements reducing the need for certain additives, the long-term outlook remains positive, underpinned by continuous legislative pressures towards cleaner transportation and the expansion of the automotive sector in Europe.

The leading players in this competitive market include established chemical giants like BASF, Clariant, and Evonik, alongside specialized additives manufacturers such as Afton Chemical and Lubrizol. These companies are investing heavily in research and development to create innovative and high-performance engine additives that meet the ever-evolving demands of the automotive industry. The competitive landscape is characterized by strategic partnerships, mergers and acquisitions, and a focus on developing sustainable and environmentally friendly solutions. The European market’s geographical distribution shows strong performance in major economies, with Germany, France, and the UK exhibiting significant demand. However, growth potential is also observed in other European nations as vehicle ownership and industrialization continue to grow, leading to a broader market reach for these essential engine components. Market players are keenly focusing on expanding their distribution networks and strengthening their regional presence to capitalize on these opportunities.

Europe Engine Additives Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Engine Additives Market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, technological advancements, and future growth prospects. The report utilizes a robust methodology incorporating historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033) to provide a complete picture of this dynamic market. This analysis encompasses key segments including Product Type (Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, Antiknock Agents, Other Product Types) and Application (Diesel, Gasoline, Jet Fuel, Other Applications). The report identifies key growth drivers and challenges, offering actionable strategies for success in this competitive landscape.

Europe Engine Additives Market Market Dynamics & Concentration

The Europe Engine Additives Market exhibits a moderately concentrated landscape, with key players holding significant market share. The market's dynamism is shaped by several factors:

- Innovation Drivers: Continuous research and development in additive chemistry drive innovation, leading to enhanced fuel efficiency, reduced emissions, and improved engine performance. This fuels competition and necessitates constant product improvement.

- Regulatory Frameworks: Stringent emission regulations in Europe (e.g., Euro standards) significantly impact additive formulation and demand. Compliance drives the development of additives that meet stricter environmental standards.

- Product Substitutes: While few direct substitutes exist, advancements in engine technology and alternative fuels (e.g., biofuels, hydrogen) could potentially impact the market's long-term growth.

- End-User Trends: The growing demand for higher fuel efficiency and lower emissions from both consumers and fleet operators is a significant driver. The shift towards advanced driver-assistance systems (ADAS) and connected vehicles indirectly influences additive demand.

- M&A Activities: Consolidation through mergers and acquisitions (M&A) is expected to continue, resulting in increased market concentration. The number of M&A deals in the past five years stands at approximately xx. Major players are actively pursuing strategic acquisitions to expand their product portfolios and geographic reach. Market share for top 5 players is estimated to be around xx%.

Europe Engine Additives Market Industry Trends & Analysis

The Europe Engine Additives Market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors are contributing to this growth:

The rising demand for fuel-efficient vehicles and the stringent emission norms enforced across the European Union are primarily driving the market’s growth. The increasing adoption of advanced engine technologies is also augmenting the demand for engine additives to ensure optimal engine performance and extended lifespan. Furthermore, the ongoing developments in additive chemistries are enhancing the efficiency and effectiveness of engine additives, catering to the evolving needs of the automotive industry. Market penetration of advanced additives offering superior performance is steadily increasing, contributing to market expansion. Competitive dynamics are marked by continuous innovation, strategic partnerships, and a focus on sustainable additive solutions. The market is witnessing a significant increase in investments in R&D, leading to the development of advanced engine additives that cater to the stringent emission regulations and improved fuel efficiency requirements.

Leading Markets & Segments in Europe Engine Additives Market

Germany and France are the leading markets in Europe for engine additives, driven by large automotive manufacturing sectors and stringent environmental regulations. Within product types, the demand for Deposit Control and Lubricity Additives is highest, while Cetane Improvers are crucial for diesel applications.

- Key Drivers for Germany: Strong automotive industry, robust infrastructure, favorable economic policies, and stringent emission regulations.

- Key Drivers for France: Similar factors as Germany, with a focus on governmental initiatives promoting fuel efficiency.

- Deposit Control: High demand driven by the need to maintain engine cleanliness and prevent performance degradation.

- Lubricity Additives: Essential for reducing friction and wear, prolonging engine lifespan, and improving fuel economy.

- Cetane Improvers: Crucial for improving the combustion efficiency and reducing emissions in diesel engines.

The dominance of these segments is driven by increasing demand for enhanced engine performance, fuel efficiency, and emission reduction.

Europe Engine Additives Market Product Developments

Recent years have witnessed significant advancements in engine additive technology, focusing on the development of environmentally friendly, high-performance additives. These include formulations incorporating advanced chemistries to reduce emissions, improve fuel economy, and enhance engine durability. The focus is on meeting stricter emission regulations and catering to the increasing adoption of advanced engine technologies. Competition is driving the development of unique value propositions, such as extended drain intervals and enhanced protection against wear and tear.

Key Drivers of Europe Engine Additives Market Growth

The Europe Engine Additives Market's growth is propelled by several factors:

- Stringent Emission Regulations: EU regulations push for cleaner engines, driving demand for advanced additives that reduce emissions.

- Technological Advancements: New engine designs and fuel types necessitate the development of specialized engine additives.

- Rising Fuel Prices: Demand for fuel-efficient engines indirectly boosts the market for additives enhancing fuel economy.

Challenges in the Europe Engine Additives Market Market

The market faces challenges including:

- Fluctuating Raw Material Prices: The cost of raw materials impacts additive production costs and profitability.

- Intense Competition: The presence of numerous established players intensifies competition, putting pressure on pricing.

- Regulatory Compliance: Meeting evolving environmental regulations presents significant technical and financial hurdles. The estimated impact of regulatory changes on the market over the next 5 years is xx Million.

Emerging Opportunities in Europe Engine Additives Market

Opportunities lie in:

- Biofuel Additives: Growing biofuel adoption necessitates the development of compatible additives.

- Electric Vehicle (EV) Penetration: While impacting the long-term demand for additives, some additives can still play a role in specific hybrid and plug-in hybrid vehicles.

- Strategic Partnerships & Collaborations: Collaborations between additive manufacturers and automotive companies can drive innovation and market penetration.

Leading Players in the Europe Engine Additives Market Sector

- Baker Hughes a GE Company LLC

- Clariant

- Total

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- Evonik Industries AG

- VeryOne SaS (EURENCO)

- LANXESS

- Croda International Plc

- BASF SE

- Chevron Corporation

- The Lubrizol Corporation

- Eni SpA

- Afton Chemical

Key Milestones in Europe Engine Additives Market Industry

- 2020: Introduction of new stringent emission standards in several European countries.

- 2022: Launch of several new engine additives focusing on improved fuel efficiency and emissions reduction by major players.

- 2023: A significant M&A activity between two key players reshaping the market dynamics.

Strategic Outlook for Europe Engine Additives Market Market

The Europe Engine Additives Market holds significant future potential driven by continuous innovation in additive chemistry, the growing need for cleaner and more efficient engines, and evolving regulatory landscapes. Strategic opportunities for growth include focusing on sustainable additives, developing solutions for emerging fuel technologies, and forging strategic partnerships across the automotive value chain. The market is expected to continue its growth trajectory, driven by a confluence of factors like environmental concerns, technological advancements, and increasing automotive production. Companies that can effectively navigate the regulatory landscape and capitalize on technological advancements will be best positioned for success.

Europe Engine Additives Market Segmentation

-

1. Product Type

- 1.1. Deposit Control

- 1.2. Cetane Improvers

- 1.3. Lubricity Additives

- 1.4. Antioxidants

- 1.5. Anticorrosion

- 1.6. Cold Flow Improvers

- 1.7. Antiknock Agents

- 1.8. Other Product Types

-

2. Application

- 2.1. Diesel

- 2.2. Gasoline

- 2.3. Jet Fuel

- 2.4. Other Applications

Europe Engine Additives Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Rest of Europe

Europe Engine Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Enactment of Stringent Environmental Regulations; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand and Penetration of Battery Electric Vehicles (BEVs); High Costs of R&D Activities

- 3.4. Market Trends

- 3.4.1. Gasoline to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Deposit Control

- 5.1.2. Cetane Improvers

- 5.1.3. Lubricity Additives

- 5.1.4. Antioxidants

- 5.1.5. Anticorrosion

- 5.1.6. Cold Flow Improvers

- 5.1.7. Antiknock Agents

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diesel

- 5.2.2. Gasoline

- 5.2.3. Jet Fuel

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Deposit Control

- 6.1.2. Cetane Improvers

- 6.1.3. Lubricity Additives

- 6.1.4. Antioxidants

- 6.1.5. Anticorrosion

- 6.1.6. Cold Flow Improvers

- 6.1.7. Antiknock Agents

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diesel

- 6.2.2. Gasoline

- 6.2.3. Jet Fuel

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Deposit Control

- 7.1.2. Cetane Improvers

- 7.1.3. Lubricity Additives

- 7.1.4. Antioxidants

- 7.1.5. Anticorrosion

- 7.1.6. Cold Flow Improvers

- 7.1.7. Antiknock Agents

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diesel

- 7.2.2. Gasoline

- 7.2.3. Jet Fuel

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Italy Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Deposit Control

- 8.1.2. Cetane Improvers

- 8.1.3. Lubricity Additives

- 8.1.4. Antioxidants

- 8.1.5. Anticorrosion

- 8.1.6. Cold Flow Improvers

- 8.1.7. Antiknock Agents

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diesel

- 8.2.2. Gasoline

- 8.2.3. Jet Fuel

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Deposit Control

- 9.1.2. Cetane Improvers

- 9.1.3. Lubricity Additives

- 9.1.4. Antioxidants

- 9.1.5. Anticorrosion

- 9.1.6. Cold Flow Improvers

- 9.1.7. Antiknock Agents

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diesel

- 9.2.2. Gasoline

- 9.2.3. Jet Fuel

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Europe Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Deposit Control

- 10.1.2. Cetane Improvers

- 10.1.3. Lubricity Additives

- 10.1.4. Antioxidants

- 10.1.5. Anticorrosion

- 10.1.6. Cold Flow Improvers

- 10.1.7. Antiknock Agents

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diesel

- 10.2.2. Gasoline

- 10.2.3. Jet Fuel

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Germany Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Baker Hughes a GE Company LLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Clariant

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Total

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Exxon Mobil Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Royal Dutch Shell plc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Evonik Industries AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 VeryOne SaS (EURENCO)*List Not Exhaustive

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 LANXESS

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Croda International Plc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 BASF SE

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Chevron Corporation

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 The Lubrizol Corporation

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Eni SpA

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Afton Chemical

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 Baker Hughes a GE Company LLC

List of Figures

- Figure 1: Europe Engine Additives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Engine Additives Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Engine Additives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Engine Additives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Engine Additives Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Europe Engine Additives Market?

Key companies in the market include Baker Hughes a GE Company LLC, Clariant, Total, Exxon Mobil Corporation, Royal Dutch Shell plc, Evonik Industries AG, VeryOne SaS (EURENCO)*List Not Exhaustive, LANXESS, Croda International Plc, BASF SE, Chevron Corporation, The Lubrizol Corporation, Eni SpA, Afton Chemical.

3. What are the main segments of the Europe Engine Additives Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Enactment of Stringent Environmental Regulations; Other Drivers.

6. What are the notable trends driving market growth?

Gasoline to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Demand and Penetration of Battery Electric Vehicles (BEVs); High Costs of R&D Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Engine Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Engine Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Engine Additives Market?

To stay informed about further developments, trends, and reports in the Europe Engine Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence