Key Insights

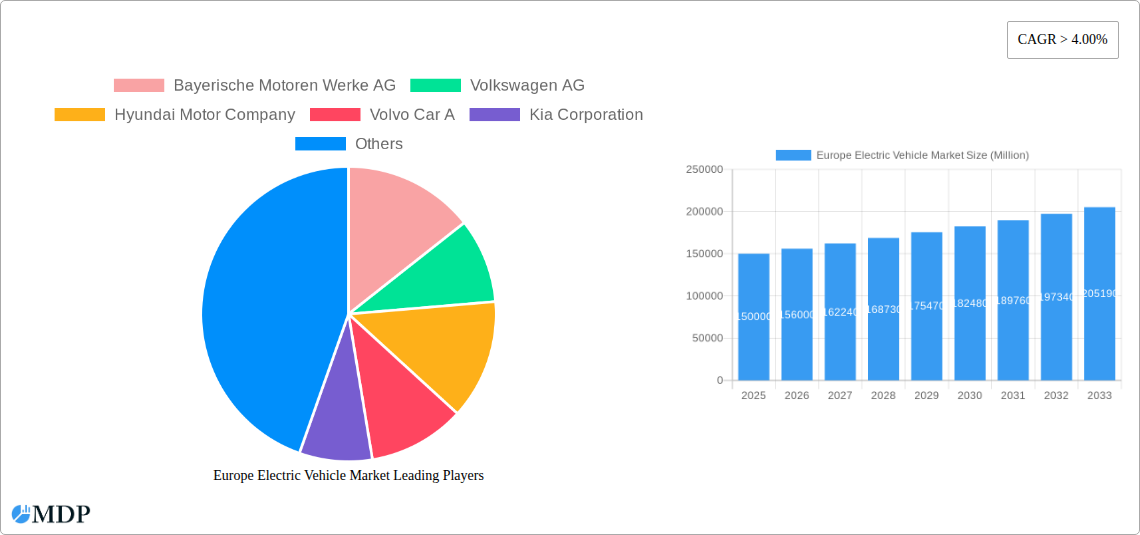

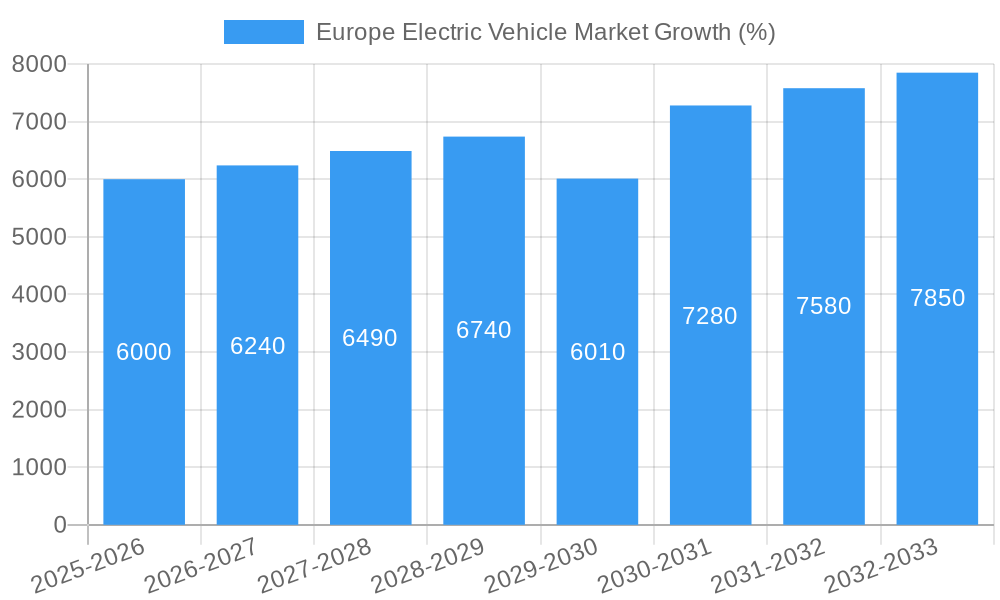

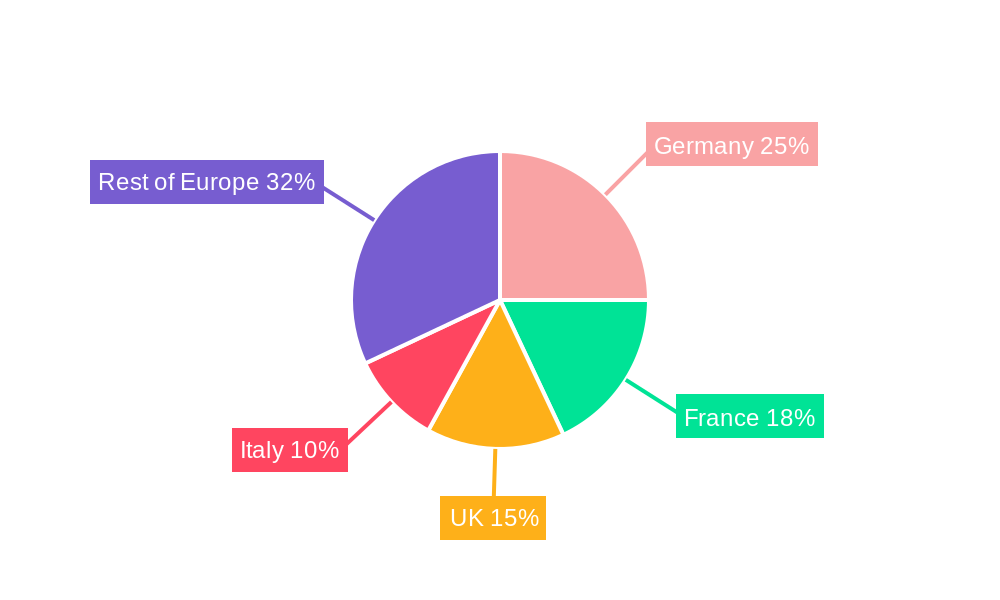

The European electric vehicle (EV) market is experiencing robust growth, driven by stringent emission regulations, increasing environmental awareness among consumers, and supportive government policies promoting electric mobility. The market, valued at an estimated €150 billion in 2025, is projected to exhibit a compound annual growth rate (CAGR) exceeding 4%, reaching substantial size by 2033. This expansion is fueled by several key factors. Firstly, the rising adoption of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) is significantly impacting market growth, driven by technological advancements leading to improved battery range and reduced charging times, alongside decreasing vehicle prices. Secondly, the expanding charging infrastructure across major European nations is alleviating range anxiety, a key barrier to EV adoption. Furthermore, substantial government incentives, including subsidies and tax breaks, are making EVs more financially attractive to consumers. Germany, France, and the UK remain the largest markets within Europe, but smaller nations are also showing significant growth, spurred by ambitious climate targets and supportive policy frameworks. The market segmentation reveals strong demand across passenger vehicles, with SUVs showing particularly robust growth, and a gradual but steady increase in the adoption of electric commercial vehicles.

However, challenges remain. The high initial cost of EVs compared to internal combustion engine vehicles continues to pose a barrier to wider adoption, especially among lower-income segments. The uneven distribution of charging infrastructure across Europe, particularly in rural areas, also presents a hurdle. Furthermore, concerns regarding battery lifespan, charging infrastructure reliability, and the overall environmental impact of EV battery production are factors that need to be addressed to ensure continued sustainable growth. Competition is fierce, with established automakers like Volkswagen, BMW, and Mercedes-Benz alongside new entrants like Tesla vying for market share. The coming years will witness intense innovation and competition focused on battery technology, charging solutions, and vehicle design, driving further market expansion and shaping the future of European transportation.

Europe Electric Vehicle Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European Electric Vehicle (EV) market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and policymakers seeking to understand the dynamics, trends, and future potential of this rapidly evolving sector. With a focus on key players like Bayerische Motoren Werke AG, Volkswagen AG, Hyundai Motor Company, Volvo Car A, Kia Corporation, Tesla Inc, Mercedes-Benz, Groupe Renault, Audi AG, and Toyota Motor Corporation, the report delivers actionable intelligence for informed decision-making.

The study encompasses various vehicle types (Passenger Vehicles, Commercial Vehicles), fuel categories (BEV, FCEV, HEV, PHEV), and segments (Sports Utility Vehicle, Two-Wheelers), analyzing key markets across Austria, Belgium, Czech Republic, Denmark, Estonia, France, Germany, Ireland, Italy, Latvia, Lithuania, Norway, Poland, Russia, Spain, Sweden, UK, and Rest-of-Europe. The report uses 2025 as the base year and provides forecasts until 2033, building upon historical data from 2019-2024.

Europe Electric Vehicle Market Market Dynamics & Concentration

The European EV market is characterized by intense competition and significant innovation. Market concentration is moderate, with a few major players holding substantial market share, while numerous smaller companies and startups contribute to a dynamic landscape. The market is driven by stringent regulatory frameworks aimed at reducing carbon emissions, particularly the EU's ambitious targets for vehicle electrification. However, the high initial cost of EVs compared to traditional vehicles remains a key challenge, mitigated partially by government incentives and subsidies. Consumer preferences are shifting toward EVs, fueled by environmental awareness and technological advancements leading to improved performance and range. The ongoing M&A activity, exemplified by recent acquisitions in battery technology (e.g., Tesla's acquisition of SiILion), reflects the industry's focus on securing vital components and expanding production capacity. The market share of BEVs is expected to exceed xx% by 2033, fueled by continuous technological advancements and decreasing battery costs. The number of M&A deals in the sector reached xx in 2024, indicating a high level of consolidation and strategic investments.

- Key Market Drivers: Stringent emission regulations, increasing consumer demand for eco-friendly vehicles, government incentives, technological advancements in battery technology and charging infrastructure.

- Key Challenges: High initial purchase price, range anxiety, limited charging infrastructure in certain regions, supply chain vulnerabilities.

- Market Concentration: Moderate, with top players holding approximately xx% of the market share collectively.

- M&A Activity: Significant activity observed in recent years, particularly focusing on battery technology and charging infrastructure development.

Europe Electric Vehicle Market Industry Trends & Analysis

The European EV market exhibits robust growth, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), exceeding xx Million units by 2033. Technological disruptions, such as advancements in battery technology (increased energy density and reduced charging times), autonomous driving features, and connected car technologies are significantly shaping consumer preferences. Market penetration of EVs is expected to reach xx% by 2033, driven by increasing affordability, improved performance, and expanding charging infrastructure. The competitive landscape is highly dynamic, with established automakers and new entrants vying for market share. This competition fosters innovation and accelerates technological advancements, further benefiting consumers. Consumer preferences are evolving towards larger battery capacities, faster charging capabilities, and advanced driver-assistance systems (ADAS).

Leading Markets & Segments in Europe Electric Vehicle Market

Germany and Norway currently lead the European EV market, with high adoption rates driven by supportive government policies, extensive charging infrastructure, and strong consumer demand. The BEV segment dominates the fuel category, accounting for a major share of total sales. Within vehicle types, passenger vehicles constitute the largest segment, although commercial vehicle electrification is gaining momentum.

- Key Drivers in Leading Markets:

- Germany: Strong government support, well-developed automotive industry, and robust charging infrastructure.

- Norway: Highly ambitious emission reduction targets, extensive incentives, and early adoption of EVs.

- Dominant Segments:

- Fuel Category: BEVs are leading due to their maturity and wider availability.

- Vehicle Type: Passenger vehicles are dominant due to higher consumer demand.

- Region: Germany and Norway lead in terms of market size and adoption rate.

Europe Electric Vehicle Market Product Developments

Recent product developments focus on increasing battery range, enhancing charging speeds, integrating advanced driver-assistance systems, and improving overall vehicle performance. Manufacturers are also focusing on innovative design elements, improved connectivity features, and integration of sustainable materials to enhance the appeal and environmental footprint of their EVs. These advancements directly address consumer concerns regarding range anxiety and driving experience, leading to increased market acceptance and penetration.

Key Drivers of Europe Electric Vehicle Market Growth

The growth of the European EV market is driven by several key factors: stringent government regulations aimed at reducing greenhouse gas emissions, growing consumer awareness of environmental issues, government subsidies and incentives to promote EV adoption, rapid advancements in battery technology leading to improved range and performance, and increasing investments in charging infrastructure development across Europe.

Challenges in the Europe Electric Vehicle Market Market

Significant challenges remain for the European EV market. High initial purchase prices of EVs compared to internal combustion engine (ICE) vehicles remain a barrier to widespread adoption, particularly for price-sensitive consumers. Range anxiety, the fear of running out of battery charge, continues to deter some potential buyers. Furthermore, the uneven distribution of charging infrastructure across European countries creates disparities in EV adoption rates. Supply chain disruptions and the availability of raw materials necessary for battery production pose further challenges.

Emerging Opportunities in Europe Electric Vehicle Market

The long-term growth of the European EV market hinges on several emerging opportunities. Advancements in solid-state battery technology promise to dramatically increase energy density, range, and safety, leading to more competitive EVs. Strategic partnerships between automotive manufacturers and battery producers are strengthening the supply chain and reducing production costs. Expansion into new markets within Europe, particularly in regions with underdeveloped charging infrastructure, offers significant growth potential.

Leading Players in the Europe Electric Vehicle Market Sector

- Bayerische Motoren Werke AG

- Volkswagen AG

- Hyundai Motor Company

- Volvo Car A

- Kia Corporation

- Tesla Inc

- Mercedes-Benz

- Groupe Renault

- Audi AG

- Toyota Motor Corporation

Key Milestones in Europe Electric Vehicle Market Industry

- November 2023: Tesla acquired US-based startup SiILion, bolstering its battery production capabilities. This strategic move signals a push for vertical integration and enhanced battery supply chain security, potentially impacting market competitiveness.

- November 2023: Volkswagen launched the Nivus in Argentina, expanding its global presence and potentially influencing market share in South America. Although not directly impacting the European market, it highlights the company's broader EV strategies.

- November 2023: Tesla opened a new supercharger station in the US, further enhancing its charging infrastructure and potentially influencing consumer perception and adoption. While not directly related to Europe, it demonstrates the company's commitment to bolstering EV infrastructure globally.

Strategic Outlook for Europe Electric Vehicle Market Market

The future of the European EV market appears bright, fueled by strong growth drivers and emerging opportunities. Continued technological advancements, coupled with supportive government policies and increasing consumer demand, are poised to propel market expansion. Strategic partnerships and investments in charging infrastructure will play a crucial role in overcoming existing challenges and unlocking the full potential of this dynamic sector. The market is expected to witness further consolidation, with leading players investing in research and development, expanding production capacity, and strengthening their supply chains.

Europe Electric Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

-

1.2. Passenger Vehicles

- 1.2.1. Hatchback

- 1.2.2. Multi-purpose Vehicle

- 1.2.3. Sedan

- 1.2.4. Sports Utility Vehicle

- 1.3. Two-Wheelers

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Europe Electric Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Passenger Vehicles

- 5.1.2.1. Hatchback

- 5.1.2.2. Multi-purpose Vehicle

- 5.1.2.3. Sedan

- 5.1.2.4. Sports Utility Vehicle

- 5.1.3. Two-Wheelers

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Bayerische Motoren Werke AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Volkswagen AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hyundai Motor Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Volvo Car A

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kia Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Tesla Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mercedes-Benz

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Groupe Renault

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Audi AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Toyota Motor Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Europe Electric Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Electric Vehicle Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: Europe Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Europe Electric Vehicle Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 15: Europe Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Electric Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Vehicle Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Europe Electric Vehicle Market?

Key companies in the market include Bayerische Motoren Werke AG, Volkswagen AG, Hyundai Motor Company, Volvo Car A, Kia Corporation, Tesla Inc, Mercedes-Benz, Groupe Renault, Audi AG, Toyota Motor Corporation.

3. What are the main segments of the Europe Electric Vehicle Market?

The market segments include Vehicle Type, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

November 2023: Tesla has acquired US-based start-up SiILion battery (Battery manufacturer) to excel the battery production in US.November 2023: In Argentina, Volkswagen debuted the brand-new Nivus. Both the Comfortline and Highline models of the VW Nivus will be offered in Argentina. They both come equipped with a 1.0-liter TSi three-cylinder engine that generates 116 horsepower and 200 Nm of torque and is coupled to a six-speed automated transmission.November 2023: Tesla opened its single-point electric vehicle super-charging station between the Bay Area and Los Angeles areas in the US.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence