Key Insights

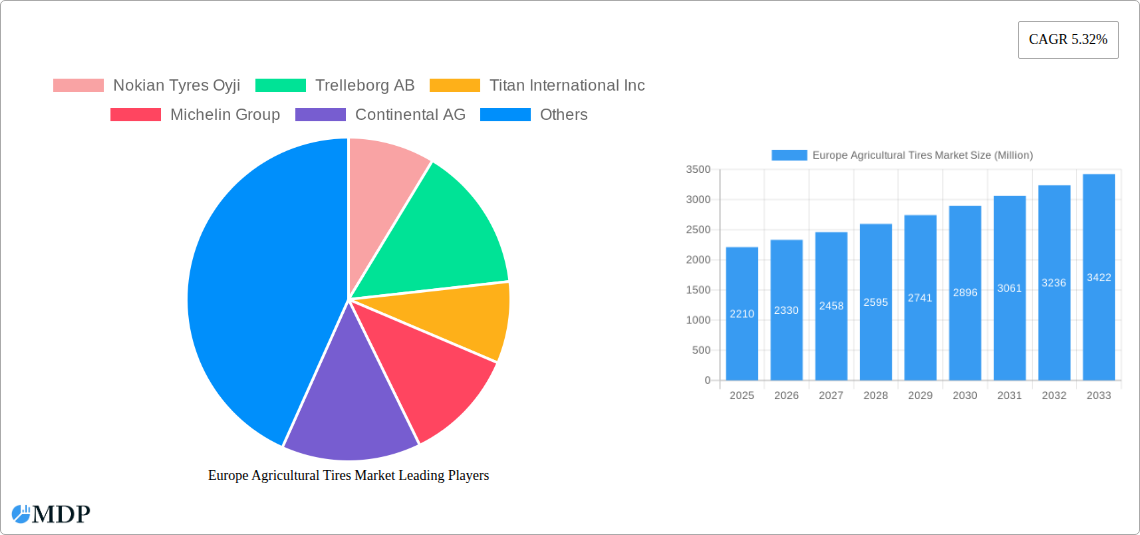

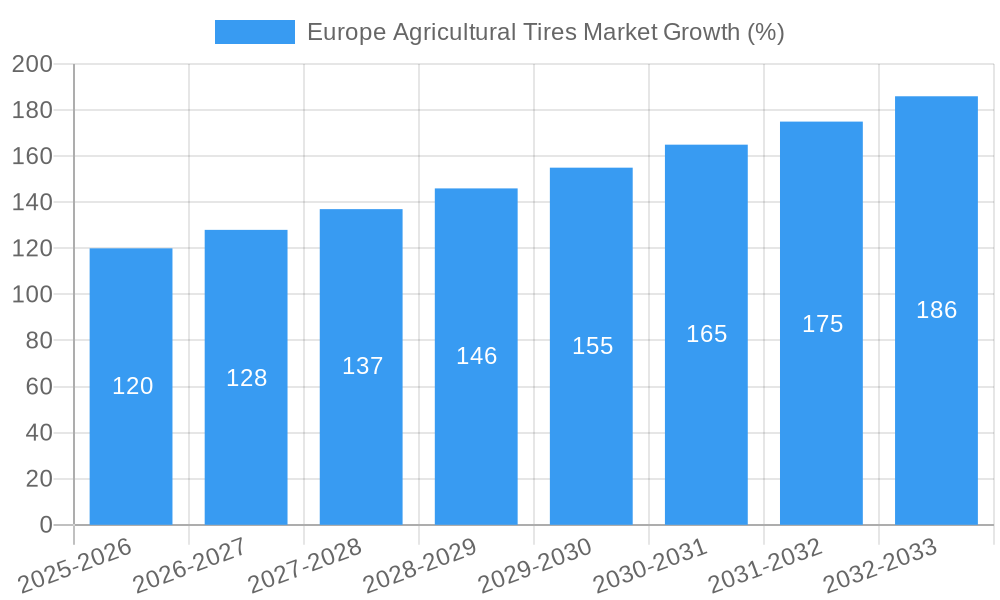

The European agricultural tire market, valued at €2.21 billion in 2025, is projected to experience robust growth, driven by the increasing demand for efficient and high-performance agricultural machinery across major European nations. Factors such as rising agricultural output, modernization of farming practices, and a focus on improving crop yields are key contributors to this market expansion. The market is segmented by application type (tractors, combine harvesters, sprayers, trailers, loaders, and other machinery) and sales channel (OEM and replacement/aftermarket). Tractors currently dominate the application segment, reflecting their widespread use in European agriculture. The replacement/aftermarket segment is expected to witness significant growth due to the aging agricultural machinery fleet requiring frequent tire replacements. Germany, France, and Italy represent the largest national markets within Europe, benefiting from intensive agricultural activities and a relatively high density of farming operations. Growth is further fueled by technological advancements in tire manufacturing, leading to improved tire durability, fuel efficiency, and traction. However, fluctuating raw material prices and potential economic downturns pose potential restraints on market growth. Competitive pressures among established players like Nokian Tyres, Trelleborg AB, Michelin, and Continental, as well as emerging players, are shaping pricing strategies and innovation within the sector. The consistent 5.32% CAGR projected through 2033 indicates a sustained period of market expansion, with significant opportunities for both established and new entrants.

The forecast period (2025-2033) anticipates a continued upward trajectory for the European agricultural tire market, fueled by increasing investments in precision farming technologies and a growing emphasis on sustainable agricultural practices. The market's growth is intrinsically linked to the overall health and productivity of the European agricultural sector. Government policies promoting sustainable agriculture and technological advancements aimed at improving farm efficiency will be crucial in determining the market's pace of expansion. While challenges such as climate change and potential supply chain disruptions exist, the long-term outlook remains positive, driven by the essential role agricultural tires play in optimizing farm operations and maximizing crop yields. Market segmentation will continue to evolve, driven by specific needs of various agricultural machinery types and the adoption of specialized tire technologies. Competitive dynamics will likely remain intense, with companies focusing on product differentiation, technological innovation, and strategic partnerships to maintain their market share.

Europe Agricultural Tires Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Agricultural Tires Market, offering crucial insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. This report is meticulously crafted, offering actionable data and forecasts, without placeholders, to provide a clear understanding of the market landscape and its future trajectory. Key players analyzed include Nokian Tyres Oyji, Trelleborg AB, Titan International Inc, Michelin Group, Continental AG, Prometeon Tyre Group, Yokohama Rubber Co Ltd, Balakrishna Industries Limited, and Bridgestone Corporation. The market is segmented by application type (Tractors, Combine Harvester, Sprayers, Trailers, Loaders, Other Machinery) and sales channel (OEM, Replacement/Aftermarket).

Europe Agricultural Tires Market Market Dynamics & Concentration

The European agricultural tire market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. The market share of the top 5 players is estimated at xx% in 2025. Innovation in tire technology, driven by demand for improved fuel efficiency, traction, and longevity, is a key driver. Stringent environmental regulations across Europe are shaping product development, pushing manufacturers toward eco-friendly materials and manufacturing processes. The market faces competition from alternative materials, but the resilience of rubber-based tires remains strong due to superior performance characteristics. End-user trends toward precision farming and larger machinery are fueling demand for specialized agricultural tires. M&A activity in the sector has been relatively moderate in recent years, with xx major deals recorded between 2019 and 2024. This consolidation trend is expected to continue, driven by the need for scale and technological advancements.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: Improved fuel efficiency, traction, longevity, and eco-friendly materials.

- Regulatory Framework: Stringent environmental regulations impacting material choices and manufacturing processes.

- Product Substitutes: Limited viable alternatives; rubber remains dominant.

- End-User Trends: Shift toward precision farming and larger machinery.

- M&A Activity: xx major deals between 2019-2024.

Europe Agricultural Tires Market Industry Trends & Analysis

The Europe Agricultural Tires Market is projected to witness a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several factors, including rising agricultural output, increasing mechanization in farming, and government initiatives promoting sustainable agricultural practices. Technological advancements, such as smart tire technology that monitors tire pressure and tread depth, are enhancing operational efficiency and reducing downtime. Consumer preferences are shifting towards higher-performance tires offering superior durability, fuel efficiency, and traction in varied terrains. Intense competition among major players is driving innovation and price optimization. Market penetration of premium agricultural tires is increasing, driven by farmers' willingness to invest in higher-quality products for improved productivity and reduced operational costs.

Leading Markets & Segments in Europe Agricultural Tires Market

The Tractor segment dominates the Europe Agricultural Tires Market by application type, accounting for approximately xx% of total market value in 2025. This is primarily due to the widespread use of tractors in various agricultural operations across Europe. The Replacement/Aftermarket sales channel holds a larger market share compared to the OEM channel, reflecting the continuous need for tire replacements in the agricultural sector.

- Dominant Region/Country: Germany, France, and UK are leading markets due to large agricultural sectors and robust economies.

- Dominant Segment (Application): Tractors (xx% market share in 2025), followed by Combine Harvesters and Sprayers.

- Dominant Segment (Sales Channel): Replacement/Aftermarket.

Key Drivers by Region:

- Germany: Strong agricultural infrastructure, supportive government policies, and high farm mechanization rates.

- France: Extensive agricultural land, high adoption of advanced farming techniques, and significant investments in agricultural technology.

- UK: Large-scale farming operations, sophisticated agricultural practices, and relatively high disposable income amongst farmers.

Europe Agricultural Tires Market Product Developments

Recent years have witnessed significant product innovations, including the introduction of tires with improved traction, enhanced durability, and reduced rolling resistance. These advancements cater to the increasing demand for fuel-efficient and high-performance agricultural tires. Manufacturers are incorporating advanced materials and designs to optimize tire performance and extend their lifespan. The focus is on creating products that align with sustainable agricultural practices and reduce the environmental footprint of farming operations. The introduction of smart tire technology allows for real-time monitoring of tire pressure and condition, resulting in improved operational efficiency and reduced downtime.

Key Drivers of Europe Agricultural Tires Market Growth

The European agricultural tire market's growth is driven by a combination of factors including rising agricultural output spurred by increasing global population and demand for food. Increased mechanization in farming operations necessitate more tires. Government incentives and policies encouraging the adoption of sustainable agricultural practices and modern farming techniques are also playing a vital role. Technological advancements leading to the development of high-performance, fuel-efficient tires further fuel this growth.

Challenges in the Europe Agricultural Tires Market Market

The market faces challenges including volatile raw material prices impacting production costs. Supply chain disruptions and logistical bottlenecks can lead to delays and increased expenses. Intense competition among established players and new entrants pressures profit margins. Stringent environmental regulations impose compliance costs, adding to the financial burden. The fluctuation of agricultural commodity prices can influence investment decisions in new tire technology.

Emerging Opportunities in Europe Agricultural Tires Market

The market presents significant growth opportunities. The adoption of precision farming techniques and autonomous vehicles creates demand for specialized agricultural tires. Strategic partnerships between tire manufacturers and agricultural machinery companies enable the development of integrated solutions. The expansion into emerging markets in Eastern Europe creates new sales channels. Technological advancements in tire materials and designs will continue to unlock further efficiency and performance gains.

Leading Players in the Europe Agricultural Tires Market Sector

- Nokian Tyres Oyj

- Trelleborg AB

- Titan International Inc

- Michelin Group

- Continental AG

- Prometeon Tyre Group

- Yokohama Rubber Co Ltd

- Balakrishna Industries Limited

- Bridgestone Corporation

Key Milestones in Europe Agricultural Tires Market Industry

- April 2022: Bridgestone's VX-TRACTOR patterned tires approved for selected New Holland T6 and T7 Series tractors in Ireland and the UK (28-42 inch sizes).

- May 2023: Bridgestone introduces its new premium VX-R TRACTOR tire range for Europe and Asia Pacific markets, featuring wide-tread traction, long wear life, and excellent driver comfort.

Strategic Outlook for Europe Agricultural Tires Market Market

The future of the Europe Agricultural Tires Market looks promising, driven by sustained growth in the agricultural sector, technological innovation, and supportive government policies. Strategic partnerships, investments in R&D, and expansion into new markets will be crucial for success. Focus on sustainability and the development of eco-friendly tires will gain importance. Companies that can adapt to evolving market demands and technological advancements are poised for significant growth in the years to come.

Europe Agricultural Tires Market Segmentation

-

1. Application Type

- 1.1. Tractors

- 1.2. Combine Harvester

- 1.3. Sprayers

- 1.4. Trailers

- 1.5. Loaders

- 1.6. Other Machinery

-

2. Sales Channel

- 2.1. OEM

- 2.2. Replacement/Aftermarket

Europe Agricultural Tires Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Europe Agricultural Tires Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advances in Agricultural Equipment

- 3.3. Market Restrains

- 3.3.1. Low Quality of Duplicate Tyres

- 3.4. Market Trends

- 3.4.1. Aftermarket Tires Segment to Gain Momentum Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Tractors

- 5.1.2. Combine Harvester

- 5.1.3. Sprayers

- 5.1.4. Trailers

- 5.1.5. Loaders

- 5.1.6. Other Machinery

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. OEM

- 5.2.2. Replacement/Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Germany Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nokian Tyres Oyji

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Trelleborg AB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Titan International Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Michelin Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Continental AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Prometeon Tyre Group*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Yokohama Rubber Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Balakrishna Industries Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bridgestone Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Nokian Tyres Oyji

List of Figures

- Figure 1: Europe Agricultural Tires Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Agricultural Tires Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Agricultural Tires Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Europe Agricultural Tires Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 4: Europe Agricultural Tires Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 14: Europe Agricultural Tires Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 15: Europe Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Europe Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Agricultural Tires Market?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Europe Agricultural Tires Market?

Key companies in the market include Nokian Tyres Oyji, Trelleborg AB, Titan International Inc, Michelin Group, Continental AG, Prometeon Tyre Group*List Not Exhaustive, Yokohama Rubber Co Ltd, Balakrishna Industries Limited, Bridgestone Corporation.

3. What are the main segments of the Europe Agricultural Tires Market?

The market segments include Application Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advances in Agricultural Equipment.

6. What are the notable trends driving market growth?

Aftermarket Tires Segment to Gain Momentum Over the Forecast Period.

7. Are there any restraints impacting market growth?

Low Quality of Duplicate Tyres.

8. Can you provide examples of recent developments in the market?

May 2023: Bridgestone introduces its new premium VX-R TRACTOR tire range with wide-tread traction, long wear life, and excellent driver comfort for Europe and Asia Pacific Markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Agricultural Tires Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Agricultural Tires Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Agricultural Tires Market?

To stay informed about further developments, trends, and reports in the Europe Agricultural Tires Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence