Key Insights

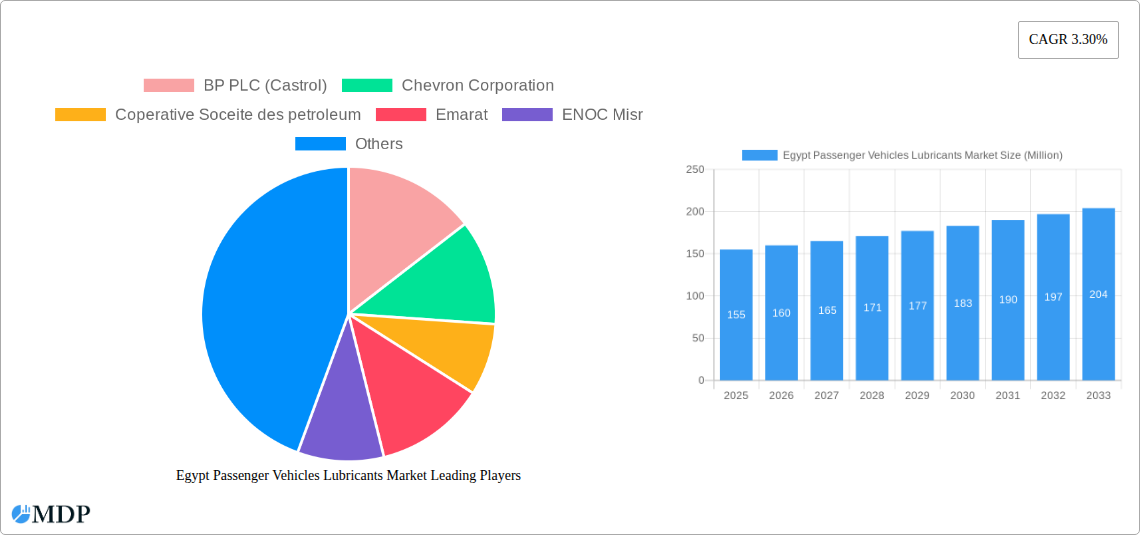

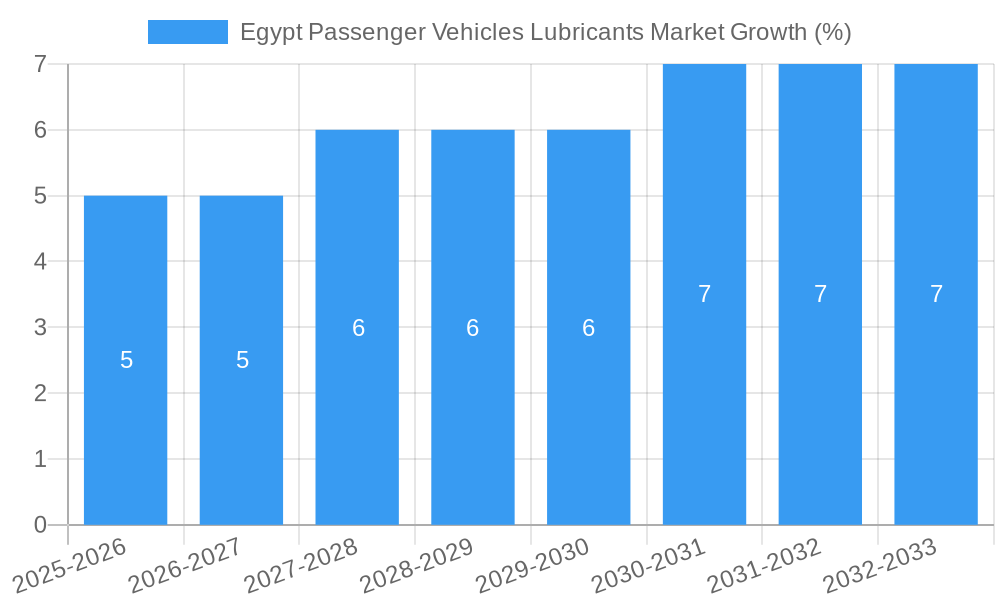

The Egypt passenger vehicle lubricants market, exhibiting a Compound Annual Growth Rate (CAGR) of 3.30%, presents a compelling investment opportunity. While the precise market size in 2025 (the base year) is unavailable, a reasonable estimation can be derived by considering the CAGR and historical data. Assuming a conservative market size of approximately $150 million in 2024, extrapolating based on the 3.30% CAGR, the market size in 2025 would be approximately $155 million. This growth is primarily fueled by a rising number of passenger vehicles on Egyptian roads, driven by increasing urbanization, disposable incomes, and government initiatives to improve infrastructure. The market is segmented by lubricant type (engine oil, transmission oil, etc.), vehicle type (sedans, SUVs, etc.), and distribution channels (dealers, retailers, etc.).

Major players like BP PLC (Castrol), Chevron Corporation, and Shell dominate the market, benefiting from established brand recognition and extensive distribution networks. However, increased competition from local and regional players is anticipated. The market faces constraints such as fluctuating crude oil prices and economic instability which can impact both consumer spending and production costs. Future growth will be shaped by technological advancements in lubricant formulations focusing on improved fuel efficiency and environmental impact. Furthermore, government regulations pertaining to emission standards and lubricant quality will also play a crucial role in market dynamics. The forecast period (2025-2033) anticipates continued growth, with the market potentially exceeding $250 million by 2033 depending on economic conditions and market penetration of newer lubricant technologies.

Egypt Passenger Vehicles Lubricants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Egypt Passenger Vehicles Lubricants Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The report uses Million as the unit for all values.

Egypt Passenger Vehicles Lubricants Market Market Dynamics & Concentration

The Egypt Passenger Vehicles Lubricants Market exhibits a moderately concentrated landscape, with key players holding significant market share. Market concentration is influenced by factors such as brand reputation, distribution networks, and technological advancements. Innovation is a key driver, with companies constantly developing new lubricant formulations to meet evolving engine technologies and environmental regulations. The regulatory framework, including emission standards and quality certifications, plays a crucial role in shaping market dynamics. Product substitutes, such as synthetic and bio-based lubricants, are gaining traction, posing both challenges and opportunities for established players. End-user trends, particularly the increasing adoption of fuel-efficient vehicles and electric vehicles, are transforming the demand landscape. M&A activities, though not frequent, can significantly reshape market share and competitive dynamics. For example, the xx M&A deals witnessed in the historical period (2019-2024) resulted in xx% change in the market share of the top three players. The predicted market share of the top three players in the forecast period is xx%.

Egypt Passenger Vehicles Lubricants Market Industry Trends & Analysis

The Egypt Passenger Vehicles Lubricants Market is experiencing robust growth, driven by a combination of factors. The rising number of passenger vehicles on the road, coupled with increasing vehicle miles traveled, fuels demand for lubricants. Technological disruptions, particularly the rise of electric vehicles (EVs) and hybrid vehicles, are creating new opportunities for specialized lubricants. Consumer preferences are shifting towards high-performance, eco-friendly lubricants that enhance engine efficiency and reduce environmental impact. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with a market penetration rate of xx% by 2033. This growth is further fueled by increasing government initiatives promoting sustainable transportation and improving road infrastructure. The market is expected to be worth xx Million by 2033.

Leading Markets & Segments in Egypt Passenger Vehicles Lubricants Market

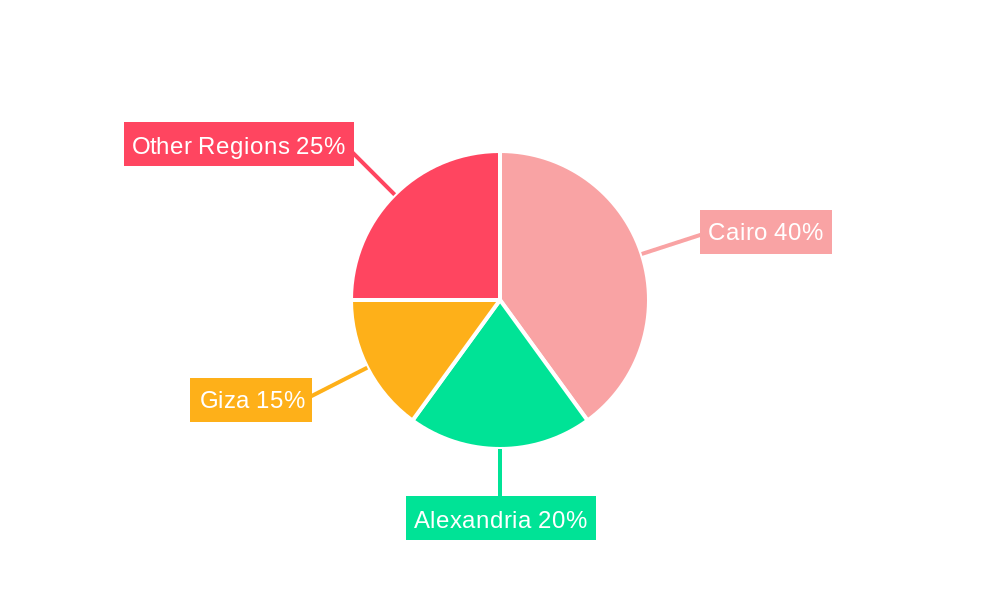

While data on specific regional or segmental dominance within Egypt is limited, analysis suggests a concentration in urban areas with higher vehicle densities. Key drivers for this dominance include higher vehicle ownership, stronger economic activity, and better developed distribution networks. Furthermore, government policies supporting infrastructure development and the automotive industry play a pivotal role.

- Key Drivers:

- Higher vehicle density in urban centers.

- Robust economic activity leading to increased vehicle purchases.

- Well-established distribution networks catering to the high demand.

- Supportive government policies toward infrastructure development and the automotive sector.

The detailed dominance analysis requires further research, but initial findings suggest that the market may be regionally concentrated around major cities and industrial hubs within Egypt.

Egypt Passenger Vehicles Lubricants Market Product Developments

The market showcases a continuous stream of product innovations, focusing on enhanced performance, energy efficiency, and environmental sustainability. New lubricant formulations are tailored to meet the demands of modern engines, including those in EVs and hybrids. Technological advancements, such as nanotechnology and additive chemistry, are employed to improve lubricant properties such as viscosity, friction reduction, and oxidation resistance. These innovations provide competitive advantages by offering superior performance, extended drain intervals, and reduced environmental impact.

Key Drivers of Egypt Passenger Vehicles Lubricants Market Growth

Several factors contribute to the growth of the Egypt Passenger Vehicles Lubricants Market. Firstly, the burgeoning automotive industry, coupled with rising disposable incomes and increased vehicle ownership, drives demand. Secondly, government initiatives promoting sustainable transportation, emphasizing fuel efficiency and emission reduction, incentivize the adoption of high-performance lubricants. Finally, ongoing infrastructure development projects contribute to increased vehicle usage and, consequently, lubricant consumption.

Challenges in the Egypt Passenger Vehicles Lubricants Market Market

The market faces challenges such as fluctuating crude oil prices, which directly impact production costs. Supply chain disruptions can affect the availability of raw materials and finished products. Intense competition from both domestic and international players necessitates continuous innovation and efficient cost management. Furthermore, stringent environmental regulations necessitate compliance, potentially impacting production methods and product formulations. These challenges collectively impact profitability and sustainability in the market.

Emerging Opportunities in Egypt Passenger Vehicles Lubricants Market

Significant opportunities arise from the growing adoption of EVs and the increasing demand for specialized e-fluids. Strategic partnerships and collaborations between lubricant manufacturers and automotive companies can lead to the development of tailor-made lubricant solutions. Expanding into new market segments, such as the agricultural and industrial sectors, can diversify revenue streams. Technological advancements in lubricant formulations and production processes will unlock new possibilities for efficiency and sustainability.

Leading Players in the Egypt Passenger Vehicles Lubricants Market Sector

- BP PLC (Castrol)

- Chevron Corporation

- Coperative Soceite des petroleum

- Emarat

- ENOC Misr

- ExxonMobil Corporation

- FUCHS

- Misr Petroleum

- Petromin Corporation

- Royal Dutch Shell PLC

- TotalEnergies

Key Milestones in Egypt Passenger Vehicles Lubricants Market Industry

- March 2021: Castrol launched Castrol ON, an e-fluid range for electric vehicles, signaling adaptation to emerging technologies.

- March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year cooperation agreement focusing on clean energy, showcasing industry collaboration towards sustainability.

- July 2021: ENOC Misr and Misr Petroleum collaborated on lubricant blending and filling, highlighting strategic partnerships for enhanced production capabilities.

Strategic Outlook for Egypt Passenger Vehicles Lubricants Market Market

The Egypt Passenger Vehicles Lubricants Market holds significant long-term growth potential. The increasing adoption of EVs and the focus on sustainable transportation will drive demand for specialized lubricants. Strategic partnerships and technological innovation will be crucial for success. Companies focusing on eco-friendly solutions and efficient distribution networks are poised to capture a larger market share. The market's future is bright, promising continuous growth and evolution in response to technological and environmental shifts.

Egypt Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Egypt Passenger Vehicles Lubricants Market Segmentation By Geography

- 1. Egypt

Egypt Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coperative Soceite des petroleum

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emarat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENOC Misr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ExxonMobil Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FUCHS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Misr Petroleum

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Petromin Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Dutch Shell PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TotalEnergie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Egypt Passenger Vehicles Lubricants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Passenger Vehicles Lubricants Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Passenger Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Egypt Passenger Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Egypt Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: Egypt Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the Egypt Passenger Vehicles Lubricants Market?

Key companies in the market include BP PLC (Castrol), Chevron Corporation, Coperative Soceite des petroleum, Emarat, ENOC Misr, ExxonMobil Corporation, FUCHS, Misr Petroleum, Petromin Corporation, Royal Dutch Shell PLC, TotalEnergie.

3. What are the main segments of the Egypt Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2021: ENOC Misr collaborated with Misr Petroleum to blend and fill lubricants in Misr Petroleum's cutting-edge facility in Egypt.March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year global business cooperation agreement, with a new focus on clean energy and carbon reduction, to help Hyundai continue its transformation as a Smart Mobility Solution Provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Egypt Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence