Key Insights

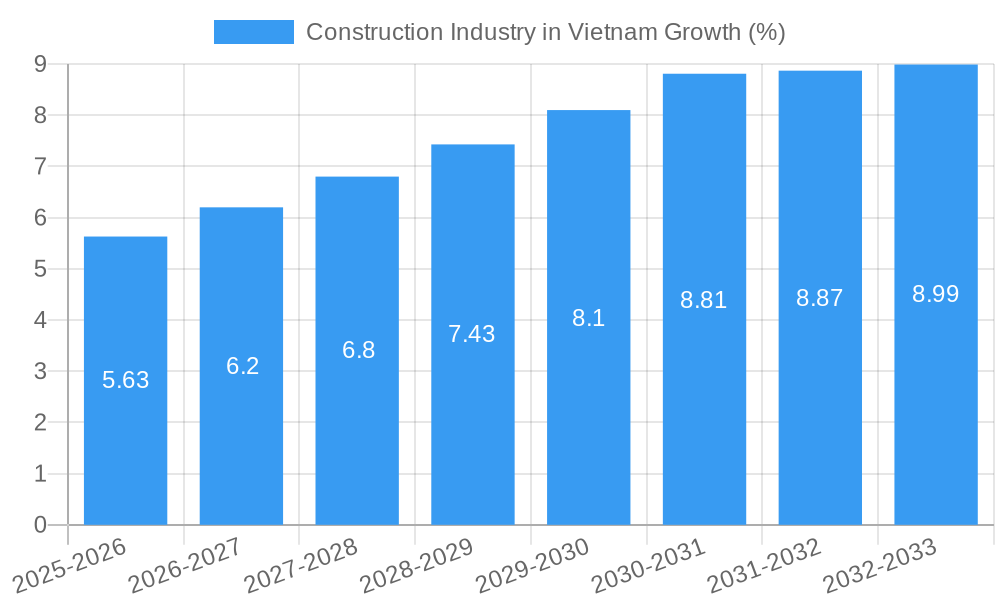

The Vietnamese construction industry, valued at $69.20 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 8.10% from 2025 to 2033. This growth is fueled by several key factors. Firstly, significant government investment in infrastructure development, particularly in transportation networks and energy projects, is driving demand for construction services. Secondly, rapid urbanization and a rising middle class are boosting residential and commercial construction activities. The expansion of industrial zones to attract foreign investment further contributes to the industry's expansion. Key segments include residential, commercial, industrial, infrastructure (transportation), and energy & utilities construction, each contributing differently to the overall market size and growth trajectory. Leading players like Coteccons, Hoa Binh, and Vincons are actively shaping the market landscape, alongside international players like Hyundai Engineering & Construction. However, challenges such as material price volatility, labor shortages, and regulatory hurdles need to be addressed to sustain this growth momentum.

The forecast period (2025-2033) is expected to witness a consistent rise in market value, driven by ongoing infrastructure projects and sustained economic growth. While the exact contribution of each sector is unavailable, it's reasonable to assume that infrastructure and residential construction will be major growth drivers, given government initiatives and demographic trends. The competitive landscape will likely see increased mergers and acquisitions, as companies strive for scale and efficiency. The industry's success hinges on effectively managing supply chain disruptions, adopting sustainable construction practices, and investing in technological advancements to enhance productivity and efficiency. Further research into specific sector growth rates would provide a more granular understanding of the market's future.

Construction Industry in Vietnam: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of Vietnam's construction industry, offering valuable insights for investors, stakeholders, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, key players, emerging trends, and future prospects of this rapidly growing sector. The report projects a market size exceeding XX Million USD by 2033, presenting significant investment opportunities.

Construction Industry in Vietnam Market Dynamics & Concentration

Vietnam's construction industry is experiencing robust growth, driven by significant investments in infrastructure, rapid urbanization, and a burgeoning real estate market. Market concentration is moderate, with several large players dominating specific segments while numerous smaller firms compete in niche areas. The industry is characterized by intense competition, leading to frequent mergers and acquisitions (M&A) activity. The regulatory framework, while evolving, can present both opportunities and challenges for businesses. The increasing adoption of sustainable building practices and technological innovations is reshaping the industry landscape.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, with projections suggesting a slight increase to xx% by 2033.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024, indicating a strong appetite for consolidation within the industry.

- Innovation Drivers: Government initiatives promoting sustainable construction, coupled with rising demand for advanced building technologies, are driving innovation.

- Regulatory Framework: The government’s focus on infrastructure development and foreign investment creates both opportunities and challenges related to licensing, permits, and environmental regulations.

- Product Substitutes: The emergence of prefabricated construction methods and modular buildings presents alternatives to traditional construction approaches.

- End-User Trends: Growing demand for high-quality, sustainable, and technologically advanced buildings influences product development and market segmentation.

Construction Industry in Vietnam Industry Trends & Analysis

The Vietnamese construction industry is characterized by a strong Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), projected to reach xx% during the forecast period (2025-2033). This growth is driven by several factors, including increased government spending on infrastructure projects, rapid urbanization, and a robust real estate sector. However, the industry also faces challenges such as material price volatility, skilled labor shortages, and fluctuating foreign investment. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and other digital technologies are gradually increasing efficiency and productivity. Consumer preferences are shifting towards sustainable and energy-efficient buildings, creating new opportunities for companies embracing green construction practices. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, particularly in specialized segments like renewable energy construction. Market penetration of advanced construction technologies remains relatively low, providing significant room for growth and innovation.

Leading Markets & Segments in Construction Industry in Vietnam

Residential construction remains the largest segment, contributing approximately xx% to the overall market value in 2025, followed by Commercial construction (xx%) and Infrastructure (xx%). The South-East region of Vietnam dominates the overall market, driven by its high population density, economic dynamism, and significant infrastructure investments.

- Residential Construction: Key drivers include population growth, rising disposable incomes, and government policies promoting affordable housing.

- Commercial Construction: Driven by economic growth, increasing foreign investment, and the expansion of retail and hospitality sectors.

- Industrial Construction: Fueled by the growth of manufacturing and export-oriented industries.

- Infrastructure (Transportation) Construction: Government initiatives focusing on upgrading roads, railways, and ports are significantly boosting this segment.

- Energy and Utilities Construction: Increasing demand for electricity and renewable energy sources drives considerable investment in power plants and related infrastructure.

Construction Industry in Vietnam Product Developments

The Vietnamese construction industry is witnessing a gradual shift towards advanced building materials, prefabricated components, and innovative construction techniques. The adoption of Building Information Modeling (BIM) is enhancing design efficiency and reducing construction errors. The growing focus on sustainable development is driving demand for eco-friendly materials and energy-efficient building designs. This creates competitive advantages for firms that can effectively leverage these technological advancements and cater to the increasing demand for sustainable and high-performance buildings.

Key Drivers of Construction Industry in Vietnam Growth

Several factors are fueling the growth of Vietnam's construction industry. These include: robust economic growth, increased government spending on infrastructure, rising urbanization, a growing middle class boosting demand for housing, and favorable government policies promoting foreign investment. Technological advancements, such as the adoption of BIM and advanced construction materials, further enhance productivity and efficiency. Moreover, the nation's strategic location and participation in regional trade agreements are also boosting investment.

Challenges in the Construction Industry in Vietnam Market

Despite the strong growth potential, several challenges hinder the industry's development. These include skilled labor shortages, fluctuating material prices, bureaucratic procedures, and regulatory uncertainties that can delay project implementation. Competition remains intense, squeezing profit margins for many firms. Supply chain disruptions, especially during the recent pandemic, also posed significant difficulties for the sector. The impact of these challenges amounts to an estimated loss of xx Million USD annually in 2024, affecting overall productivity and market stability.

Emerging Opportunities in Construction Industry in Vietnam

The long-term growth of Vietnam's construction industry is driven by several emerging opportunities. The government’s emphasis on sustainable infrastructure development presents opportunities for firms specializing in green building technologies and sustainable construction practices. Further expansion into rural areas and the development of smart cities will also create substantial demand. Strategic partnerships between local and international companies can leverage expertise and capital to drive technological advancements and improve project execution.

Leading Players in the Construction Industry in Vietnam Sector

- Newtecons Vietnam

- Coteccons Construction JSC

- Hoa Binh Construction Group JSC

- Visicons Construction and Investment JSC

- Ricons Construction Investment Group JSC

- Hung Thinh Incons JSC

- Danieli & C Officine Meccaniche SpA

- An Phong

- Vincons Vietnam Construction JSC

- Takco

- Delta Corp

- Choyoda Corp

- COFICO

- Fecon Corp JSC

- Hyundai Engineering & Construction Co Ltd

- Song Da Corp JSC

- ECOBA Vietnam JSC

- Central Cons

- GS Engineering and Construction

- CTCI Corp

Key Milestones in Construction Industry in Vietnam Industry

- November 2023: COFICO and partners completed the Taking Over Singing Ceremony for a new Betalactam factory in Hau Giang province, highlighting the growing demand for high-tech pharmaceutical facilities and the opportunities for specialized construction firms.

- October 2023: Song Da Corp JSC's involvement in the 500kV circuit 3 line project underscores the government's commitment to enhancing national power grid infrastructure, creating significant opportunities for large-scale infrastructure contractors.

Strategic Outlook for Construction Industry in Vietnam Market

Vietnam's construction industry holds immense long-term potential. Continued urbanization, infrastructure development, and government support will drive sustained growth. Strategic partnerships, technological advancements, and a focus on sustainable practices will be key to success. The focus should be on embracing innovation, streamlining regulatory processes, and developing a skilled workforce to capitalize on the industry's considerable growth potential.

Construction Industry in Vietnam Segmentation

-

1. Sector

- 1.1. Residential Construction

- 1.2. Commercial Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

Construction Industry in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and population growth; Government policies and Foreign Investnents

- 3.3. Market Restrains

- 3.3.1. Skilled Labor Shortage; Material Price Fluctuations

- 3.4. Market Trends

- 3.4.1. Government plans to develop Infrastructure driving the Construction Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential Construction

- 5.1.2. Commercial Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential Construction

- 6.1.2. Commercial Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential Construction

- 7.1.2. Commercial Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential Construction

- 8.1.2. Commercial Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential Construction

- 9.1.2. Commercial Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential Construction

- 10.1.2. Commercial Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Newtecons Vietnam

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Coteccons Construction JSC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hoa Binh Construction Group JSC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Visicons Construction and Investment JSC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ricons Construction Investment Group JSC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hung Thinh Incons JSC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danieli & C Officine Meccaniche SpA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 An Phong

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vincons Vietnam Construction JSC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Takco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Delta Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Choyoda Corp

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 COFICO

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Fecon Corp JSC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hyundai Engineering & Construction Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Song Da Corp JSC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ECOBA Vietnam JSC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Central Cons**List Not Exhaustive

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 GS Engineering and Construction

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 CTCI Corp

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Newtecons Vietnam

List of Figures

- Figure 1: Global Construction Industry in Vietnam Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Vietnam Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 3: Vietnam Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Construction Industry in Vietnam Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Construction Industry in Vietnam Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Construction Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Construction Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Industry in Vietnam Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Industry in Vietnam Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Construction Industry in Vietnam Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Construction Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Construction Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Vietnam?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Construction Industry in Vietnam?

Key companies in the market include Newtecons Vietnam, Coteccons Construction JSC, Hoa Binh Construction Group JSC, Visicons Construction and Investment JSC, Ricons Construction Investment Group JSC, Hung Thinh Incons JSC, Danieli & C Officine Meccaniche SpA, An Phong, Vincons Vietnam Construction JSC, Takco, Delta Corp, Choyoda Corp, COFICO, Fecon Corp JSC, Hyundai Engineering & Construction Co Ltd, Song Da Corp JSC, ECOBA Vietnam JSC, Central Cons**List Not Exhaustive, GS Engineering and Construction, CTCI Corp.

3. What are the main segments of the Construction Industry in Vietnam?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and population growth; Government policies and Foreign Investnents.

6. What are the notable trends driving market growth?

Government plans to develop Infrastructure driving the Construction Market.

7. Are there any restraints impacting market growth?

Skilled Labor Shortage; Material Price Fluctuations.

8. Can you provide examples of recent developments in the market?

November 2023: COFICO and joint venture partners TVC and Searefico opportunistically attended the Taking Over Singing Ceremony of The New Betalactam Factory that Meets Global GMP Standards for the Investor – DHG Pharmaceutical Joint Stock Company. The project is located at Tan Phu Thanh Industrial Park – Phase 1, Chau Thanh A district, Hau Giang province, with a total project area of about 6 hectares. It is expected that after completion and operation in 2024, the Betalactam factory will meet global GMP standards, requiring high technical specifications in the stages of design, construction, and finishing. This project holds particular significance for the plan to develop high-quality product lines and deliver numerous qualified product lines to replace imported drugs for consumers of DHG Pharma.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Vietnam?

To stay informed about further developments, trends, and reports in the Construction Industry in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence