Key Insights

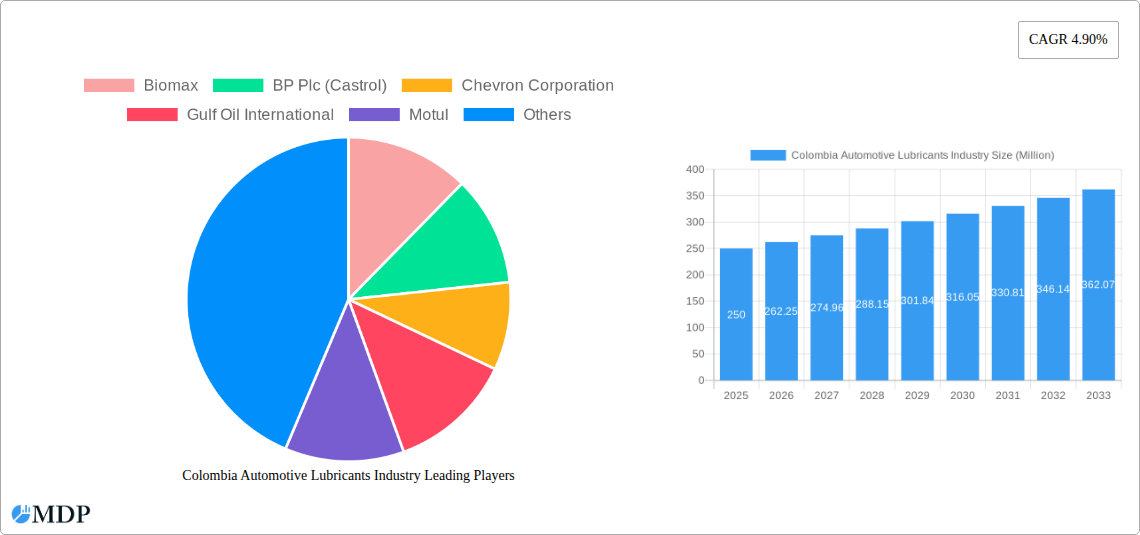

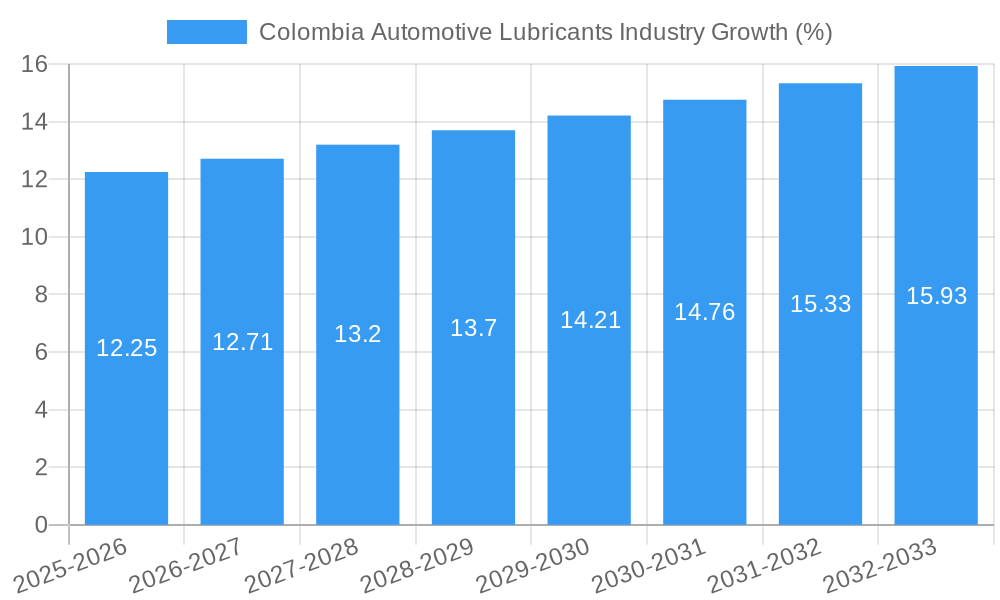

The Colombian automotive lubricants market, valued at approximately $250 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.90% from 2025 to 2033. This expansion is driven by several key factors. The increasing number of vehicles on Colombian roads, fueled by a growing middle class and improving infrastructure, significantly boosts demand for lubricants. Furthermore, the government's focus on infrastructure development and automotive manufacturing stimulates economic activity and subsequently, the need for vehicle maintenance and repair services, which rely heavily on lubricants. A shift towards higher-quality, synthetic lubricants, driven by consumer preference for enhanced engine performance and extended lifespan, contributes to market growth. However, price volatility in crude oil and fluctuating exchange rates present challenges to market stability. Competitive pressures from both domestic and international players also influence pricing strategies and market share dynamics. The segment encompassing passenger vehicles likely dominates the market due to higher vehicle density compared to commercial vehicles.

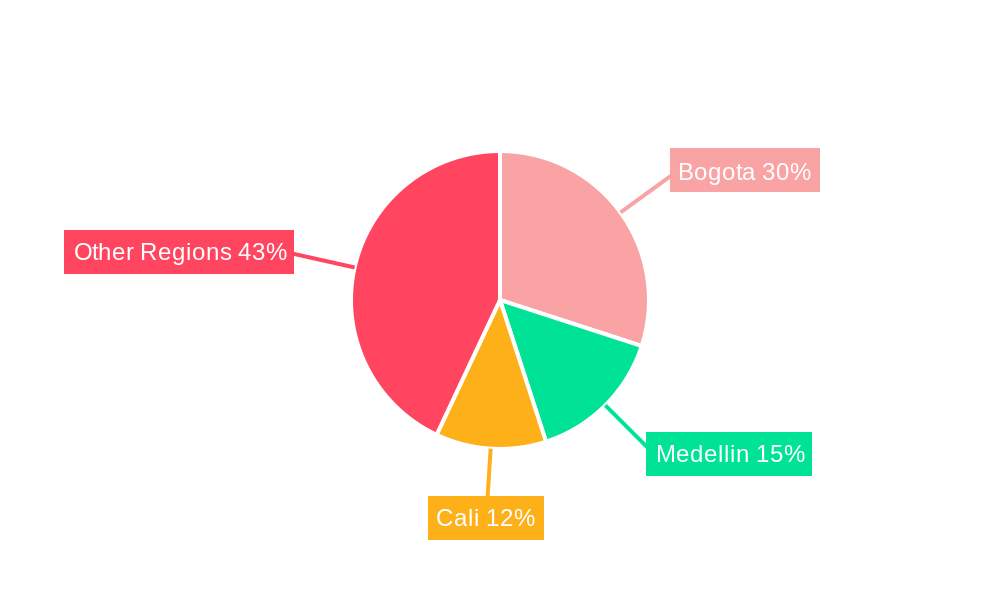

The market segmentation reveals a diverse landscape, with key players such as Biomax, BP Plc (Castrol), Chevron Corporation, Gulf Oil International, Motul, Petrobras, Petromil SA, Primax, Royal Dutch Shell PLC, Terpel, TotalEnergies, and Valvoline Inc. These companies compete through product differentiation, branding strategies, and distribution networks. The regional distribution likely reflects population density and economic activity, with major cities and economically active regions showing higher demand. The forecast period (2025-2033) is expected to witness further market consolidation, as companies strive to optimize their supply chains and cater to the evolving needs of the Colombian automotive sector. Technological advancements in lubricant formulation, focused on improved fuel efficiency and environmental sustainability, are expected to shape the market’s future trajectory.

Colombia Automotive Lubricants Industry: 2019-2033 Market Report

Dive deep into the dynamic Colombian automotive lubricants market with this comprehensive report, offering invaluable insights for industry stakeholders. This in-depth analysis covers the period 2019-2033, with a focus on the estimated year 2025. Unlock actionable strategies, identify emerging opportunities, and navigate the competitive landscape with data-driven clarity.

Colombia Automotive Lubricants Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, regulatory influences, and market trends within the Colombian automotive lubricants sector. The report examines market concentration through metrics such as market share held by key players (xx% for the top 3 players in 2025). This includes an assessment of M&A activity, with a projected xx number of deals anticipated during the forecast period (2025-2033). Factors driving innovation, including technological advancements and evolving consumer preferences, are meticulously evaluated. The impact of government regulations, the availability of substitute products, and the prevalent end-user trends are thoroughly explored, providing a holistic understanding of the market's dynamic nature. The historical period (2019-2024) serves as a foundation, revealing past trends that shape the current and future landscape.

- Market Concentration: Analysis of market share distribution among key players, including Biomax, BP Plc (Castrol), Chevron Corporation, Gulf Oil International, Motul, Petrobras, Petromil SA, Primax, Royal Dutch Shell PLC, Terpel, TotalEnergies, and Valvoline Inc.

- Innovation Drivers: Exploration of technological advancements, such as the development of synthetic lubricants and enhanced performance additives.

- Regulatory Framework: Assessment of government policies and regulations impacting the industry.

- Product Substitutes: Evaluation of competing products and their market impact.

- End-User Trends: Analysis of changing consumer preferences and their influence on product demand.

- M&A Activities: Review of past and projected merger and acquisition activity, including deal counts and their implications.

Colombia Automotive Lubricants Industry Industry Trends & Analysis

This section delves into the key trends shaping the Colombian automotive lubricants market, offering a comprehensive analysis of market growth drivers, technological advancements, evolving consumer preferences, and the competitive dynamics at play. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), based on factors including rising vehicle ownership, expanding industrial sectors, and the increasing adoption of advanced lubricant technologies. Market penetration rates for various lubricant types (e.g., synthetic oils, biolubricants) are also analyzed. The impact of technological disruptions, such as the shift towards electric vehicles and the development of sustainable lubricants, is thoroughly assessed.

- Market Growth Drivers: Analysis of factors driving market expansion, including economic growth, infrastructure development, and urbanization.

- Technological Disruptions: Evaluation of the impact of technological advancements on market dynamics.

- Consumer Preferences: Examination of changing consumer preferences toward specific lubricant types and brands.

- Competitive Dynamics: Analysis of competitive strategies employed by key players, including pricing, product differentiation, and distribution networks.

Leading Markets & Segments in Colombia Automotive Lubricants Industry

This section identifies the dominant regions, segments, and countries within the Colombian automotive lubricants market. The analysis uses a multifaceted approach incorporating economic indicators, infrastructure assessments, and market dynamics. Key drivers behind the dominance of specific regions or segments are highlighted, revealing critical factors that influence market share and growth potential. The report offers a deep dive into the reasons for the leading market's dominance, providing a detailed understanding of its competitive advantages and growth prospects.

- Key Drivers for Dominant Region/Segment:

- Economic Policies (e.g., government incentives for automotive manufacturing).

- Infrastructure Development (e.g., improved road networks and logistics).

- Demographic Trends (e.g., rising middle class and increased vehicle ownership).

- Dominance Analysis: A detailed examination of factors contributing to the dominance of the identified region/segment.

Colombia Automotive Lubricants Industry Product Developments

This section provides an overview of recent and anticipated product innovations, highlighting their applications and competitive advantages. The emphasis is on emerging technological trends and the market fit of new products. The section discusses the shift toward higher-performance, eco-friendly lubricants, including synthetic oils, biolubricants, and low-viscosity formulations. This analysis accounts for the demands of modern vehicles and environmental regulations. The competitive landscape is assessed in relation to the technological superiority and market appeal of new products.

Key Drivers of Colombia Automotive Lubricants Industry Growth

The growth of the Colombian automotive lubricants industry is driven by a confluence of factors. Economic expansion fuels increased vehicle sales and industrial activity, boosting demand for lubricants. Technological advancements, such as the development of higher-performance lubricants and fuel-efficient formulations, also contribute significantly. Furthermore, supportive government policies and infrastructure development enhance the market's growth potential.

Challenges in the Colombia Automotive Lubricants Industry Market

The Colombian automotive lubricants market faces several challenges. Fluctuations in crude oil prices impact production costs and profitability. Stringent environmental regulations require manufacturers to invest in greener products, increasing operational expenses. Furthermore, intense competition among established and emerging players poses a significant challenge to market share and profitability. The impact of these challenges is quantified where possible using available market data. The import and export dynamics also influence market stability.

Emerging Opportunities in Colombia Automotive Lubricants Industry

The long-term growth of the Colombian automotive lubricants industry is underpinned by several opportunities. The increasing adoption of advanced technologies, such as the development of electric vehicles and biofuels, will demand innovative lubricant solutions. Strategic partnerships and collaborations between industry players can foster technological advancements and market expansion. The burgeoning automotive sector and the rising middle class present significant market potential for growth.

Leading Players in the Colombia Automotive Lubricants Industry Sector

- Biomax

- BP Plc (Castrol)

- Chevron Corporation

- Gulf Oil International

- Motul

- Petrobras

- Petromil SA

- Primax

- Royal Dutch Shell PLC

- Terpel

- TotalEnergies

- Valvoline Inc

Key Milestones in Colombia Automotive Lubricants Industry Industry

- August 2021: Motul launched a new and improved version of its flagship product, showcasing its enhanced performance at the 24 Hours of Le Mans. This boosted brand image and market share.

- August 2021: Megacomercial expanded its Motul distribution network to include Antioquia, Chocó, and the Atlantic Coast in the motorcycle segment, increasing market reach.

- October 2021: Valvoline and Cummins extended their collaboration agreement, securing Valvoline's position as a preferred lubricant supplier for Cummins' products. This strengthened Valvoline's market position and distribution channels.

Strategic Outlook for Colombia Automotive Lubricants Industry Market

The Colombian automotive lubricants market holds considerable future potential. Continued economic growth, infrastructure development, and rising vehicle ownership will drive demand for lubricants. The adoption of advanced technologies and the increasing focus on environmental sustainability will shape product innovation and market dynamics. Strategic partnerships and collaborations will play a crucial role in shaping the future landscape. Companies that adapt to changing consumer preferences and embrace sustainable practices will be best positioned for long-term success.

Colombia Automotive Lubricants Industry Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Transmission & Gear Oils

Colombia Automotive Lubricants Industry Segmentation By Geography

- 1. Colombia

Colombia Automotive Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Automotive Lubricants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Transmission & Gear Oils

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Biomax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP Plc (Castrol)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gulf Oil International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Motul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petrobras

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Petromil SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Primax

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal Dutch Shell PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Terpel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TotalEnergies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Valvoline Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Biomax

List of Figures

- Figure 1: Colombia Automotive Lubricants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Colombia Automotive Lubricants Industry Share (%) by Company 2024

List of Tables

- Table 1: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Colombia Automotive Lubricants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Automotive Lubricants Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Colombia Automotive Lubricants Industry?

Key companies in the market include Biomax, BP Plc (Castrol), Chevron Corporation, Gulf Oil International, Motul, Petrobras, Petromil SA, Primax, Royal Dutch Shell PLC, Terpel, TotalEnergies, Valvoline Inc.

3. What are the main segments of the Colombia Automotive Lubricants Industry?

The market segments include Vehicle Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : Commercial Vehicles.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.August 2021: Motul introduces a new and improved version of its flagship product, with a revolutionary formula that once again pushes the boundaries of performance, which would be showcased at the 24 Hours of Le Mans, the world's most famous racing event.August 2021: Megacomercial has been a Motul Importers Network Member in the auto, industry, marine, and heavy categories since 2019. It would now do so for Antioquia, Chocó, and the Atlantic Coast in the motorcycle segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Automotive Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Automotive Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Automotive Lubricants Industry?

To stay informed about further developments, trends, and reports in the Colombia Automotive Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence