Key Insights

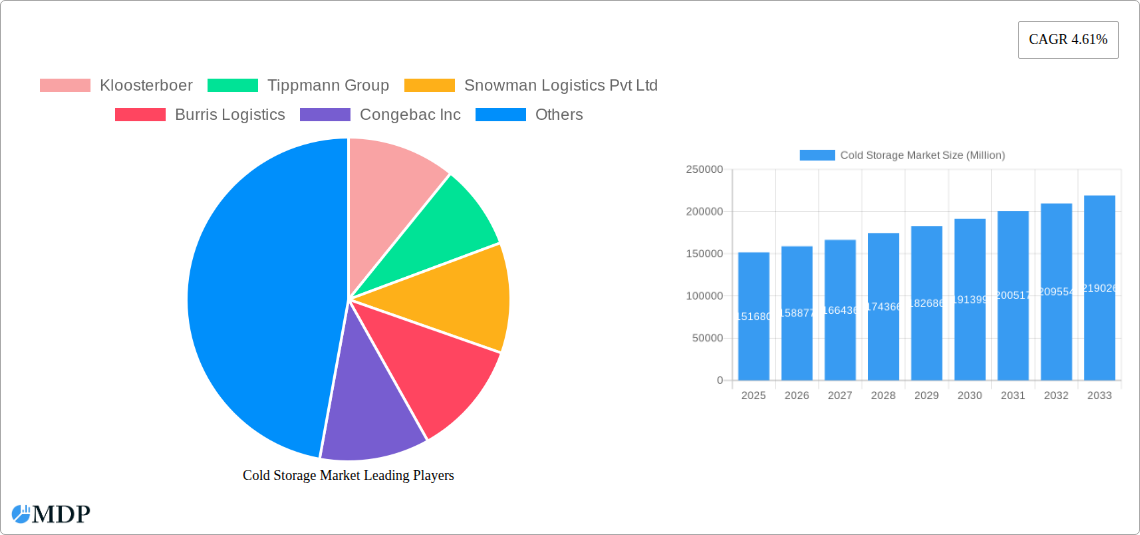

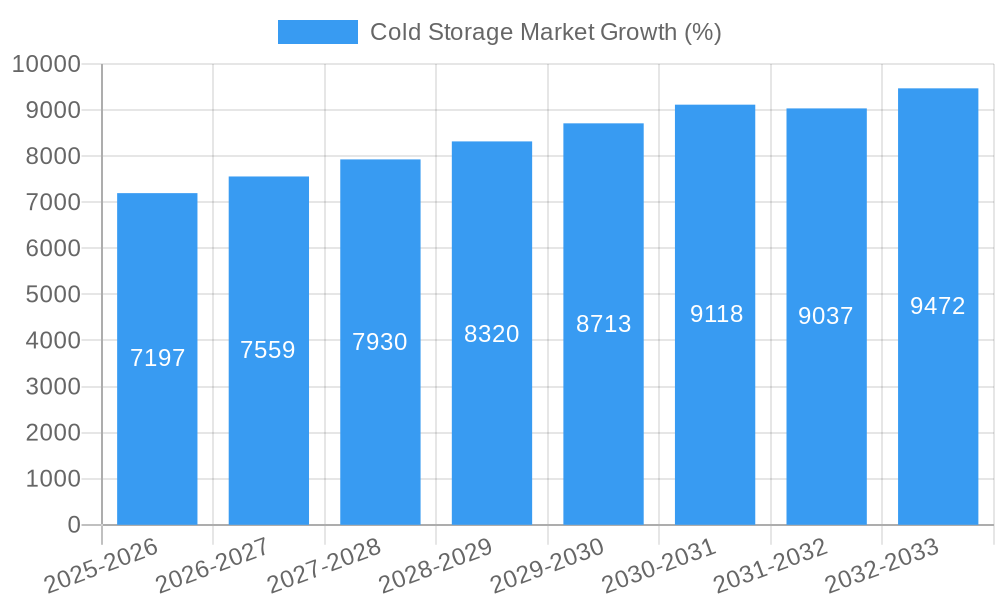

The global cold storage market, valued at $151.68 billion in 2025, is projected to experience robust growth, driven by the increasing demand for perishable goods, rising disposable incomes, and the expanding food processing and pharmaceutical industries. The market's Compound Annual Growth Rate (CAGR) of 4.61% from 2019 to 2024 indicates a steady upward trajectory, expected to continue throughout the forecast period (2025-2033). Key growth drivers include the need for efficient supply chain management to minimize food waste and maintain product quality, particularly in emerging economies with expanding populations. The increasing adoption of advanced technologies like automated storage and retrieval systems (AS/RS) and improved cold chain logistics are further fueling market expansion. Segmentation reveals a diverse landscape, with bulk storage dominating the construction type, frozen storage leading in temperature control, and fruits and vegetables comprising a significant portion of application-based segments. Major players, including Lineage Logistics Holdings, Americold Logistics LLC, and Kloosterboer, are driving innovation and consolidation within the market.

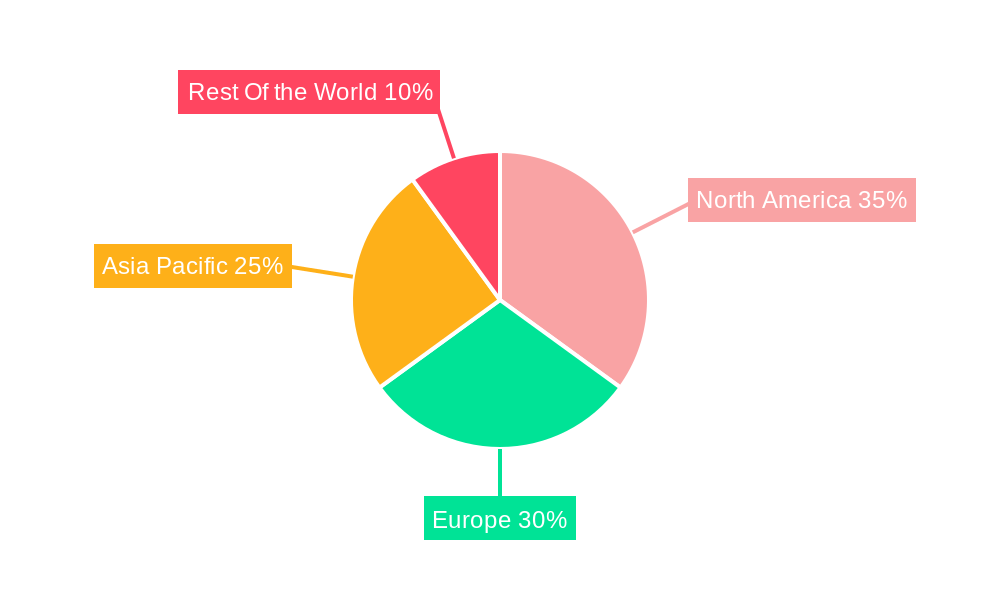

Growth will likely be influenced by regional variations. North America and Europe are anticipated to maintain substantial market shares due to their established infrastructure and high consumption of perishable goods. However, the Asia-Pacific region, particularly countries like India and China, is poised for significant growth, driven by rapid economic expansion and increasing urbanization. While factors such as high initial investment costs and stringent regulatory requirements could pose challenges, the overall market outlook remains positive, with considerable potential for expansion driven by technological advancements and evolving consumer preferences for fresh and convenient food options. The development of sustainable cold storage solutions is also likely to gain traction, in response to growing environmental concerns.

Cold Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global cold storage market, encompassing market dynamics, industry trends, leading segments, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders seeking to navigate this rapidly evolving market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Cold Storage Market Market Dynamics & Concentration

The cold storage market is characterized by a moderately consolidated landscape, with several large players holding significant market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and strategic mergers & acquisitions (M&A). The top 10 players collectively account for approximately xx% of the global market share in 2025. Innovation is a key driver, with companies continuously investing in advanced technologies to improve efficiency, reduce costs, and enhance the quality of cold chain solutions. Regulatory frameworks, particularly those concerning food safety and environmental sustainability, are shaping market practices. The rise of e-commerce and the increasing demand for fresh produce are driving the growth of cold storage facilities. Product substitutes, such as modified atmosphere packaging (MAP), are challenging the traditional cold storage industry, but the need for large-scale storage and temperature control remains paramount. End-user trends, particularly the rising demand for processed foods and pharmaceuticals, are influencing the demand for cold storage services. M&A activity remains robust, with a notable increase in deal counts over the past five years. The following illustrates the dynamic nature of the market:

- Market Share: Top 3 players hold approximately xx%, Top 5 players hold approximately xx%

- M&A activity: An average of xx deals per year between 2019 and 2024.

- Regulatory impact: Stringent regulations on food safety and temperature control standards are impacting operations.

- Technological influence: Automated systems, IoT integration, and AI are transforming efficiency.

Cold Storage Market Industry Trends & Analysis

The cold storage market is experiencing robust growth, driven by several key factors. The increasing demand for fresh and processed foods, particularly in emerging economies, is a major catalyst. The rising popularity of e-commerce and online grocery delivery is further fueling demand for reliable and efficient cold chain solutions. Technological advancements, such as automated storage and retrieval systems (AS/RS) and advanced temperature monitoring technologies, are enhancing operational efficiency and reducing waste. Consumer preferences are shifting toward convenience and quality, driving the demand for fresh and healthy food products, which in turn requires robust cold storage infrastructure. Competitive dynamics are shaped by the presence of both large multinational corporations and smaller regional players. Pricing strategies, service offerings, and technological capabilities are key competitive differentiators. The market is experiencing disruption through the adoption of innovative technologies like blockchain for traceability and AI for predictive maintenance. This trend leads to optimized inventory management, reduced spoilage, and enhanced supply chain visibility.

- CAGR: The market is projected to register a xx% CAGR from 2025 to 2033.

- Market Penetration: xx% penetration across major food and pharmaceutical sectors in developed economies.

Leading Markets & Segments in Cold Storage Market

The cold storage market demonstrates strong regional variations in growth and segment dominance.

By Region: [Insert Dominant Region, e.g., North America] currently holds the largest market share driven by robust demand and existing infrastructure. [Insert Second Largest Region, e.g., Europe] is expected to witness significant growth in the coming years. Asia-Pacific exhibits a high growth potential.

By Construction Type: The bulk storage segment dominates due to its cost-effectiveness and suitability for large volumes. However, production stores are gaining traction due to their integration with processing facilities. Ports are becoming increasingly important as global trade in temperature-sensitive goods increases.

By Temperature: Frozen storage accounts for the majority of the market share due to the long shelf life it provides and demand for frozen food. Chilled storage is a significant segment with demand driven by perishable food and pharmaceuticals.

By Application: Fruits & Vegetables represent a significant segment. Dairy, Fish, Meat & Seafood, and Processed Food also contribute significantly, driven by rising demand. Pharmaceuticals are a high-growth segment, demanding stringent temperature control and quality standards.

- Key Drivers (By Region):

- North America: Strong food processing industry, advanced cold chain logistics.

- Europe: High disposable income, stringent food safety regulations.

- Asia-Pacific: Rapidly growing population, increasing urbanization.

- Key Drivers (By Segment):

- Bulk Storage: Economies of scale, suitability for large-volume storage.

- Frozen: Extended shelf-life, demand for frozen foods.

- Fruits & Vegetables: High perishability, demand for fresh produce.

Cold Storage Market Product Developments

Recent product innovations include automated guided vehicles (AGVs) for efficient material handling, advanced temperature monitoring systems with IoT connectivity, and energy-efficient refrigeration technologies. These developments are enhancing operational efficiency, reducing energy consumption, and minimizing waste. The focus is on improving supply chain visibility, traceability, and overall quality control. The increasing integration of AI and machine learning enables better inventory management and predictive maintenance, further optimizing operations. New applications are emerging in areas like e-commerce fulfillment and specialized storage for pharmaceuticals and vaccines.

Key Drivers of Cold Storage Market Growth

Several factors are driving the growth of the cold storage market, notably: the increasing demand for fresh and processed food, expanding e-commerce, and the rising adoption of advanced cold chain technologies. Government regulations promoting food safety and quality standards are also impacting growth, necessitating better cold chain infrastructure. The focus on sustainable practices is boosting investments in energy-efficient cold storage facilities and technologies. The increasing globalization of food and pharmaceutical trade is also driving growth.

Challenges in the Cold Storage Market Market

The cold storage market faces challenges such as fluctuating energy prices, which significantly impact operational costs. Stringent regulatory compliance requirements necessitate continuous investment in compliance measures. Supply chain disruptions, as evidenced in recent years, can severely impact the cold chain, causing product loss and financial strain. Maintaining optimal temperature control is crucial and requires continuous monitoring and maintenance. Intense competition amongst both large and small players makes it a highly competitive space. The industry also faces logistical challenges which may stem from issues in infrastructure or transportation limitations.

Emerging Opportunities in Cold Storage Market

Long-term growth opportunities include the expansion into emerging markets with growing populations and increasing consumption. Strategic partnerships and collaborations, particularly in technology integration and supply chain optimization, can enhance efficiency and market reach. Advancements in automation and AI offer potential for significant cost reduction and enhanced service quality. The increased focus on sustainable cold chain practices creates opportunities for environmentally friendly solutions. Increased demand for specialized storage solutions, like those for pharmaceuticals and vaccines, will lead to niche market development.

Leading Players in the Cold Storage Market Sector

- Kloosterboer

- Tippmann Group

- Snowman Logistics Pvt Ltd

- Burris Logistics

- Congebac Inc

- Cloverleaf Cold Storage

- The United States Cold Storage

- Lineage Logistics Holdings

- NewCold

- VX Cold Chain Logistics

- Constellation Cold Logistics

- Nichirei Corporation

- Americold Logistics LLC

Key Milestones in Cold Storage Market Industry

- March 2023: Lineage Logistics establishes a new Southern Europe headquarters in Madrid, Spain, signaling expansion plans and strengthening its European network.

- March 2023: Americold Property Trust expands its Santa Perpetua, Barcelona facility, adding 12,000 pallet spaces and 11 loading bays, increasing capacity and service offerings in Spain.

Strategic Outlook for Cold Storage Market Market

The cold storage market is poised for significant growth, driven by evolving consumer demands, technological innovation, and the expansion of the global food and pharmaceutical industries. Strategic investments in automation, energy efficiency, and sustainable practices will be crucial for long-term success. Companies focusing on data-driven decision-making and supply chain optimization will be well-positioned to capitalize on emerging opportunities. Expanding into new markets and forming strategic partnerships will drive further growth and enhance market share.

Cold Storage Market Segmentation

-

1. Construction Type

- 1.1. Bulk storage

- 1.2. Production stores

- 1.3. Ports

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Fruits & Vegetables

- 3.2. Dairy, Fish, Meat, & Seafood

- 3.3. Processed Food

- 3.4. Pharmaceuticals

- 3.5. Others

Cold Storage Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest Of the World

Cold Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Rapid Growth in Import and Export Activities of Food Items and Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 5.1.1. Bulk storage

- 5.1.2. Production stores

- 5.1.3. Ports

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits & Vegetables

- 5.3.2. Dairy, Fish, Meat, & Seafood

- 5.3.3. Processed Food

- 5.3.4. Pharmaceuticals

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest Of the World

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 6. North America Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 6.1.1. Bulk storage

- 6.1.2. Production stores

- 6.1.3. Ports

- 6.2. Market Analysis, Insights and Forecast - by Temperature

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fruits & Vegetables

- 6.3.2. Dairy, Fish, Meat, & Seafood

- 6.3.3. Processed Food

- 6.3.4. Pharmaceuticals

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 7. Europe Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 7.1.1. Bulk storage

- 7.1.2. Production stores

- 7.1.3. Ports

- 7.2. Market Analysis, Insights and Forecast - by Temperature

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fruits & Vegetables

- 7.3.2. Dairy, Fish, Meat, & Seafood

- 7.3.3. Processed Food

- 7.3.4. Pharmaceuticals

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 8. Asia Pacific Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 8.1.1. Bulk storage

- 8.1.2. Production stores

- 8.1.3. Ports

- 8.2. Market Analysis, Insights and Forecast - by Temperature

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fruits & Vegetables

- 8.3.2. Dairy, Fish, Meat, & Seafood

- 8.3.3. Processed Food

- 8.3.4. Pharmaceuticals

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 9. Rest Of the World Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 9.1.1. Bulk storage

- 9.1.2. Production stores

- 9.1.3. Ports

- 9.2. Market Analysis, Insights and Forecast - by Temperature

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fruits & Vegetables

- 9.3.2. Dairy, Fish, Meat, & Seafood

- 9.3.3. Processed Food

- 9.3.4. Pharmaceuticals

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 10. North America Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest Of the World Cold Storage Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Kloosterboer

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tippmann Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Snowman Logistics Pvt Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Burris Logistics

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Congebac Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cloverleaf Cold Storage

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 The United States Cold Storage

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Lineage Logistics Holdings

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 NewCold

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 VX Cold Chain Logistics

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Constellation Cold Logistics**List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Nichirei Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Americold Logistics LLC

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 Kloosterboer

List of Figures

- Figure 1: Global Cold Storage Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cold Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cold Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cold Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest Of the World Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest Of the World Cold Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Cold Storage Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 11: North America Cold Storage Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 12: North America Cold Storage Market Revenue (Million), by Temperature 2024 & 2032

- Figure 13: North America Cold Storage Market Revenue Share (%), by Temperature 2024 & 2032

- Figure 14: North America Cold Storage Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Cold Storage Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Cold Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Cold Storage Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 19: Europe Cold Storage Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 20: Europe Cold Storage Market Revenue (Million), by Temperature 2024 & 2032

- Figure 21: Europe Cold Storage Market Revenue Share (%), by Temperature 2024 & 2032

- Figure 22: Europe Cold Storage Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Cold Storage Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Cold Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cold Storage Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 27: Asia Pacific Cold Storage Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 28: Asia Pacific Cold Storage Market Revenue (Million), by Temperature 2024 & 2032

- Figure 29: Asia Pacific Cold Storage Market Revenue Share (%), by Temperature 2024 & 2032

- Figure 30: Asia Pacific Cold Storage Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Cold Storage Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Cold Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest Of the World Cold Storage Market Revenue (Million), by Construction Type 2024 & 2032

- Figure 35: Rest Of the World Cold Storage Market Revenue Share (%), by Construction Type 2024 & 2032

- Figure 36: Rest Of the World Cold Storage Market Revenue (Million), by Temperature 2024 & 2032

- Figure 37: Rest Of the World Cold Storage Market Revenue Share (%), by Temperature 2024 & 2032

- Figure 38: Rest Of the World Cold Storage Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest Of the World Cold Storage Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest Of the World Cold Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest Of the World Cold Storage Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cold Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 3: Global Cold Storage Market Revenue Million Forecast, by Temperature 2019 & 2032

- Table 4: Global Cold Storage Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Cold Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Cold Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Cold Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Cold Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Cold Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 15: Global Cold Storage Market Revenue Million Forecast, by Temperature 2019 & 2032

- Table 16: Global Cold Storage Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 19: Global Cold Storage Market Revenue Million Forecast, by Temperature 2019 & 2032

- Table 20: Global Cold Storage Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 23: Global Cold Storage Market Revenue Million Forecast, by Temperature 2019 & 2032

- Table 24: Global Cold Storage Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 27: Global Cold Storage Market Revenue Million Forecast, by Temperature 2019 & 2032

- Table 28: Global Cold Storage Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Cold Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Storage Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Cold Storage Market?

Key companies in the market include Kloosterboer, Tippmann Group, Snowman Logistics Pvt Ltd, Burris Logistics, Congebac Inc, Cloverleaf Cold Storage, The United States Cold Storage, Lineage Logistics Holdings, NewCold, VX Cold Chain Logistics, Constellation Cold Logistics**List Not Exhaustive, Nichirei Corporation, Americold Logistics LLC.

3. What are the main segments of the Cold Storage Market?

The market segments include Construction Type, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.68 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Rapid Growth in Import and Export Activities of Food Items and Pharmaceutical.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

March 2023: Lineage Logistics, one of the top global suppliers of temperature-controlled industrial REIT and logistics solutions, established a new Southern Europe headquarters in Madrid, Spain. Lineage's new offices in Madrid demonstrate the company's ongoing commitment to the area and create the groundwork for future expansion. Also, the increasing attention on Southern Europe strengthens ties to the hub network of Lineage Logistics in Northern Europe and elsewhere.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Storage Market?

To stay informed about further developments, trends, and reports in the Cold Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence