Key Insights

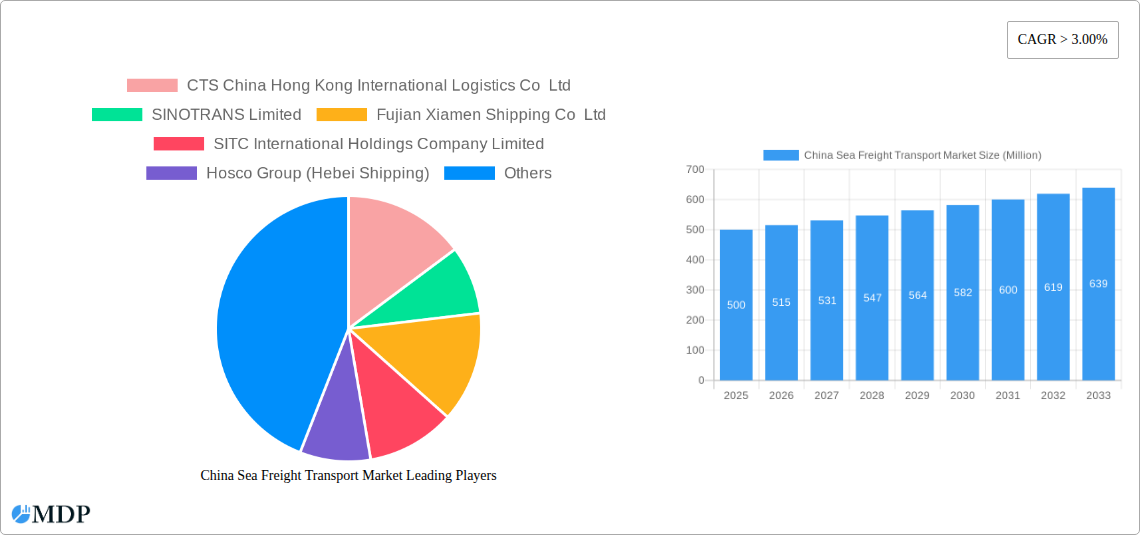

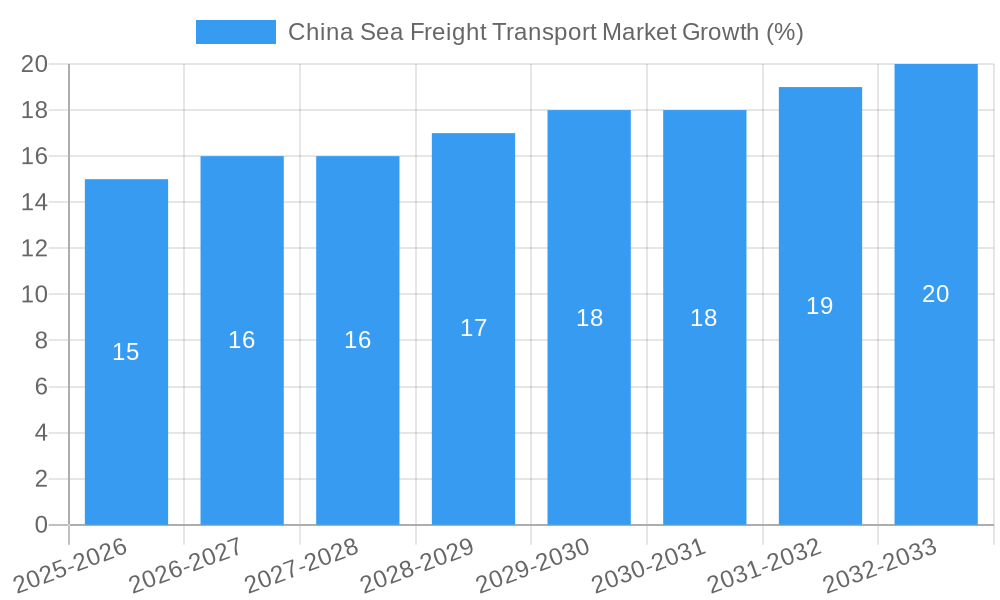

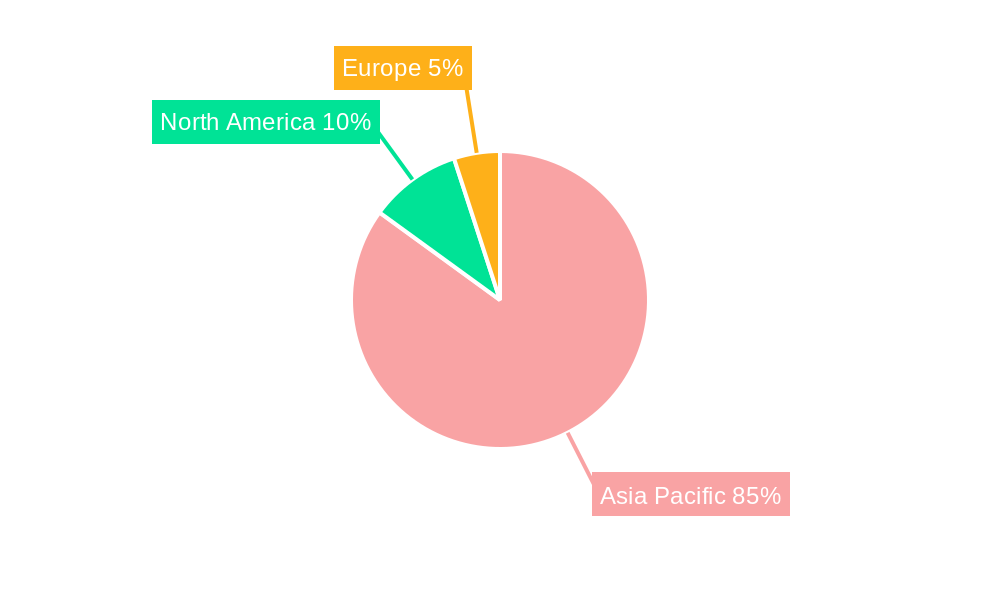

The China sea freight transport market, currently experiencing robust growth with a CAGR exceeding 3%, presents a significant opportunity for investors and stakeholders. Driven by the nation's expanding manufacturing and export sectors, particularly in manufacturing, retail, and agriculture, the market's value in 2025 is estimated to be in the hundreds of millions of dollars (a precise figure requires additional data). This growth is fueled by increasing global trade, particularly within the Asia-Pacific region, encompassing key economies like Japan, South Korea, and India. The market is segmented by cargo type (containerized, bulk, liquid), vessel type (container ships, bulk carriers, tankers), and end-use industry. Containerized cargo, given China's role in global manufacturing, likely dominates the market share, followed by bulk and liquid cargo depending on specific commodity export patterns. The increasing demand for efficient and reliable shipping solutions, coupled with technological advancements in vessel operations and logistics management, are further bolstering market expansion. However, challenges such as fluctuating fuel prices, geopolitical uncertainties, and port congestion remain potential restraints to sustained growth. The competitive landscape features both large, established players like COSCO Shipping Lines and China Merchants Group, along with numerous smaller regional operators. Strategic partnerships, infrastructure investments, and technological innovation will be crucial for companies seeking a strong competitive edge within this dynamic market.

The forecast period (2025-2033) anticipates continued expansion, driven by sustained economic growth in China and increased global trade. The Asia-Pacific region will remain the dominant market, with China itself serving as the primary engine of growth due to its vast manufacturing base and intricate global supply chains. However, careful consideration of potential risks, including environmental regulations and the ongoing global economic climate, is essential for accurate long-term projections. Market players are likely to focus on optimizing their logistics networks, investing in sustainable shipping practices, and leveraging data analytics to enhance efficiency and competitiveness. The consistent growth trajectory indicates a promising outlook for the China sea freight transport market, albeit one that requires strategic navigation of various challenges and opportunities.

China Sea Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Sea Freight Transport Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. It meticulously examines market dynamics, leading players, emerging trends, and future growth opportunities within this vital sector of the Chinese economy. Key segments analyzed include cargo type (containerized, bulk, liquid), vessel type (container ships, bulk carriers, tankers), and end-use industry (manufacturing, retail, agriculture).

China Sea Freight Transport Market Market Dynamics & Concentration

This section analyzes the competitive landscape of the China Sea Freight Transport Market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large, established players and smaller, specialized companies. Market share is highly dynamic, influenced by factors such as fleet size, operational efficiency, and strategic partnerships. The estimated market concentration ratio (CR4) for 2025 is xx%, indicating a moderately concentrated market. Several factors drive innovation, including technological advancements in vessel design, automation, and digital logistics platforms. Regulatory frameworks, such as those governing maritime safety and environmental protection, significantly impact market operations. Product substitutes, such as rail and road transport, exert competitive pressure. Finally, M&A activity within the sector has been relatively frequent in recent years, with an estimated xx M&A deals recorded between 2019 and 2024, driven by strategies for consolidation and expansion.

- Market Concentration: Estimated CR4 (2025): xx%

- Innovation Drivers: Technological advancements, automation, digital logistics

- Regulatory Frameworks: Maritime safety, environmental regulations

- M&A Activity: Estimated xx deals (2019-2024)

- End-User Trends: Shifting demand based on economic growth and industrial development

China Sea Freight Transport Market Industry Trends & Analysis

The China Sea Freight Transport Market exhibits a complex interplay of growth drivers, technological disruptions, and competitive dynamics. The market experienced a CAGR of xx% during the historical period (2019-2024), and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include China's expanding trade volumes, the increasing demand for efficient logistics solutions, and government investments in port infrastructure. Technological disruptions, such as the adoption of autonomous vessels and AI-powered route optimization systems, are transforming operational efficiency and cost structures. Consumer preferences, while indirectly influencing the market through demand for imported and exported goods, are largely shaped by macroeconomic factors and consumer spending patterns. Competitive dynamics are intense, with established players vying for market share through capacity expansion, service differentiation, and strategic alliances. Market penetration of containerized cargo is high, estimated at xx% in 2025, reflecting the dominance of container shipping in the market.

Leading Markets & Segments in China Sea Freight Transport Market

Within the China Sea Freight Transport Market, containerized cargo constitutes the largest segment by cargo type, representing approximately xx Million tons in 2025. This dominance stems from the widespread adoption of containerization for efficient handling and transportation of diverse goods. Among vessel types, container ships hold a significant market share due to their superior capacity and flexibility. The manufacturing sector is the leading end-use industry, driving the majority of sea freight transport demand.

By Cargo Type:

- Containerized Cargo: Dominant due to efficiency and versatility. 2025 volume: xx Million tons.

- Bulk Cargo: Significant but less dominant than containerized cargo. 2025 volume: xx Million tons.

- Liquid Cargo: Specialized segment, showing steady growth. 2025 volume: xx Million tons.

By Vessel Type:

- Container Ships: Largest market share due to high capacity and adaptability. 2025 fleet size: xx vessels.

- Bulk Carriers: Significant role in transporting raw materials. 2025 fleet size: xx vessels.

- Tankers: Essential for liquid cargo transportation. 2025 fleet size: xx vessels.

By End-Use Industry:

- Manufacturing: Largest segment due to export-oriented industries. 2025 share: xx%.

- Retail: Growing segment fueled by e-commerce and consumer goods. 2025 share: xx%.

- Agriculture: Smaller segment but showing potential for growth. 2025 share: xx%.

Key Drivers for Dominant Segments:

- Containerized Cargo: Efficiency, standardization, and versatility.

- Container Ships: High capacity, flexibility, and economies of scale.

- Manufacturing: High export volumes and reliance on global supply chains.

China Sea Freight Transport Market Product Developments

Recent product developments in the China sea freight transport market center on enhancing efficiency, sustainability, and technological integration. This includes the introduction of larger container vessels, the adoption of advanced route optimization software powered by AI, and the integration of IoT sensors for real-time cargo tracking and monitoring. These innovations aim to improve operational efficiency, reduce transportation costs, enhance supply chain transparency, and minimize environmental impact through optimized fuel consumption and reduced emissions. The market fit for these innovations is strong, aligning with the industry's continuous drive for cost-effectiveness and sustainability.

Key Drivers of China Sea Freight Transport Market Growth

Several factors fuel the growth of the China Sea Freight Transport Market. Firstly, China's robust economic growth drives increased trade volumes, necessitating greater freight capacity. Secondly, government investments in port infrastructure and logistics networks enhance operational efficiency and connectivity. Thirdly, technological advancements such as automation and digitalization optimize logistics processes, creating efficiencies and cost savings. Finally, the expansion of China's Belt and Road Initiative opens new trade routes and expands market access, further driving demand for sea freight services.

Challenges in the China Sea Freight Transport Market Market

The China Sea Freight Transport Market faces several challenges. Fluctuations in global trade and economic cycles directly impact demand, creating uncertainty for businesses. Stringent environmental regulations and the push for decarbonization increase operational costs and necessitate investments in cleaner technologies. Supply chain disruptions, particularly those stemming from geopolitical events or pandemics, cause significant delays and cost increases, impacting reliability. Finally, intense competition among freight companies puts pressure on pricing and profit margins, demanding continuous operational improvements and cost optimization. These challenges can collectively decrease the market's overall profitability if not properly managed.

Emerging Opportunities in China Sea Freight Transport Market

Significant opportunities exist for long-term growth in the China Sea Freight Transport Market. The ongoing adoption of autonomous vessels and AI-powered systems promises substantial efficiency gains and cost reductions. Strategic partnerships between shipping companies and technology providers will accelerate innovation and market penetration of new technologies. Expanding trade routes associated with China's Belt and Road Initiative and growth in e-commerce are expected to significantly drive future demand. These opportunities highlight the potential for sustained growth and profitability within the sector in the years to come.

Leading Players in the China Sea Freight Transport Market Sector

- CTS China Hong Kong International Logistics Co Ltd

- SINOTRANS Limited

- Fujian Xiamen Shipping Co Ltd

- SITC International Holdings Company Limited

- Hosco Group (Hebei Shipping)

- Jincheng International Shipping Agency

- COSCO Shipping Lines

- China Merchants Group

- C&K Ocean Shipping Company

- Nanjing Ocean Shipping Co Ltd

Key Milestones in China Sea Freight Transport Market Industry

- 2020: Increased focus on digitalization and automation within the industry.

- 2021: Significant investments in port infrastructure modernization projects.

- 2022: Implementation of stricter environmental regulations impacting fuel efficiency standards.

- 2023: Several mergers and acquisitions among smaller shipping companies aiming for greater market share.

- 2024: Increased adoption of AI-powered route optimization and cargo management systems.

Strategic Outlook for China Sea Freight Transport Market Market

The future of the China Sea Freight Transport Market is bright, driven by robust economic growth, increasing trade volumes, and continuous technological advancements. The strategic opportunities lie in embracing digitalization, investing in sustainable solutions, and forging strategic partnerships to navigate competitive pressures. Companies that effectively adapt to changing regulations, optimize their operations, and capitalize on technological advancements are poised to achieve significant growth and market leadership in this dynamic sector. The market is expected to continue its expansion, presenting significant opportunities for investment and innovation in the coming decade.

China Sea Freight Transport Market Segmentation

- 1. Water Transport Services

- 2. Vessel Leasing and Rental Services

- 3. Cargo Ha

- 4. Supporti

China Sea Freight Transport Market Segmentation By Geography

- 1. China

China Sea Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1. Positive Trend of Chinese Imports and Exports.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Water Transport Services

- 5.2. Market Analysis, Insights and Forecast - by Vessel Leasing and Rental Services

- 5.3. Market Analysis, Insights and Forecast - by Cargo Ha

- 5.4. Market Analysis, Insights and Forecast - by Supporti

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Water Transport Services

- 6. China China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8. India China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 CTS China Hong Kong International Logistics Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 SINOTRANS Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fujian Xiamen Shipping Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SITC International Holdings Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hosco Group (Hebei Shipping)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Jincheng International Shipping Agency**List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 COSCO Shipping Lines

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 China Merchants Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 C&K Ocean Shipping Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nanjing Ocean Shipping Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 CTS China Hong Kong International Logistics Co Ltd

List of Figures

- Figure 1: China Sea Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Sea Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: China Sea Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Sea Freight Transport Market Revenue Million Forecast, by Water Transport Services 2019 & 2032

- Table 3: China Sea Freight Transport Market Revenue Million Forecast, by Vessel Leasing and Rental Services 2019 & 2032

- Table 4: China Sea Freight Transport Market Revenue Million Forecast, by Cargo Ha 2019 & 2032

- Table 5: China Sea Freight Transport Market Revenue Million Forecast, by Supporti 2019 & 2032

- Table 6: China Sea Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Sea Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: China Sea Freight Transport Market Revenue Million Forecast, by Water Transport Services 2019 & 2032

- Table 16: China Sea Freight Transport Market Revenue Million Forecast, by Vessel Leasing and Rental Services 2019 & 2032

- Table 17: China Sea Freight Transport Market Revenue Million Forecast, by Cargo Ha 2019 & 2032

- Table 18: China Sea Freight Transport Market Revenue Million Forecast, by Supporti 2019 & 2032

- Table 19: China Sea Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sea Freight Transport Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the China Sea Freight Transport Market?

Key companies in the market include CTS China Hong Kong International Logistics Co Ltd, SINOTRANS Limited, Fujian Xiamen Shipping Co Ltd, SITC International Holdings Company Limited, Hosco Group (Hebei Shipping), Jincheng International Shipping Agency**List Not Exhaustive, COSCO Shipping Lines, China Merchants Group, C&K Ocean Shipping Company, Nanjing Ocean Shipping Co Ltd.

3. What are the main segments of the China Sea Freight Transport Market?

The market segments include Water Transport Services, Vessel Leasing and Rental Services, Cargo Ha, Supporti.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

Positive Trend of Chinese Imports and Exports..

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sea Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sea Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sea Freight Transport Market?

To stay informed about further developments, trends, and reports in the China Sea Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence