Key Insights

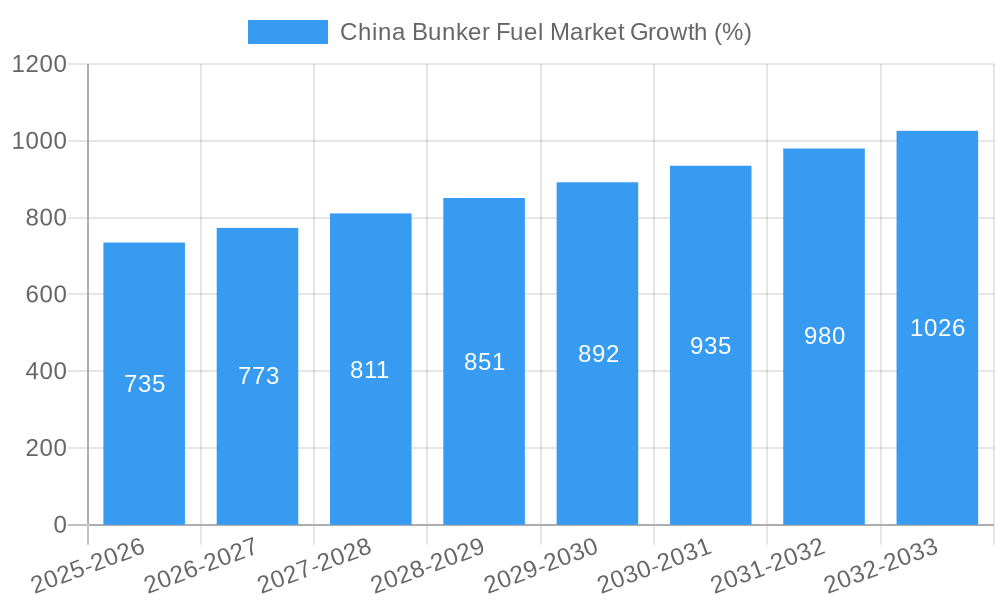

The China bunker fuel market, valued at approximately $XX million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, China's burgeoning maritime trade and increasing reliance on seaborne transportation for both imports and exports significantly boosts demand for bunker fuels. The continuous growth of the country's container shipping and bulk carrier sectors, coupled with the expansion of its offshore energy exploration activities, further propels market expansion. Furthermore, the ongoing transition towards cleaner fuels, specifically Very-low Sulfur Fuel Oil (VLSFO), presents a significant opportunity, although high sulfur fuel oil (HSFO) still holds a considerable market share. Regulatory pressures aimed at reducing marine pollution and achieving environmental sustainability are also driving the adoption of VLSFO. However, the market faces certain constraints, including fluctuating crude oil prices that impact fuel costs and potentially hinder growth during periods of volatility. Competition within the market from a mix of established state-owned companies like Sinopec and PetroChina, along with privately owned players like Brightoil Petroleum, is intense, leading to price competitiveness.

The market segmentation reveals insights into specific fuel types and vessel categories. While VLSFO is gaining traction due to environmental regulations, HSFO remains a substantial segment, primarily among older vessels. The distribution of market share across various vessel types reflects the diversity of China's maritime activities. Container ships and tankers are likely the dominant vessel types consuming the largest volume of bunker fuel. Looking ahead, technological advancements in fuel efficiency and alternative fuel sources, such as LNG, will continue to shape the market landscape. This includes the increasing adoption of scrubber technology for HSFO usage and potential development of alternative fuels within the forecast period. The competitive dynamics will likely see further consolidation as companies adapt to stricter environmental standards and evolving market conditions. The significant increase in China’s investments in maritime infrastructure and its growing role in global trade suggest that positive market trends are likely to continue over the forecast period.

China Bunker Fuel Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China Bunker Fuel Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, industry trends, leading players, and future growth prospects. The analysis encompasses key fuel types (HSFO, VLSFO, MGO, Others) and vessel types (Containers, Tankers, General Cargo, Bulk Carriers, Other Vessel Types), providing a granular understanding of this crucial market segment. Expect detailed analysis of market concentration, regulatory impacts, technological advancements, and competitive landscapes, all supported by robust data and projections.

China Bunker Fuel Market Market Dynamics & Concentration

The China Bunker Fuel Market, valued at xx Million in 2025, exhibits a complex interplay of factors influencing its dynamics and concentration. Market concentration is moderately high, with a few dominant players controlling a significant share. Sinopec Fuel Oil Sales Co Ltd and PetroChina Company Limited, for instance, hold substantial market share, while others such as Cosco Shipping Lines Co Ltd and China Merchants Energy Shipping Co Ltd also play a significant role.

Key Dynamics:

- Innovation Drivers: The ongoing push for cleaner fuels, driven by stringent emission regulations (IMO 2020), is a primary driver, leading to increased demand for VLSFO and the exploration of alternative fuels.

- Regulatory Frameworks: Stringent environmental regulations and policies significantly influence market dynamics, shaping fuel choices and operational strategies.

- Product Substitutes: The emergence of LNG and other alternative marine fuels presents both opportunities and challenges for traditional bunker fuel suppliers.

- End-User Trends: The increasing global trade volume and the expansion of the Chinese shipping industry directly correlate with bunker fuel demand.

- M&A Activities: The market has witnessed a moderate level of M&A activity (xx deals in the last 5 years), primarily focused on consolidation and expansion into new segments. This consolidation leads to increased market concentration. The market share of the top 5 players is estimated at approximately xx%.

China Bunker Fuel Market Industry Trends & Analysis

The China Bunker Fuel Market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors: the burgeoning Chinese economy and its reliance on maritime trade, stringent environmental regulations promoting cleaner fuels, and technological advancements in fuel efficiency.

Market penetration of VLSFO is rapidly increasing due to regulatory compliance. However, the price differential between HSFO and VLSFO remains a significant factor influencing fuel selection. Competitive dynamics are intensifying, with established players facing competition from emerging fuel suppliers and the potential disruption caused by alternative fuels. Consumer preferences are shifting towards environmentally friendly options, impacting demand for cleaner fuels. Technological disruptions, such as the development of fuel-efficient vessels and alternative fuel infrastructure, are reshaping the industry.

Leading Markets & Segments in China Bunker Fuel Market

The coastal regions of China, particularly major ports like Shanghai, Ningbo-Zhoushan, and Guangzhou, dominate the bunker fuel market. This dominance stems from high vessel traffic and industrial activity.

Leading Fuel Types:

- VLSFO: The fastest-growing segment due to IMO 2020 regulations and environmental concerns.

- HSFO: While declining, HSFO still holds significant market share, particularly in vessels not fully compliant with IMO 2020.

- MGO: Maintains a steady demand driven by smaller vessels and specific operational requirements.

Leading Vessel Types:

- Containers: The largest segment driven by the robust growth of China's export-oriented economy.

- Tankers: Significant demand fueled by the transportation of crude oil and refined petroleum products.

Key Drivers:

- Economic growth: Continued growth of the Chinese economy drives increased maritime trade and bunker fuel demand.

- Infrastructure development: Investment in port infrastructure enhances operational efficiency and fuels market growth.

- Government policies: Supportive government policies and regulations promoting sustainable shipping contribute to market expansion.

China Bunker Fuel Market Product Developments

Recent product developments have focused on improving fuel quality, reducing emissions, and enhancing efficiency. Innovations include the introduction of advanced fuel blends to meet stricter environmental standards and the development of biofuels as sustainable alternatives. These advancements aim to improve fuel efficiency, reduce operational costs, and minimize the environmental impact of shipping operations. The market is seeing a push for fuel additives that enhance combustion and reduce emissions.

Key Drivers of China Bunker Fuel Market Growth

Several factors drive the growth of the China Bunker Fuel Market:

- Growing maritime trade: The continuous expansion of China's international trade necessitates a higher demand for bunker fuels.

- Stringent environmental regulations: Policies aimed at reducing emissions are accelerating the adoption of cleaner fuels, such as VLSFO.

- Technological advancements: Improved fuel efficiency technologies and the development of alternative fuels are shaping market growth.

Challenges in the China Bunker Fuel Market Market

The market faces challenges including:

- Price volatility: Fluctuations in crude oil prices significantly impact bunker fuel costs, affecting market stability.

- Supply chain disruptions: Global events can disrupt the supply chain, impacting the availability and pricing of bunker fuels.

- Competition: Increased competition from both domestic and international players puts pressure on profit margins.

Emerging Opportunities in China Bunker Fuel Market

The long-term growth of the China Bunker Fuel Market is fueled by several opportunities:

- Expansion of LNG bunkering infrastructure: Investments in LNG bunkering facilities will create new market opportunities.

- Growth of alternative fuels: The adoption of biofuels and other sustainable fuels will open new market segments.

- Strategic partnerships: Collaboration between fuel suppliers, ship owners, and technology providers will unlock further growth.

Leading Players in the China Bunker Fuel Market Sector

- Sinopec Fuel Oil Sales Co Ltd

- Cosco Shipping Lines Co Ltd

- China Merchants Energy Shipping Co Ltd

- Nan Fung Group

- China Marine Bunker Co Ltd

- Ship Owners

- Fuel Suppliers

- Sinotrans Limited

- PetroChina Company Limited

- Parakou Group

- Brightoil Petroleum (Holdings) Limited

- Orient Overseas Container Line (OOCL)

Key Milestones in China Bunker Fuel Market Industry

- 2020 (January 1st): Implementation of IMO 2020 sulfur cap, significantly impacting fuel demand and driving the adoption of VLSFO.

- 2022 (Q3): Several major players invested heavily in LNG bunkering infrastructure, signaling a shift toward cleaner fuels.

- 2023 (Ongoing): Continuous development and adoption of fuel-efficient technologies and alternative fuels are transforming the industry.

Strategic Outlook for China Bunker Fuel Market Market

The China Bunker Fuel Market is poised for significant growth, driven by increasing maritime trade, stringent environmental regulations, and technological advancements. Strategic opportunities exist for companies to invest in cleaner fuel infrastructure, develop innovative fuel solutions, and forge strategic partnerships to capitalize on this expanding market. The focus on sustainability and efficiency will shape the future of the industry, creating a demand for innovative and environmentally friendly solutions.

China Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Others

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

China Bunker Fuel Market Segmentation By Geography

- 1. China

China Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Marine Transportation of Essential Commodities in South America4.; Supportive Policies for Cleaner Bunker Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Nature of Oil Market

- 3.4. Market Trends

- 3.4.1. Trade Tensions between the United States and China is Likely to Restrain the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 2 Sinopec Fuel Oil Sales Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 Cosco Shipping Lines Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3 China Merchants Energy Shipping Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 6 Nan Fung Group*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3 China Marine Bunker Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ship Owners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fuel Suppliers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4 Sinotrans Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 1 PetroChina Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 5 Parakou Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 Brightoil Petroleum (Holdings) Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 2 Orient Overseas Container Line (OOCL)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 2 Sinopec Fuel Oil Sales Co Ltd

List of Figures

- Figure 1: China Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: China Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: China Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: China Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 5: China Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: China Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 7: China Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 9: China Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 11: China Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: China Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 13: China Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: China Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 15: China Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Bunker Fuel Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the China Bunker Fuel Market?

Key companies in the market include 2 Sinopec Fuel Oil Sales Co Ltd, 1 Cosco Shipping Lines Co Ltd, 3 China Merchants Energy Shipping Co Ltd, 6 Nan Fung Group*List Not Exhaustive, 3 China Marine Bunker Co Ltd, Ship Owners, Fuel Suppliers, 4 Sinotrans Limited, 1 PetroChina Company Limited, 5 Parakou Group, 4 Brightoil Petroleum (Holdings) Limited, 2 Orient Overseas Container Line (OOCL).

3. What are the main segments of the China Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Marine Transportation of Essential Commodities in South America4.; Supportive Policies for Cleaner Bunker Fuel.

6. What are the notable trends driving market growth?

Trade Tensions between the United States and China is Likely to Restrain the Market Growth.

7. Are there any restraints impacting market growth?

4.; Volatile Nature of Oil Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the China Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence