Key Insights

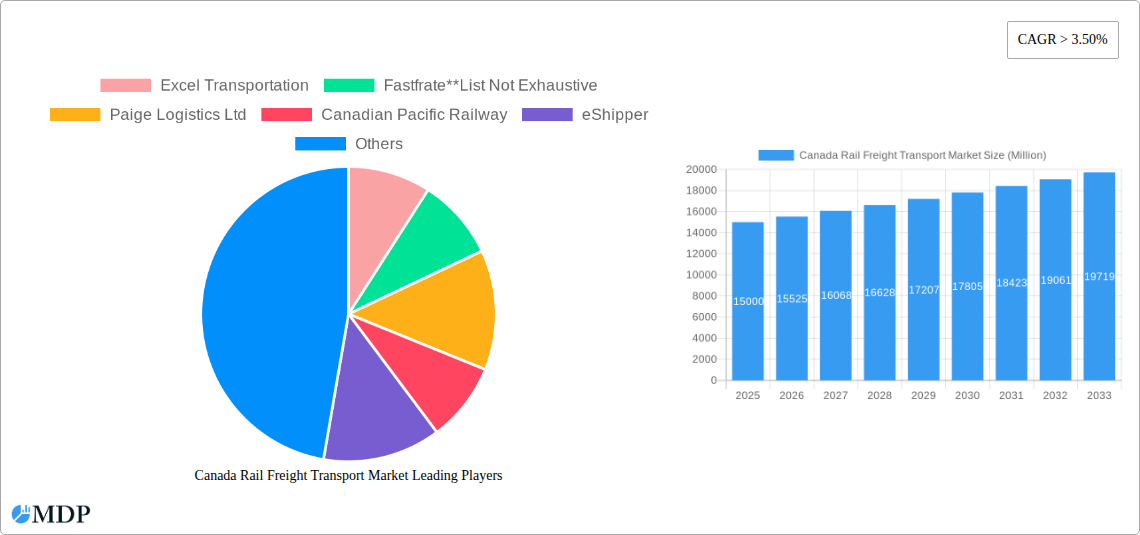

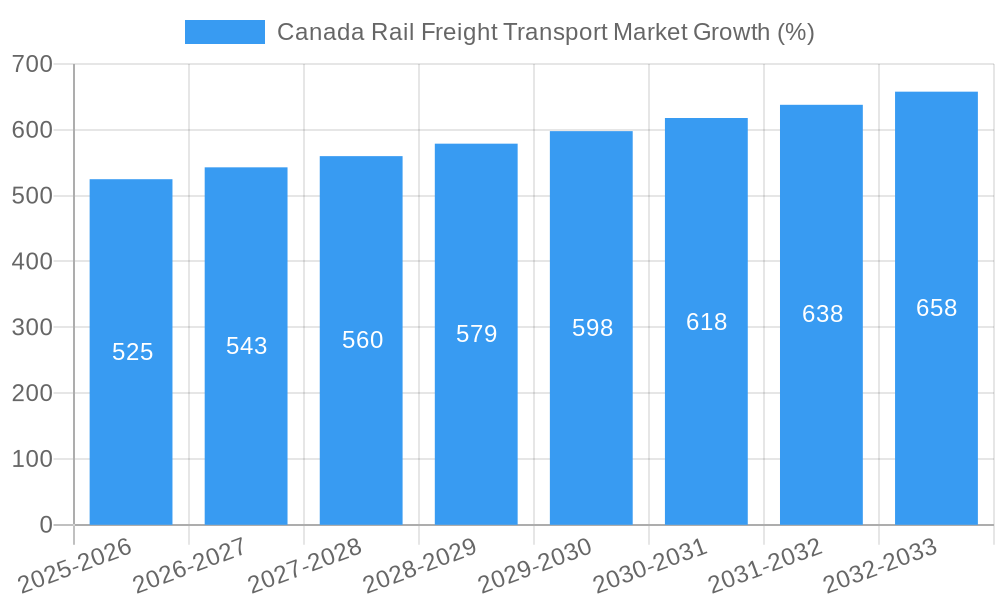

The Canada Rail Freight Transport Market, valued at an estimated $XX million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key drivers. Increased cross-border trade between Canada and the United States, coupled with the rising demand for efficient and reliable long-haul transportation solutions, significantly contributes to market growth. Furthermore, ongoing investments in rail infrastructure modernization and expansion, aimed at improving capacity and reducing transit times, are creating a positive environment for market expansion. The growing e-commerce sector and its reliance on timely and cost-effective freight delivery further bolster this market's prospects. Market segmentation reveals a strong presence of containerized cargo, driven by its efficiency and standardization, alongside a substantial demand for both domestic and international transportation services. The allied services segment, encompassing railcar maintenance, track upkeep, cargo switching, and storage, represents a significant portion of the market, highlighting the comprehensive nature of the industry.

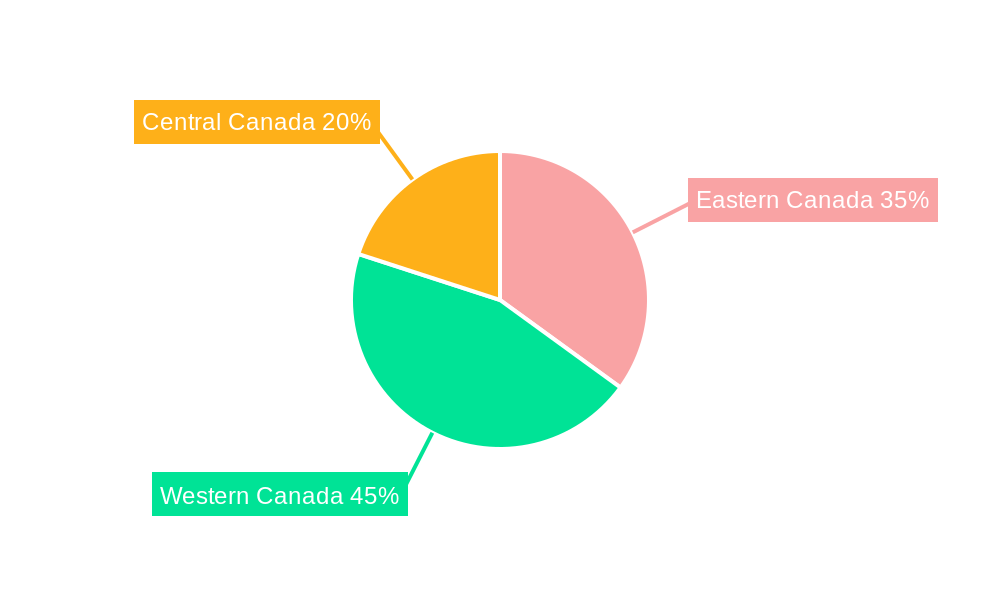

The market's growth trajectory, however, faces certain challenges. Fluctuations in fuel prices and potential labor shortages represent key restraints. Moreover, increasing competition from alternative transportation modes, such as trucking, necessitates continuous innovation and strategic investments to maintain a competitive edge. Addressing environmental concerns through sustainable practices and technologies will be crucial for sustained growth in the long term. Regional analysis reveals that Western Canada, owing to its vast resources and industrial activity, contributes significantly to the market's overall value. The market is concentrated among a number of key players, including Canadian Pacific Railway, Canadian National Railway, and several significant logistics providers. These companies are actively shaping the market through strategic partnerships, technological advancements, and service diversification. The forecast period of 2025-2033 presents substantial opportunities for expansion and innovation within the Canadian rail freight transport sector.

Canada Rail Freight Transport Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada Rail Freight Transport Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamic landscape, highlighting key trends, opportunities, and challenges. The report covers Million values for all financial data.

Canada Rail Freight Transport Market Dynamics & Concentration

The Canadian rail freight transport market exhibits a moderately concentrated structure, dominated by major players like Canadian National Railway and Canadian Pacific Railway, holding a combined market share of approximately xx%. However, the market also encompasses a diverse range of smaller companies like Excel Transportation, Fastfrate, Paige Logistics Ltd, eShipper, Alpha Logistiques, M3 Transport, Liberate Logistics, and MSolution Groups, each contributing to specific niches. Market concentration is influenced by factors such as significant capital investments required for infrastructure and operational expertise. Innovation drivers include technological advancements in train control systems (like the recently implemented enhanced train control system), automation, and data analytics for optimized logistics. Stringent regulatory frameworks, encompassing safety regulations and environmental standards, shape market practices. Substitute modes of transport, including trucking and pipelines, exert competitive pressure, particularly for shorter distances and specific cargo types. End-user trends, reflecting shifts in consumer demand and supply chain strategies, influence freight volumes and cargo composition. The M&A activity within the sector has remained relatively moderate in recent years, with an average of xx deals annually during the historical period (2019-2024). The increasing focus on efficiency and sustainability is expected to further drive consolidation.

- Market Share: Canadian National Railway and Canadian Pacific Railway hold approximately xx% combined.

- M&A Deal Count (2019-2024): xx (average annual)

- Key Innovation Drivers: Enhanced train control systems, automation, data analytics.

- Regulatory Frameworks: Safety regulations, environmental standards.

- Substitute Modes: Trucking, pipelines.

Canada Rail Freight Transport Market Industry Trends & Analysis

The Canadian rail freight transport market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors. Firstly, increasing cross-border trade and domestic economic growth contribute to higher freight volumes. Secondly, the ongoing investments in infrastructure upgrades, such as track improvements and terminal expansions, enhance the efficiency and capacity of the rail network. Technological advancements, including the adoption of enhanced train control systems and improved logistics software, boost operational efficiency and reduce transportation costs. Shifting consumer preferences towards e-commerce and faster delivery times are driving demand for efficient and reliable freight solutions. However, competitive pressures from other transportation modes and fluctuating fuel prices remain challenges. Market penetration of new technologies is gradually increasing, with an estimated xx% adoption rate of enhanced train control systems by 2033. The competitive landscape is characterized by a mix of large, established players and smaller, specialized companies.

Leading Markets & Segments in Canada Rail Freight Transport Market

The domestic segment of the Canadian rail freight transport market holds the largest share, driven by robust intra-provincial and inter-provincial trade. While international freight transport is significant, domestic shipments continue to dominate due to Canada's vast geographical expanse and reliance on rail for inter-regional connectivity. Within cargo types, containerized freight (including intermodal) is the leading segment, followed by non-containerized and liquid bulk.

- Key Drivers for Domestic Segment: Robust intra-provincial and inter-provincial trade, vast geographical expanse.

- Key Drivers for Containerized Freight: Efficiency, standardization, suitability for intermodal transport.

- Key Drivers for Non-containerized Freight: Bulk commodities, specialized handling requirements.

- Key Drivers for Liquid Bulk Freight: Energy, agricultural products, chemical transportation.

The provision of transportation services constitutes the primary revenue stream for market participants. Allied transportation services like maintenance, switching, and storage are also substantial but hold a smaller share compared to core transport operations.

Canada Rail Freight Transport Market Product Developments

Recent product innovations focus on enhancing efficiency and safety. This includes the adoption of advanced train control systems, improved rolling stock, and sophisticated logistics software for optimized route planning and scheduling. These advancements reduce operational costs, enhance safety, and provide improved tracking and visibility throughout the supply chain. The market sees a growing trend towards the integration of data analytics and artificial intelligence to optimize network operations, predict demand, and improve resource allocation. These developments enhance the competitive advantage of rail freight transport by providing more efficient and reliable service offerings to customers.

Key Drivers of Canada Rail Freight Transport Market Growth

Several key factors are driving market growth: (1) Increased government investment in rail infrastructure upgrades boosts capacity and efficiency. (2) The rising volume of cross-border trade fuels demand for rail transportation services. (3) Technological advancements, such as enhanced train control and data analytics, improve operational efficiency and safety. (4) The growth of e-commerce further drives the demand for timely and reliable freight transportation.

Challenges in the Canada Rail Freight Transport Market Market

The industry faces several challenges, including: (1) High infrastructure maintenance costs and the need for continuous investment. (2) Competition from alternative transportation modes like trucking and pipelines. (3) Fluctuating fuel prices and their impact on operating costs. (4) Stringent safety regulations and environmental concerns impose compliance costs. These factors collectively place pressure on profitability and necessitate strategic adaptation by market players.

Emerging Opportunities in Canada Rail Freight Transport Market

Emerging opportunities include: (1) The expansion of intermodal transportation networks improves connectivity and efficiency. (2) The increasing adoption of automation and data analytics enhances operational efficiency and reduces costs. (3) Strategic partnerships and collaborations among stakeholders optimize supply chains and foster innovation. (4) Exploring new technologies like autonomous train operations offers long-term growth potential.

Leading Players in the Canada Rail Freight Transport Market Sector

- Excel Transportation

- Fastfrate

- Paige Logistics Ltd

- Canadian Pacific Railway

- eShipper

- Canadian National Railway

- Alpha Logistiques

- M3 Transport

- Liberate Logistics

- MSolution Groups

Key Milestones in Canada Rail Freight Transport Market Industry

- April 2022: Deutsche Bahn International Operations (DB IO) secured a 25-year contract (valued at €10 Billion) to operate and maintain the GO regional rail network in Ontario. This significantly impacts the public transportation sector but also indirectly influences freight rail by showcasing investment and technological advancements.

- August 2022: Transport Canada mandated enhanced train control systems for major freight railways, boosting safety and potentially influencing investment in newer technologies and infrastructure upgrades.

Strategic Outlook for Canada Rail Freight Transport Market Market

The Canadian rail freight transport market is poised for continued growth, driven by infrastructure development, technological advancements, and increasing trade volumes. Strategic opportunities exist in expanding intermodal capabilities, investing in automation and data analytics, and fostering collaborations to enhance efficiency and competitiveness within the sector. The market’s long-term potential hinges on addressing challenges related to sustainability, safety, and economic factors.

Canada Rail Freight Transport Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Services

-

2. Cargo Type

- 2.1. Containerized (Includes Intermodal)

- 2.2. Non-containerized

- 2.3. Liquid Bulk

-

3. Destination

- 3.1. Domestic

- 3.2. International

Canada Rail Freight Transport Market Segmentation By Geography

- 1. Canada

Canada Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1 Government initiatives

- 3.4.2 investments and Technological innovation in rail freight industry has driven the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Containerized (Includes Intermodal)

- 5.2.2. Non-containerized

- 5.2.3. Liquid Bulk

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Eastern Canada Canada Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Excel Transportation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Fastfrate**List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Paige Logistics Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Canadian Pacific Railway

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 eShipper

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Canadian National Railway

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Alpha Logistiques

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 M3 Transport

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Liberate Logistics

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 MSolution Groups

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Excel Transportation

List of Figures

- Figure 1: Canada Rail Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Rail Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Rail Freight Transport Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Canada Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 4: Canada Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 5: Canada Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Rail Freight Transport Market Revenue Million Forecast, by Service 2019 & 2032

- Table 11: Canada Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 12: Canada Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: Canada Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Rail Freight Transport Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Canada Rail Freight Transport Market?

Key companies in the market include Excel Transportation, Fastfrate**List Not Exhaustive, Paige Logistics Ltd, Canadian Pacific Railway, eShipper, Canadian National Railway, Alpha Logistiques, M3 Transport, Liberate Logistics, MSolution Groups.

3. What are the main segments of the Canada Rail Freight Transport Market?

The market segments include Service, Cargo Type, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

Government initiatives. investments and Technological innovation in rail freight industry has driven the market.

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

April 2022: Deutsche Bahn International Operations (DB IO) will plan, operate and maintain the GO regional rail public transportation network in Toronto and the wider province of Ontario. The contract has a duration of 25 years and carries a value of 10 Billion of euros.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Canada Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence