Key Insights

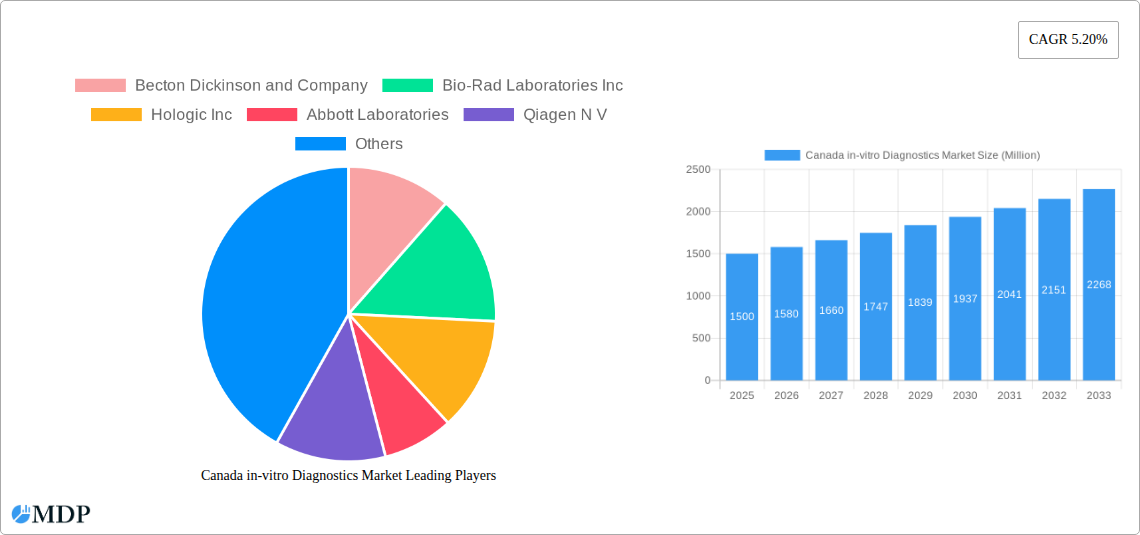

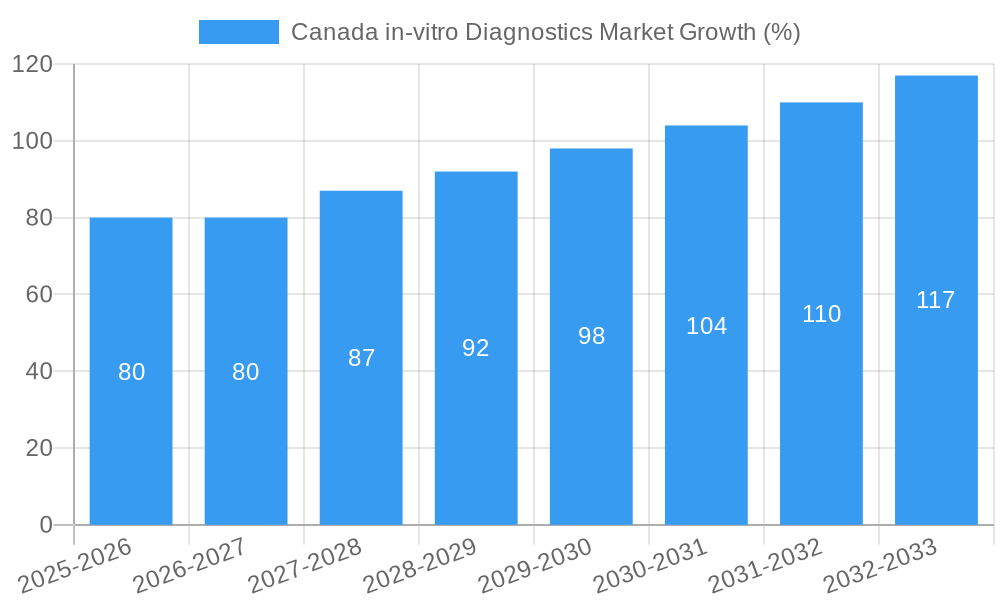

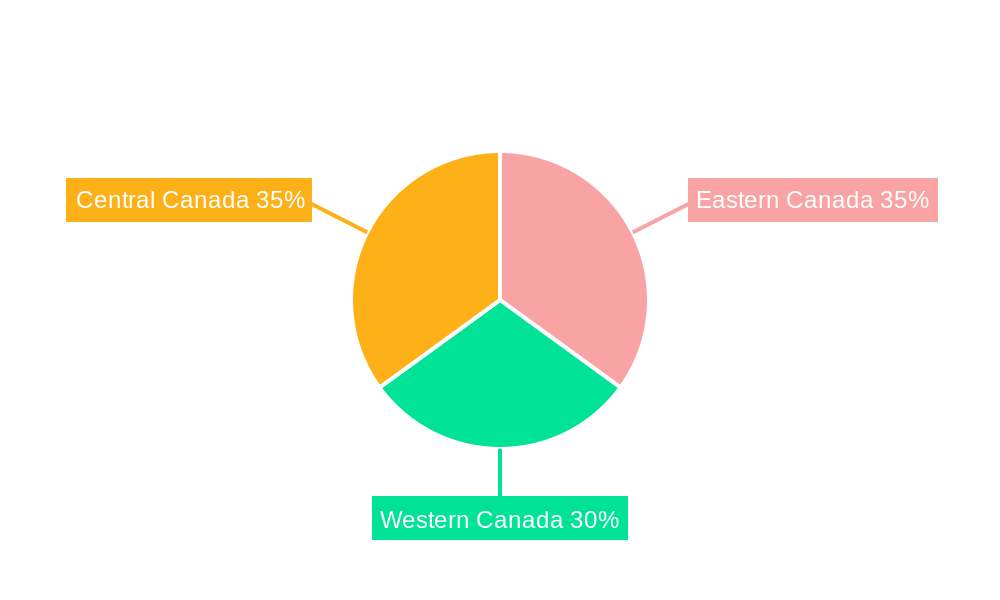

The Canadian in-vitro diagnostics (IVD) market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.20% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions fuels demand for accurate and timely diagnostic testing. Advancements in IVD technologies, including molecular diagnostics and automation, are enhancing diagnostic capabilities and efficiency, further stimulating market growth. Moreover, the growing geriatric population in Canada contributes significantly to the demand for IVD tests, as older individuals often require more frequent screenings and monitoring. Government initiatives focused on improving healthcare infrastructure and expanding access to diagnostic services are also supportive of market expansion. The market is segmented by test type (clinical chemistry, molecular diagnostics, hematology, immunodiagnostics, and others), product (instruments, reagents, and other products), usability (disposable and reusable IVD devices), application (infectious diseases, diabetes, cancer, cardiology, autoimmune diseases, nephrology, and others), and end-users (diagnostic laboratories, hospitals and clinics, and others). Competition within the market is intense, with major players such as Becton Dickinson, Bio-Rad Laboratories, Hologic, Abbott Laboratories, and others vying for market share through innovation and strategic partnerships. Regional variations within Canada (Eastern, Western, and Central) exist, reflecting differences in healthcare infrastructure and population demographics, though a comprehensive analysis of these variations requires further data.

The Canadian IVD market's future trajectory will be influenced by factors including the pace of technological innovation, the success of government healthcare initiatives, and the ongoing management of chronic diseases. Emerging technologies like point-of-care diagnostics and personalized medicine hold significant potential to reshape the market landscape. However, challenges such as regulatory hurdles for new technologies and pricing pressures from payers could impact market growth. The market is expected to witness a gradual shift towards more sophisticated and automated diagnostic systems, along with a rising demand for molecular diagnostics, which offer enhanced accuracy and speed in diagnosing a wide array of diseases. Furthermore, the increasing focus on preventative healthcare and early disease detection will likely drive demand for various IVD tests, particularly those related to infectious diseases and chronic conditions. The regional segmentation within Canada will likely remain a significant factor influencing market dynamics, with variations in demand patterns across different regions.

Canada In-Vitro Diagnostics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canada in-vitro diagnostics (IVD) market, offering valuable insights for industry stakeholders, investors, and researchers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by test type, product, usability, application, and end-user, providing a granular understanding of market dynamics and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key players like Becton Dickinson, Bio-Rad Laboratories, and Abbott Laboratories are analyzed, alongside emerging trends and opportunities.

Canada In-Vitro Diagnostics Market Market Dynamics & Concentration

The Canadian IVD market is characterized by a moderately concentrated landscape with several multinational corporations holding significant market share. Major players such as Becton Dickinson and Company, Bio-Rad Laboratories Inc., Hologic Inc., Abbott Laboratories, and others compete intensely, driving innovation and price competition. Market share dynamics are influenced by factors such as product portfolio breadth, technological advancements, regulatory approvals, and strategic partnerships. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, mainly focused on expanding product portfolios and geographical reach. Innovation is driven by the need for faster, more accurate, and cost-effective diagnostic tools, particularly in areas such as molecular diagnostics and point-of-care testing. The regulatory framework, primarily governed by Health Canada, plays a crucial role, ensuring the safety and efficacy of IVD products. The presence of substitute diagnostic methods, such as imaging techniques, also impacts market growth. End-user trends are shifting towards decentralized testing and increased demand for rapid diagnostic tests.

Canada In-Vitro Diagnostics Market Industry Trends & Analysis

The Canadian IVD market has witnessed significant growth in recent years, fueled by several key factors. Increasing prevalence of chronic diseases like diabetes and cancer, coupled with a growing aging population, has significantly boosted the demand for diagnostic testing. Technological advancements, such as the development of automated and high-throughput systems, have enhanced testing efficiency and accuracy. Government initiatives to improve healthcare infrastructure and access to diagnostic services have also contributed to market growth. Consumer preferences are increasingly leaning towards convenient and rapid diagnostic solutions, leading to the rise of point-of-care testing devices. However, reimbursement policies and pricing pressures remain significant challenges. The market experienced a noticeable impact from the COVID-19 pandemic, with a surge in demand for molecular diagnostic tests. Post-pandemic, market growth is expected to continue at a steady pace, driven by ongoing technological advancements and increasing focus on preventative healthcare. Market penetration of advanced technologies like next-generation sequencing (NGS) is expected to increase, and the market is forecasted to reach xx Million by 2033, representing a xx% CAGR during the forecast period. Competitive dynamics are shaping the market, with companies focused on innovation, strategic partnerships, and geographic expansion to gain a competitive edge.

Leading Markets & Segments in Canada In-Vitro Diagnostics Market

- Dominant Test Type: Molecular diagnostics is currently the fastest-growing segment, driven by the increasing adoption of PCR and NGS technologies for infectious disease diagnostics and genetic testing. Clinical chemistry remains a significant segment due to its wide application in routine diagnostics.

- Dominant Product Category: Reagents dominate the market due to their continuous consumption in various diagnostic tests. However, the demand for advanced instruments is increasing due to technological advancements and a move towards automation.

- Dominant Usability: Disposable IVD devices hold a larger market share due to their convenience and reduced risk of cross-contamination. However, reusable devices are still prevalent in specific applications due to their cost-effectiveness.

- Dominant Application: Infectious disease diagnostics has experienced significant growth, particularly post-COVID-19 pandemic, due to the increasing prevalence of infectious diseases and the demand for rapid diagnostic tests. Cancer/oncology is another substantial segment due to increasing cancer incidence rates.

- Dominant End-User: Hospitals and clinics are the largest consumers of IVD products due to their extensive diagnostic capabilities and high patient volume. Diagnostic laboratories play a crucial role, particularly in advanced testing procedures.

Key drivers for the dominant segments include factors like:

- Government funding for healthcare infrastructure

- Rising prevalence of chronic diseases

- Technological advancements and increased automation

- Increased focus on preventative care

Canada In-Vitro Diagnostics Market Product Developments

Recent product developments in the Canadian IVD market focus on improved accuracy, speed, and ease of use. Companies are developing innovative point-of-care testing devices for rapid diagnostics, particularly in infectious disease and critical care settings. Miniaturization and integration of multiple tests onto single platforms are key technological trends. Furthermore, advancements in molecular diagnostics, including NGS and advanced PCR technologies, are expanding the capabilities of IVD products to offer more comprehensive and personalized diagnostics. These developments enhance diagnostic accuracy and efficiency, which improves patient care and streamlines workflows in healthcare settings.

Key Drivers of Canada In-Vitro Diagnostics Market Growth

Several key factors are driving the growth of the Canadian IVD market. These include:

- Technological advancements: The continuous development of advanced technologies like molecular diagnostics, automated systems, and point-of-care testing is significantly expanding the market's capabilities.

- Increasing prevalence of chronic diseases: The rising incidence of chronic diseases like diabetes, cardiovascular disease, and cancer fuels the demand for diagnostic testing.

- Government support and healthcare reforms: Government funding and initiatives aimed at improving healthcare infrastructure and access to diagnostics play a crucial role in market expansion.

Challenges in the Canada In-Vitro Diagnostics Market Market

The Canadian IVD market faces several challenges, including:

- Strict regulatory approvals: Health Canada's stringent regulatory requirements can delay product launches and increase development costs.

- Price pressure and reimbursement policies: Reimbursement rates from government and insurance providers can constrain profitability.

- Competitive intensity: The market is highly competitive, with established players and emerging companies vying for market share. This leads to price competition and the need for continuous innovation.

Emerging Opportunities in Canada In-Vitro Diagnostics Market

The Canadian IVD market offers several promising opportunities for growth. The increasing adoption of telehealth and remote patient monitoring creates opportunities for developing point-of-care diagnostics. Strategic partnerships between IVD companies and healthcare providers are leading to improved service delivery and market expansion. Furthermore, the rise of personalized medicine and the growing demand for genomic testing are creating new avenues for growth in molecular diagnostics.

Leading Players in the Canada In-Vitro Diagnostics Market Sector

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- Hologic Inc

- Abbott Laboratories

- Qiagen N V

- Siemens AG

- Danaher Corporation

- F Hoffmann-La Roche AG

- Thermo Fischer Scientific Inc

- Arkray Inc

Key Milestones in Canada In-Vitro Diagnostics Market Industry

- May 2022: BioMérieux received Health Canada approval for the BioFire Blood Culture Identification 2 (BCID2) panel, significantly enhancing rapid identification of bloodstream infections.

- January 2022: Yourgene launched its expanded facility, "Yourgene Health Canada Inc.", expanding its molecular diagnostics capabilities in the Canadian market.

Strategic Outlook for Canada In-Vitro Diagnostics Market Market

The future of the Canadian IVD market appears promising, driven by technological advancements, increasing prevalence of chronic diseases, and government initiatives to improve healthcare access. Companies focusing on innovation, strategic partnerships, and expansion into emerging diagnostic areas will be well-positioned for success. The integration of artificial intelligence and big data analytics in diagnostics is expected to further enhance accuracy, efficiency, and personalization of diagnostic testing. The market's continued growth will rely on addressing the challenges of regulatory approvals, price pressures, and intense competition.

Canada in-vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Hematology

- 1.4. Immuno Diagnostics

- 1.5. Other Tests

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End Users

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End Users

Canada in-vitro Diagnostics Market Segmentation By Geography

- 1. Canada

Canada in-vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Point-of-Care (POC) Diagnostics and Advancements in Technology; Increasing Awareness and Acceptance of Personalized Medicine and Companion Diagnostics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations and Cumbersome Reimbursement Procedures

- 3.4. Market Trends

- 3.4.1. Reagent Segment is Expected to hold the Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Hematology

- 5.1.4. Immuno Diagnostics

- 5.1.5. Other Tests

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End Users

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End Users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Eastern Canada Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Becton Dickinson and Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bio-Rad Laboratories Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hologic Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abbott Laboratories

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Qiagen N V

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Siemens AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Danaher Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 F Hoffmann-La Roche AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Thermo Fischer Scientific Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Arkray Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Canada in-vitro Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada in-vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 5: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Canada in-vitro Diagnostics Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 7: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Eastern Canada Canada in-vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Canada Canada in-vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Central Canada Canada in-vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 13: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 15: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Canada in-vitro Diagnostics Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 17: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada in-vitro Diagnostics Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Canada in-vitro Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, Hologic Inc, Abbott Laboratories, Qiagen N V, Siemens AG, Danaher Corporation, F Hoffmann-La Roche AG, Thermo Fischer Scientific Inc, Arkray Inc.

3. What are the main segments of the Canada in-vitro Diagnostics Market?

The market segments include Test Type, Product, Usability, Application, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Point-of-Care (POC) Diagnostics and Advancements in Technology; Increasing Awareness and Acceptance of Personalized Medicine and Companion Diagnostics.

6. What are the notable trends driving market growth?

Reagent Segment is Expected to hold the Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations and Cumbersome Reimbursement Procedures.

8. Can you provide examples of recent developments in the market?

In May 2022, BioMérieux received Health Canada approval for the BioFire Blood Culture Identification 2 (BCID2) panel for rapid identification of bloodstream infections. The BCID2 panel includes additional pathogens, an expanded list of antimicrobial resistance genes, and revised targets compared to the original BCID panel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada in-vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada in-vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada in-vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the Canada in-vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence