Key Insights

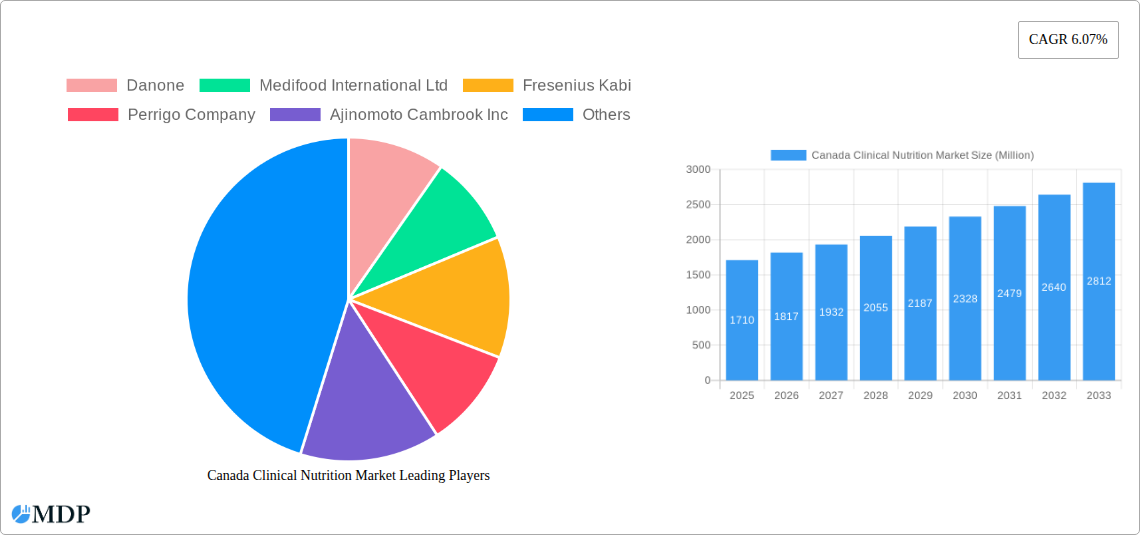

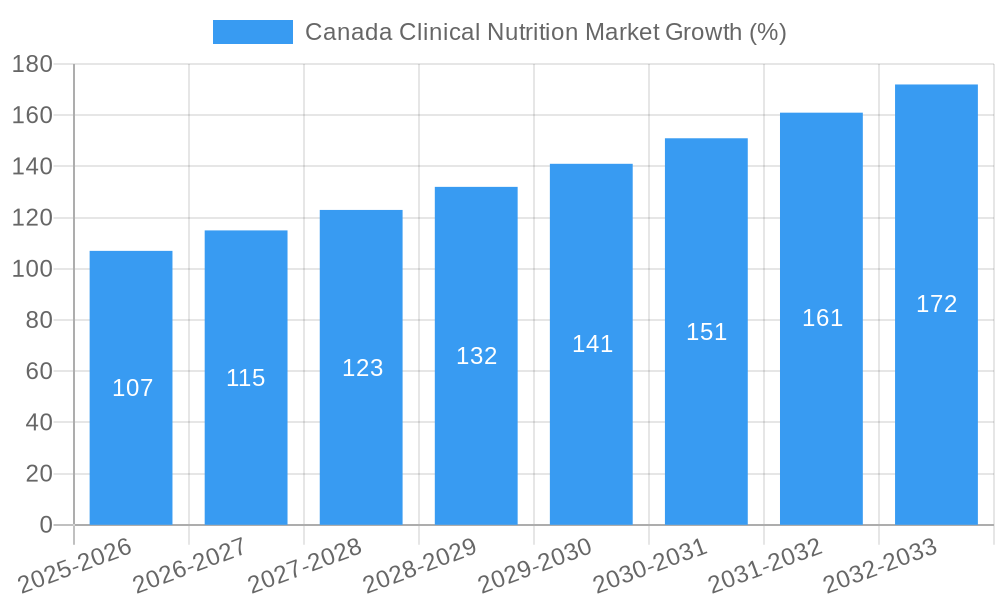

The Canadian clinical nutrition market, valued at $1.71 billion in 2025, is projected to experience robust growth, driven by a rising elderly population, increasing prevalence of chronic diseases like cancer and metabolic disorders, and growing awareness of nutritional therapies' importance. The market's Compound Annual Growth Rate (CAGR) of 6.07% from 2025 to 2033 indicates a significant expansion opportunity. Key segments fueling this growth include adult clinical nutrition, driven by the aging population and higher incidence of chronic illnesses requiring specialized nutritional support. Oral and enteral routes of administration dominate the market due to convenience and cost-effectiveness, although parenteral nutrition remains vital for patients with severe digestive issues. The cancer and malnutrition applications represent significant market segments, with increasing demand for specialized products tailored to specific disease needs. Leading companies like Danone, Nestlé Health Science, and Abbott Laboratories are actively engaged in innovation and product diversification within this space, fostering competition and market development. However, the market faces challenges such as stringent regulatory approvals for new products and high costs associated with specialized clinical nutrition solutions, potentially limiting accessibility for some patients.

The forecast period (2025-2033) suggests continued market expansion, propelled by advancements in nutritional formulations, increased healthcare spending, and an expanding network of healthcare providers specializing in clinical nutrition. The increasing integration of telehealth and personalized medicine may further accelerate growth, enabling remote monitoring and tailored nutritional plans. Geographical expansion within Canada, targeting underserved regions and focusing on educational initiatives to improve awareness of clinical nutrition's benefits among healthcare professionals and patients, will play a key role in shaping the market's trajectory. Competitive pressures will necessitate continuous innovation in product development, pricing strategies, and distribution networks for companies to maintain and enhance their market share within the Canadian clinical nutrition landscape.

Canada Clinical Nutrition Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Clinical Nutrition Market, offering invaluable insights for stakeholders including manufacturers, distributors, investors, and healthcare professionals. The market is projected to reach xx Million by 2033, exhibiting robust growth driven by several key factors detailed within. This report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year.

Canada Clinical Nutrition Market Market Dynamics & Concentration

The Canadian clinical nutrition market is characterized by a moderately concentrated landscape with a few major players holding significant market share. Danone, Nestle Health Science, and Abbott Laboratories, for example, command substantial portions of the market, driven by their established brand recognition and extensive product portfolios. However, the market also accommodates several smaller players, particularly in specialized segments like pediatric nutrition.

Market concentration is influenced by factors including stringent regulatory approvals, high research and development costs, and the need for extensive distribution networks. Innovation, primarily focused on specialized formulas catering to specific dietary needs and improved delivery systems (e.g., ready-to-drink formats), is a key driver. The regulatory framework, overseen by Health Canada, plays a crucial role in shaping market dynamics, including product approvals and labeling requirements.

The market experiences competition from substitute products, particularly in certain applications. For instance, traditional dietary approaches might compete with specialized clinical nutrition products in managing malnutrition. Mergers and acquisitions (M&A) activity has been moderate, with a few notable deals aimed at expanding product portfolios or market access, averaging approximately xx M&A deals annually over the historical period (2019-2024). The market share for top players fluctuates but generally remains relatively stable.

Canada Clinical Nutrition Market Industry Trends & Analysis

The Canadian clinical nutrition market demonstrates consistent growth, exhibiting a CAGR of xx% during the historical period (2019-2024) and a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

- Rising prevalence of chronic diseases: The increasing incidence of conditions like cancer, diabetes, and neurological disorders significantly boosts demand for specialized clinical nutrition products.

- Aging population: Canada’s aging demographic fuels demand for products tailored to the nutritional needs of older adults, including those with age-related health conditions.

- Technological advancements: Innovations in product formulation, packaging, and delivery systems (e.g., improved palatability and convenient formats) are enhancing market appeal.

- Increased healthcare expenditure: Growing government investment in healthcare strengthens access to clinical nutrition products through public health programs and insurance coverage. Market penetration for specialized products remains high, particularly in hospitals and long-term care facilities.

- Shifting consumer preferences: Growing awareness about the role of nutrition in health and well-being drives consumer demand for high-quality, specialized clinical nutrition solutions.

- Competitive intensity: Existing players face challenges from emerging companies that introduce innovative products or competitive pricing strategies.

Leading Markets & Segments in Canada Clinical Nutrition Market

The adult segment holds the largest share of the Canada clinical nutrition market, driven by the prevalence of chronic diseases and the aging population. However, the pediatric segment showcases notable growth potential due to increasing awareness regarding the importance of nutrition in child development.

- Dominant End-User Segment: Adult segment dominates due to a higher prevalence of chronic diseases.

- Route of Administration: Oral and enteral nutrition accounts for the largest market share due to ease of use and convenience. Parenteral nutrition maintains significant importance in specific clinical settings.

- Application: Cancer treatment and the management of malnutrition and metabolic disorders are the primary application areas, owing to the associated high healthcare expenditure.

Key drivers for dominance in each segment include:

- Adult segment: High prevalence of chronic diseases, aging population, and increased healthcare spending.

- Pediatric segment: Rising awareness of nutritional needs for child development and government initiatives promoting healthy child nutrition.

- Oral and enteral: Convenience, cost-effectiveness, and suitability for various settings.

- Parenteral: Necessity for critical care patients and those with severe gastrointestinal issues.

- Cancer treatment: High prevalence of cancer and significant reliance on specialized nutritional support.

Canada Clinical Nutrition Market Product Developments

Recent innovations focus on developing products with enhanced palatability and improved nutrient profiles. Manufacturers are introducing ready-to-drink formats, convenient packaging, and specialized formulas addressing specific dietary needs. These advancements are enhancing product appeal and accessibility, contributing to market growth. The competitive advantage lies in developing products that cater to niche needs, improving patient compliance, and offering cost-effective solutions.

Key Drivers of Canada Clinical Nutrition Market Growth

Several factors are driving the growth of the Canada clinical nutrition market:

- Technological advancements: Innovations in product formulation and delivery systems are improving product efficacy and accessibility.

- Economic growth: Increased disposable incomes improve access to high-quality clinical nutrition products.

- Government regulations: Favorable policies and initiatives promoting healthy nutrition strengthen market demand. For example, improved reimbursement policies enhance accessibility for patients.

Challenges in the Canada Clinical Nutrition Market Market

The market faces several challenges:

- Stringent regulatory requirements: Meeting the rigorous regulatory standards imposed by Health Canada increases the time and cost associated with product development and launch.

- Supply chain disruptions: Potential supply chain disruptions due to global events impact product availability and pricing. This leads to xx Million in potential lost revenue annually.

- Intense competition: Competition among established players and new entrants puts pressure on pricing and margins.

Emerging Opportunities in Canada Clinical Nutrition Market

The market presents significant opportunities for growth through:

- Strategic partnerships: Collaborations between manufacturers and healthcare providers enhance product distribution and market access.

- Market expansion: Exploring new segments and application areas can create new revenue streams.

- Technological breakthroughs: Continued development of innovative products and delivery systems offers growth potential.

Leading Players in the Canada Clinical Nutrition Market Sector

- Danone

- Medifood International Ltd

- Fresenius Kabi

- Perrigo Company

- Ajinomoto Cambrook Inc

- Aymes International Ltd

- Nestle Health Science

- Baxter

- B Braun SE

- Abbott Laboratories

- Reckitt Benckiser

Key Milestones in Canada Clinical Nutrition Market Industry

- 2021: Introduction of a new line of specialized pediatric nutrition products by Nestle Health Science.

- 2022: Abbott Laboratories secures regulatory approval for a novel enteral nutrition formula.

- 2023: Danone announces a strategic partnership with a major Canadian healthcare provider.

- 2024: Merger between two smaller clinical nutrition companies expands market presence.

Strategic Outlook for Canada Clinical Nutrition Market Market

The Canada clinical nutrition market holds significant growth potential driven by a confluence of factors including an aging population, rising healthcare expenditure, and technological advancements. Strategic opportunities exist in developing innovative products tailored to specific patient needs, expanding distribution networks, and forging strategic alliances to enhance market access. The market is poised for sustained growth through the forecast period (2025-2033).

Canada Clinical Nutrition Market Segmentation

-

1. Route of Administration

- 1.1. Oral and Enteral

- 1.2. Parenteral

-

2. Application

- 2.1. Cancer

- 2.2. Malnutrition

- 2.3. Metabolic Disorders

- 2.4. Neurological Diseases

- 2.5. Gastrointestinal Disorders

- 2.6. Others

-

3. End User

- 3.1. Pediatric

- 3.2. Adult

Canada Clinical Nutrition Market Segmentation By Geography

- 1. Canada

Canada Clinical Nutrition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic and Metabolic Diseases; Increasing Pre-term Births; Rise in the Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Stringent Regulation for Clinical Nutrition

- 3.4. Market Trends

- 3.4.1. Malnutrition is Expected to Hold a Major Share in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Clinical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral and Enteral

- 5.1.2. Parenteral

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer

- 5.2.2. Malnutrition

- 5.2.3. Metabolic Disorders

- 5.2.4. Neurological Diseases

- 5.2.5. Gastrointestinal Disorders

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pediatric

- 5.3.2. Adult

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Danone

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medifood International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fresenius Kabi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Perrigo Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Cambrook Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aymes International Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle Health Science

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Baxter

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B Braun SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Abbott Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Reckitt Benckiser

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Danone

List of Figures

- Figure 1: Canada Clinical Nutrition Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Clinical Nutrition Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Clinical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Clinical Nutrition Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Canada Clinical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: Canada Clinical Nutrition Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 5: Canada Clinical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Canada Clinical Nutrition Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Canada Clinical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Canada Clinical Nutrition Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Canada Clinical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Clinical Nutrition Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Canada Clinical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Canada Clinical Nutrition Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Canada Clinical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 14: Canada Clinical Nutrition Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 15: Canada Clinical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Canada Clinical Nutrition Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: Canada Clinical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Canada Clinical Nutrition Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Canada Clinical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Canada Clinical Nutrition Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Clinical Nutrition Market?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the Canada Clinical Nutrition Market?

Key companies in the market include Danone, Medifood International Ltd, Fresenius Kabi, Perrigo Company, Ajinomoto Cambrook Inc, Aymes International Ltd, Nestle Health Science, Baxter, B Braun SE, Abbott Laboratories, Reckitt Benckiser.

3. What are the main segments of the Canada Clinical Nutrition Market?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic and Metabolic Diseases; Increasing Pre-term Births; Rise in the Geriatric Population.

6. What are the notable trends driving market growth?

Malnutrition is Expected to Hold a Major Share in the Coming Years.

7. Are there any restraints impacting market growth?

Stringent Regulation for Clinical Nutrition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Clinical Nutrition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Clinical Nutrition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Clinical Nutrition Market?

To stay informed about further developments, trends, and reports in the Canada Clinical Nutrition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence