Key Insights

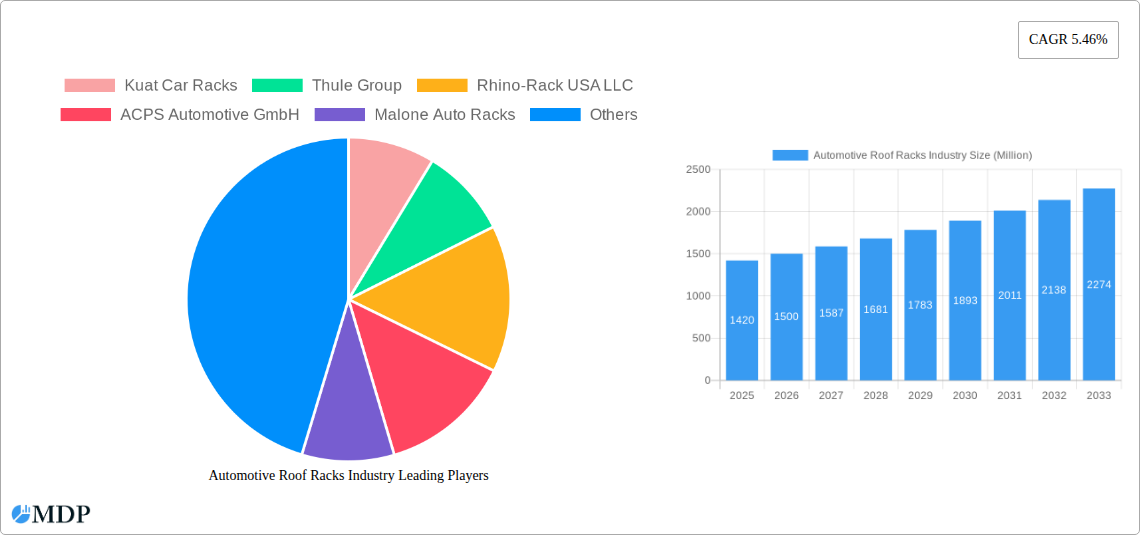

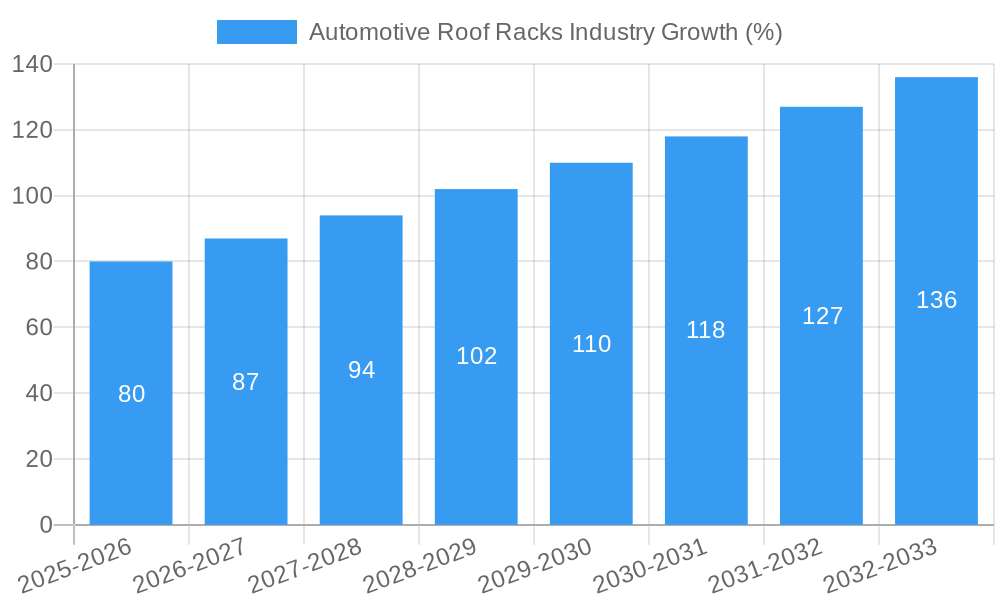

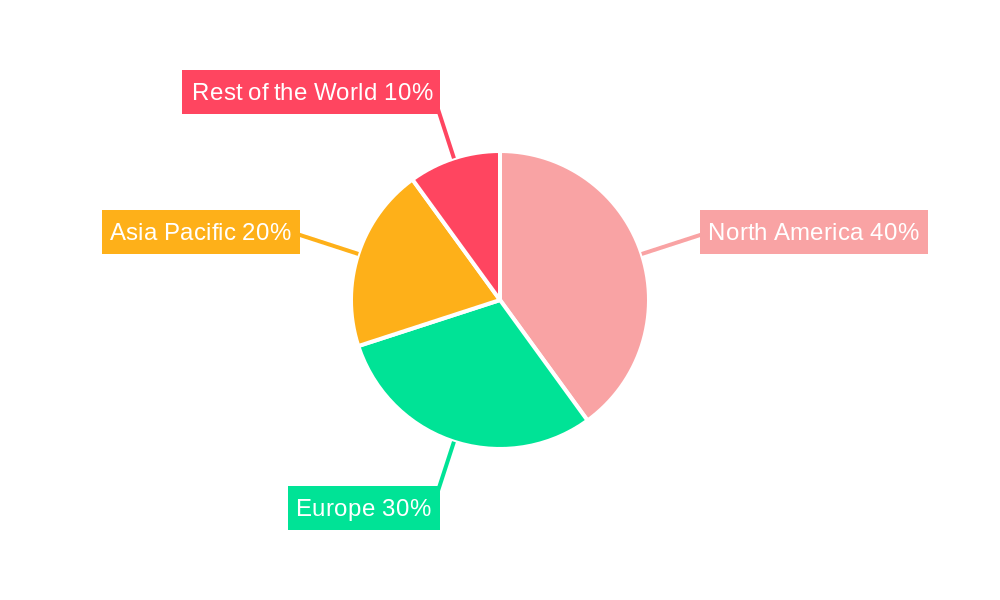

The global automotive roof rack market, valued at $1.42 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.46% from 2025 to 2033. This expansion is fueled by several key factors. The rising popularity of outdoor recreational activities like skiing, snowboarding, and cycling is directly impacting demand for roof racks to transport equipment safely and conveniently. Furthermore, the increasing ownership of SUVs and crossovers, vehicles ideally suited for roof racks, contributes significantly to market growth. Technological advancements, such as the introduction of more aerodynamic and user-friendly designs, are also enhancing consumer appeal. The market is segmented by application type, encompassing roof racks, roof boxes, bike carriers, ski racks, and watersport carriers, each segment exhibiting varying growth trajectories based on consumer preferences and regional trends. North America currently holds a substantial market share, driven by high vehicle ownership and a strong culture of outdoor recreation. However, Asia-Pacific is anticipated to witness significant growth in the coming years due to rising disposable incomes and increasing adoption of recreational activities in developing economies. Competitive dynamics are characterized by a mix of established players like Thule Group and Yakima Products Inc., and emerging regional manufacturers, leading to a dynamic and innovative market landscape.

While growth is projected to be positive, the market faces certain restraints. Fluctuations in raw material prices, particularly steel and aluminum, can impact production costs and potentially hinder growth. Additionally, stringent safety regulations and emission norms in certain regions may pose challenges for manufacturers. However, the overall positive outlook for the automotive roof rack market is driven by the sustained growth in the recreational vehicle sector and the increasing demand for practical and stylish solutions for outdoor equipment transportation. The market’s future will likely hinge on manufacturers' ability to innovate, adapt to changing consumer needs, and offer sustainable and technologically advanced products.

Automotive Roof Racks Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global automotive roof racks industry, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data and actionable strategies for success. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Automotive Roof Racks Industry Market Dynamics & Concentration

The automotive roof rack market is characterized by a moderately concentrated landscape, with several key players holding significant market share. While exact figures for market share are proprietary, leading companies such as Thule Group, Rhino-Rack USA LLC, and Yakima Products Inc. command substantial portions of the market. The industry witnesses consistent innovation, driven by the demand for enhanced functionality, safety features, and aerodynamic designs. Regulatory frameworks concerning vehicle safety and emissions indirectly influence the design and manufacturing of roof racks. Product substitutes, such as interior storage solutions and trailer hitches, exert a degree of competitive pressure. End-user trends favor versatile, easy-to-install, and aesthetically pleasing roof rack systems catering to various outdoor activities like cycling, skiing, and watersports. Mergers and acquisitions (M&A) activity within the industry has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Enhanced functionality, safety, aerodynamics.

- Regulatory Frameworks: Vehicle safety and emission standards.

- Product Substitutes: Interior storage, trailer hitches.

- End-User Trends: Versatility, ease of installation, aesthetics.

- M&A Activity (2019-2024): Approximately xx deals

Automotive Roof Racks Industry Industry Trends & Analysis

The automotive roof rack industry is experiencing robust growth, driven primarily by increasing consumer interest in outdoor recreational activities and the rising popularity of SUVs and crossovers, which offer greater compatibility with roof racks. Technological advancements, particularly in materials science (lighter, stronger materials) and smart features (integrated lighting, locking mechanisms), are further shaping market trends. Consumer preferences are shifting towards more stylish, user-friendly designs that integrate seamlessly with vehicle aesthetics. The competitive landscape remains intense, with established players focusing on product differentiation and innovation while new entrants leverage disruptive technologies and niche market targeting. This has resulted in a market penetration rate of approximately xx% in 2025, projected to increase to xx% by 2033.

Leading Markets & Segments in Automotive Roof Racks Industry

While precise regional dominance data is proprietary, North America and Europe are currently considered significant markets for automotive roof racks. This dominance stems from a higher disposable income level and established car culture within these regions. The automotive roof rack market is segmented into different application types: Roof Rack, Roof Box, Bike Car Rack, Ski Rack, and Watersport Carrier.

- Key Drivers of Regional Dominance:

- North America: High vehicle ownership rates, strong outdoor recreational culture, well-developed retail infrastructure.

- Europe: Similar to North America, but with a greater emphasis on eco-conscious and sustainable transportation solutions.

- Segment Analysis: The Roof Rack segment currently holds the largest market share due to its versatility and broad applications. However, the Bike Car Rack and Roof Box segments are projected to experience significant growth driven by the rising popularity of cycling and the need for secure storage solutions.

Automotive Roof Racks Industry Product Developments

Recent product innovations focus on enhanced functionality, ease of use, and aerodynamic design. Manufacturers are increasingly integrating smart features like integrated locking mechanisms and LED lighting. Materials science advancements lead to lighter and stronger racks that improve fuel efficiency and durability. These advancements address market demands for convenient, safe, and stylish roof rack solutions catering to diverse user needs and vehicles.

Key Drivers of Automotive Roof Racks Industry Growth

Several factors contribute to the growth of the automotive roof rack industry. Firstly, the rising popularity of SUVs and crossovers provides a larger market for compatible roof racks. Secondly, an increased focus on outdoor activities and adventure travel stimulates demand for equipment like bike racks, ski carriers, and cargo boxes. Finally, technological advancements resulting in more efficient, safer, and aesthetically pleasing designs further fuel market expansion.

Challenges in the Automotive Roof Racks Industry Market

The automotive roof rack industry faces challenges including fluctuating raw material prices, increasing manufacturing costs, and intense competition. Supply chain disruptions can cause production delays and impact profitability. Moreover, stringent safety regulations require continuous investment in research and development to ensure compliance, adding to costs.

Emerging Opportunities in Automotive Roof Racks Industry

Long-term growth opportunities arise from the increasing popularity of e-commerce and the integration of smart technologies into roof rack systems. Strategic partnerships with vehicle manufacturers and the expansion into developing markets present significant potential for industry players. Advances in lightweight materials and customizable designs can enhance product offerings and cater to evolving customer preferences.

Leading Players in the Automotive Roof Racks Industry Sector

- Kuat Car Racks

- Thule Group

- Rhino-Rack USA LLC

- ACPS Automotive GmbH

- Malone Auto Racks

- Cruzber SA

- Yakima Products Inc

- Allen Sports

- Saris

- Car Mate Mfg Co Ltd

Key Milestones in Automotive Roof Racks Industry Industry

- September 2022: Cruzber launched the Cruz Pipe Carrier for transporting pipes on light commercial vehicles. This expands Cruzber's product line into the commercial vehicle market.

- September 2022: Cruzber introduced several new products at Automechanika Frankfurt, including CRUZ Stema (bike rack for towbars), Cruz FIX Feet, CRUZ Tailo (multi-functional towbar platform), CRUZ ladder Clamp, further diversifying their product portfolio and strengthening market presence.

- March 2022: Rhino-Rack US LLC launched Reconn-Deck truck bed systems. This expansion into truck bed systems showcases Rhino-Rack's commitment to product diversification and expansion into adjacent markets.

Strategic Outlook for Automotive Roof Racks Industry Market

The future of the automotive roof rack industry appears bright, driven by continuous innovation, increased consumer demand, and strategic partnerships. Focus on sustainable materials and smart technologies will drive growth. Expansion into emerging markets and diversification into adjacent product categories offer substantial opportunities for players to enhance market share and profitability.

Automotive Roof Racks Industry Segmentation

-

1. Application Type

- 1.1. Roof Rack

- 1.2. Roof Box

- 1.3. Bike Car Rack

- 1.4. Ski Rack

- 1.5. Watersport Carrier

Automotive Roof Racks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Automotive Roof Racks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. Recreational Vehicle Rental to Affect The Market Over the Long Term

- 3.4. Market Trends

- 3.4.1. Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Roof Rack

- 5.1.2. Roof Box

- 5.1.3. Bike Car Rack

- 5.1.4. Ski Rack

- 5.1.5. Watersport Carrier

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Roof Rack

- 6.1.2. Roof Box

- 6.1.3. Bike Car Rack

- 6.1.4. Ski Rack

- 6.1.5. Watersport Carrier

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Roof Rack

- 7.1.2. Roof Box

- 7.1.3. Bike Car Rack

- 7.1.4. Ski Rack

- 7.1.5. Watersport Carrier

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Roof Rack

- 8.1.2. Roof Box

- 8.1.3. Bike Car Rack

- 8.1.4. Ski Rack

- 8.1.5. Watersport Carrier

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Roof Rack

- 9.1.2. Roof Box

- 9.1.3. Bike Car Rack

- 9.1.4. Ski Rack

- 9.1.5. Watersport Carrier

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. North America Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 South Africa

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Kuat Car Racks

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Thule Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Rhino-Rack USA LLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 ACPS Automotive GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Malone Auto Racks

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cruzber SA

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Yakima Products Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Allen Sports

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Saris*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Car Mate Mfg Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Kuat Car Racks

List of Figures

- Figure 1: Global Automotive Roof Racks Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 11: North America Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 12: North America Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 15: Europe Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 16: Europe Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 19: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 20: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 23: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 24: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Roof Racks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Global Automotive Roof Racks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of North America Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Africa Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Other Countries Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 24: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of North America Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 29: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Germany Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United Kingdom Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 36: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Asia Pacific Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 42: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Brazil Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Other Countries Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Roof Racks Industry?

The projected CAGR is approximately 5.46%.

2. Which companies are prominent players in the Automotive Roof Racks Industry?

Key companies in the market include Kuat Car Racks, Thule Group, Rhino-Rack USA LLC, ACPS Automotive GmbH, Malone Auto Racks, Cruzber SA, Yakima Products Inc, Allen Sports, Saris*List Not Exhaustive, Car Mate Mfg Co Ltd.

3. What are the main segments of the Automotive Roof Racks Industry?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period.

7. Are there any restraints impacting market growth?

Recreational Vehicle Rental to Affect The Market Over the Long Term.

8. Can you provide examples of recent developments in the market?

September, 2022: Cruz, the Spanish rack brand of Cruzber, launched Cruz Pipe Carrier. It is an accessory for transporting pipes safely on the roof of a light commercial vehicle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Roof Racks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Roof Racks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Roof Racks Industry?

To stay informed about further developments, trends, and reports in the Automotive Roof Racks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence