Key Insights

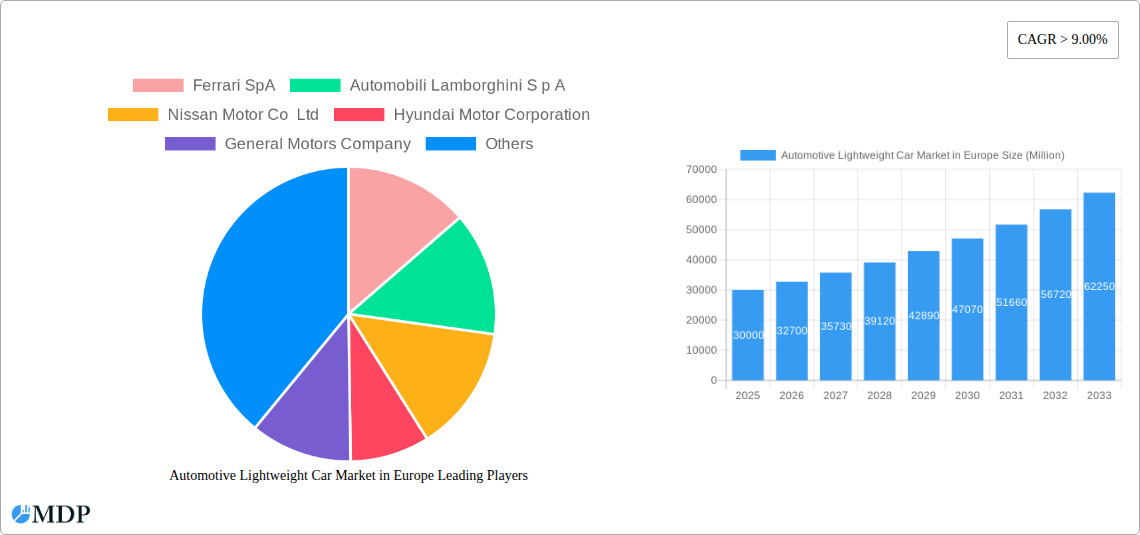

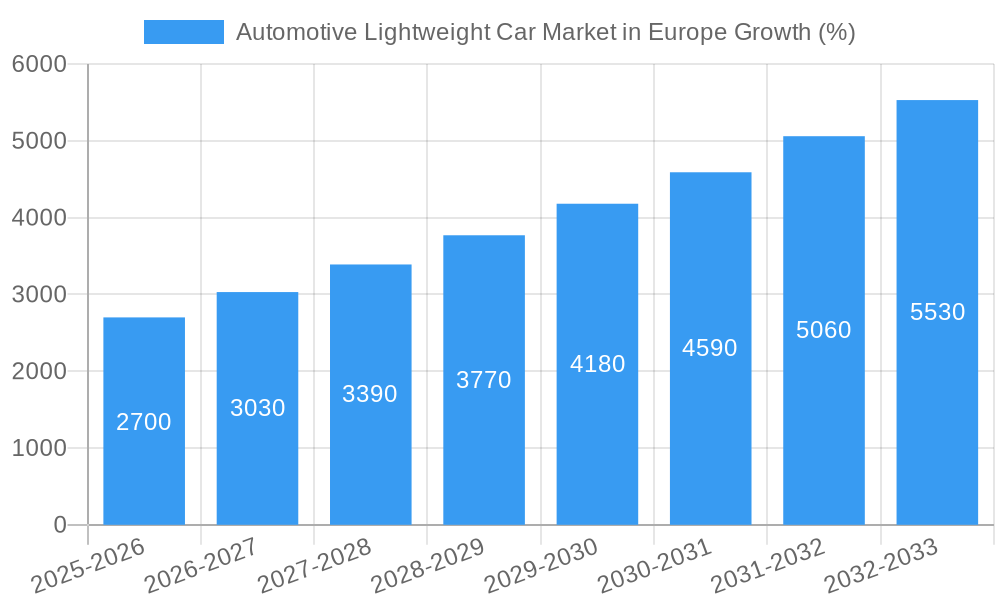

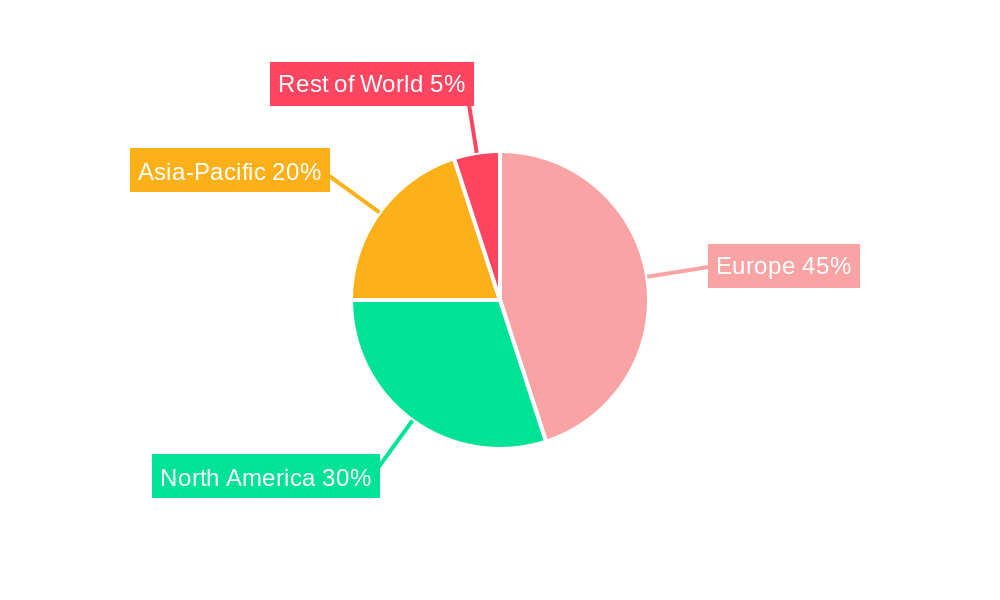

The European automotive lightweight car market is experiencing robust growth, driven by stringent fuel efficiency regulations, increasing consumer demand for fuel-efficient vehicles, and the rising adoption of electric and hybrid vehicles. The market, valued at approximately €30 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 9% from 2025 to 2033. This expansion is fueled by several key factors. The increasing use of lightweight materials such as advanced high-strength steels, aluminum alloys, carbon fiber composites, and plastics is significantly reducing vehicle weight, leading to improved fuel economy and reduced CO2 emissions. Furthermore, advancements in manufacturing processes like extrusion, stamping, forging, and casting are enabling the production of complex lightweight components with enhanced performance characteristics. The automotive industry's focus on improving vehicle safety also contributes to market growth, as lighter materials often offer improved crash performance when designed correctly. The strong presence of major automotive manufacturers in Europe, including Volkswagen AG, Daimler AG, BMW Group, and Renault-Nissan-Mitsubishi Alliance, further strengthens the market's growth trajectory. Demand is particularly strong in the structural, powertrain, and exterior applications segments, reflecting the strategic importance of weight reduction across all vehicle systems.

However, market growth faces some challenges. The high initial investment costs associated with the adoption of lightweight materials and advanced manufacturing techniques can be a significant barrier for smaller manufacturers. Fluctuations in raw material prices, particularly for metals and composites, can impact production costs and market profitability. The need for extensive research and development to ensure the structural integrity and durability of lightweight components also poses a constraint. Despite these challenges, the long-term outlook for the European automotive lightweight car market remains positive, driven by continuous technological advancements and the increasing regulatory pressure for reduced emissions. The market segmentation by material type (metals, composites, plastics), manufacturing process (extrusion, stamping, forging, casting), and application (structural, powertrain, interior, exterior) reveals substantial opportunities for specialized material suppliers and automotive component manufacturers to cater to specific market needs.

Automotive Lightweight Car Market in Europe: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Lightweight Car Market in Europe, covering market dynamics, industry trends, leading segments, key players, and future outlook. The study period spans from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. This report is essential for automotive manufacturers, material suppliers, technology providers, and investors seeking to navigate this rapidly evolving market. The European automotive industry is undergoing a significant transformation driven by stringent emission regulations, rising fuel efficiency demands, and the growing popularity of electric vehicles. This report delves into these critical aspects and provides actionable insights for strategic decision-making. The market size is estimated at xx Million in 2025 and projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Automotive Lightweight Car Market in Europe Market Dynamics & Concentration

The European automotive lightweight car market is characterized by intense competition among established players and emerging entrants. Market concentration is moderate, with a few major players holding significant market share, while several smaller companies compete in niche segments. The market's dynamics are shaped by several factors:

- Innovation Drivers: Continuous advancements in materials science, manufacturing processes, and design engineering drive innovation. The development of lighter, stronger, and more cost-effective materials like advanced composites and high-strength steels is crucial.

- Regulatory Frameworks: Stringent emission regulations, such as the EU's CO2 emission standards, are a major driving force, compelling automakers to adopt lightweighting technologies to improve fuel efficiency.

- Product Substitutes: The market faces competition from alternative technologies, including alternative fuel vehicles and vehicle downsizing strategies. However, lightweighting remains a preferred approach due to its multiple benefits.

- End-User Trends: Growing consumer demand for fuel-efficient and environmentally friendly vehicles is boosting the adoption of lightweight car technology. Safety and performance also significantly influence consumer preferences.

- M&A Activities: The number of mergers and acquisitions (M&A) in the automotive lightweighting sector has seen a steady increase in recent years, with xx M&A deals recorded in 2024. This indicates strategic consolidation among players seeking to expand their market reach and technological capabilities. Major players such as Volkswagen AG and Toyota Motor Corporation are actively involved in strategic partnerships and acquisitions to strengthen their positions in the lightweighting materials market. The market share of the top 5 players accounts for approximately xx% of the total market.

Automotive Lightweight Car Market in Europe Industry Trends & Analysis

The European automotive lightweight car market is witnessing robust growth, driven by several key trends:

The market is experiencing a significant shift towards electric vehicles (EVs), which inherently require lightweighting solutions to extend their range and enhance performance. The adoption of lightweight materials is also driven by the increasing demand for enhanced fuel efficiency and reduced CO2 emissions, propelled by stringent environmental regulations. Furthermore, advancements in manufacturing technologies, such as high-pressure die casting and advanced fiber placement, are enabling the production of more complex and lightweight components. The market penetration of lightweight materials is expected to reach xx% by 2033. The CAGR for the market during the forecast period is projected to be xx%. Consumer preferences are increasingly focused on vehicles that offer improved fuel economy, reduced emissions, and enhanced safety features, all of which are positively influenced by lightweighting technologies. Intense competition among automakers is also stimulating innovation in lightweighting, with each company striving to differentiate its products through superior fuel efficiency, performance, and safety.

Leading Markets & Segments in Automotive Lightweight Car Market in Europe

Germany and France represent the leading markets within Europe for lightweight cars, driven by strong automotive manufacturing bases and supportive government policies. The UK also holds a significant market share.

Material Types:

- Metals: Steel (high-strength steel, advanced high-strength steel) remains the dominant material due to its cost-effectiveness and established manufacturing processes. Aluminum alloys are gaining traction, particularly in body panels and other exterior components.

- Composites: Carbon fiber reinforced polymers (CFRP) and other advanced composites are increasingly used in high-performance vehicles and specific structural components due to their high strength-to-weight ratio, although their high cost remains a barrier to widespread adoption.

- Plastics: Plastics continue to find application in interior and exterior components, though their use in structural applications remains limited compared to metals and composites.

Manufacturing Process:

- Stamping: Dominates the manufacturing of sheet metal components for body panels, offering high production efficiency and cost-effectiveness.

- Extrusion: Widely used for producing lightweight profiles for structural applications.

- Casting: Suitable for complex shapes, particularly in engine components and other powertrain elements.

- Forging: Used for high-strength components requiring exceptional durability.

Application:

- Structural: Lightweighting in the chassis, body, and other structural elements is crucial for fuel efficiency and overall vehicle weight reduction.

- Powertrain: Lightweighting engine components, transmissions, and other powertrain elements improves performance and fuel economy.

- Interior: Using lightweight materials in interior components reduces overall vehicle weight.

- Exterior: Lightweight exterior panels contribute to improved aerodynamics and fuel efficiency.

Key Drivers for Dominant Segments:

- Germany: Strong automotive industry, government support for innovation, and access to advanced materials and technologies.

- France: Significant automotive manufacturing capabilities and a focus on sustainable transportation.

- Steel: Cost-effectiveness and mature manufacturing processes.

- Stamping: High production efficiency and suitability for mass production.

- Structural Applications: Direct impact on vehicle weight and fuel efficiency.

Automotive Lightweight Car Market in Europe Product Developments

Recent product developments demonstrate a clear trend towards using a combination of lightweight materials optimized for specific vehicle applications. For instance, the use of aluminum in body panels (Nissan Qashqai) and the integration of lightweight sports exhausts in high-performance vehicles (Lamborghini Urus Performante) showcase diverse approaches to achieving significant weight reductions. This trend is further reinforced by the increasing adoption of electric vehicle platforms that offer inherent opportunities for weight optimization through design and materials selection.

Key Drivers of Automotive Lightweight Car Market in Europe Growth

Several factors drive the growth of the European automotive lightweight car market:

- Stringent Emission Regulations: EU regulations push automakers towards fuel-efficient vehicles, necessitating lightweighting.

- Fuel Efficiency Demands: Consumers increasingly prefer fuel-efficient vehicles, influencing demand for lightweight designs.

- Technological Advancements: Innovations in materials and manufacturing processes offer lighter and stronger components.

- Rising Demand for EVs: Electric vehicles inherently benefit from lightweighting to extend their range.

Challenges in the Automotive Lightweight Car Market in Europe Market

The market faces several challenges:

- High Cost of Advanced Materials: Materials like carbon fiber composites are expensive, hindering their widespread adoption.

- Supply Chain Disruptions: Global supply chain uncertainties can impact the availability and cost of materials.

- Manufacturing Complexity: Some lightweighting technologies require complex manufacturing processes, increasing costs.

- Recycling Concerns: The recyclability of some advanced materials remains a significant environmental concern.

Emerging Opportunities in Automotive Lightweight Car Market in Europe

The market offers significant long-term opportunities:

- Advancements in Material Science: New lightweight materials with improved performance and cost-effectiveness are continuously emerging.

- Strategic Partnerships: Collaborations between automakers and material suppliers foster innovation and technology transfer.

- Market Expansion in Emerging Countries: Growth in developing countries will create new market opportunities for lightweight car technologies.

- Integration of Lightweighting with ADAS: Integrating lightweighting with advanced driver-assistance systems will open new value propositions.

Leading Players in the Automotive Lightweight Car Market in Europe Sector

- Ferrari SpA

- Automobili Lamborghini S p A

- Nissan Motor Co Ltd

- Hyundai Motor Corporation

- General Motors Company

- Volkswagen AG

- Kia Motors Corporation

- Toyota Motor Corporation

- Honda Motor Co Ltd

- Porsche AG

- Ford Motor Company

Key Milestones in Automotive Lightweight Car Market in Europe Industry

- May 2021: Nissan launched the all-new Qashqai, featuring aluminum panels for weight reduction (60 kg lighter). This significantly improved fuel efficiency and reduced emissions, showcasing a commitment to lightweighting technologies.

- March 2022: Renault launched Megane E-TECH Electric, utilizing the CMF-EV platform for enhanced lightweighting and efficiency in electric vehicles. This marked a step towards reconquering the compact EV segment.

- March 2022: Lotus unveiled the Eletre, an all-electric crossover SUV emphasizing lightweight design for superior performance. This demonstrates the increasing integration of lightweighting into the electric vehicle market.

- August 2022: Automobili Lamborghini introduced the Urus Performante, reducing weight by 47 kg and enhancing the power-to-weight ratio. This highlights the continued importance of lightweighting in high-performance vehicles.

Strategic Outlook for Automotive Lightweight Car Market in Europe Market

The European automotive lightweight car market exhibits substantial growth potential over the forecast period. Continued advancements in material science, manufacturing processes, and design optimization will drive further weight reduction and fuel efficiency improvements. Strategic partnerships and collaborations among automakers, material suppliers, and technology providers will be crucial for driving innovation and accelerating the adoption of lightweighting technologies. The increasing demand for electric and hybrid vehicles will further fuel the demand for lightweight solutions, creating lucrative opportunities for companies operating in this space. Focusing on sustainable and recyclable lightweight materials will become increasingly important for environmental compliance and brand reputation.

Automotive Lightweight Car Market in Europe Segmentation

-

1. Material Types

- 1.1. Metals

- 1.2. Composites

- 1.3. Plastics

-

2. Manufacturing Process

- 2.1. Extrusion

- 2.2. Stamping

- 2.3. Forging

- 2.4. Casting

- 2.5. Others

-

3. Application

- 3.1. Structural

- 3.2. Powertrain

- 3.3. Interior

- 3.4. Exterior

Automotive Lightweight Car Market in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. Spain

- 5. Rest of Europe

Automotive Lightweight Car Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments into Developing Charging Infrastructure in the Country

- 3.3. Market Restrains

- 3.3.1. Lack of Public Charging Station

- 3.4. Market Trends

- 3.4.1. Continuous Evolution in Automotive AHSS Technology to Enhance Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Types

- 5.1.1. Metals

- 5.1.2. Composites

- 5.1.3. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.2.1. Extrusion

- 5.2.2. Stamping

- 5.2.3. Forging

- 5.2.4. Casting

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Structural

- 5.3.2. Powertrain

- 5.3.3. Interior

- 5.3.4. Exterior

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Italy

- 5.4.4. Spain

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Types

- 6. Germany Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material Types

- 6.1.1. Metals

- 6.1.2. Composites

- 6.1.3. Plastics

- 6.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 6.2.1. Extrusion

- 6.2.2. Stamping

- 6.2.3. Forging

- 6.2.4. Casting

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Structural

- 6.3.2. Powertrain

- 6.3.3. Interior

- 6.3.4. Exterior

- 6.1. Market Analysis, Insights and Forecast - by Material Types

- 7. United Kingdom Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material Types

- 7.1.1. Metals

- 7.1.2. Composites

- 7.1.3. Plastics

- 7.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 7.2.1. Extrusion

- 7.2.2. Stamping

- 7.2.3. Forging

- 7.2.4. Casting

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Structural

- 7.3.2. Powertrain

- 7.3.3. Interior

- 7.3.4. Exterior

- 7.1. Market Analysis, Insights and Forecast - by Material Types

- 8. Italy Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material Types

- 8.1.1. Metals

- 8.1.2. Composites

- 8.1.3. Plastics

- 8.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 8.2.1. Extrusion

- 8.2.2. Stamping

- 8.2.3. Forging

- 8.2.4. Casting

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Structural

- 8.3.2. Powertrain

- 8.3.3. Interior

- 8.3.4. Exterior

- 8.1. Market Analysis, Insights and Forecast - by Material Types

- 9. Spain Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material Types

- 9.1.1. Metals

- 9.1.2. Composites

- 9.1.3. Plastics

- 9.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 9.2.1. Extrusion

- 9.2.2. Stamping

- 9.2.3. Forging

- 9.2.4. Casting

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Structural

- 9.3.2. Powertrain

- 9.3.3. Interior

- 9.3.4. Exterior

- 9.1. Market Analysis, Insights and Forecast - by Material Types

- 10. Rest of Europe Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material Types

- 10.1.1. Metals

- 10.1.2. Composites

- 10.1.3. Plastics

- 10.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 10.2.1. Extrusion

- 10.2.2. Stamping

- 10.2.3. Forging

- 10.2.4. Casting

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Structural

- 10.3.2. Powertrain

- 10.3.3. Interior

- 10.3.4. Exterior

- 10.1. Market Analysis, Insights and Forecast - by Material Types

- 11. Germany Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 12. France Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 13. Italy Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Automotive Lightweight Car Market in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Ferrari SpA

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Automobili Lamborghini S p A

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Nissan Motor Co Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Hyundai Motor Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 General Motors Company

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Volkswagen AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Kia Motors Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Toyota Motor Corporation

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Honda Motor Co Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Porsche AG *List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Ford Motor Company

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Ferrari SpA

List of Figures

- Figure 1: Automotive Lightweight Car Market in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Automotive Lightweight Car Market in Europe Share (%) by Company 2024

List of Tables

- Table 1: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Material Types 2019 & 2032

- Table 3: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 4: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Automotive Lightweight Car Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Automotive Lightweight Car Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Automotive Lightweight Car Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Automotive Lightweight Car Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Automotive Lightweight Car Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Automotive Lightweight Car Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Automotive Lightweight Car Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Material Types 2019 & 2032

- Table 15: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 16: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Material Types 2019 & 2032

- Table 19: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 20: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Material Types 2019 & 2032

- Table 23: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 24: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Material Types 2019 & 2032

- Table 27: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 28: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Material Types 2019 & 2032

- Table 31: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Manufacturing Process 2019 & 2032

- Table 32: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Automotive Lightweight Car Market in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Lightweight Car Market in Europe?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Automotive Lightweight Car Market in Europe?

Key companies in the market include Ferrari SpA, Automobili Lamborghini S p A, Nissan Motor Co Ltd, Hyundai Motor Corporation, General Motors Company, Volkswagen AG, Kia Motors Corporation, Toyota Motor Corporation, Honda Motor Co Ltd, Porsche AG *List Not Exhaustive, Ford Motor Company.

3. What are the main segments of the Automotive Lightweight Car Market in Europe?

The market segments include Material Types, Manufacturing Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments into Developing Charging Infrastructure in the Country.

6. What are the notable trends driving market growth?

Continuous Evolution in Automotive AHSS Technology to Enhance Market Growth.

7. Are there any restraints impacting market growth?

Lack of Public Charging Station.

8. Can you provide examples of recent developments in the market?

In August 2022, Automobili Lamborghini announced the Urus Performante. It has a V8 twin-turbo powerplant and a lightweight sports exhaust. The Performante's power is increased by 16 CV to 666 CV, and its weight is reduced by 47 kg, giving it a best-in-class weight-to-power ratio of 3,2.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Lightweight Car Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Lightweight Car Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Lightweight Car Market in Europe?

To stay informed about further developments, trends, and reports in the Automotive Lightweight Car Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence