Key Insights

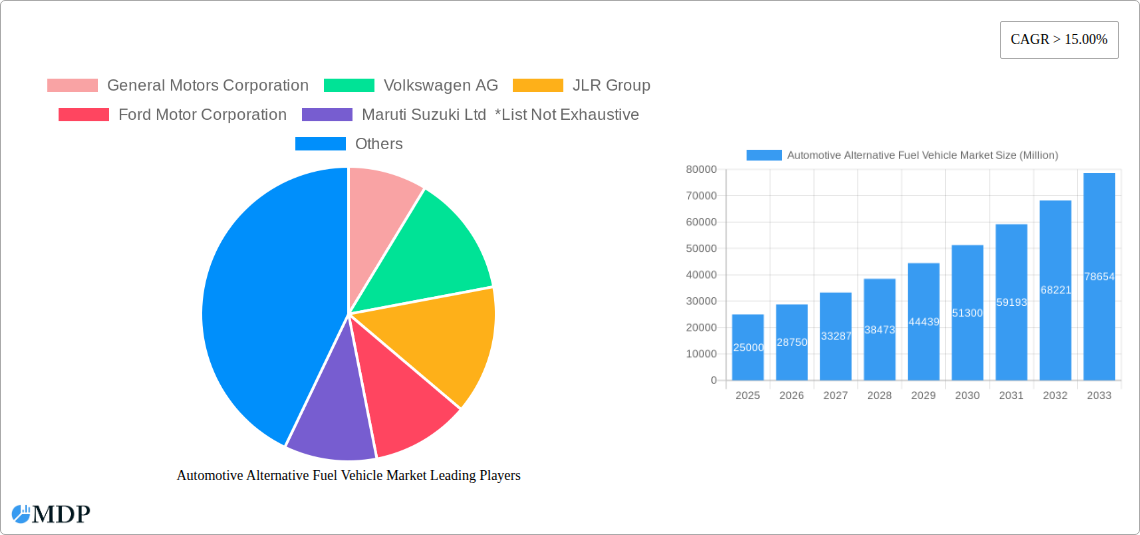

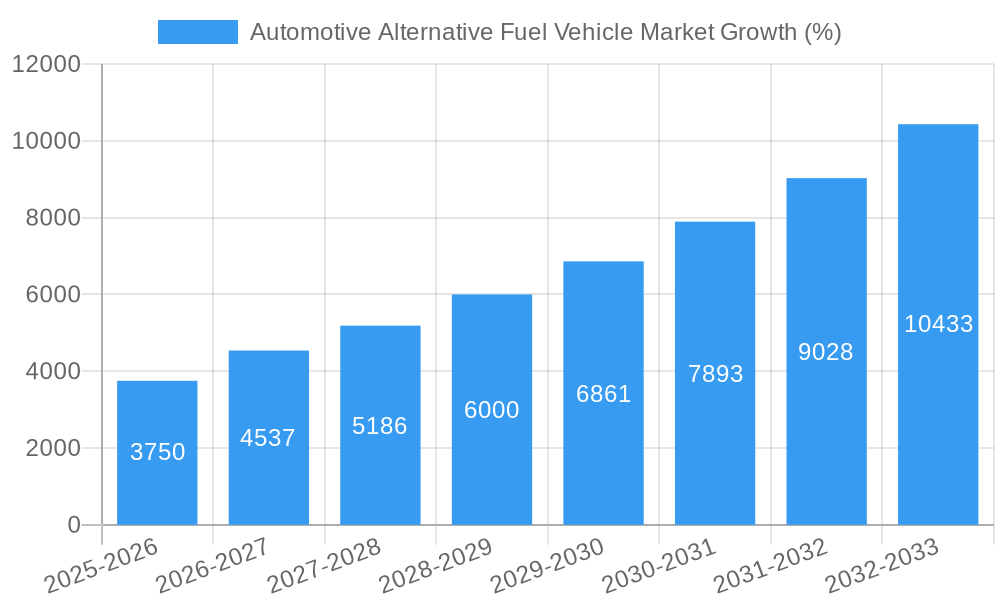

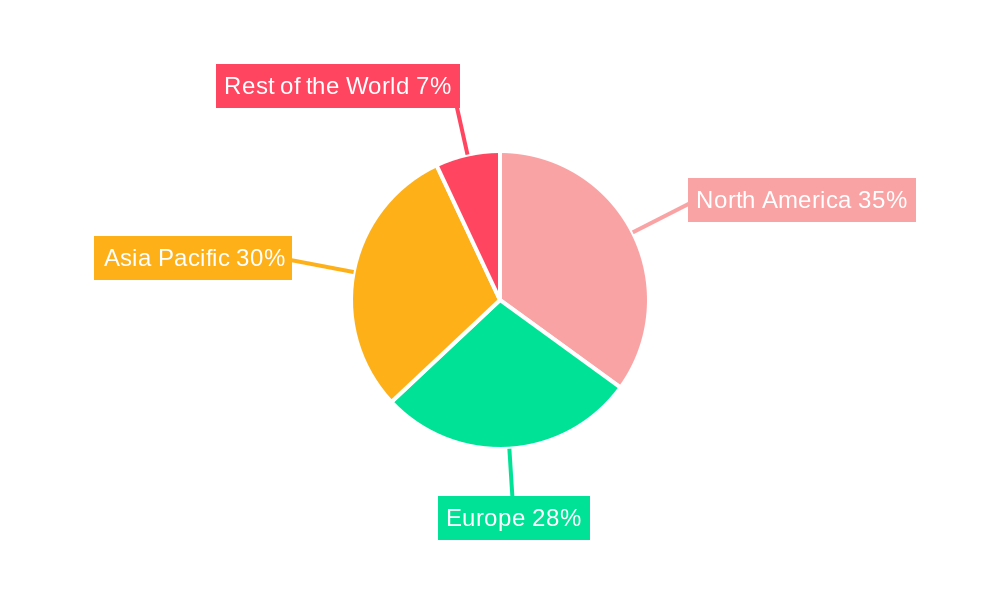

The Automotive Alternative Fuel Vehicle (AFV) market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 15% from 2025 to 2033. This expansion is fueled by escalating concerns about climate change and air pollution, coupled with stringent government regulations promoting cleaner transportation. The increasing cost of traditional fossil fuels and advancements in battery technology and alternative fuel infrastructure are further driving market adoption. Significant market segments include Compressed Natural Gas (CNG), methanol, and electric vehicles across passenger, light commercial, and heavy-duty commercial vehicle categories. Leading manufacturers like Tesla, BYD, Volkswagen, and General Motors are heavily investing in R&D and production to capitalize on this burgeoning market. Geographical analysis reveals strong growth across North America, particularly the United States and Canada, driven by supportive policies and consumer demand. The Asia-Pacific region, especially China and India, represents a significant growth opportunity, fueled by expanding economies and rising vehicle ownership. However, challenges such as high initial costs of AFVs, limited charging infrastructure in certain regions, and the development of robust refueling networks for CNG and methanol present headwinds to market penetration.

The market segmentation reveals a dynamic landscape. Electric vehicles currently dominate the market share among alternative fuel types due to technological advancements and substantial government incentives. However, CNG and methanol vehicles hold a significant position, especially in commercial vehicle segments, offering a cost-effective transition solution. Future growth is expected to be driven by innovations in battery technology leading to increased range and reduced charging times for electric vehicles, along with improvements in the efficiency and infrastructure for CNG and methanol. The competitive landscape is fiercely contested, with established automakers and new entrants vying for market dominance. Strategic partnerships, mergers, and acquisitions are anticipated to shape the industry's future trajectory, ultimately accelerating the transition towards a more sustainable automotive sector.

Automotive Alternative Fuel Vehicle Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Alternative Fuel Vehicle Market, encompassing market dynamics, industry trends, leading segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for stakeholders seeking to navigate the evolving landscape of sustainable transportation. The report utilizes data from the historical period (2019-2024) and incorporates key industry developments to provide accurate and actionable forecasts. Expect detailed analysis of market share, CAGR, and market penetration, offering a clear understanding of investment opportunities and potential risks.

Automotive Alternative Fuel Vehicle Market Market Dynamics & Concentration

The Automotive Alternative Fuel Vehicle (AFV) market is experiencing dynamic growth, driven by stringent emission regulations, rising consumer awareness of environmental concerns, and technological advancements in battery technology and alternative fuel infrastructure. Market concentration is moderate, with several major players dominating specific segments. However, the emergence of new entrants and strategic partnerships is intensifying competition.

Market Concentration Metrics (2024 Estimates):

- Top 5 Players Market Share: xx%

- Number of M&A deals (2019-2024): xx

Innovation Drivers:

- Advancements in battery technology (e.g., solid-state batteries) are extending electric vehicle (EV) ranges and reducing charging times.

- Development of hydrogen fuel cell technology offers a promising alternative for long-haul transportation.

- Continuous improvement in CNG and methanol engine efficiency and infrastructure development.

Regulatory Frameworks:

Government incentives like tax credits, subsidies, and emission standards are significantly boosting AFV adoption. Stringent emission norms in various regions are driving the shift towards cleaner transportation options.

Product Substitutes:

Traditional internal combustion engine (ICE) vehicles remain a primary substitute, but their market share is gradually declining due to rising fuel costs and environmental concerns.

End-User Trends:

Consumer preferences are shifting towards fuel-efficient and environmentally friendly vehicles, driving demand for AFVs. The increasing adoption of shared mobility services is also positively influencing the market.

M&A Activities: Recent mergers and acquisitions (M&As) reflect the industry’s consolidation and the pursuit of technological advancements and market expansion. The strategic alliances between established automakers and technology companies are reshaping the competitive landscape.

Automotive Alternative Fuel Vehicle Market Industry Trends & Analysis

The Automotive Alternative Fuel Vehicle market is experiencing robust growth, primarily propelled by escalating environmental concerns and governmental policies favoring sustainable transportation. The global market is witnessing a significant shift towards electric vehicles, fueled by technological advancements, falling battery costs, and expanding charging infrastructure.

Market Growth Drivers:

- Stringent Emission Regulations: Governments worldwide are implementing stricter emission standards, pushing automakers to prioritize AFV development.

- Technological Advancements: Improvements in battery technology, fuel cell technology, and charging infrastructure are driving down the cost and improving the performance of AFVs.

- Rising Fuel Prices: Fluctuations in traditional fuel prices are making AFVs a more cost-effective option for consumers in the long run.

- Government Incentives: Substantial government support, including tax credits, subsidies, and purchase incentives, are stimulating demand.

- Growing Environmental Awareness: Increasing public awareness of climate change and its impact is driving consumer preference towards greener vehicles.

Technological Disruptions:

The rapid evolution of battery technology, particularly the development of solid-state batteries, promises to significantly improve the range, charging speed, and safety of EVs. Advancements in hydrogen fuel cell technology are also creating new opportunities for AFVs.

Consumer Preferences:

Consumers increasingly prioritize fuel efficiency, environmental friendliness, and advanced technology features in their vehicle choices. This trend strongly favors the adoption of AFVs.

Competitive Dynamics: The market is characterized by intense competition among established automakers and new entrants, resulting in continuous innovation and price pressure.

CAGR (2025-2033): xx% Market Penetration (2025): xx%

Leading Markets & Segments in Automotive Alternative Fuel Vehicle Market

The electric vehicle segment dominates the Automotive Alternative Fuel Vehicle market, followed by CNG vehicles. Passenger vehicles currently constitute the largest vehicle type segment. Geographically, the market is concentrated in developed countries with robust government support and infrastructure.

Leading Segments:

Fuel Type: Electric vehicles are projected to dominate the market throughout the forecast period, driven by technological advancements, declining battery costs, and government incentives. The CNG segment is expected to experience steady growth, particularly in regions with established natural gas infrastructure. Methanol vehicles hold a smaller share, and "Others" includes niche technologies.

Vehicle Type: Passenger vehicles represent the largest share of the AFV market, driven by high consumer demand. The Light Commercial Vehicles (LCVs) segment is expected to show strong growth due to the increasing adoption of delivery vans and commercial vehicles powered by alternative fuels. Medium & Heavy-duty Commercial Vehicles (M&HCVs) adoption is slower due to higher upfront costs and longer payback periods.

Key Drivers by Region (Examples):

- China: Government policies promoting electric vehicles, substantial investment in charging infrastructure, and a large consumer base.

- Europe: Stringent emission regulations, substantial government incentives, and developing hydrogen fuel cell infrastructure.

- North America: Growing consumer awareness of environmental issues, government support for EVs, and investments in charging infrastructure.

Dominance Analysis:

Electric vehicles are expected to maintain their dominance due to continuous technological advancements, cost reductions, and government support. However, CNG will remain a significant segment, especially in regions with readily available natural gas infrastructure.

Automotive Alternative Fuel Vehicle Market Product Developments

Recent product innovations focus on enhancing battery performance, improving fuel cell efficiency, and developing innovative charging technologies. Automakers are integrating advanced features such as autonomous driving capabilities and enhanced connectivity to enhance the customer experience. This continuous innovation aims to address consumer needs and create a competitive edge in the market. The market fit is strong, driven by the increasing demand for sustainable and technologically advanced vehicles.

Key Drivers of Automotive Alternative Fuel Vehicle Market Growth

The growth of the Automotive Alternative Fuel Vehicle market is driven by a convergence of factors: stringent government regulations aimed at reducing emissions, substantial technological advancements leading to improved vehicle performance and reduced costs, and growing consumer preference for environmentally friendly vehicles. Government incentives, such as tax credits and subsidies, further accelerate market adoption. The expanding charging infrastructure for EVs and fueling infrastructure for other alternative fuel types plays a vital role in market expansion.

Challenges in the Automotive Alternative Fuel Vehicle Market Market

Several challenges hinder the widespread adoption of AFVs. High initial costs, limited charging infrastructure in some regions, and concerns about battery range and charging time remain significant barriers. Supply chain disruptions related to battery materials can affect production and availability. Competition from established ICE vehicle manufacturers is also a factor to be considered. The overall impact of these challenges is a slower rate of market penetration compared to projections in certain regions.

Emerging Opportunities in Automotive Alternative Fuel Vehicle Market

Technological advancements such as solid-state batteries, improved fuel cell technology, and advancements in battery charging infrastructure represent significant opportunities for accelerated market growth. Strategic partnerships between automakers and technology companies are driving innovation and opening new avenues for market expansion. Government policies promoting AFVs, including the establishment of charging networks and tax credits, create favorable conditions for market expansion. Growth in the shared mobility sector also presents exciting new avenues for increased AFV adoption.

Leading Players in the Automotive Alternative Fuel Vehicle Sector

- General Motors Corporation

- Volkswagen AG

- JLR Group

- Ford Motor Corporation

- Maruti Suzuki Ltd

- Mercedes Benz Group

- Hyundai Motor Company

- BMW AG

- Tesla Inc

- BYD Auto Co Ltd

- Audi AG

- Toyota Motor Corporation

- Rev Group

Key Milestones in Automotive Alternative Fuel Vehicle Market Industry

- September 2022: IVECO and Petit Forestier signed an MoU to procure 2000 eDaily electric delivery vans, expanding the electric commercial vehicle market.

- September 2022: Mercedes-Benz Vans partnered with Rivian to cooperate on electric van production, signifying collaboration in the EV sector.

- May 2022: Mahindra & Mahindra and Volkswagen AG agreed to share VW's MEB electric platform, fostering collaboration and component sharing.

- April 2022: Tesla Inc. commenced operations at Giga Berlin, significantly increasing European EV production capacity.

Strategic Outlook for Automotive Alternative Fuel Vehicle Market Market

The Automotive Alternative Fuel Vehicle market shows significant long-term growth potential. Technological breakthroughs, strategic partnerships, and supportive government policies are creating a favorable environment. The increasing consumer demand for sustainable transportation and the declining costs of alternative fuel vehicles will continue to fuel market expansion. Companies focusing on innovation, strategic collaborations, and efficient supply chains are well-positioned to capitalize on the market's considerable growth opportunities.

Automotive Alternative Fuel Vehicle Market Segmentation

-

1. Fuel Type

- 1.1. Compressed Natural Gas (CNG)

- 1.2. Methanol

- 1.3. Electric

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Light Commercial Vehicles

- 2.3. Medium & Heavy-duty Commercial Vehicles

Automotive Alternative Fuel Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive Alternative Fuel Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Subsidies Help Boost Electric Rikshaw Sales in India

- 3.3. Market Restrains

- 3.3.1. Limited Charging Infrastructure and Range Anxiety May Hamper the Growth of Electric Rikshaw Sales in India

- 3.4. Market Trends

- 3.4.1. Stringent Government rules and regulations and growth in sales of electric vehicles will drive growth in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Compressed Natural Gas (CNG)

- 5.1.2. Methanol

- 5.1.3. Electric

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Light Commercial Vehicles

- 5.2.3. Medium & Heavy-duty Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. North America Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Compressed Natural Gas (CNG)

- 6.1.2. Methanol

- 6.1.3. Electric

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Vehicles

- 6.2.2. Light Commercial Vehicles

- 6.2.3. Medium & Heavy-duty Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Europe Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Compressed Natural Gas (CNG)

- 7.1.2. Methanol

- 7.1.3. Electric

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Vehicles

- 7.2.2. Light Commercial Vehicles

- 7.2.3. Medium & Heavy-duty Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Asia Pacific Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Compressed Natural Gas (CNG)

- 8.1.2. Methanol

- 8.1.3. Electric

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Vehicles

- 8.2.2. Light Commercial Vehicles

- 8.2.3. Medium & Heavy-duty Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of the World Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Compressed Natural Gas (CNG)

- 9.1.2. Methanol

- 9.1.3. Electric

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Vehicles

- 9.2.2. Light Commercial Vehicles

- 9.2.3. Medium & Heavy-duty Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. North America Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Alternative Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Mexico

- 13.1.3 United Arab Emirates

- 13.1.4 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 General Motors Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Volkswagen AG

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 JLR Group

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Ford Motor Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Maruti Suzuki Ltd *List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Mercedes Benz Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Hyundai Motor Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 BMW AG

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Tesla Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 BYD Auto Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Audi AG

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Toyota Motor Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Rev Group

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 General Motors Corporation

List of Figures

- Figure 1: Global Automotive Alternative Fuel Vehicle Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Alternative Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 11: North America Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 12: North America Automotive Alternative Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 13: North America Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 14: North America Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Automotive Alternative Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 17: Europe Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 18: Europe Automotive Alternative Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 19: Europe Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 20: Europe Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 23: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 24: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 25: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 26: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 29: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 30: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Automotive Alternative Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 3: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Mexico Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Arab Emirates Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Other Countries Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 27: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 28: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 33: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 34: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Germany Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 41: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 42: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: India Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 49: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Global Automotive Alternative Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Brazil Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Mexico Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: United Arab Emirates Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Other Countries Automotive Alternative Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Alternative Fuel Vehicle Market?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the Automotive Alternative Fuel Vehicle Market?

Key companies in the market include General Motors Corporation, Volkswagen AG, JLR Group, Ford Motor Corporation, Maruti Suzuki Ltd *List Not Exhaustive, Mercedes Benz Group, Hyundai Motor Company, BMW AG, Tesla Inc, BYD Auto Co Ltd, Audi AG, Toyota Motor Corporation, Rev Group.

3. What are the main segments of the Automotive Alternative Fuel Vehicle Market?

The market segments include Fuel Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Subsidies Help Boost Electric Rikshaw Sales in India.

6. What are the notable trends driving market growth?

Stringent Government rules and regulations and growth in sales of electric vehicles will drive growth in the market.

7. Are there any restraints impacting market growth?

Limited Charging Infrastructure and Range Anxiety May Hamper the Growth of Electric Rikshaw Sales in India.

8. Can you provide examples of recent developments in the market?

In September 2022, IVECO and Petit Forestier, a European refrigerated vehicle rental and leasing company signed an MoU to procure 2000 units of eDaily electric delivery vans.As early as 2023, Petit Forestier's customers operating in the European Union territory, Great Britain and Switzerland will be offered priority access to rent the eDAILY. The available fleet, initially comprised of 200 vehicles, will reach a total of 2,000 by 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Alternative Fuel Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Alternative Fuel Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Alternative Fuel Vehicle Market?

To stay informed about further developments, trends, and reports in the Automotive Alternative Fuel Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence