Key Insights

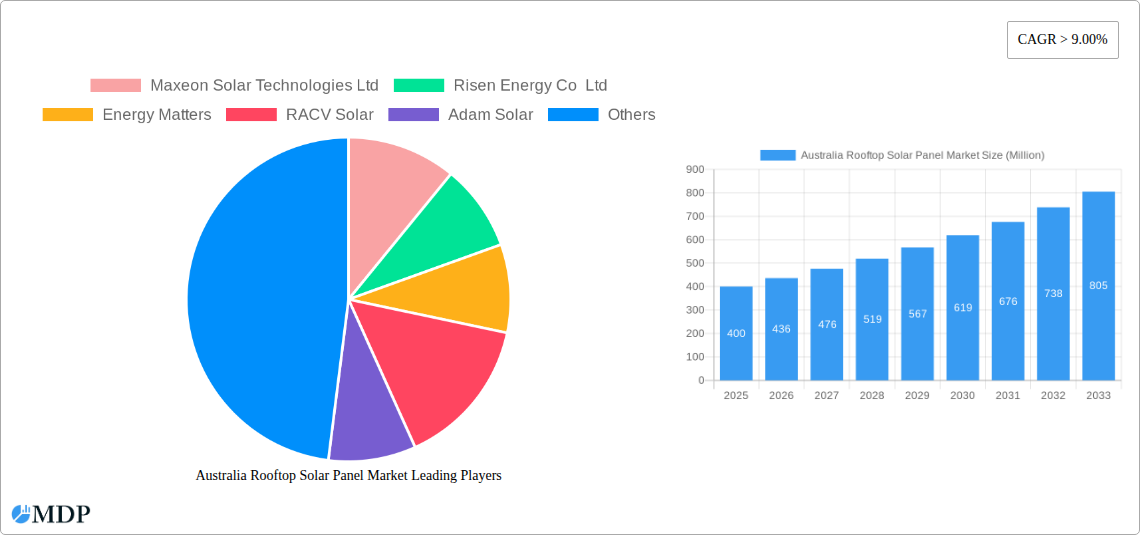

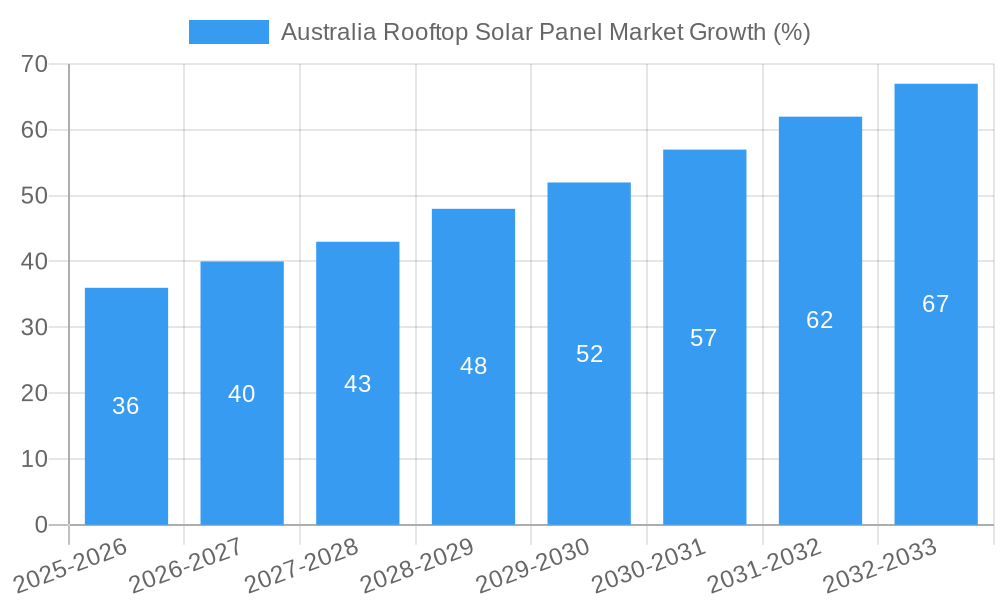

The Australian rooftop solar panel market is experiencing robust growth, fueled by increasing electricity prices, government incentives like the Small-scale Renewable Energy Scheme (SRES), and rising environmental awareness. With a Compound Annual Growth Rate (CAGR) exceeding 9% and a market size currently in the hundreds of millions (precise figures unavailable, but estimated based on global market trends and Australian energy consumption data), the sector is poised for significant expansion throughout the forecast period (2025-2033). The market is segmented by product type (hybrid, monocrystalline, polycrystalline) reflecting consumer preferences for efficiency and cost-effectiveness, and by application (residential, commercial, industrial) showcasing the diverse range of users. Key players like Maxeon Solar Technologies, Risen Energy, and Trina Solar are driving innovation and competition, contributing to price reductions and improved technology. Growth is particularly strong in the residential sector, driven by individual household adoption, while the commercial and industrial sectors are showing steady growth as businesses seek to reduce energy costs and improve their sustainability profiles. Challenges include intermittent solar power generation and the need for robust grid infrastructure to effectively integrate distributed renewable energy sources. However, ongoing technological advancements, supportive government policies, and escalating energy costs are expected to overcome these challenges and ensure continued market expansion.

The Asia-Pacific region, particularly Australia, is a key market driver due to high solar irradiance levels and strong government support. While precise market sizing for 2025 is unavailable, extrapolating from the CAGR and considering the significant growth witnessed in previous years, a conservative estimate would place the Australian rooftop solar panel market value in the range of $300-$500 million AUD in 2025. Future growth will be shaped by factors such as technological breakthroughs in battery storage, advancements in solar panel efficiency, and evolving government policies. The shift towards net-zero targets by businesses and households is further bolstering demand, creating opportunities for established players and new entrants alike. Competition is intense, prompting continuous improvement in product quality, service offerings, and affordability. This competitive landscape benefits consumers by providing a diverse range of options to choose from based on their specific energy needs and budget.

Australia Rooftop Solar Panel Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian rooftop solar panel market, covering market dynamics, industry trends, leading segments, key players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for investors, industry stakeholders, and businesses seeking to navigate this rapidly evolving market.

Australia Rooftop Solar Panel Market Market Dynamics & Concentration

The Australian rooftop solar panel market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderate, with several key players vying for market share. However, the market exhibits strong innovation, driven by advancements in solar panel technology, energy storage solutions, and smart grid integration. Stringent regulatory frameworks, including government incentives and renewable energy targets, significantly impact market growth. Product substitutes, such as other renewable energy sources, present some competitive pressure, but the decreasing cost of solar panels maintains its competitive edge. End-user trends favor environmentally conscious consumers and businesses seeking energy independence and cost savings. The last few years have seen moderate M&A activity, contributing to market consolidation and technological advancements. While precise market share figures for each player fluctuate, the leading companies collectively hold approximately xx% of the market. Over the past five years, the number of M&A deals recorded in the Australian solar sector stands at approximately xx.

- Market Concentration: Moderate, with top players holding approximately xx% market share.

- Innovation Drivers: Technological advancements in panel efficiency, energy storage, and smart grid integration.

- Regulatory Framework: Government incentives, renewable energy targets, and building codes.

- Product Substitutes: Other renewable energy sources (wind, hydro).

- End-User Trends: Growing demand for sustainable energy solutions and cost reduction.

- M&A Activity: Approximately xx deals in the past five years.

Australia Rooftop Solar Panel Market Industry Trends & Analysis

The Australian rooftop solar panel market exhibits robust growth, fueled by several key factors. The rising awareness of climate change and the increasing focus on sustainability are driving consumer demand for renewable energy solutions. Government incentives, including tax rebates and feed-in tariffs, significantly encourage the adoption of rooftop solar systems. The declining cost of solar panels further enhances their affordability and accessibility, making them an attractive option for both residential and commercial sectors. Technological advancements such as higher efficiency panels and improved energy storage solutions are constantly improving the performance and reliability of solar systems. Furthermore, the competitive landscape fuels innovation, leading to improved products and services. The market is experiencing strong competition, with numerous local and international players vying for market share. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, and market penetration has reached approximately xx% of suitable rooftops. The forecast period (2025-2033) projects continued growth, driven by a strengthening focus on national energy security and the expansion of grid-connected infrastructure to manage the influx of distributed generation.

Leading Markets & Segments in Australia Rooftop Solar Panel Market

The residential segment dominates the Australian rooftop solar panel market, accounting for approximately xx% of total installations. This is primarily due to rising electricity costs and the accessibility of government incentives geared towards homeowners. The commercial and industrial sectors are also showing significant growth, driven by the desire to reduce operational costs and improve sustainability credentials. Geographically, the highest adoption rates are observed in states with favorable solar irradiance levels and supportive policies, such as New South Wales, Victoria and Queensland. Monocrystalline panels currently dominate the product type segment due to their higher efficiency and aesthetic appeal, though the hybrid segment is experiencing rapid growth, driven by the increasing popularity of battery storage solutions.

- Dominant Segment: Residential (xx% of market share)

- Key Drivers for Residential: High electricity prices, government incentives, and ease of installation.

- Key Drivers for Commercial: Cost reduction, environmental responsibility, and corporate sustainability goals.

- Key Drivers for Industrial: Large energy consumption, cost savings, and improved energy security.

- Dominant Product Type: Monocrystalline (xx% of market share).

- Fastest Growing Product Type: Hybrid (xx% projected market share by 2033).

Australia Rooftop Solar Panel Market Product Developments

The Australian rooftop solar panel market witnesses continuous product innovation, primarily focusing on enhancing efficiency, durability, and aesthetics. Technological advancements include the development of higher efficiency monocrystalline and hybrid panels incorporating integrated energy storage solutions. The integration of smart technology is also gaining traction, enabling remote monitoring, optimization, and improved grid integration. This constant drive for improved performance and functionality enhances the competitiveness of solar panel solutions, leading to increased market penetration. The focus on advanced features like sunlight backup and intelligent energy management systems enhances both user experience and economic viability.

Key Drivers of Australia Rooftop Solar Panel Market Growth

Several factors propel the growth of the Australian rooftop solar panel market. Falling panel costs, combined with supportive government policies such as feed-in tariffs and tax incentives, significantly lower the barrier to entry for consumers and businesses. Increasing electricity prices and growing awareness of climate change incentivize the adoption of renewable energy solutions. Further technological advancements in panel efficiency and battery storage enhance the value proposition of rooftop solar installations, making them increasingly attractive and competitive.

Challenges in the Australia Rooftop Solar Panel Market Market

Despite its positive trajectory, the Australian rooftop solar panel market encounters several obstacles. Intermittency of solar power requires robust energy storage solutions, adding to the overall cost. Grid infrastructure limitations in certain areas pose challenges for widespread adoption. The availability and pricing of raw materials, as well as supply chain disruptions, can impact manufacturing and installation costs. Finally, strong competition and fluctuating government policies present ongoing challenges to market stability. These issues, collectively, create a xx% impediment to the market's potential growth, as estimated in 2024.

Emerging Opportunities in Australia Rooftop Solar Panel Market

The long-term growth of the Australian rooftop solar panel market hinges on several emerging opportunities. Technological breakthroughs in perovskite solar cells and advancements in battery technology promise to further enhance efficiency and reduce costs. Strategic partnerships between solar panel manufacturers, energy storage providers, and grid operators are crucial for improving grid integration and optimizing energy management. Expansion into underserved markets, such as remote communities, coupled with community solar projects, promises significant market expansion and wider accessibility.

Leading Players in the Australia Rooftop Solar Panel Market Sector

- Maxeon Solar Technologies Ltd

- Risen Energy Co Ltd

- Energy Matters

- RACV Solar

- Adam Solar

- GEM Energy

- Trina Solar

- Tindo Solar

- Infinite Energy

- Soltek Energy

Key Milestones in Australia Rooftop Solar Panel Market Industry

- January 2022: Semper Solaris partnered with Enphase Energy, Inc. to deploy IQ8 solar microinverters, enhancing residential rooftop systems with sunlight backup during outages. This partnership boosted consumer confidence and drove adoption in the residential segment.

- September 2022: Solar Bay and Logos commenced construction of Australia's largest roof-mounted solar storage project, showcasing the scalability and potential of large-scale industrial solar deployments. This project significantly increased investor and industry interest in large-scale rooftop projects.

Strategic Outlook for Australia Rooftop Solar Panel Market Market

The future of the Australian rooftop solar panel market looks promising, with significant growth potential driven by continued technological advancements, supportive government policies, and rising consumer demand. Strategic partnerships and investments in research and development will play a pivotal role in shaping the market's future. The focus on integrating energy storage solutions, optimizing grid infrastructure, and expanding into new market segments will be key for realizing the market's full potential. The market is poised for sustained growth, exceeding xx Million by 2033.

Australia Rooftop Solar Panel Market Segmentation

- 1. Residential

- 2. Commercial and Industrial (C&I)

Australia Rooftop Solar Panel Market Segmentation By Geography

- 1. Australia

Australia Rooftop Solar Panel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Backup Applications in Data Centers4.; Rising Power Outages to Increase the Demand for UPS

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital Cost and Operation Expenditure of UPS Systems

- 3.4. Market Trends

- 3.4.1. Residential Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Residential

- 5.2. Market Analysis, Insights and Forecast - by Commercial and Industrial (C&I)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Residential

- 6. China Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 8. India Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Maxeon Solar Technologies Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Risen Energy Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Energy Matters

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 RACV Solar

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Adam Solar

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GEM Energy

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Trina Solar

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Tindo Solar

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Infinite Energy

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Soltek Energy

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Maxeon Solar Technologies Ltd

List of Figures

- Figure 1: Australia Rooftop Solar Panel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Rooftop Solar Panel Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Residential 2019 & 2032

- Table 4: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Residential 2019 & 2032

- Table 5: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Commercial and Industrial (C&I) 2019 & 2032

- Table 6: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Commercial and Industrial (C&I) 2019 & 2032

- Table 7: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: China Australia Rooftop Solar Panel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Australia Rooftop Solar Panel Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Japan Australia Rooftop Solar Panel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Australia Rooftop Solar Panel Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: India Australia Rooftop Solar Panel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Australia Rooftop Solar Panel Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: South Korea Australia Rooftop Solar Panel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Australia Rooftop Solar Panel Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Australia Rooftop Solar Panel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Australia Rooftop Solar Panel Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Australia Australia Rooftop Solar Panel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Australia Rooftop Solar Panel Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Australia Rooftop Solar Panel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Australia Rooftop Solar Panel Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Residential 2019 & 2032

- Table 26: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Residential 2019 & 2032

- Table 27: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Commercial and Industrial (C&I) 2019 & 2032

- Table 28: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Commercial and Industrial (C&I) 2019 & 2032

- Table 29: Australia Rooftop Solar Panel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Rooftop Solar Panel Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Australia Rooftop Solar Panel Market?

Key companies in the market include Maxeon Solar Technologies Ltd, Risen Energy Co Ltd, Energy Matters, RACV Solar, Adam Solar, GEM Energy, Trina Solar, Tindo Solar, Infinite Energy, Soltek Energy.

3. What are the main segments of the Australia Rooftop Solar Panel Market?

The market segments include Residential, Commercial and Industrial (C&I).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Backup Applications in Data Centers4.; Rising Power Outages to Increase the Demand for UPS.

6. What are the notable trends driving market growth?

Residential Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Capital Cost and Operation Expenditure of UPS Systems.

8. Can you provide examples of recent developments in the market?

January 2022: Semper Solaris partnered with Enphase Energy, Inc., a global energy technology company, to deploy IQ8 solar microinverters, which provide sunlight backup during an outage for residential rooftop installation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Rooftop Solar Panel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Rooftop Solar Panel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Rooftop Solar Panel Market?

To stay informed about further developments, trends, and reports in the Australia Rooftop Solar Panel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence