Key Insights

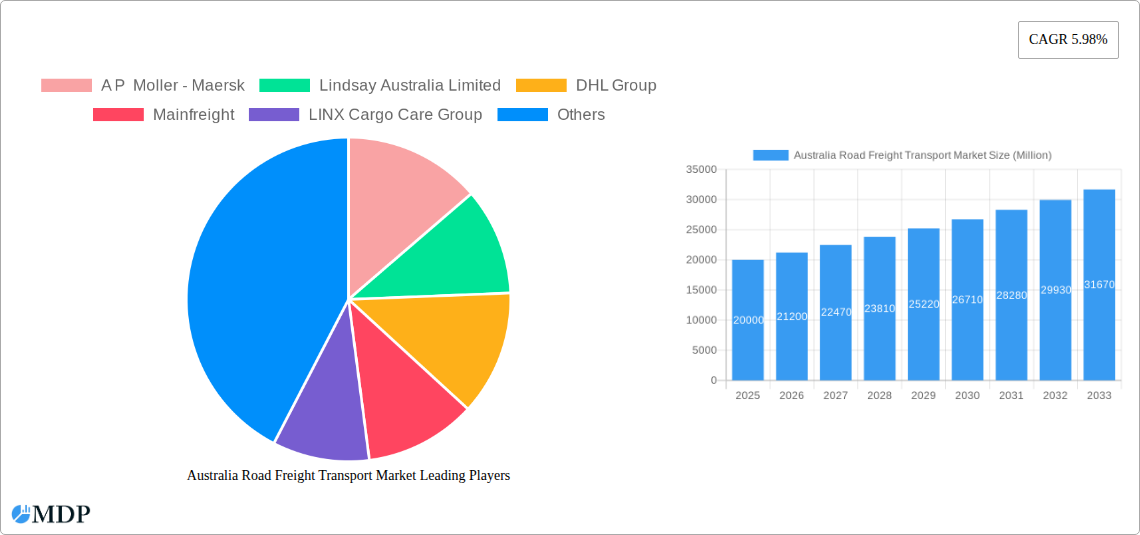

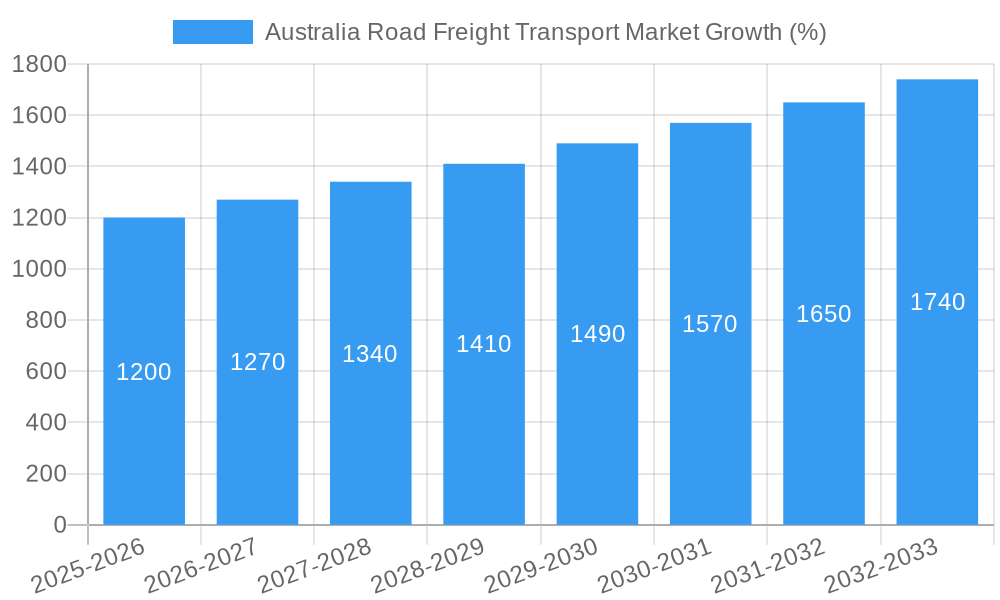

The Australian road freight transport market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector necessitates efficient and reliable last-mile delivery solutions, significantly boosting demand for road freight services. Simultaneously, Australia's robust construction and mining industries, along with the ongoing expansion of agricultural exports, contribute to a high volume of goods requiring transportation. Further driving growth is the increasing adoption of temperature-controlled transportation for perishable goods like produce and pharmaceuticals, representing a significant segment within the market. While challenges exist, such as driver shortages and fluctuating fuel prices, the long-term outlook remains positive, with opportunities for technological advancements like improved logistics software and autonomous trucking to enhance efficiency and sustainability within the sector.

However, the market faces certain restraints. Rising fuel costs and the increasing scarcity of qualified drivers pose significant operational challenges for freight companies, leading to increased operating expenses. Stringent government regulations concerning environmental sustainability and road safety also impose compliance costs. The geographical expanse of Australia presents logistical complexities, particularly impacting long-haul transportation, thereby affecting overall efficiency. Nevertheless, the continued growth of key industries, coupled with ongoing investments in infrastructure development and technological innovation, suggest a promising trajectory for the Australian road freight transport market. The market segmentation by temperature control, end-user industry, transport mode (FTL/LTL), containerization, distance, and goods configuration will allow for targeted investments and strategic market positioning for businesses. The competitive landscape is characterized by a mix of large multinational corporations and smaller, regional players; each leveraging its respective strengths in this dynamic market.

Australia Road Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian road freight transport market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils market dynamics, leading players, and future growth prospects. The market is segmented by temperature control, end-user industry, destination, truckload specification, containerization, distance, and goods configuration, providing granular data for informed decision-making. The report's forecast period is 2025-2033, with historical data spanning 2019-2024, enabling accurate predictions and strategic planning. Expect detailed analysis of key players such as A P Moller - Maersk, Lindsay Australia Limited, DHL Group, Mainfreight, LINX Cargo Care Group, Scott's Refrigerated Logistics, Linfox Pty Ltd, Kings Transport and Logistics, K&S Corporation Limited, and Toll Group. The total market size in 2025 is estimated at xx Million.

Australia Road Freight Transport Market Market Dynamics & Concentration

The Australian road freight transport market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors like economies of scale, technological advancements, and regulatory frameworks. Innovation drives competition, with companies investing in advanced logistics technologies like telematics, route optimization software, and automated warehousing systems. Stringent safety regulations and environmental concerns also shape the market landscape. Product substitutes, such as rail and air freight, pose some competition, though road freight remains dominant due to its flexibility and cost-effectiveness for many applications. End-user trends, particularly the growth of e-commerce and the increasing demand for faster delivery times, are key growth drivers. Mergers and acquisitions (M&A) activity has been relatively consistent, with approximately xx M&A deals occurring between 2019 and 2024. Market leaders like Linfox Pty Ltd and Toll Group often participate in these activities to expand their service offerings and geographic reach. The top 5 players control an estimated xx% of the market.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Telematics, route optimization, automated warehousing.

- Regulatory Framework: Stringent safety and environmental regulations.

- Product Substitutes: Rail and air freight.

- End-User Trends: Growth of e-commerce and demand for faster delivery.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Australia Road Freight Transport Market Industry Trends & Analysis

The Australian road freight transport market exhibits a robust growth trajectory, driven primarily by the expansion of the e-commerce sector and increasing industrial activity. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to remain strong at xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of autonomous vehicles and the increasing use of data analytics for improved efficiency, are reshaping the industry. Consumer preferences are shifting towards faster and more reliable delivery services, pressuring companies to invest in technology and improve their operational capabilities. Competitive dynamics are intense, with companies vying for market share through pricing strategies, service differentiation, and strategic alliances. Market penetration of advanced technologies like real-time tracking and delivery management systems is steadily increasing, with an estimated xx% penetration rate in 2025.

Leading Markets & Segments in Australia Road Freight Transport Market

The Australian road freight transport market is predominantly driven by domestic transportation. The largest end-user industries are Wholesale and Retail Trade, followed by Manufacturing and Construction. Within the temperature-controlled segment, the demand for refrigerated transport is significant, particularly for agricultural and food products. The Full-Truck-Load (FTL) segment holds a larger market share compared to Less-than-Truck-Load (LTL), reflecting the prevalence of large-scale shipments. The long-haul segment is also dominant, driven by the vast distances across the country. Solid goods dominate the goods configuration segment.

- Key Drivers (Economic Policies, Infrastructure): Government investment in infrastructure projects, growth of e-commerce, rising consumer spending.

- Dominant Segment Analysis: Domestic transportation, Wholesale and Retail Trade, FTL, Long Haul, Solid Goods, Temperature Controlled (for specific industries like food and pharmaceuticals).

Australia Road Freight Transport Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and safety. This includes the integration of telematics and GPS tracking systems, the adoption of fuel-efficient vehicles, and the increasing use of electric vehicles to reduce carbon emissions. These advancements offer competitive advantages by improving delivery times, lowering operating costs, and enhancing environmental performance. The market fit for these innovations is high, driven by the increasing demand for sustainable and technologically advanced logistics solutions.

Key Drivers of Australia Road Freight Transport Market Growth

The growth of the Australian road freight transport market is fueled by several key factors. Firstly, the burgeoning e-commerce sector requires efficient and timely delivery solutions, driving significant demand. Secondly, increasing industrial activity, particularly in mining and manufacturing, contributes to higher freight volumes. Finally, government initiatives to improve infrastructure and promote technological adoption further stimulate market growth. For example, investments in road networks and ports enhance logistics efficiency.

Challenges in the Australia Road Freight Transport Market Market

The Australian road freight transport market faces challenges such as driver shortages, rising fuel costs, and intense competition. Driver shortages lead to increased labor costs and operational inefficiencies. Fluctuating fuel prices significantly impact operational profitability. Furthermore, the highly competitive market forces companies to constantly optimize their operations and pricing strategies to maintain profitability. These challenges collectively impose an estimated xx Million cost burden on the industry annually.

Emerging Opportunities in Australia Road Freight Transport Market

The future of the Australian road freight transport market holds promising opportunities. Technological advancements, such as autonomous vehicles and improved route optimization software, promise increased efficiency and cost reductions. Strategic partnerships between logistics providers and technology companies can unlock further innovation. Expansion into new markets and service offerings, such as specialized transportation for sensitive goods, also presents attractive opportunities.

Leading Players in the Australia Road Freight Transport Market Sector

- A P Moller - Maersk

- Lindsay Australia Limited

- DHL Group

- Mainfreight

- LINX Cargo Care Group

- Scott's Refrigerated Logistics

- Linfox Pty Ltd

- Kings Transport and Logistics

- K&S Corporation Limited

- Toll Group

Key Milestones in Australia Road Freight Transport Market Industry

- September 2023: DHL Supply Chain receives its first Volvo FL Electric trucks with enhanced battery range, signaling a push toward electric fleets.

- October 2023: DHL Supply Chain secures a contract with Alcon, expanding its market presence in the healthcare sector.

- February 2024: DHL Supply Chain adds electric yard tractors and light-duty trucks to its fleet, furthering its decarbonization efforts. These actions indicate a broader industry trend toward sustainability and technological adoption.

Strategic Outlook for Australia Road Freight Transport Market Market

The Australian road freight transport market is poised for continued growth, driven by e-commerce expansion, infrastructure development, and technological innovation. Companies that embrace sustainable practices, invest in advanced technologies, and focus on delivering exceptional customer service will be best positioned to capitalize on emerging opportunities and navigate the challenges ahead. The market's potential is significant, with projected growth exceeding xx Million by 2033.

Australia Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Australia Road Freight Transport Market Segmentation By Geography

- 1. Australia

Australia Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lindsay Australia Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mainfreight

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LINX Cargo Care Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Scott's Refrigerated Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Linfox Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kings Transport and Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 K&S Corporation Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toll Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Australia Road Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Road Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Australia Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Australia Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Australia Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Australia Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Australia Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Australia Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Australia Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Australia Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Australia Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: Australia Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 14: Australia Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 15: Australia Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 16: Australia Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 17: Australia Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 18: Australia Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Road Freight Transport Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Australia Road Freight Transport Market?

Key companies in the market include A P Moller - Maersk, Lindsay Australia Limited, DHL Group, Mainfreight, LINX Cargo Care Group, Scott's Refrigerated Logistics, Linfox Pty Ltd, Kings Transport and Logistics, K&S Corporation Limited, Toll Grou.

3. What are the main segments of the Australia Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: DHL Supply Chain (DHL) is continuing the decarbonization of its Australian transport fleet by introducing additional new electric vehicles. The company has added two Terberg YT200EV electric yard tractors to its truck fleet and is supporting Australian electric vehicle manufacturing with the introduction of its first SEA Electric light duty truck to its last-mile fleet.October 2023: DHL Supply Chain has signed a contract to become the Australian logistics provider of global eye care company, Alcon. DHL will handle Alcon’s storage, inbound, outbound and inventory functions.September 2023: DHL Supply Chain (DHL) has energised its transition to electric vehicles with the first Australian delivery of Volvo FL Electric with second-generation battery packs. The updated battery packs provide an increase in range over the previous range of FL Electric.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Australia Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence