Key Insights

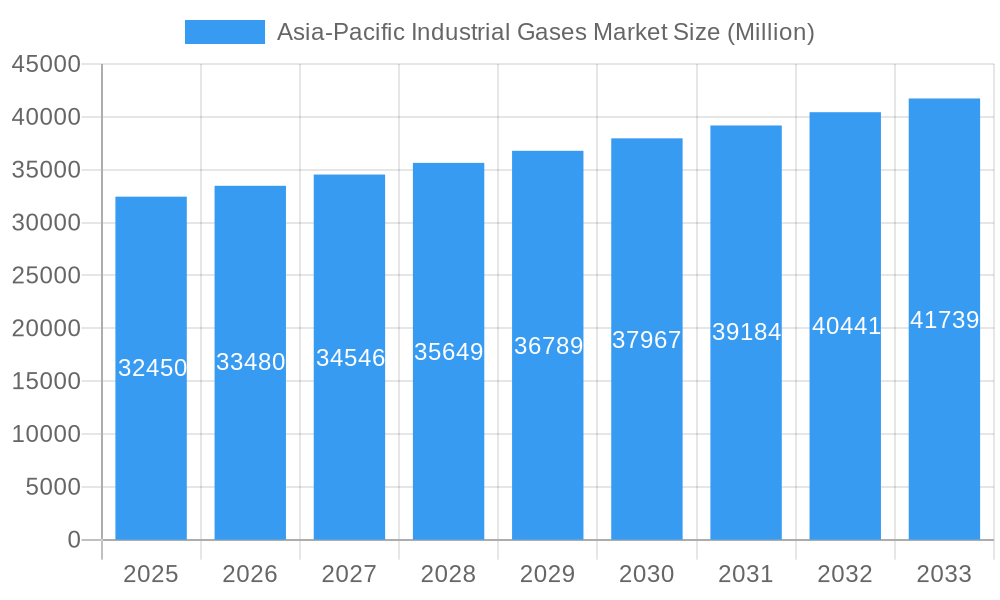

The Asia-Pacific industrial gases market, valued at $32,450 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning chemical processing and refining industries across the region, particularly in China and India, represent a significant demand driver for gases like nitrogen, oxygen, and hydrogen. Secondly, the rapid growth of electronics manufacturing, particularly in South Korea and Taiwan, necessitates substantial quantities of high-purity gases for semiconductor production. Furthermore, the increasing adoption of industrial automation and advanced manufacturing techniques across various sectors contributes to elevated gas consumption. The rising focus on environmental sustainability also presents an opportunity, as industrial gases play a crucial role in water treatment and pollution control. However, potential restraints include fluctuating raw material prices and stringent environmental regulations that may impact production costs and operational efficiency. The market is segmented by product type (nitrogen, oxygen, etc.) and end-user industry (chemical processing, electronics, etc.), with significant contributions from major players like Linde PLC, Air Products and Chemicals Inc., and Air Liquide, indicating a competitive landscape.

Asia-Pacific Industrial Gases Market Market Size (In Billion)

Specific regional performance within Asia-Pacific is expected to vary. China, with its massive industrial base and ongoing infrastructure development, will likely remain the dominant market. India's growing manufacturing sector and improving infrastructure will also contribute to strong growth. Other countries, such as South Korea and Japan, will see continued, albeit potentially slower, growth due to their mature industrial economies. The ‘Rest of Asia-Pacific’ segment, encompassing countries like Australia and Taiwan, will demonstrate significant growth prospects driven by increasing industrialization and economic expansion. While precise growth figures for individual countries within the Asia-Pacific region are not available, the overall CAGR suggests a consistent and substantial expansion across the forecast period. This dynamic market presents significant opportunities for both established players and emerging companies.

Asia-Pacific Industrial Gases Market Company Market Share

Asia-Pacific Industrial Gases Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific industrial gases market, covering market dynamics, industry trends, leading segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses operating in or seeking to enter this dynamic market. The report analyzes the market’s size and growth trajectory, identifying key opportunities and challenges shaping its future. The total market value in 2025 is estimated at xx Million.

Asia-Pacific Industrial Gases Market Market Dynamics & Concentration

The Asia-Pacific industrial gases market is characterized by a moderately concentrated landscape, with several multinational corporations and regional players vying for market share. The market's dynamics are shaped by several key factors:

- Market Concentration: The market exhibits a relatively high concentration, with the top five players holding approximately xx% of the market share in 2025. This is primarily due to the significant capital investment required for production facilities and distribution networks.

- Innovation Drivers: Technological advancements in gas production, purification, and delivery systems are driving efficiency gains and new product development. The increasing adoption of sustainable and green technologies, particularly in hydrogen and ammonia production, is also a significant factor.

- Regulatory Frameworks: Government regulations focusing on environmental protection and safety standards influence market operations and investment decisions. Stringent emission control norms are pushing the adoption of cleaner technologies.

- Product Substitutes: Limited direct substitutes exist for many industrial gases, but improvements in alternative technologies for specific applications present indirect competition.

- End-User Trends: Growing demand from end-user industries like chemical processing, electronics, and energy is a key driver of market expansion. Shifting industrial production patterns and technological advancements in these sectors directly impact gas demand.

- M&A Activities: The market has witnessed a significant number of mergers and acquisitions (M&A) activities in recent years, with approximately xx deals recorded between 2019 and 2024. This consolidation trend reflects companies' strategies to gain scale and expand their market reach.

Asia-Pacific Industrial Gases Market Industry Trends & Analysis

The Asia-Pacific industrial gases market is poised for substantial growth, projected to exhibit a robust CAGR during the forecast period (2025-2033). This expansion is driven by a confluence of factors, creating a dynamic and evolving market landscape.

- Accelerated Industrialization and Technological Advancement: Rapid industrialization, particularly within emerging economies, fuels escalating demand for industrial gases across diverse sectors. The integration of advanced automation and Industry 4.0 technologies in manufacturing processes further amplifies this growth trajectory. This includes increased adoption of robotics, AI, and IoT in industrial settings, leading to higher gas consumption.

- Technological Innovations and Sustainability: Advancements in gas production and liquefaction technologies are enhancing efficiency, lowering costs, and minimizing environmental impact. The burgeoning green hydrogen sector, with its focus on sustainable production methods and integration into industrial processes, is fundamentally reshaping the market dynamics and attracting significant investments. This includes innovations in electrolysis, renewable energy integration, and carbon capture technologies.

- Evolving Consumer Preferences and Environmental Responsibility: Growing environmental awareness is driving demand for eco-friendly gases and production processes. Companies are increasingly prioritizing sustainability initiatives, aiming to reduce their carbon footprint and adopt cleaner, more responsible technologies. This translates to a growing preference for gases produced through renewable energy sources and a focus on circular economy principles.

- Intense Competition and Market Consolidation: A fiercely competitive market featuring both established multinational corporations and emerging local players fuels innovation and investment in enhanced production capabilities and optimized distribution networks. While market penetration by major players remains high in specific segments, the competitive landscape is dynamic and influenced by pricing strategies, customer service excellence, and the adoption of new technologies, particularly in the green hydrogen space. Consolidation through mergers and acquisitions is also reshaping the competitive dynamics.

Leading Markets & Segments in Asia-Pacific Industrial Gases Market

The Asia-Pacific industrial gases market is characterized by several key regional and segmental drivers:

Key Regional Markets: China retains its position as the dominant market, fueled by its extensive industrial base and sustained economic growth. Other significant contributors include India, witnessing rapid industrialization and infrastructure development; Japan, leveraging its technological prowess and established industrial infrastructure; South Korea, with its advanced electronics manufacturing sector; and Australia, benefiting from a robust mining and resource extraction industry. The Southeast Asian region is also demonstrating significant growth potential.

Leading Product Segments: Nitrogen and oxygen remain the dominant product types, holding a substantial share of the overall market. However, the hydrogen segment is experiencing accelerated growth, driven by substantial investments in green hydrogen technologies and its role in decarbonization efforts. Other specialty gases are also witnessing increased demand in niche applications.

Major End-User Industries: Chemical processing and refining, electronics manufacturing, and metal fabrication constitute the primary end-user industries. The expanding medical and pharmaceutical sector is also emerging as a significant growth driver, along with the burgeoning food and beverage industry and the energy sector's transition to cleaner technologies.

Regional Market Dynamics:

- China: Continued industrial expansion, supportive government policies focused on technological advancement and sustainability, and substantial investments in manufacturing and infrastructure are key drivers.

- India: Rapid industrialization, significant infrastructure development initiatives, and a thriving chemical industry contribute to its strong growth trajectory.

- Japan: Technological advancements, robust manufacturing capabilities, and a well-established industrial infrastructure maintain its position as a key market.

- South Korea: Advanced electronics manufacturing and a commitment to technological innovation fuel market growth.

- Australia: A thriving mining and resource extraction sector, coupled with increasing energy demand, provides significant market opportunities.

- Southeast Asia: Rapid economic growth and industrialization across countries like Vietnam, Indonesia, and Thailand are driving significant demand for industrial gases.

Asia-Pacific Industrial Gases Market Product Developments

Recent product developments focus on enhancing gas purity, improving delivery systems, and developing eco-friendly production methods. Technological advancements in gas separation and purification techniques are creating more efficient and cost-effective products. The development of on-site gas generation systems and the growing adoption of packaged gas solutions are gaining traction. These developments improve the flexibility and convenience of industrial gas usage, catering to diverse customer needs and enhancing competitive advantages.

Key Drivers of Asia-Pacific Industrial Gases Market Growth

The expansion of the Asia-Pacific industrial gases market is propelled by a combination of factors:

- Technological Advancements: Continuous innovations in gas production, purification, and delivery systems enhance efficiency, reduce costs, and improve sustainability.

- Economic Growth and Industrial Expansion: Rapid economic growth across numerous Asian nations fuels industrial expansion, driving increased demand for industrial gases across various sectors.

- Government Support and Policy Initiatives: Favorable government policies promoting industrial development and infrastructure investment stimulate market growth and attract foreign direct investment.

- Rising Energy Demand and Transition to Cleaner Energy: Growing energy needs are driving demand for industrial gases in power generation, especially as the region transitions towards cleaner and more sustainable energy sources.

Challenges in the Asia-Pacific Industrial Gases Market Market

The Asia-Pacific industrial gases market faces several challenges:

- Stringent environmental regulations: Compliance with stringent emission norms and environmental regulations necessitates investment in cleaner production technologies, adding to operational costs.

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability and cost of raw materials, affecting production and profitability.

- Intense competition: The presence of numerous players, both large multinationals and smaller regional competitors, creates intense competition, impacting pricing and profit margins. This competition is likely to intensify further with the increasing adoption of green hydrogen technologies.

Emerging Opportunities in Asia-Pacific Industrial Gases Market

Several factors present emerging opportunities for growth in the Asia-Pacific industrial gases market:

The increasing demand for green hydrogen, driven by global decarbonization initiatives, presents significant opportunities for investment and expansion. Strategic partnerships and collaborations between industrial gas producers and renewable energy companies are crucial for capturing this growing market segment. Furthermore, market expansion into new geographical areas and the diversification of end-user industries will further drive growth.

Leading Players in the Asia-Pacific Industrial Gases Market Sector

- Linde PLC

- Ellenbarrie industrial Gases

- Air Products and Chemicals Inc

- Bhuruka Gases Limited

- BASF SE

- Iwatani Corporation

- PT Samator Indo Gas Tbk

- Asia Technical Gas Co Pte Ltd

- Air Liquide

- Nippon Sanso Holdings Corporation

- Yingde Gas

- Messer SE & Co KGaA

Key Milestones in Asia-Pacific Industrial Gases Market Industry

- December 2022: Yingde Gases' acquisition of Shanghai Nanhua Industrial Gas Company Ltd. significantly expanded its presence in the packaged gas and medical oxygen markets, highlighting the ongoing consolidation within the sector.

- July 2022: Yingde Gases Group's collaboration with China Hydrogen marked a substantial step towards establishing green hydrogen and ammonia facilities, reflecting the industry's shift toward sustainable practices and the growing importance of green hydrogen.

- [Add other recent significant milestones here, including mergers, acquisitions, new plant openings, technological advancements, etc.]

Strategic Outlook for Asia-Pacific Industrial Gases Market Market

The Asia-Pacific industrial gases market is poised for sustained growth, driven by increasing industrialization, technological advancements, and the growing focus on sustainability. Companies focusing on innovation, strategic partnerships, and expansion into high-growth segments are expected to capture significant market share. The increasing adoption of green technologies, particularly in hydrogen production, presents a major opportunity for future growth and market leadership.

Asia-Pacific Industrial Gases Market Segmentation

-

1. Product Type

- 1.1. Nitrogen

- 1.2. Oxygen

- 1.3. Carbon dioxide

- 1.4. Hydrogen

- 1.5. Helium

- 1.6. Argon

- 1.7. Ammonia

- 1.8. Methane

- 1.9. Propane

- 1.10. Butane

- 1.11. Other Product Types (Fluorine and Nitrous oxide)

-

2. End-user Industry

- 2.1. Chemical Processing and Refining

- 2.2. Electronics

- 2.3. Food and Beverage

- 2.4. Oil and Gas

- 2.5. Metal Manufacturing and Fabrication

- 2.6. Medical and Pharmaceutical

- 2.7. Automotive and Transportation

- 2.8. Energy and Power

- 2.9. Other En

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Industrial Gases Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Industrial Gases Market Regional Market Share

Geographic Coverage of Asia-Pacific Industrial Gases Market

Asia-Pacific Industrial Gases Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Frozen and Stored Food; Growing Need for Alternate Energy Sources; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations and Safety Issues; Other Restraints

- 3.4. Market Trends

- 3.4.1. Chemical Processing and Refining to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Nitrogen

- 5.1.2. Oxygen

- 5.1.3. Carbon dioxide

- 5.1.4. Hydrogen

- 5.1.5. Helium

- 5.1.6. Argon

- 5.1.7. Ammonia

- 5.1.8. Methane

- 5.1.9. Propane

- 5.1.10. Butane

- 5.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Chemical Processing and Refining

- 5.2.2. Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Oil and Gas

- 5.2.5. Metal Manufacturing and Fabrication

- 5.2.6. Medical and Pharmaceutical

- 5.2.7. Automotive and Transportation

- 5.2.8. Energy and Power

- 5.2.9. Other En

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Nitrogen

- 6.1.2. Oxygen

- 6.1.3. Carbon dioxide

- 6.1.4. Hydrogen

- 6.1.5. Helium

- 6.1.6. Argon

- 6.1.7. Ammonia

- 6.1.8. Methane

- 6.1.9. Propane

- 6.1.10. Butane

- 6.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Chemical Processing and Refining

- 6.2.2. Electronics

- 6.2.3. Food and Beverage

- 6.2.4. Oil and Gas

- 6.2.5. Metal Manufacturing and Fabrication

- 6.2.6. Medical and Pharmaceutical

- 6.2.7. Automotive and Transportation

- 6.2.8. Energy and Power

- 6.2.9. Other En

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Nitrogen

- 7.1.2. Oxygen

- 7.1.3. Carbon dioxide

- 7.1.4. Hydrogen

- 7.1.5. Helium

- 7.1.6. Argon

- 7.1.7. Ammonia

- 7.1.8. Methane

- 7.1.9. Propane

- 7.1.10. Butane

- 7.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Chemical Processing and Refining

- 7.2.2. Electronics

- 7.2.3. Food and Beverage

- 7.2.4. Oil and Gas

- 7.2.5. Metal Manufacturing and Fabrication

- 7.2.6. Medical and Pharmaceutical

- 7.2.7. Automotive and Transportation

- 7.2.8. Energy and Power

- 7.2.9. Other En

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Nitrogen

- 8.1.2. Oxygen

- 8.1.3. Carbon dioxide

- 8.1.4. Hydrogen

- 8.1.5. Helium

- 8.1.6. Argon

- 8.1.7. Ammonia

- 8.1.8. Methane

- 8.1.9. Propane

- 8.1.10. Butane

- 8.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Chemical Processing and Refining

- 8.2.2. Electronics

- 8.2.3. Food and Beverage

- 8.2.4. Oil and Gas

- 8.2.5. Metal Manufacturing and Fabrication

- 8.2.6. Medical and Pharmaceutical

- 8.2.7. Automotive and Transportation

- 8.2.8. Energy and Power

- 8.2.9. Other En

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Nitrogen

- 9.1.2. Oxygen

- 9.1.3. Carbon dioxide

- 9.1.4. Hydrogen

- 9.1.5. Helium

- 9.1.6. Argon

- 9.1.7. Ammonia

- 9.1.8. Methane

- 9.1.9. Propane

- 9.1.10. Butane

- 9.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Chemical Processing and Refining

- 9.2.2. Electronics

- 9.2.3. Food and Beverage

- 9.2.4. Oil and Gas

- 9.2.5. Metal Manufacturing and Fabrication

- 9.2.6. Medical and Pharmaceutical

- 9.2.7. Automotive and Transportation

- 9.2.8. Energy and Power

- 9.2.9. Other En

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. ASEAN Countries Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Nitrogen

- 10.1.2. Oxygen

- 10.1.3. Carbon dioxide

- 10.1.4. Hydrogen

- 10.1.5. Helium

- 10.1.6. Argon

- 10.1.7. Ammonia

- 10.1.8. Methane

- 10.1.9. Propane

- 10.1.10. Butane

- 10.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Chemical Processing and Refining

- 10.2.2. Electronics

- 10.2.3. Food and Beverage

- 10.2.4. Oil and Gas

- 10.2.5. Metal Manufacturing and Fabrication

- 10.2.6. Medical and Pharmaceutical

- 10.2.7. Automotive and Transportation

- 10.2.8. Energy and Power

- 10.2.9. Other En

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Asia Pacific Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Nitrogen

- 11.1.2. Oxygen

- 11.1.3. Carbon dioxide

- 11.1.4. Hydrogen

- 11.1.5. Helium

- 11.1.6. Argon

- 11.1.7. Ammonia

- 11.1.8. Methane

- 11.1.9. Propane

- 11.1.10. Butane

- 11.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Chemical Processing and Refining

- 11.2.2. Electronics

- 11.2.3. Food and Beverage

- 11.2.4. Oil and Gas

- 11.2.5. Metal Manufacturing and Fabrication

- 11.2.6. Medical and Pharmaceutical

- 11.2.7. Automotive and Transportation

- 11.2.8. Energy and Power

- 11.2.9. Other En

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Linde PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ellenbarrie industrial Gases

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Air Products and Chemicals Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bhuruka Gases Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 BASF SE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Iwatani Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 PT Samator Indo Gas Tbk

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Asia Technical Gas Co Pte Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Air Liquide

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Nippon Sanso Holdings Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Yingde Gas*List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Messer SE & Co KGaA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Linde PLC

List of Figures

- Figure 1: Asia-Pacific Industrial Gases Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Industrial Gases Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 13: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 29: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 35: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 36: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 37: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 43: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 44: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 45: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 51: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 52: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 53: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 55: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Gases Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Asia-Pacific Industrial Gases Market?

Key companies in the market include Linde PLC, Ellenbarrie industrial Gases, Air Products and Chemicals Inc, Bhuruka Gases Limited, BASF SE, Iwatani Corporation, PT Samator Indo Gas Tbk, Asia Technical Gas Co Pte Ltd, Air Liquide, Nippon Sanso Holdings Corporation, Yingde Gas*List Not Exhaustive, Messer SE & Co KGaA.

3. What are the main segments of the Asia-Pacific Industrial Gases Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 32450 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Frozen and Stored Food; Growing Need for Alternate Energy Sources; Other Drivers.

6. What are the notable trends driving market growth?

Chemical Processing and Refining to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Regulations and Safety Issues; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Yingde Gases announced the completion of the purchase of a 100% share in Shanghai Nanhua Industrial Gas Company Ltd. Yingde Gases' first packaged gas purchase boosted the group's impact in industrial packaged gas and medical oxygen. The purchase is a step forward in the organization's strategic packaged-gas strategy, indicating the group's entry into the market of packaged gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Gases Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Gases Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Gases Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Gases Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence