Key Insights

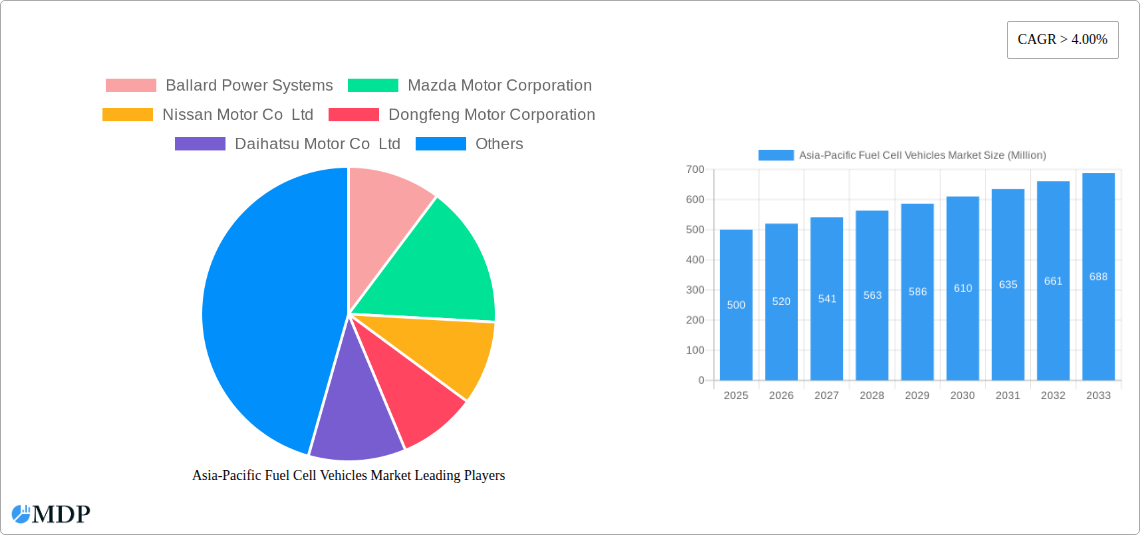

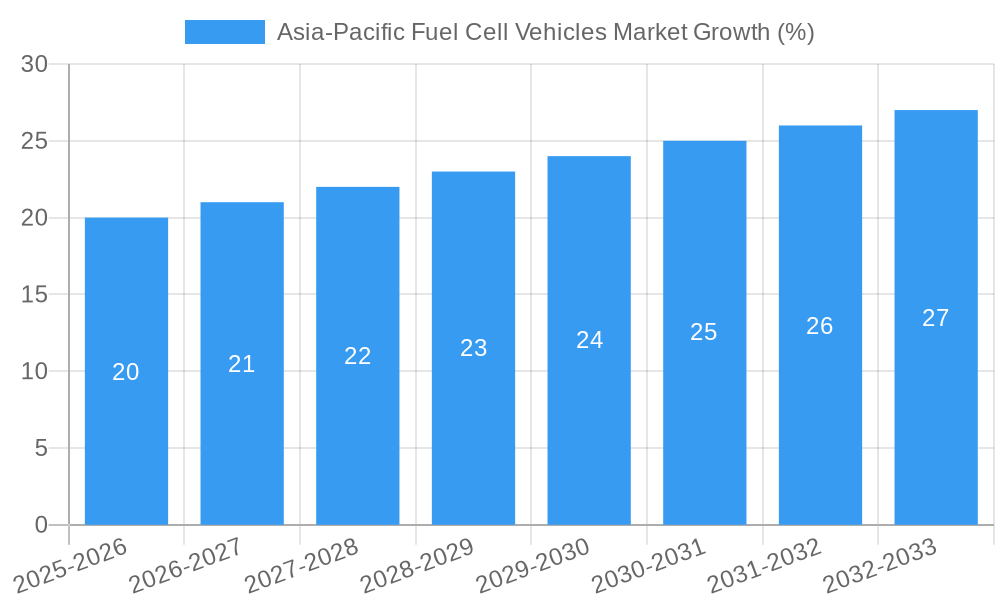

The Asia-Pacific fuel cell vehicle (FCV) market is poised for substantial growth, driven by increasing environmental concerns, supportive government policies promoting clean energy adoption, and advancements in fuel cell technology leading to improved efficiency and reduced costs. The market, currently valued at an estimated $XX million in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the region's burgeoning automotive industry, particularly in China, Japan, and South Korea, provides a fertile ground for FCV adoption. Secondly, stringent emission regulations in major APAC countries are pushing automakers to invest heavily in cleaner technologies, including FCVs. Furthermore, investments in hydrogen infrastructure, including refueling stations, are beginning to address a major barrier to FCV market penetration. While challenges remain, such as high initial vehicle costs and limited refueling infrastructure in certain areas, ongoing technological advancements and government incentives are expected to mitigate these constraints and drive market expansion.

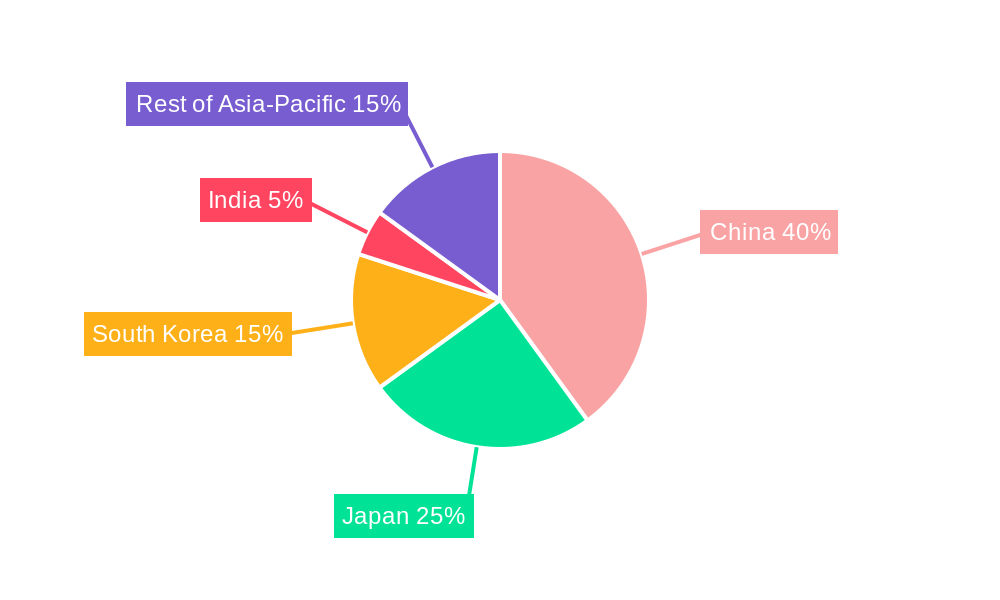

Segment-wise, commercial vehicles are likely to witness faster adoption than passenger vehicles due to their higher mileage and potential for significant emissions reductions. Within the regional breakdown, China, with its massive automotive market and ambitious clean energy targets, is expected to be the dominant player. However, Japan and South Korea, being early adopters in fuel cell technology, will also continue to contribute significantly. The growth in other countries like India, Indonesia, and Thailand will be influenced by the pace of infrastructure development and government support for clean transportation initiatives. Key players like Toyota, Hyundai, and Ballard Power Systems are strategically positioning themselves to capitalize on the growing market opportunities, focusing on technological innovation and strategic partnerships to achieve market leadership. The forecast period (2025-2033) will be characterized by increased competition, technological breakthroughs, and further government support, ultimately shaping the future of the Asia-Pacific FCV market.

Asia-Pacific Fuel Cell Vehicles Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Fuel Cell Vehicles market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this study examines market dynamics, industry trends, leading players, and future opportunities. It leverages extensive data analysis to forecast market growth and identify key strategic imperatives.

Asia-Pacific Fuel Cell Vehicles Market Market Dynamics & Concentration

The Asia-Pacific fuel cell vehicle market is experiencing a period of significant transformation, driven by a confluence of factors impacting market concentration, innovation, and regulatory landscapes. Market concentration is currently moderate, with several key players vying for market share, though this is expected to shift in the coming years. Innovation is largely driven by advancements in fuel cell technology, reducing costs and improving efficiency. Stringent emission regulations across several APAC nations are further accelerating market growth, pushing adoption of cleaner transportation solutions. While battery electric vehicles (BEVs) present a strong competitive challenge, fuel cell vehicles (FCVs) offer advantages in terms of refueling time and range, particularly for commercial vehicles. Significant M&A activity is expected as companies consolidate and seek to enhance their technological capabilities and market reach. The number of M&A deals in the sector is projected to reach xx in 2025, a xx% increase compared to 2024, largely driven by the consolidation of the industry. Market share for the top 5 players is estimated at xx% in 2025, with a predicted shift in the coming years.

Asia-Pacific Fuel Cell Vehicles Market Industry Trends & Analysis

The Asia-Pacific fuel cell vehicle market is poised for substantial growth, with a projected CAGR of xx% during the forecast period (2025-2033). This robust growth is fueled by several key trends. Firstly, increasing government support for clean energy initiatives, including generous subsidies and tax breaks, is incentivizing both manufacturers and consumers. Secondly, rapid advancements in fuel cell technology, leading to improved efficiency and reduced costs, are making FCVs more competitive. Thirdly, the burgeoning demand for sustainable transportation solutions in densely populated urban areas is further boosting adoption. Consumer preferences are shifting toward eco-friendly vehicles, aligning with broader sustainability goals. However, challenges remain, including high initial vehicle costs, limited refueling infrastructure, and competition from BEVs. Market penetration is currently at xx% in 2025 but is expected to increase to xx% by 2033. The competitive landscape is characterized by intense rivalry among established automakers and emerging fuel cell technology companies.

Leading Markets & Segments in Asia-Pacific Fuel Cell Vehicles Market

Dominant Countries: China and Japan are currently the leading markets for fuel cell vehicles in the Asia-Pacific region, driven by supportive government policies and well-established automotive industries. South Korea is also emerging as a significant player.

Key Drivers:

- China: Strong government support for new energy vehicles, including significant investments in hydrogen infrastructure.

- Japan: Advanced fuel cell technology, coupled with a strong focus on hydrogen energy as a key element of its energy strategy.

- South Korea: Government incentives and investments in R&D are driving increased adoption.

Dominant Vehicle Type: Commercial vehicles are witnessing higher adoption rates than passenger vehicles due to their suitability for longer routes and higher payload capacities. This segment is expected to drive significant growth in the coming years.

Other Countries: While other countries such as Australia, India, Indonesia, Malaysia, and Thailand are still in the early stages of fuel cell vehicle adoption, growth potential is significant, especially with increasing focus on sustainability and improved infrastructure.

The detailed analysis in this report reveals a complex interplay of factors influencing market dominance. While Japan's advanced technology provides a first-mover advantage, China's sheer market size and governmental support presents formidable potential for future dominance.

Asia-Pacific Fuel Cell Vehicles Market Product Developments

Recent product innovations focus on increasing fuel cell efficiency, extending vehicle range, and lowering manufacturing costs. Manufacturers are exploring different applications of fuel cell technology beyond transportation, including stationary power generation and industrial applications. This diversification is crucial for market expansion and strengthening the overall business case for fuel cell technology. Competitive advantages are increasingly driven by advancements in fuel cell stack design, hydrogen storage solutions, and overall vehicle integration. This focus on technological edge and market fit signifies the growing maturity and competitiveness of the industry.

Key Drivers of Asia-Pacific Fuel Cell Vehicles Market Growth

Technological advancements, coupled with supportive government policies and growing environmental concerns, are accelerating the adoption of fuel cell vehicles in the Asia-Pacific region. Technological improvements are continuously driving down costs and improving efficiency. Governments are implementing incentives to boost FCV adoption, such as tax breaks and subsidies. The rising awareness of environmental sustainability among consumers is also fueling demand for cleaner transportation options. For example, China's significant investments in hydrogen infrastructure are creating a supportive ecosystem for FCV growth.

Challenges in the Asia-Pacific Fuel Cell Vehicles Market Market

The Asia-Pacific fuel cell vehicle market faces several significant challenges. High initial vehicle costs compared to internal combustion engine (ICE) vehicles remain a major barrier to widespread adoption. The limited refueling infrastructure for hydrogen poses a significant constraint on market expansion. Furthermore, competition from battery electric vehicles, which are becoming increasingly competitive in terms of cost and range, presents a major challenge. These factors collectively impact market growth and penetration rates. For example, the high cost of hydrogen production currently limits the commercial viability of FCVs in some regions.

Emerging Opportunities in Asia-Pacific Fuel Cell Vehicles Market

The long-term growth outlook for the Asia-Pacific fuel cell vehicle market is positive, driven by several key opportunities. Continued technological breakthroughs will lead to even more efficient and cost-effective fuel cell systems. Strategic partnerships between automakers, energy companies, and technology providers will accelerate innovation and infrastructure development. Market expansion into new geographical areas with growing environmental awareness will unlock significant growth potential. These catalysts will drive long-term market expansion and profitability for stakeholders.

Leading Players in the Asia-Pacific Fuel Cell Vehicles Market Sector

- Ballard Power Systems

- Mazda Motor Corporation

- Nissan Motor Co Ltd

- Dongfeng Motor Corporation

- Daihatsu Motor Co Ltd

- Daimler AG (Mercedes-Benz AG)

- Hyundai Motor Company

- Honda Motor Co Ltd

- Toyota Motor Corporation

Key Milestones in Asia-Pacific Fuel Cell Vehicles Market Industry

July 2023: Honda's next-generation fuel cell system makes its Chinese debut, expanding its application to fuel cell electric vehicles, commercial vehicles, and stationary power supplies. This signals a significant step toward market expansion in a key region.

May 2023: Japanese motorcycle makers establish research body “HySE” for hydrogen small mobility engines. This indicates a growing interest in expanding fuel cell technology beyond larger vehicles.

April 2023: Dongfeng Motor Corporation (DFM) announces its commitment to hydrogen energy, showcasing its R&D capabilities. DFM's parallel development of various electrified platforms demonstrates a diversified approach to the new energy vehicle market.

Strategic Outlook for Asia-Pacific Fuel Cell Vehicles Market Market

The Asia-Pacific fuel cell vehicle market presents substantial long-term growth potential. Continued technological advancements, increasing government support, and growing consumer demand for sustainable transportation solutions will be key drivers. Strategic partnerships and investments in infrastructure development will be crucial for unlocking this potential. Focusing on cost reduction, range extension, and improved refueling infrastructure will be vital for driving market penetration. The future success of this market hinges on a coordinated effort between governments, industry players, and consumers.

Asia-Pacific Fuel Cell Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

-

1.1. Commercial Vehicles

Asia-Pacific Fuel Cell Vehicles Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Fuel Cell Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ballard Power Systems

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Mazda Motor Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nissan Motor Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Dongfeng Motor Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Daihatsu Motor Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Daimler AG (Mercedes-Benz AG)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hyundai Motor Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Honda Motor Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Toyota Motor Corporatio

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Ballard Power Systems

List of Figures

- Figure 1: Asia-Pacific Fuel Cell Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Fuel Cell Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Fuel Cell Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Fuel Cell Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Asia-Pacific Fuel Cell Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia-Pacific Fuel Cell Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia-Pacific Fuel Cell Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 13: Asia-Pacific Fuel Cell Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia-Pacific Fuel Cell Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Fuel Cell Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Asia-Pacific Fuel Cell Vehicles Market?

Key companies in the market include Ballard Power Systems, Mazda Motor Corporation, Nissan Motor Co Ltd, Dongfeng Motor Corporation, Daihatsu Motor Co Ltd, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Honda Motor Co Ltd, Toyota Motor Corporatio.

3. What are the main segments of the Asia-Pacific Fuel Cell Vehicles Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

July 2023: Honda's next-generation fuel cell system makes its Chinese debut.It is mainly applied to fuel cell electric vehicles, commercial vehicles, fixed power supply, and engineering machinery.May 2023: Japanese motorcycle makers to establish research body “HySE” for development of hydrogen small mobility engines.April 2023: DFM has launched its development in the new energy field in 2021. In terms of platform development, it has built three electrified platforms. In terms of technology innovation, it adheres to the parallel technical routes of PHREV, battery electric, and hydrogen energy. In terms of hydrogen power R&D, it has established the Qingzhou technology brand, covering power from 20kW to 300kW and meeting the needs of various passenger and commercial vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Fuel Cell Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Fuel Cell Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Fuel Cell Vehicles Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Fuel Cell Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence